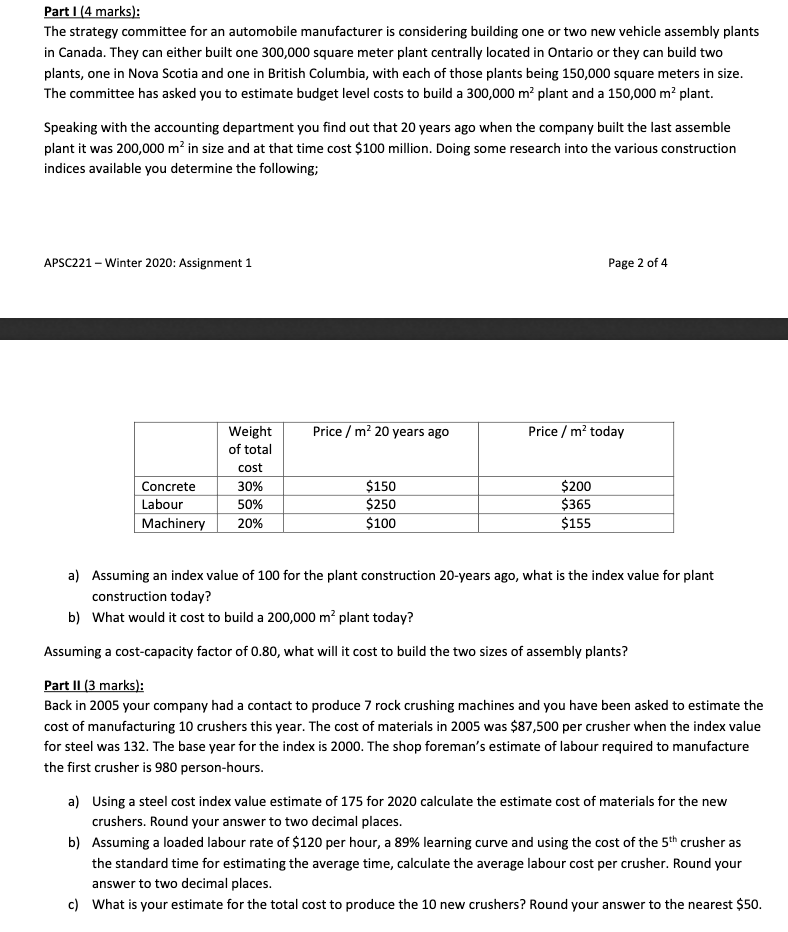

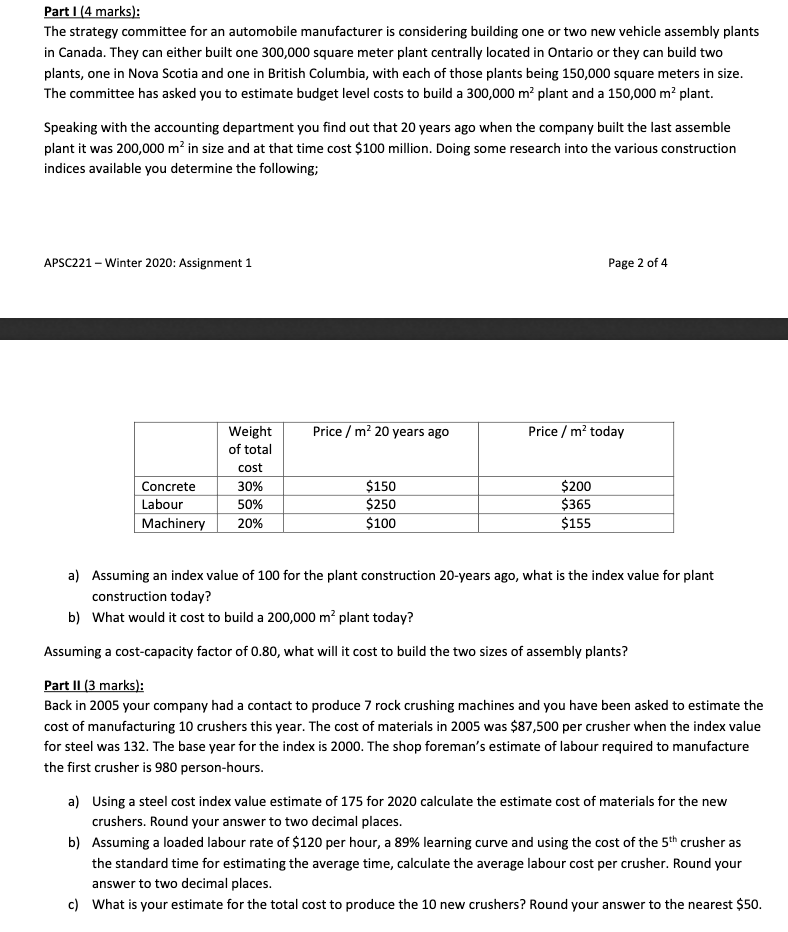

Part 1 (4 marks): The strategy committee for an automobile manufacturer is considering building one or two new vehicle assembly plants in Canada. They can either built one 300,000 square meter plant centrally located in Ontario or they can build two plants, one in Nova Scotia and one in British Columbia, with each of those plants being 150,000 square meters in size. The committee has asked you to estimate budget level costs to build a 300,000 m plant and a 150,000 m plant. Speaking with the accounting department you find out that 20 years ago when the company built the last assemble plant it was 200,000 m in size and at that time cost $100 million. Doing some research into the various construction indices available you determine the following; APSC221 - Winter 2020: Assignment 1 Page 2 of 4 Price / m 20 years ago Price / m today Weight of total cost 30% 50% 20% Concrete Labour Machinery $150 $250 $100 $200 $365 $155 a) Assuming an index value of 100 for the plant construction 20-years ago, what is the index value for plant construction today? b) What would it cost to build a 200,000 m plant today? Assuming a cost-capacity factor of 0.80, what will it cost to build the two sizes of assembly plants? Part II (3 marks): Back in 2005 your company had a contact to produce 7 rock crushing machines and you have been asked to estimate the cost of manufacturing 10 crushers this year. The cost of materials in 2005 was $87,500 per crusher when the index value for steel was 132. The base year for the index is 2000. The shop foreman's estimate of labour required to manufacture the first crusher is 980 person-hours. a) Using a steel cost index value estimate of 175 for 2020 calculate the estimate cost of materials for the new crushers. Round your answer to two decimal places. b) Assuming a loaded labour rate of $120 per hour, a 89% learning curve and using the cost of the 5th crusher as the standard time for estimating the average time, calculate the average labour cost per crusher. Round your answer to two decimal places. c) What is your estimate for the total cost to produce the 10 new crushers? Round your answer to the nearest $50