Answered step by step

Verified Expert Solution

Question

1 Approved Answer

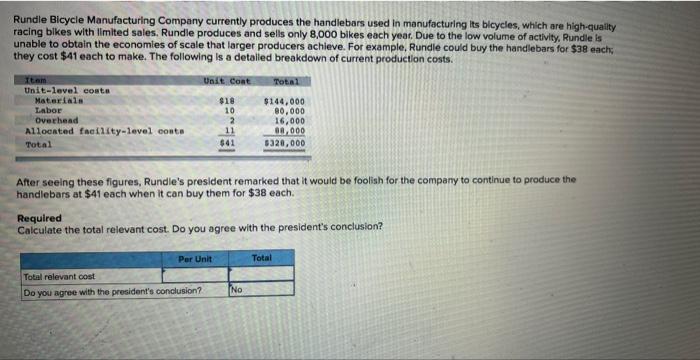

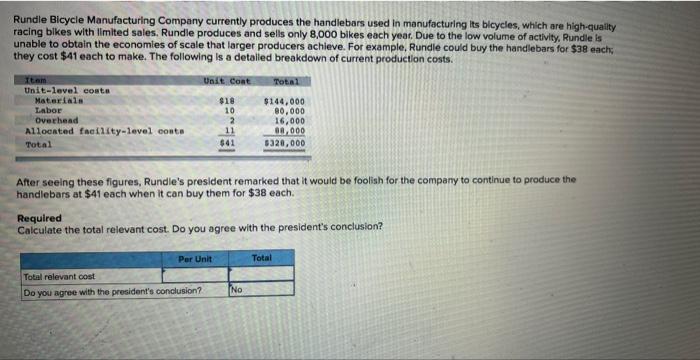

part 1 and 2 Rundle Bicycle Manufacturing Company currently produces the handlebars used in manufacturing its blcycles, which are high-quality racing bikes with llmited sales.

part 1 and 2

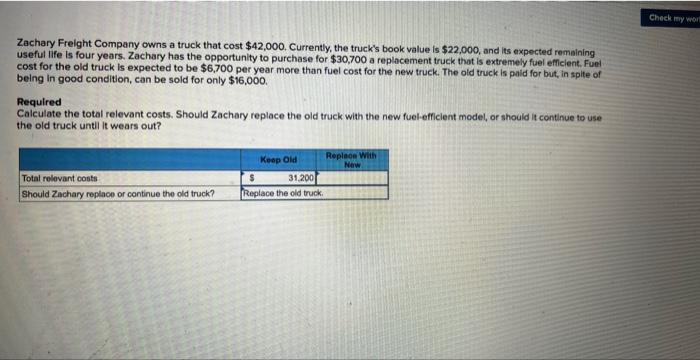

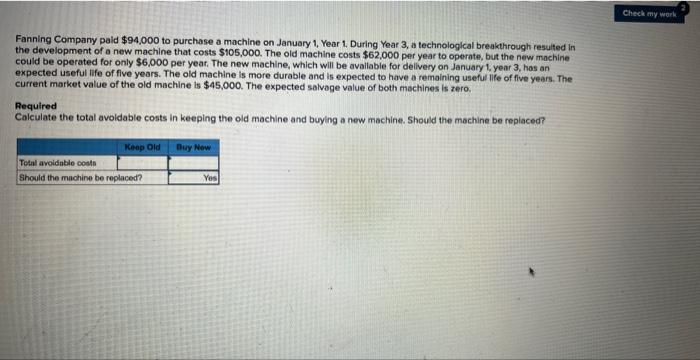

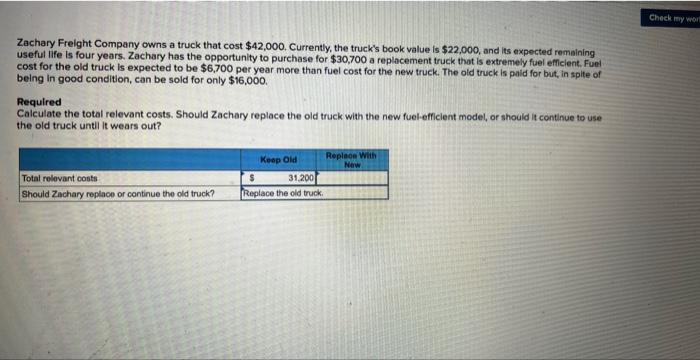

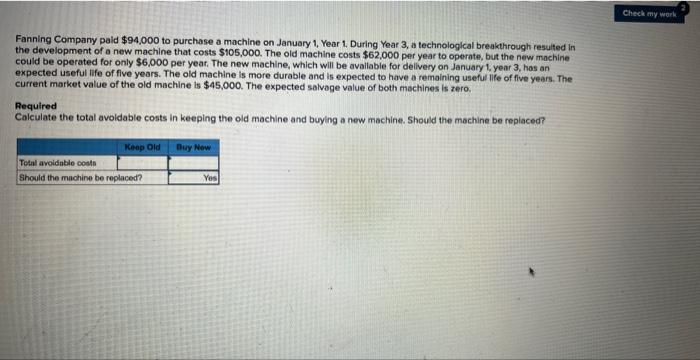

Rundle Bicycle Manufacturing Company currently produces the handlebars used in manufacturing its blcycles, which are high-quality racing bikes with llmited sales. Rundle produces and sells only 8,000 bikes each year, Due to the low volume of activity, Rundie is unable to obtain the economies of scale that larger producers achieve. For example. Rundle could buy the handlebars for $38 each, they cost $41 each to make. The following is a detalled breakdown of current production costs. After seeing these figures, Rundle's president remarked that it would be foolish for the compary to continue to produce the handlebars at $41 each when it can buy them for $38 each. Required Calculate the total relevant cost. Do you agree with the president's conclusion? Zachary Freight Company owns a truck that cost $42,000. Currently, the truck's book value is $22,000, and its expected remaining useful life is four years. Zachary has the opportunity to purchase for $30,700 a replacement truck that is extremely fuel efficient. Fuel cost for the old truck is expected to be $6,700 per year more than fuel cost for the new truck. The old truck is pald for but, in spite of being in good condition, can be sold for only $16,000. Required Calculate the total relevant costs. Should Zachary replace the old truck with the new fuel-efficlent model, or should it continue to use the old truck until it wears out? Fanning Company paid $94,000 to purchase a machine on January 1, Year 1. During Year 3, a technologlcal breakthrough resulted in the development of a new machine that costs $105,000. The old machine costs $62,000 per year to operate, but the new machine could be operated for only $6,000 per year. The new machine, which will be available for delivery on January 1 , year 3 , has an expected useful life of five years. The old machine is more durable and is expected to have a remaining useful life of five years. The current market value of the old machine is $45,000. The expected salvage value of both machines is zero. Required Calculate the total avoldable costs in keeping the old machine and buying a new machine. Should the machine be replaced

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started