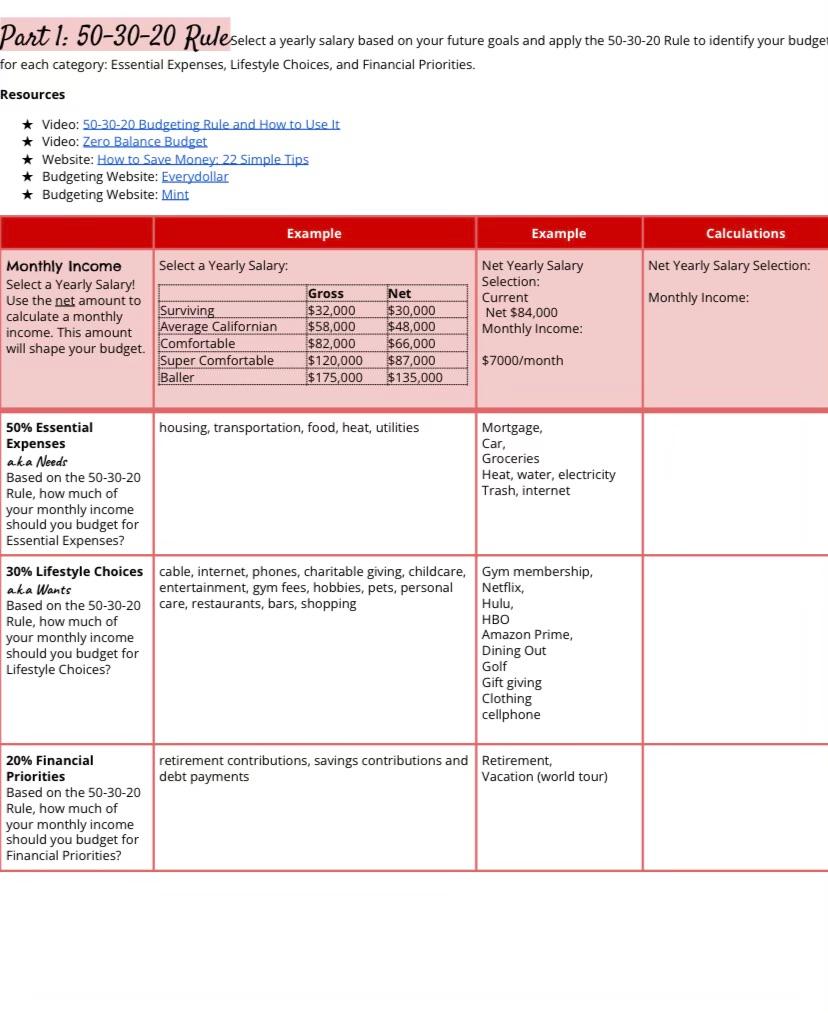

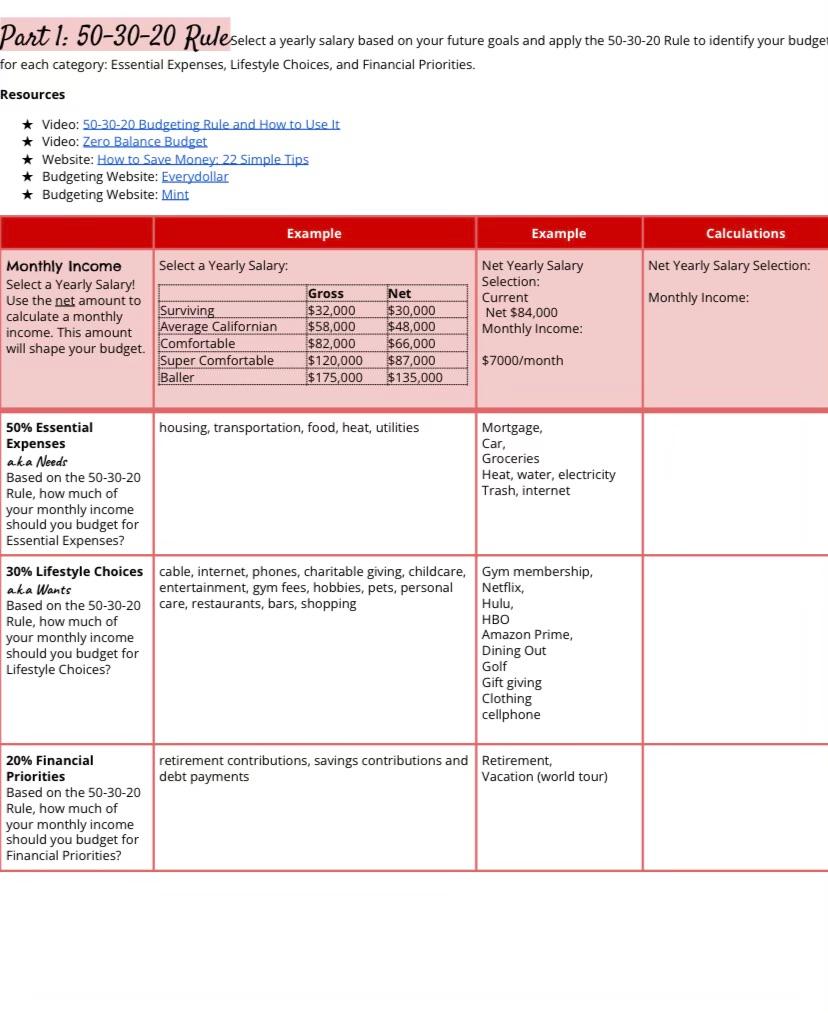

Part 1: 50-30-20 Ruleselect a yearly salary based on your future goals and apply the 50-30-20 Rule to identify your budge for each category: Essential Expenses, Lifestyle Choices, and Financial Priorities. a Resources * Video: 50-30-20 Budgeting Rule and How to Use It * Video: Zero Balance Budget * Website: How to Save Money: 22 Simple Tips * Budgeting Website: Everydollar * Budgeting Website: Mint Example Example Calculations Net Yearly Salary Selection: Monthly Income Select a Yearly Salary: Select a Yearly Salary! Use the net amount to calculate a monthly Surviving income. This amount Average Californian will shape your budget. Comfortable Super Comfortable Baller Monthly Income: Gross $32,000 $58,000 $82,000 $120,000 $175,000 Net Yearly Salary Selection: Current Net $84,000 Monthly Income: Net $30,000 $48,000 $66,000 $87,000 $135,000 $7000/month housing, transportation, food, heat, utilities 50% Essential Expenses aka Needs Based on the 50-30-20 Rule, how much of your monthly income should you budget for Essential Expenses? Mortgage Car, Groceries Heat, water, electricity Trash, internet cable, internet, phones, charitable giving, childcare, Gym membership, entertainment, gym fees, hobbies, pets, personal Netflix, care, restaurants, bars, shopping Hulu, 30% Lifestyle Choices aka Wants Based on the 50-30-20 Rule, how much of your monthly income should you budget for Lifestyle Choices? HBO Amazon Prime, Dining Out Golf Gift giving Clothing cellphone retirement contributions, savings contributions and Retirement, debt payments Vacation (world tour) 20% Financial Priorities Based on the 50-30-20 Rule, how much of your monthly income should you budget for Financial Priorities? Part 1: 50-30-20 Ruleselect a yearly salary based on your future goals and apply the 50-30-20 Rule to identify your budge for each category: Essential Expenses, Lifestyle Choices, and Financial Priorities. a Resources * Video: 50-30-20 Budgeting Rule and How to Use It * Video: Zero Balance Budget * Website: How to Save Money: 22 Simple Tips * Budgeting Website: Everydollar * Budgeting Website: Mint Example Example Calculations Net Yearly Salary Selection: Monthly Income Select a Yearly Salary: Select a Yearly Salary! Use the net amount to calculate a monthly Surviving income. This amount Average Californian will shape your budget. Comfortable Super Comfortable Baller Monthly Income: Gross $32,000 $58,000 $82,000 $120,000 $175,000 Net Yearly Salary Selection: Current Net $84,000 Monthly Income: Net $30,000 $48,000 $66,000 $87,000 $135,000 $7000/month housing, transportation, food, heat, utilities 50% Essential Expenses aka Needs Based on the 50-30-20 Rule, how much of your monthly income should you budget for Essential Expenses? Mortgage Car, Groceries Heat, water, electricity Trash, internet cable, internet, phones, charitable giving, childcare, Gym membership, entertainment, gym fees, hobbies, pets, personal Netflix, care, restaurants, bars, shopping Hulu, 30% Lifestyle Choices aka Wants Based on the 50-30-20 Rule, how much of your monthly income should you budget for Lifestyle Choices? HBO Amazon Prime, Dining Out Golf Gift giving Clothing cellphone retirement contributions, savings contributions and Retirement, debt payments Vacation (world tour) 20% Financial Priorities Based on the 50-30-20 Rule, how much of your monthly income should you budget for Financial Priorities