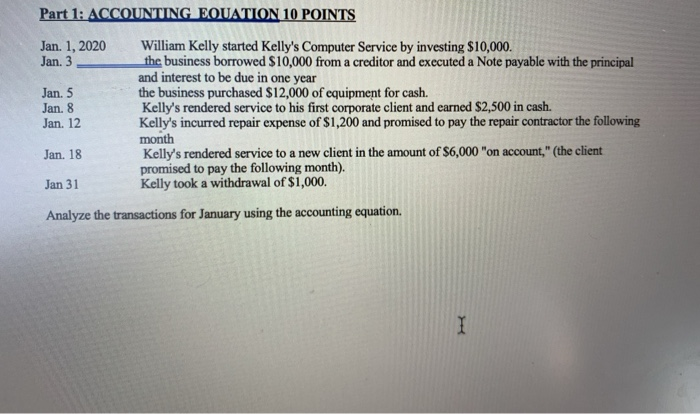

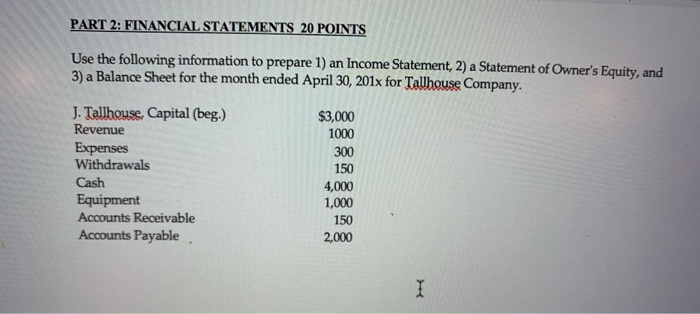

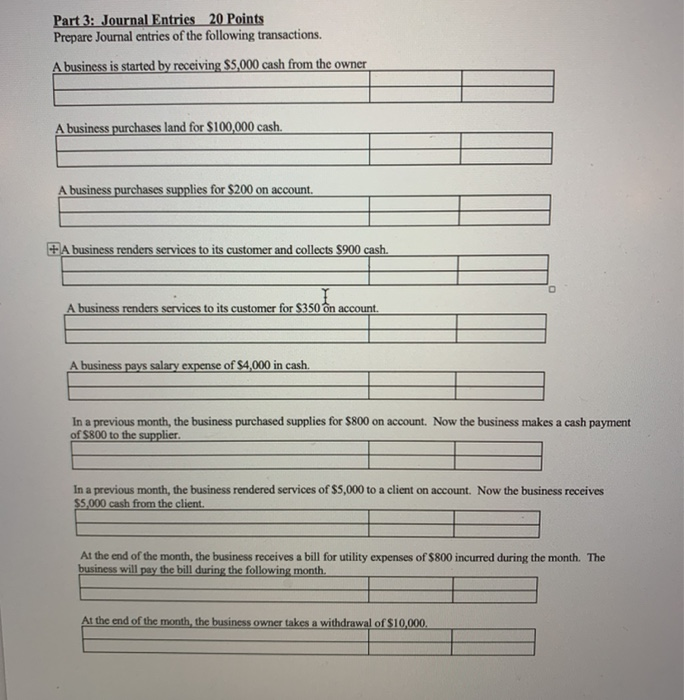

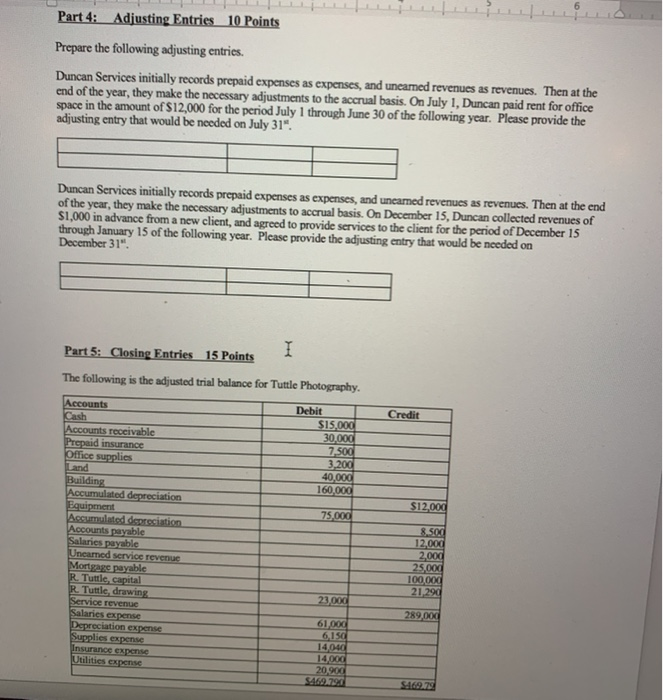

Part 1: ACCOUNTING EQUATION 10 POINTS Jan. 1, 2020 William Kelly started Kelly's Computer Service by investing $10,000. Jan. 3 the business borrowed $10,000 from a creditor and executed a Note payable with the principal and interest to be due in one year Jan. 5 the business purchased $12,000 of equipment for cash. Jan. 8 Kelly's rendered service to his first corporate client and earned $2,500 in cash. Jan. 12 Kelly's incurred repair expense of $1,200 and promised to pay the repair contractor the following month Jan. 18 Kelly's rendered service to a new client in the amount of $6,000 "on account," (the client promised to pay the following month). Jan 31 Kelly took a withdrawal of $1,000. Analyze the transactions for January using the accounting equation. I PART 2: FINANCIAL STATEMENTS 20 POINTS Use the following information to prepare 1) an Income Statement, 2) a Statement of Owner's Equity, and 3) a Balance Sheet for the month ended April 30, 201x for Tallhouse Company. J. Tallhouse, Capital (beg.) Revenue Expenses Withdrawals Cash Equipment Accounts Receivable Accounts Payable $3,000 1000 300 150 4,000 1,000 150 2,000 I Part 3: Journal Entries 20 Points Prepare Journal entries of the following transactions. A business is started by receiving $5,000 cash from the owner A business purchases land for $100,000 cash. A business purchases supplies for $200 on account. + A business renders services to its customer and collects $900 cash. A business renders services to its customer for $350 on account. A business pays salary expense of $4,000 in cash. In a previous month, the business purchased supplies for $800 on account. Now the business makes a cash payment of $800 to the supplier. In a previous month, the business rendered services of $5,000 to a client on account. Now the business receives $5,000 cash from the client. At the end of the month, the business receives a bill for utility expenses of $800 incurred during the month. The business will pay the bill during the following month. At the end of the month the business owner takes a withdrawal of $10,000 6 Part 4: Adjusting Entries 10 Points Prepare the following adjusting entries. Duncan Services initially records prepaid expenses as expenses, and uneared revenues as revenues. Then at the end of the year, they make the necessary adjustments to the accrual basis. On July 1, Duncan paid rent for office space in the amount of $12,000 for the period July 1 through June 30 of the following year. Please provide the adjusting entry that would be needed on July 31". Duncan Services initially records prepaid expenses as expenses, and uncanned revenues as revenues. Then at the end of the year, they make the necessary adjustments to accrual basis. On December 15, Duncan collected revenues of $1,000 in advance from a new client, and agreed to provide services to the client for the period of December 15 through January 15 of the following year. Please provide the adjusting entry that would be needed on December 31". Part 5: Closing Entries 15 Points I The following is the adjusted trial balance for Tuttle Photography. Credit Debit $15.000 30,000 7.500 3,200 40,000 160,000 $12.000 75.000 Accounts Cash Accounts receivable Prepaid insurance Office supplies Land Building Accumulated depreciation Equipment Accumulated depreciation Accounts payable Salaries payable Uncamned service revenue Mortgage payable R. Tuttle capital R. Tuttle, drawing Service revenue Salaries expense Depreciation expense Supplies expense Insurance expense Utilities expose 8.500 12.000 2.000 25.000 100,000 21 290 23.000 289.000 61,00d 6150 14040 14,000 20.900 $469.720 SAGA Using the information from the worksheet above, prepare the closing entries. DR CR +