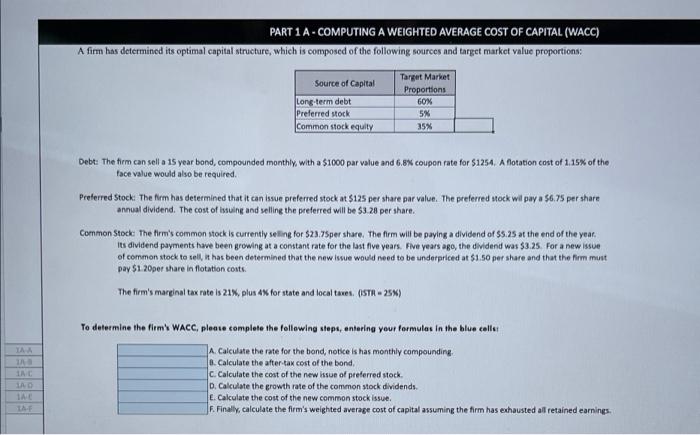

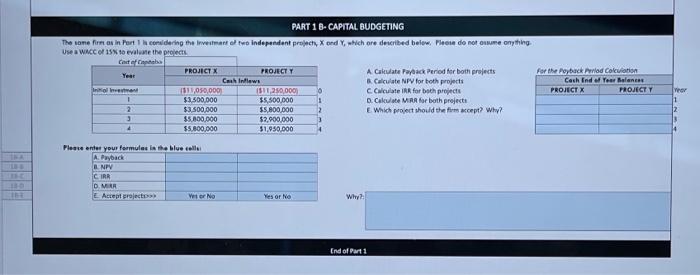

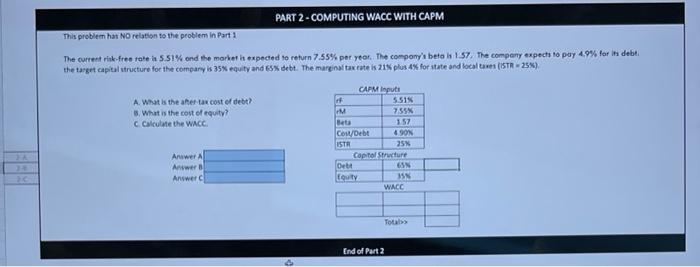

PART 1 A-COMPUTING A WEIGHTED AVERAGE COST OF CAPITAL (WACC) A firm has determined its optimal capital structure, which is composed of the following sources and target market value proportions: Source of Capital Long-term debt Preferred stock Common stock equity Target Market Proportions 6OX 5% 35% Debt: The firm can sell a 15 year bond, compounded monthly with a $1000 par value and 6.8% coupon rate for $1254. A flotation cost of 1.15% of the face value would also be required. Preferred Stock The Nem has determined that it can losue preferred stock at $125 per share par value. The preferred stock will pay a 6.75 per share annual dividend. The cost of suine and selline the preferred will be $3.28 per share. Common Stock The firm's common stock is currently selling for $23.75per share. The firm will be paying a dividend of $5.25 at the end of the year. Its dividend payments have been growing at a constant rate for the last five years. Five years ago, the dividend was $3.25. For a new issue of common stock to call it has been determined that the new issue would need to be underpriced at $1.50 per share and that the firm must pay $1.20per share in flotation costs. The firm's marginal tax rate is 21% plus 4 for state and local taxes. (STR.25) TAA INC To determine the firm's WACC, please complete the following steps, entering your formulas in the blue celler A. Calculate the rate for the bond, notice is has monthly compounding 1. Calculate the after-tax cost of the bond, C.Calculate the cost of the new issue of preferred stock D. Calculate the growth rate of the common stock dividends. E. Calculate the cost of the new common stock issue. JF. Finally, calculate the firm's weighted average cost of capital assuming the firm has exhausted all retained earnings DAE PART 1 - CAPITAL BUDGETING The tone firm as in Perth considering the remastel two independent proch, Xord y, which are described below. Placu do not usume anything Use WACC to evaluate the project Castofa PROJECT X Year PROJECT Y Chinews line 1511.050.000 15.250,000) $2.500.000 $5.500.000 2 $3.500,000 35,800,000 $5.000.000 $2,900,000 4 $5.800,000 $1.950.000 A Calculate Parack Period for both projects Calculate NPV for both projects c. Ciculate in for both projecte D. Cal MIRA for both projects E Which project should the form cept? Why? For the Royack Pad Calvin Cash End Year Balances PROJECT X PROJECT Y 6 Yor 12 2 3 Please enter your formules in the blue talle A. Payback NPV CIRR DUR E Acceptrojeto Wtor No Yes or No Why End of Part 1 PART 2-COMPUTING WACC WITH CAPM This problem has NO relation to the problem in Part 1 The current risk-free rate 5.51% and the market is expected to return 7.55% per year. The company's beta I 1.57. The company expects to pay 4.9% for in debt the target capital structure for the company is 35 equity and debt. The marginal taxeute 21plus 4% for state and local (STR.25) A Wisat is the her tax cost of debt? 3. What is the cost of equity calculate the WACC CAFM loputi 55% M 755% Beta 157 Cost/Debt 490N USTA 25% Copto Strutture Det OSN Louity WACC Answer AL Awwer Answer Totab End of Part 2