Question

Part 1 Always aspiring to be an entrepreneur, you finally believe you may have found your niche. While you were polishing off the last of

Part 1

Always aspiring to be an entrepreneur, you finally believe you may have found your niche.

While you were polishing off the last of the brownie mix your sister gave you for the holidays last year, you realized that it was the only homemade gift you had gotten for quite some time, and further realized that you had never given a gift made with your own hands. Justifying your absence of creativity to a lack of time, it comes to you that perhaps there would be a market for handmade goodies that people could simply purchase off the shelf and give as special gifts.

You brainstorm with your two roommates and come together with a plan to prepare for the birth of SABCO, Inc., a name created as an abbreviation for Sand Art Brownie Company.

It is early April 2021, and the three of you research the holiday market and decide that all products to be sold for the holiday season must be ready to ship to retailers by October 1, 2021. This will allow the three of you to spend the remainder of the year processing orders.

The three of you determine the following:

- Each of you will contribute $15,000 on July 1, 2021 (borrowed from relatives) to form a corporation. You realize that another form of business may be less expensive but know that this is just the beginning of a wildly successful business and want to go ahead right away with the incorporation of the business. The par value of the stock is $1.00 and each of you purchase 5,000 shares of stock.

- You estimate that you can sell the brownies for $15 per container. You believe this price will make the product attractive enough to sell 100,000 containers of product for the 2021 holiday season. All the shareholders agree this would be a competitive price and a fine start to your business.

- Fifty percent of sales are expected to be taken online and paid by credit card immediately upon ordering. The bank charges a credit card fee of 2% of the transaction. This is considered a selling expense. The other 50% of sales will be sold to a wholesaler who will purchase in bulk at $13.50 per container. They will pay 60% at time of delivery and the remaining 40% will be collected the following month.

- Your roommate gets to work on building a great website and lays the groundwork to get your website to pop-up based on several appropriate key-word searches such as holiday gifts and brownies. Her hard work results in a one-time website fee of $10,500 in July, and $100 per month in maintenance fees from July December 2021. These costs are not capitalized but expensed immediately because you are sure that the website will have to be completely revamped after the holiday to gear up for the future.

- Factory space will be rented for a period of five months (July, August, September, October, and November) at $800 per month for production of the Sand Art Brownies. Utilities for the space are estimated to be $300 each month which you are also responsible for per the lease agreement. After the five months of production, the equipment will be stored in your garage, until the next holiday production rush. Due to the perishability of your product, your production must also be seasonal.

- Equipment required to run the factory is needed up front and will cost $18,000. The equipment will be depreciated over 5 years under the straight-line method. The salvage value will be negligible.

- Each day, after production, the finished product will be shipped to a fulfillment house that will store the containers until they are shipped. The rent for the agreed upon space at the fulfillment house is $2,500 per month. The rental agreement is for July through December 2021. Included in this fee are order processing charges and shipping and handling fees. Minimal returns after the holiday season are expected, but a return policy on the website instructs customers to ship returned items to your home.

- A small office will be rented downtown to handle administrative issues, field sales calls, and process online orders. The rent for this space is $250 per month and is leased from July December 2021. Utilities are included in the rent.

- All bills will be paid immediately with cash, as you suspect credit will not be established early on by your suppliers and this will be the most conservative approach in estimating your cash needs.

- Each of you will take a salary per month of $3,000. These three salaries will be the only salaries besides the direct labor and factory overhead personnel. (The tax consequences of these salaries will be ignored in this project).

- To be conservative, you expect to sell the same number of containers each week for 8 weeks (4 weeks in November and 4 weeks in December). You only have capacity to produce 6,000 containers in a week and you want to have at least two weeks of inventory on hand in advance of any sales. Additionally, you would like to run your production at maximum capacity in July, August and September, prior to sales beginning to allow for the unexpected. You only produce enough in October and November to have the expected two weeks of inventory on hand. For simplicity, assume there are four production weeks per month.

- To make sure that there will be enough product for production, all materials are purchased ahead of production. You decide that after the first month you would like to have enough materials for the first two weeks of production on hand at the end of the preceding month.

- You know that you will not have enough money to finance the operation until the money from the sales starts to come in. You are in the process of putting together a business plan to include the following for the period from July through December 2021:

- Direct labor worksheet

- Factory Overhead Worksheet

- Job Cost Detail

- Production Budget

- Direct Materials Budget

- Direct Labor Budget

- Selling and Administrative Expense Budget

- Cash Budget

- Budgeted Financial Statements

You mean to provide the business plan to the bank. You expect they will grant you a line of credit to make up your cash shortfalls through the end of the selling season. You will be applying for a line of credit that you can access at the beginning of each month to meet your cash flow needs. Because you are only allowed to draw on your line once a month, you decide that you would like to maintain a cash balance at the end of the month equal to your required purchases the subsequent month. You will make one lump payment at the end of December to pay off your borrowings plus interest at the rate of 6%. Simple interest is accrued and paid at the end of the year.

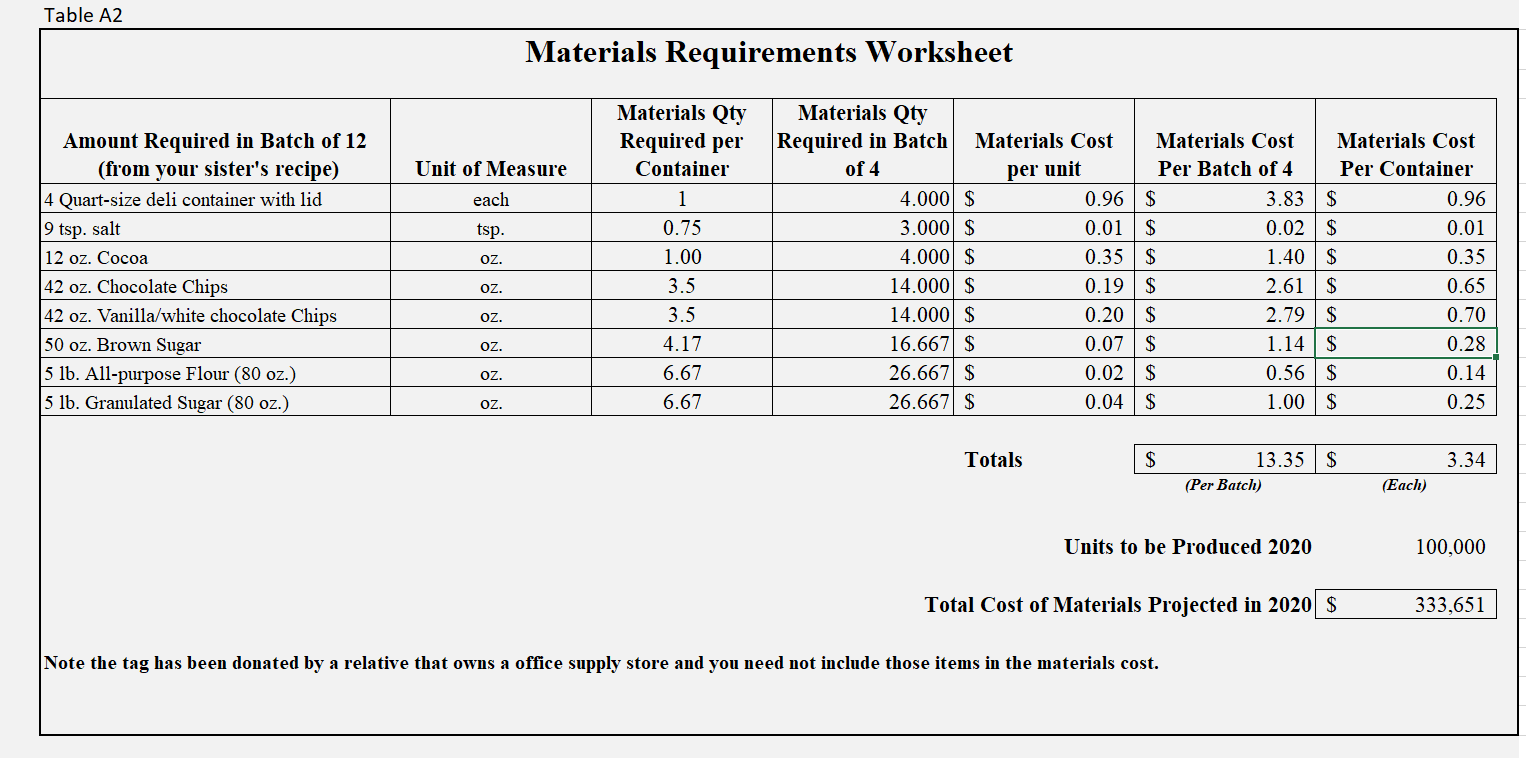

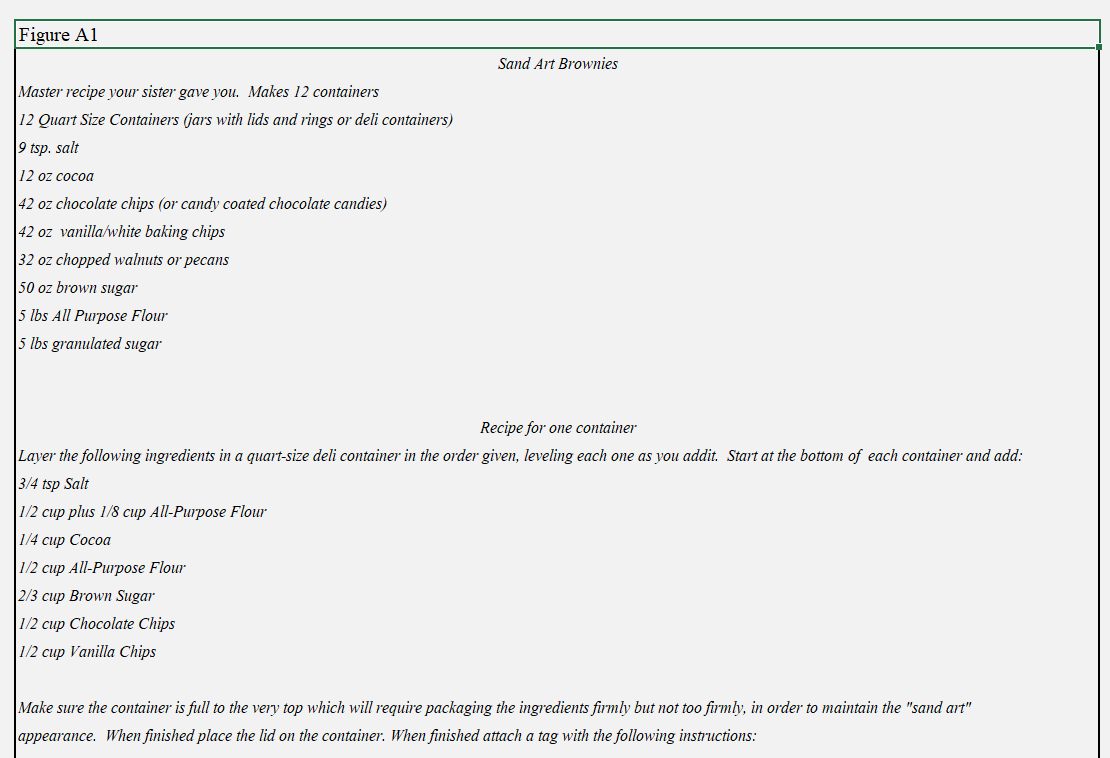

- The three shareholders feel comfortable with the plan outlined above; however, no cost studies have been done on the product to determine the cost of sales for each container. The information you do have is a recipe jotted down on the back of a napkin that your sister scrawled out when you asked her for the recipe. The napkin reads as shown in Figure 1.

- You plan to use a job cost system to capture the costs per batch. A job cost system is chosen over a different cost system because you and your business partners expect the same machinery and production lines will be used for off-season products in 2021 and beyond. Those products are yet to be determined.

6.

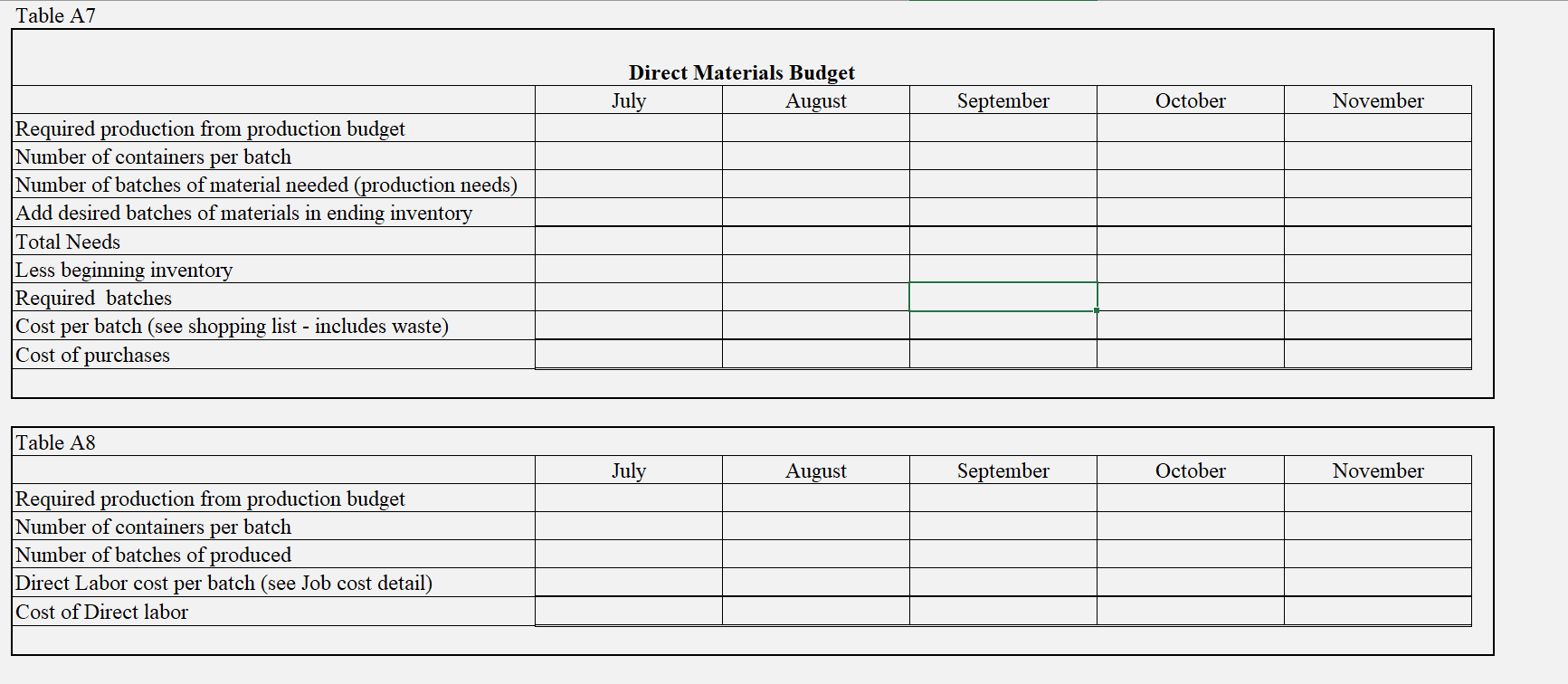

Using the information above regarding materials purchasing policies and the shopping list, complete the direct materials budget (Table A7).

Using the information above regarding materials purchasing policies and the shopping list, complete the direct materials budget (Table A7).

7. Using the information from the Job Cost Detail and the Production Budget, complete the Direct labor budget (Table A8).

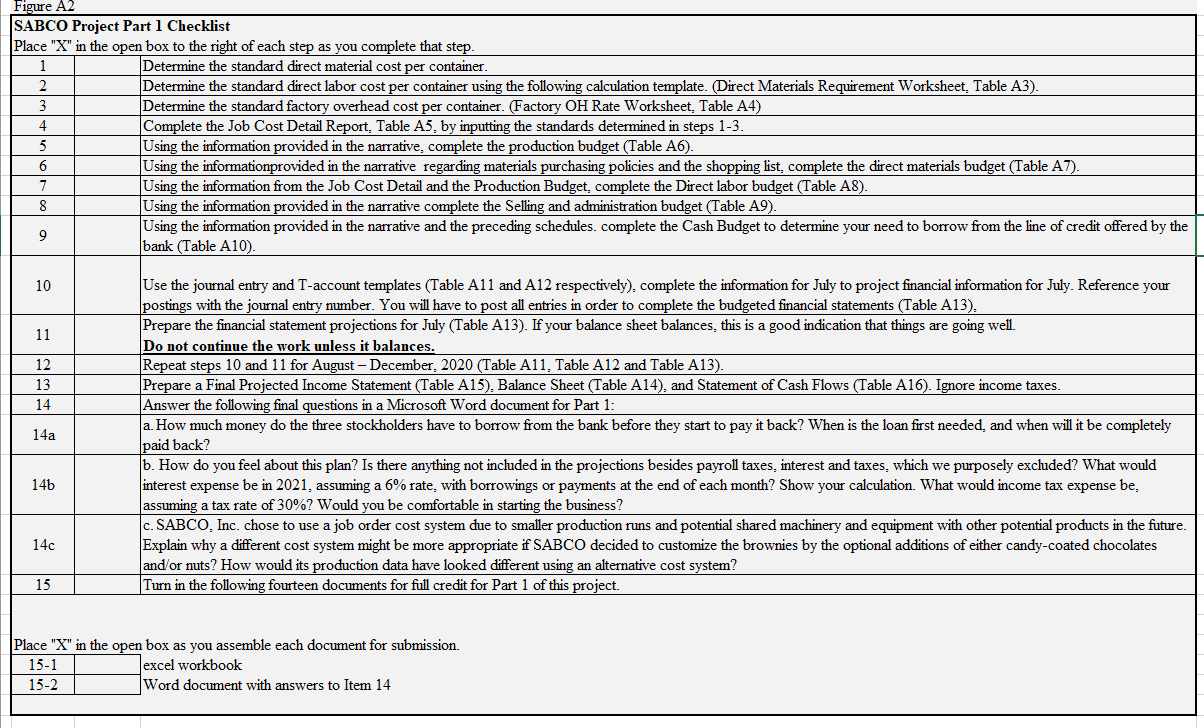

Table A7 Direct Materials Budget July August September October November per Required production from production budget Number of containers batch Number of batches of material needed (production needs) Add desired batches of materials in ending inventory Total Needs Less beginning inventory Required batches Cost per batch (see shopping list - includes waste) Cost of purchases Table A8 July August September October November Required production from production budget Number of containers per batch Number of batches of produced Direct Labor cost per batch (see Job cost detail) Cost of Direct labor Table A2 Materials Requirements Worksheet Unit of Measure each per unit tsp. oz. Amount Required in Batch of 12 (from your sister's recipe) 4 Quart-size deli container with lid 9 tsp. salt 12 oz. Cocoa 42 oz. Chocolate Chips 42 oz. Vanilla/white chocolate Chips 50 oz. Brown Sugar 5 lb. All-purpose Flour (80 oz.) 5 lb. Granulated Sugar (80 oz.) Materials Qty Required per Container 1 0.75 1.00 3.5 3.5 4.17 6.67 6.67 Materials Qty Required in Batch Materials Cost Materials Cost Materials Cost of 4 Per Batch of 4 Per Container 4.000 $ 0.96 $ 3.83 $ 0.96 3.000 $ 0.01 $ 0.02 $ 0.01 4.000 $ 0.35 $ 1.40 $ 0.35 14.000 $ 0.19 $ 2.61 $ 0.65 14.000 $ 0.20 $ 2.79$ 0.70 16.667 $ 0.07 $ 1.14 $ 0.28 26.667 $ 0.02 $ 0.56 $ 0.14 26.667 $ 0.04 $ 1.00 $ 0.25 oz. oz. oz. OZ. OZ. Totals $ 3.34 13.35$ (Per Batch) (Each) Units to be Produced 2020 100,000 Total Cost of Materials Projected in 2020 $ 333,651 Note the tag has been donated by a relative that owns a office supply store and you need not include those items in the materials cost. Figure A1 Sand Art Brownies Master recipe your sister gave you. Makes 12 containers 12 Quart Size Containers (jars with lids and rings or deli containers) 2 tsp. salt 12 oz cocoa 42 oz chocolate chips (or candy coated chocolate candies) 42 oz vanilla/white baking chips 32 oz chopped walnuts or pecans 50 oz brown sugar 5 lbs All Purpose Flour 5 lbs granulated sugar Recipe for one container Layer the following ingredients in a quart-size deli container in the order given, leveling each one as you addit. Start at the bottom of each container and add: 3/4 tsp Salt 1/2 cup plus 1/8 cup All-Purpose Flour | 1/4 cup Cocoa 1/2 cup All-Purpose Flour 2/3 cup Brown Sugar 1/2 cup Chocolate Chips 1/2 cup Vanilla Chips Make sure the container is full to the very top which will require packaging the ingredients firmly but not too firmly, in order to maintain the "sand art" appearance. When finished place the lid on the container. When finished attach a tag with the following instructions: Figure A2 SABC Project Part 1 Checklist Place "X" in the open box to the right of each step as you complete that step. 1 Determine the standard direct material cost per container. 2 Determine the standard direct labor cost per container using the following calculation template. (Direct Materials Requirement Worksheet, Table A3). 3 Determine the standard factory overhead cost per container. (Factory OH Rate Worksheet, Table A4) Complete the Job Cost Detail Report, Table A5, by inputting the standards determined in steps 1-3. 5 Using the information provided in the narrative, complete the production budget (Table A6). Using the informationprovided in the narrative regarding materials purchasing policies and the shopping list, complete the direct materials budget (Table A7). 7 Using the information from the Job Cost Detail and the Production Budget, complete the Direct labor budget (Table A8). Using the information provided in the narrative complete the Selling and administration budget (Table A9). Using the information provided in the narrative and the preceding schedules. complete the Cash Budget to determine your need to borrow from the line of credit offered by the 9 bank (Table A10). 4 6 8 10 11 12 13 14 14a Use the journal entry and T-account templates (Table A11 and A12 respectively), complete the information for July to project financial information for July. Reference your postings with the journal entry number. You will have to post all entries in order to complete the budgeted financial statements (Table A13). Prepare the financial statement projections for July (Table A13). If your balance sheet balances, this is a good indication that things are going well. Do not continue the work unless it balances. Repeat steps 10 and 11 for August - December, 2020 (Table A11, Table A12 and Table A13). Prepare a Final Projected Income Statement (Table A15). Balance Sheet (Table A14), and Statement of Cash Flows (Table A16). Ignore income taxes. Answer the following final questions in a Microsoft Word document for Part 1: a How much money do the three stockholders have to borrow from the bank before they start to pay it back? When is the loan first needed, and when will it be completely paid back? b. How do you feel about this plan? Is there anything not included in the projections besides payroll taxes, interest and taxes, which we purposely excluded? What would interest expense be in 2021, assuming a 6% rate, with borrowings or payments at the end of each month? Show your calculation. What would income tax expense be. assuming a tax rate of 30%? Would you be comfortable in starting the business? C. SABCO, Inc. chose to use a job order cost system due to smaller production runs and potential shared machinery and equipment with other potential products in the future. Explain why a different cost system might be more appropriate if SABCO decided to customize the brownies by the optional additions of either candy-coated chocolates and/or nuts? How would its production data have looked different using an alternative cost system? Turn in the following fourteen documents for full credit for Part 1 of this project. 14b 14c 15 Place "X" in the open box as you assemble each document for submission. 15-1 excel workbook Word document with answers to Item 14 15-2 Table A7 Direct Materials Budget July August September October November per Required production from production budget Number of containers batch Number of batches of material needed (production needs) Add desired batches of materials in ending inventory Total Needs Less beginning inventory Required batches Cost per batch (see shopping list - includes waste) Cost of purchases Table A8 July August September October November Required production from production budget Number of containers per batch Number of batches of produced Direct Labor cost per batch (see Job cost detail) Cost of Direct labor Table A2 Materials Requirements Worksheet Unit of Measure each per unit tsp. oz. Amount Required in Batch of 12 (from your sister's recipe) 4 Quart-size deli container with lid 9 tsp. salt 12 oz. Cocoa 42 oz. Chocolate Chips 42 oz. Vanilla/white chocolate Chips 50 oz. Brown Sugar 5 lb. All-purpose Flour (80 oz.) 5 lb. Granulated Sugar (80 oz.) Materials Qty Required per Container 1 0.75 1.00 3.5 3.5 4.17 6.67 6.67 Materials Qty Required in Batch Materials Cost Materials Cost Materials Cost of 4 Per Batch of 4 Per Container 4.000 $ 0.96 $ 3.83 $ 0.96 3.000 $ 0.01 $ 0.02 $ 0.01 4.000 $ 0.35 $ 1.40 $ 0.35 14.000 $ 0.19 $ 2.61 $ 0.65 14.000 $ 0.20 $ 2.79$ 0.70 16.667 $ 0.07 $ 1.14 $ 0.28 26.667 $ 0.02 $ 0.56 $ 0.14 26.667 $ 0.04 $ 1.00 $ 0.25 oz. oz. oz. OZ. OZ. Totals $ 3.34 13.35$ (Per Batch) (Each) Units to be Produced 2020 100,000 Total Cost of Materials Projected in 2020 $ 333,651 Note the tag has been donated by a relative that owns a office supply store and you need not include those items in the materials cost. Figure A1 Sand Art Brownies Master recipe your sister gave you. Makes 12 containers 12 Quart Size Containers (jars with lids and rings or deli containers) 2 tsp. salt 12 oz cocoa 42 oz chocolate chips (or candy coated chocolate candies) 42 oz vanilla/white baking chips 32 oz chopped walnuts or pecans 50 oz brown sugar 5 lbs All Purpose Flour 5 lbs granulated sugar Recipe for one container Layer the following ingredients in a quart-size deli container in the order given, leveling each one as you addit. Start at the bottom of each container and add: 3/4 tsp Salt 1/2 cup plus 1/8 cup All-Purpose Flour | 1/4 cup Cocoa 1/2 cup All-Purpose Flour 2/3 cup Brown Sugar 1/2 cup Chocolate Chips 1/2 cup Vanilla Chips Make sure the container is full to the very top which will require packaging the ingredients firmly but not too firmly, in order to maintain the "sand art" appearance. When finished place the lid on the container. When finished attach a tag with the following instructions: Figure A2 SABC Project Part 1 Checklist Place "X" in the open box to the right of each step as you complete that step. 1 Determine the standard direct material cost per container. 2 Determine the standard direct labor cost per container using the following calculation template. (Direct Materials Requirement Worksheet, Table A3). 3 Determine the standard factory overhead cost per container. (Factory OH Rate Worksheet, Table A4) Complete the Job Cost Detail Report, Table A5, by inputting the standards determined in steps 1-3. 5 Using the information provided in the narrative, complete the production budget (Table A6). Using the informationprovided in the narrative regarding materials purchasing policies and the shopping list, complete the direct materials budget (Table A7). 7 Using the information from the Job Cost Detail and the Production Budget, complete the Direct labor budget (Table A8). Using the information provided in the narrative complete the Selling and administration budget (Table A9). Using the information provided in the narrative and the preceding schedules. complete the Cash Budget to determine your need to borrow from the line of credit offered by the 9 bank (Table A10). 4 6 8 10 11 12 13 14 14a Use the journal entry and T-account templates (Table A11 and A12 respectively), complete the information for July to project financial information for July. Reference your postings with the journal entry number. You will have to post all entries in order to complete the budgeted financial statements (Table A13). Prepare the financial statement projections for July (Table A13). If your balance sheet balances, this is a good indication that things are going well. Do not continue the work unless it balances. Repeat steps 10 and 11 for August - December, 2020 (Table A11, Table A12 and Table A13). Prepare a Final Projected Income Statement (Table A15). Balance Sheet (Table A14), and Statement of Cash Flows (Table A16). Ignore income taxes. Answer the following final questions in a Microsoft Word document for Part 1: a How much money do the three stockholders have to borrow from the bank before they start to pay it back? When is the loan first needed, and when will it be completely paid back? b. How do you feel about this plan? Is there anything not included in the projections besides payroll taxes, interest and taxes, which we purposely excluded? What would interest expense be in 2021, assuming a 6% rate, with borrowings or payments at the end of each month? Show your calculation. What would income tax expense be. assuming a tax rate of 30%? Would you be comfortable in starting the business? C. SABCO, Inc. chose to use a job order cost system due to smaller production runs and potential shared machinery and equipment with other potential products in the future. Explain why a different cost system might be more appropriate if SABCO decided to customize the brownies by the optional additions of either candy-coated chocolates and/or nuts? How would its production data have looked different using an alternative cost system? Turn in the following fourteen documents for full credit for Part 1 of this project. 14b 14c 15 Place "X" in the open box as you assemble each document for submission. 15-1 excel workbook Word document with answers to Item 14 15-2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started