Question

Part 1 (ALREADY DONE) Create a mock merchandising company and demonstrate your knowledge of accrual basis accounting and the double-entry accounting system by creating a

Part 1 (ALREADY DONE)

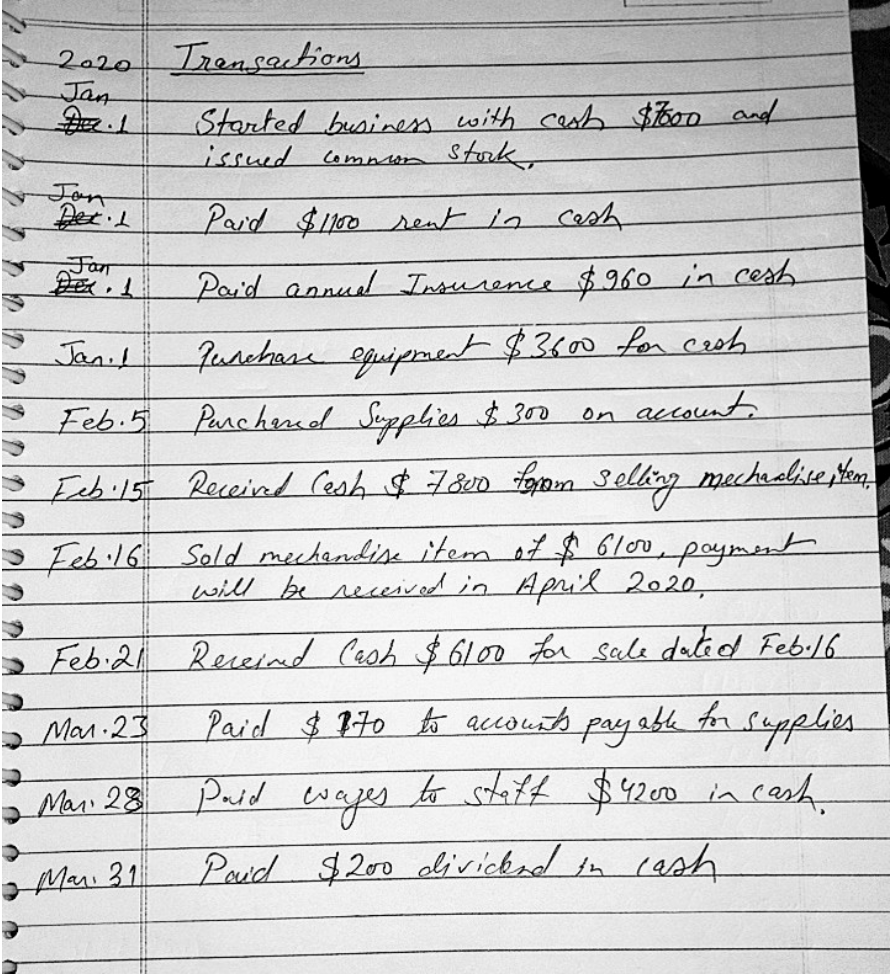

Create a mock merchandising company and demonstrate your knowledge of accrual basis accounting and the double-entry accounting system by creating a minimum of 10 original transactions spanning a period of 3 months (Jan. 1 Mar. 31) and completing the requirements below. Assume your mock company is a new company that begins operations on Jan. 1st. Beginning with a new company will be easier than an existing company as you will not have any beginning balances to deal with. The transactions should include examples of accruals and deferrals and at least one of each of the following: financing a new business (e.g. issuing stock or borrowing), obtaining assets, incurring liabilities, earning revenue, and incurring expenses.

Required (All 12 steps must be performed using EXCEL and be original work):

1) Write a list of at least 10 original transactions spanning a fiscal quarter (e.g. Jan.1 March 31) and following the guidelines above. The first transaction should be a financing transaction (issue stock or borrow).

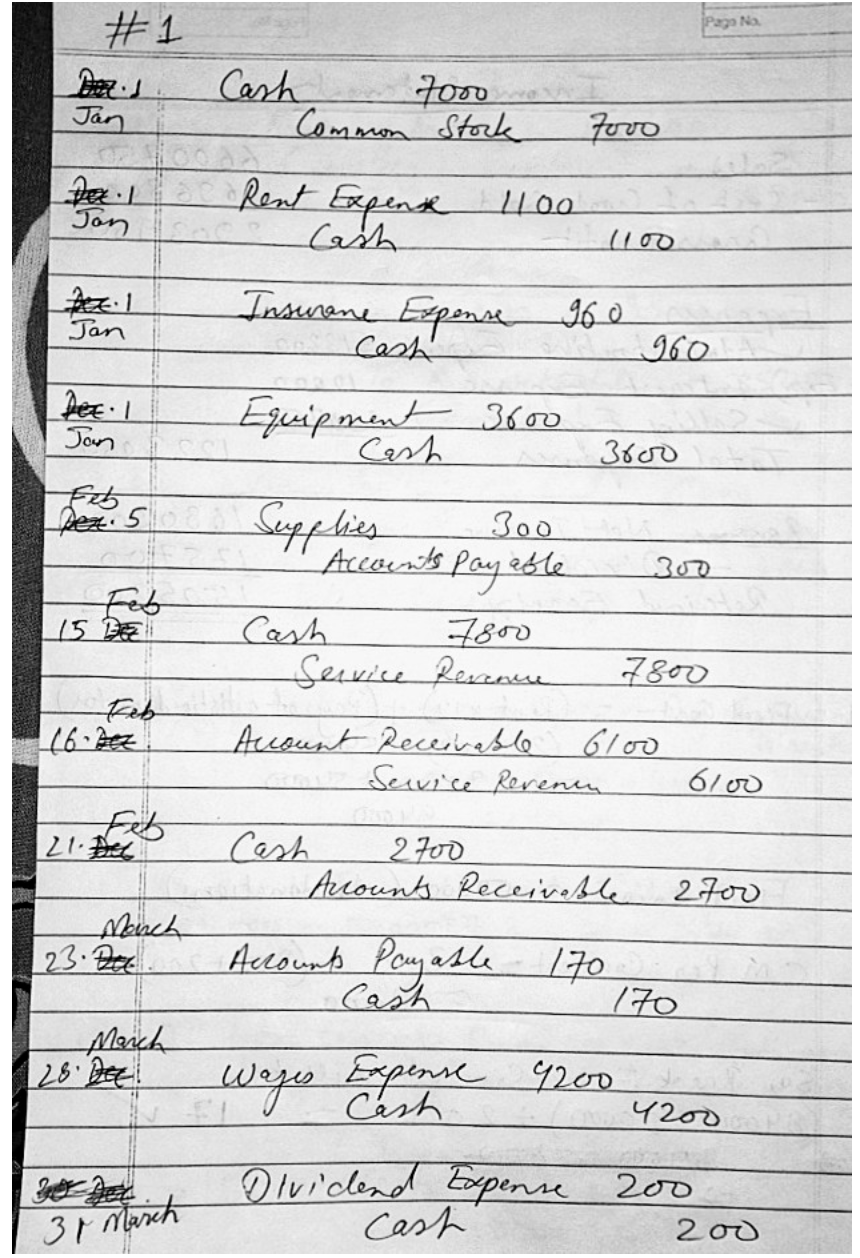

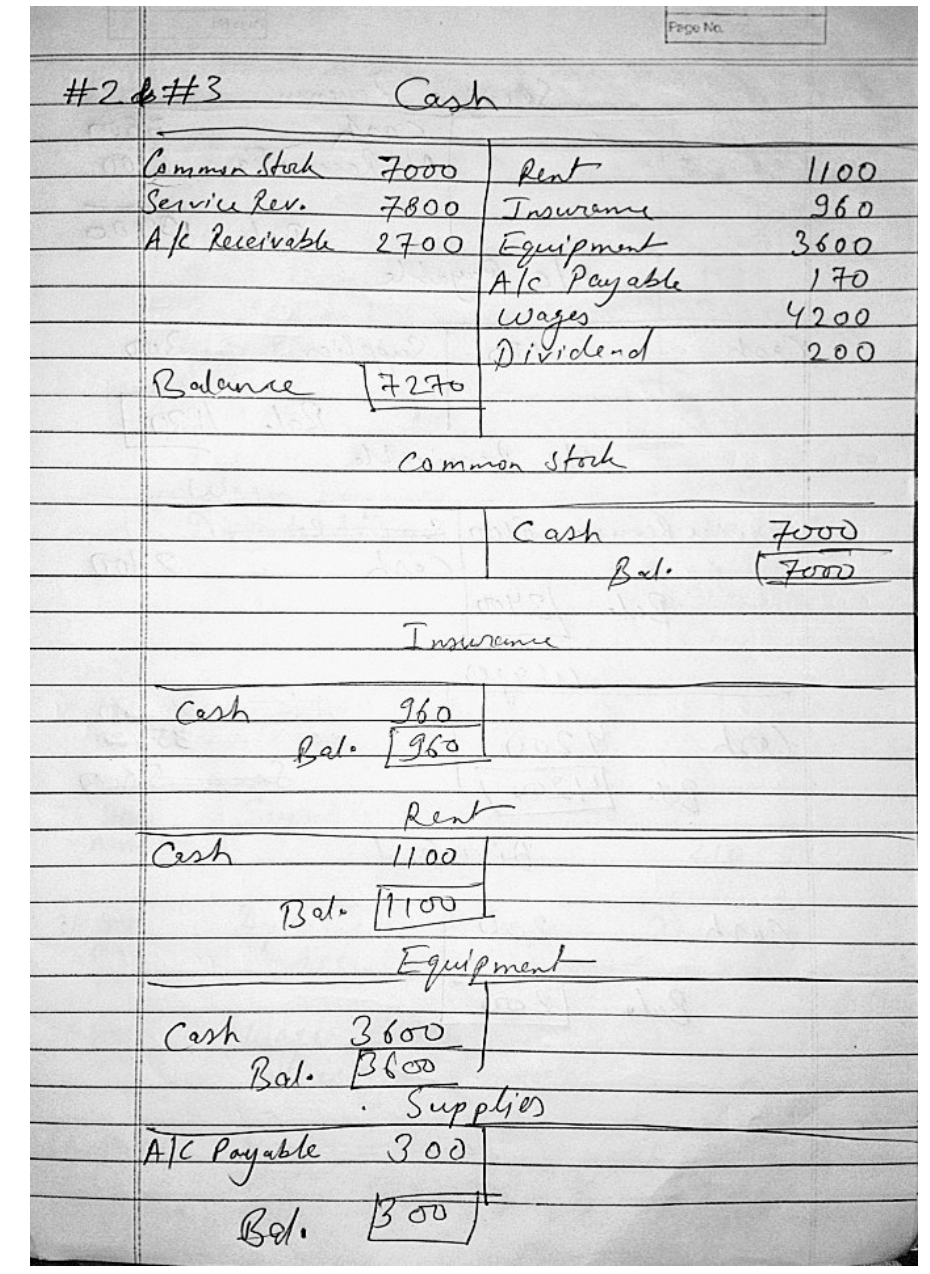

2) Journalize each transaction.

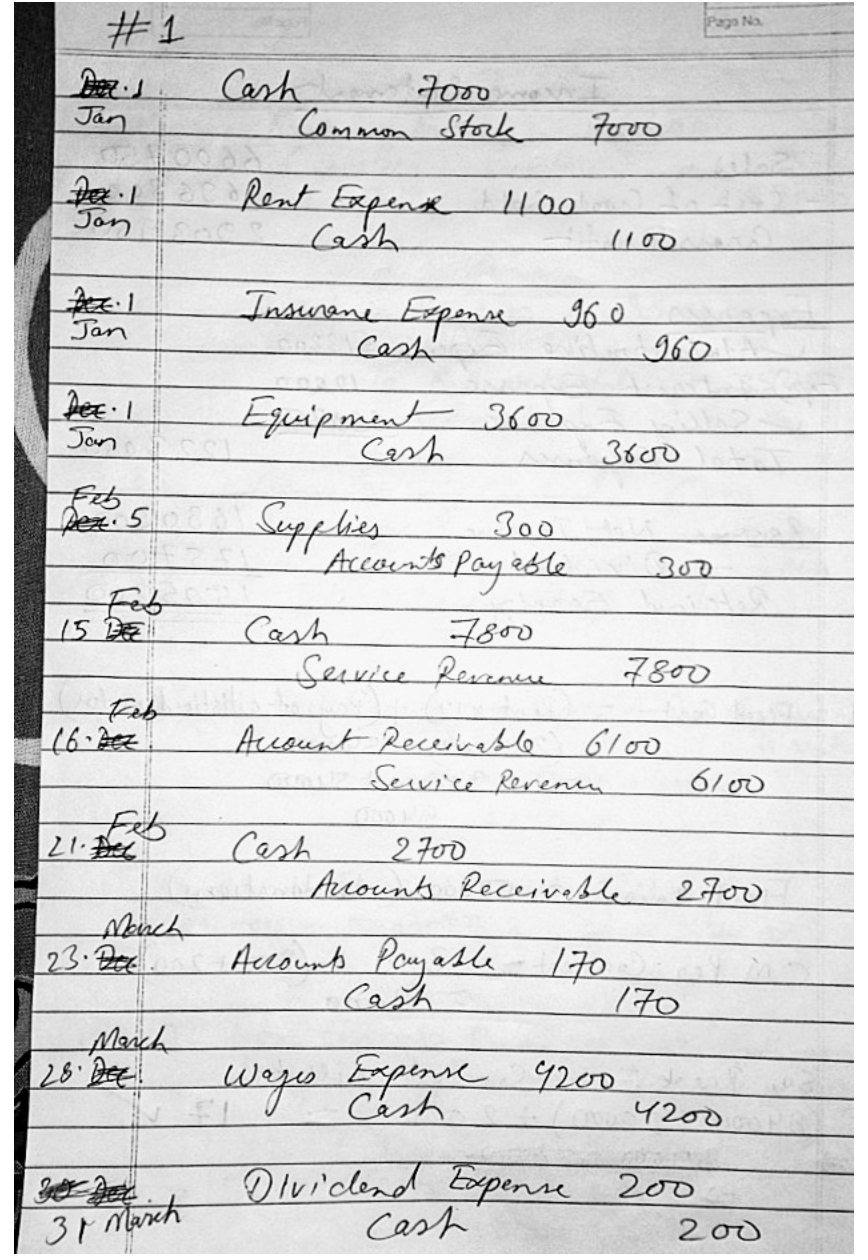

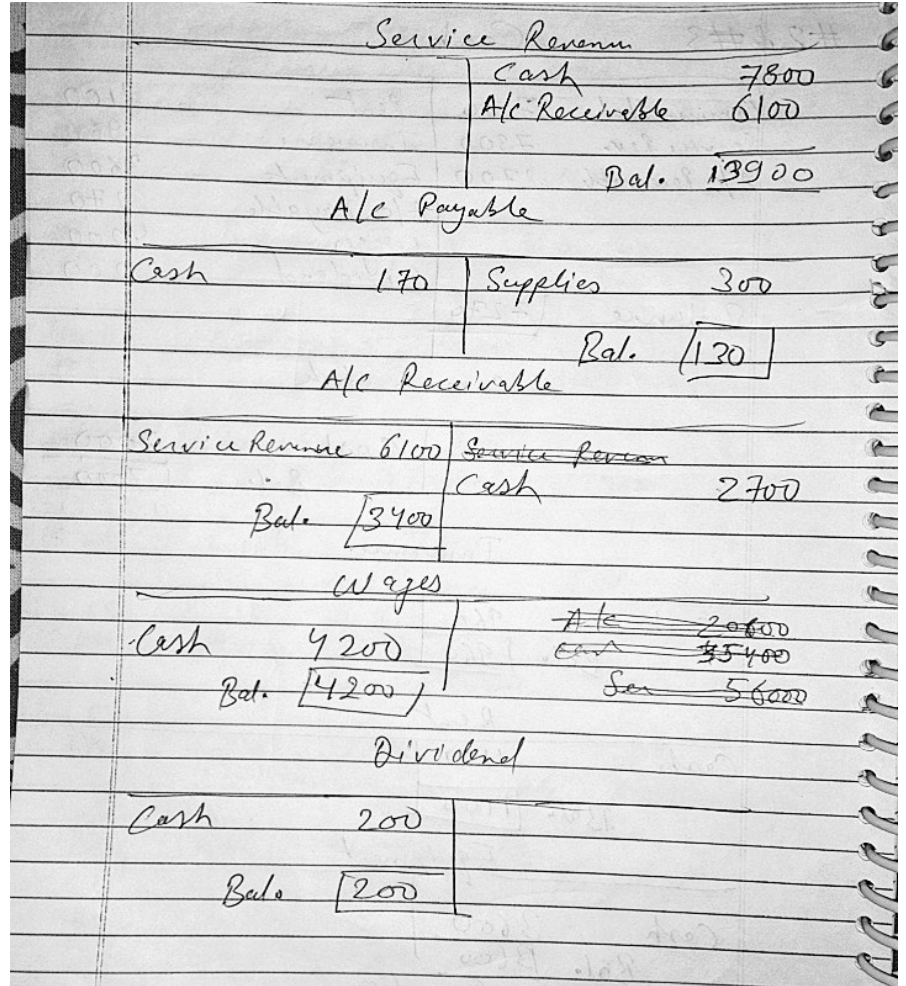

3) Post the journal entries to accounts and compute the ending balance (March 31) in each account.

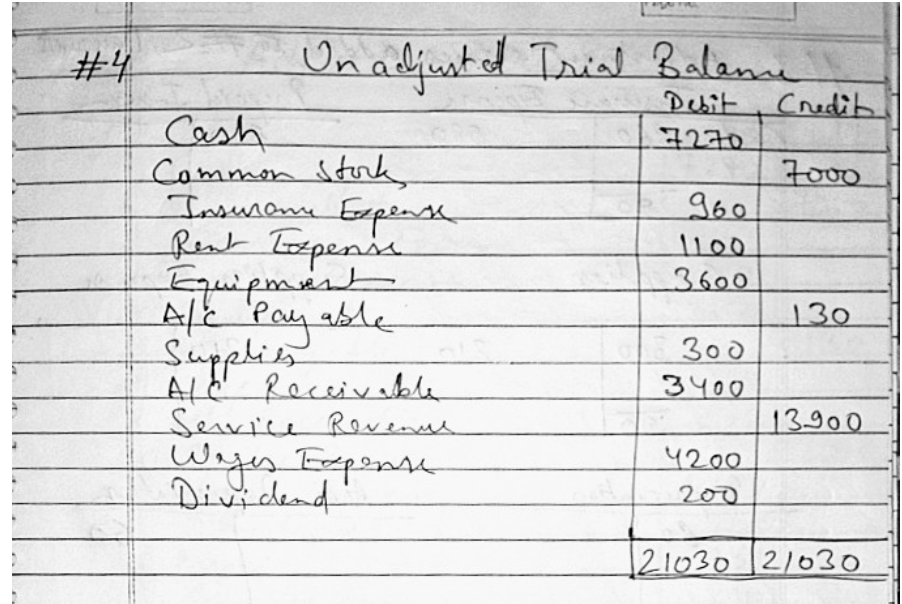

4) Prepare a trial balance from ending account balances.

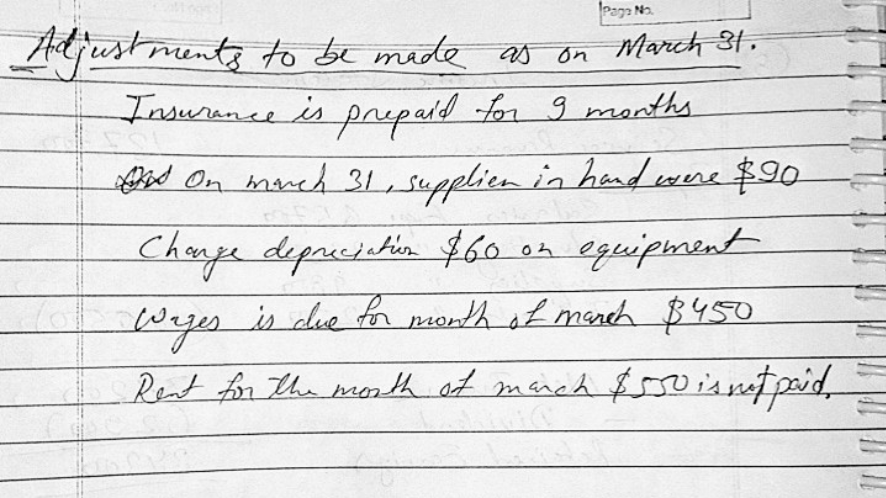

5) Write a list of at least 5 adjusting entries for the quarter-ended March 31 related to transactions prepared in step 1. Note that adjusting entries do not have an effect on the cash account.

6) Journalize the adjusting entries. Note that adjusting entries do not affect the cash account.

Part 2 (NEED)

Correct any mistakes that you made in Part 1. Continue through the accounting cycle using EXCEL and prepare each of the following documents.

7) Post the adjusting entries to accounts and compute the adjusted ending balance in each account.

8) Prepare an adjusted trial balance.

9) Prepare a balance sheet, income statement, and statement of retained earnings (in good form) from the adjusted trial balance as of and for the quarter-ended March 31st.

10) Prepare closing entries.

11) Post closing entries to accounts and compute the post-closing account balances.

12) Prepare a post-closing trial balance.

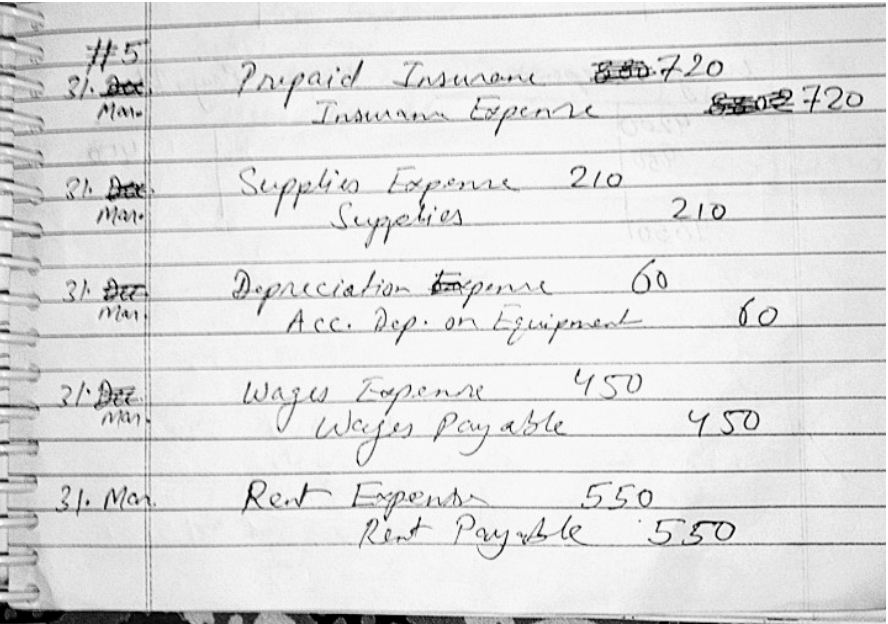

Transactions 2020 Jan 12 nalalalalalala Started business with cash $7000 and issued common stock, Dec 1 Paid $1100 rent in cash Jan Paid annuel Insurence $960 in cesh Jani! Purchase equipment $3600 for cash Feb. 5 Purchared Supplies $300 account. Feb 15 Receind Cesh $780 fanm selling mechaeliste Yen Feb.16 Sold mechandise item of $ 6100, payment will be received in April 2020, Feb.21 Rereind Cash $6100 for sale dated Feb.16 Mar. 23 Paid $ 170 to accounts payable for supplies Mar. 28 to staff $4200 in cash Poid $200 divicked in cash UUU Paid wajes 2 Man. 31 #1 Cash Jan 7000 Common Stork foro Dezil Ton Rent Expense Cash 100 1100 feel Jan Insurane Expense 960 Cash 960 Det Jan Equipment 3600 Cash 3000 pez. 5 300 Supplies Accounts 15 DEZ Cash 7800 Service Revenue 7800 (6.7z Account Receivable 6100 Service Revenin 6100 21. Det Cash 2700 Acounts Receivable 2700 Mouch 23. Dec. Accounts Payaste 170 170 March 28 Dec Wages Expense 9200 4200 Dividend Expense 200 cash 200 30 March #1 Pago Na Cash Jan 7000 Common Stock foro Dezil Jon Rent Expense 1100 Cash (100 Poezel Jan Insurane Expense 960 Cash 960 Det Jan 3600 pez. 5 Equipment 3600 Cash Supplies 300 Accounts payable Cash 7800 Service Revenue 15 DEE 7800 Feb (6. Bez Account Receivable 6100 Service Revenin 6100 21. Det Cash 2700 Arounts Receivable 2700 Manch 23. Dec Accounts Payable 170 170 March 28. DEG! Wages Expense 9200 . 4200 Dividend Expense 200 cash 200 30 March Page No #21#3 Cash Common Stock 7000 Rent Service Rev. 7800 Insurance Al Receivable 2700 Equipment Al Payable Wagen Dividend Balance 7270 Too 960 3600 170 4200 200 Common stock Cash Beli Insurance food zen Cash 960 Bal. 1960 Rent Cash Cash Bat. 1oo Equipment 3600 Bal. Broo Supplies 300 ATC Payable Ball 300 Service Revenu Cash A/C Receivable 7800 6100 Cash Bal. 139 do Ale Payable 170 Supplies 300 Bal. 11.20 Alc Receivable Service Revenue 6100 fenicu fercan 2700 Bale 13400 Cash 35400 Wages 4200 Bat. 14200) Dividend Cash 200 Balo [200 #4 On adjusted Trial Balance Debit Credit Cash 2270 Common stock 7000 Insurance Expense 960 Rent Expense Equipment Ale Payable Supplies ALC Receivable Sevice Revenue Wages Expense Dividend 3600 130 300 3400 13900 4200 200 121030 21030 Ipags Na Adjustments to be made as on March 31. Insurance is prepaid for 9 months Abid on maneh 3L supplien in hand were $90 Change depreciation $60 on equipment Wazes is due for month of march $450 Rent for the month of march $550 is not paid 210 More 210 31 pm Prepaid Insurance 0.720 Inauma espeare G402720 Supplies Expense Sugelies Depreciation stampere 60 Acc. dep. on Equipment ro 450 Waju Lapenna Wajes payable 450 Rent Expenses 550 Rent Payable 550 2. De M 31. ManStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started