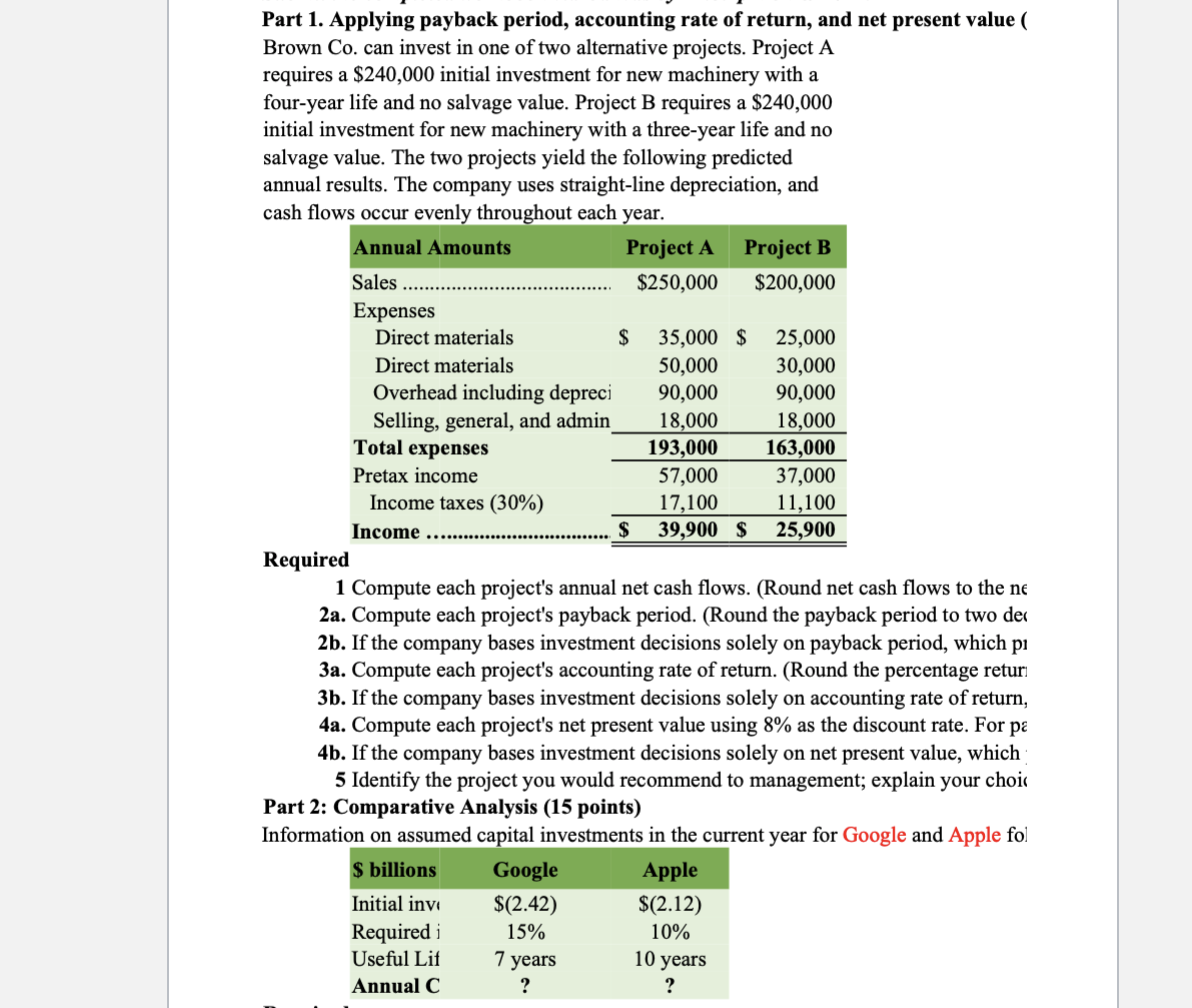

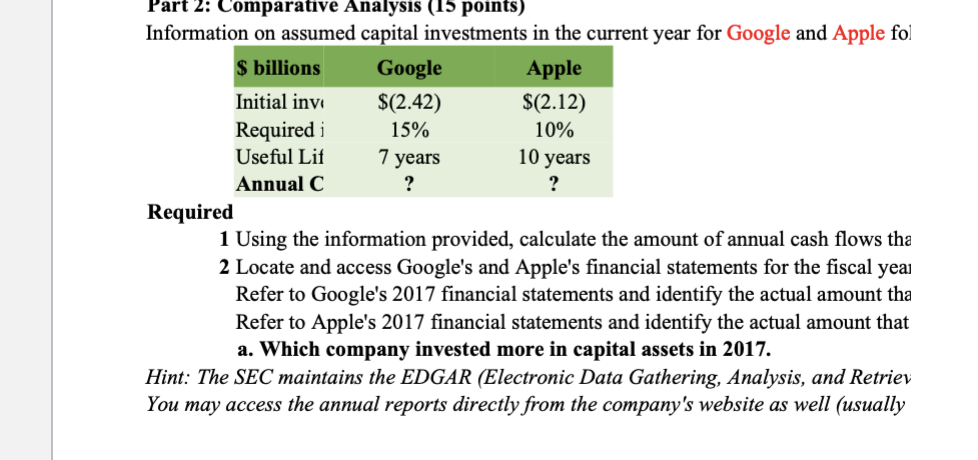

Part 1. Applying payback period, accounting rate of return, and net present value ( Brown Co. can invest in one of two alternative projects. Project A requires a $240,000 initial investment for new machinery with a four-year life and no salvage value. Project B requires a $240,000 initial investment for new machinery with a three-year life and no salvage value. The two projects yield the following predicted annual results. The company uses straight-line depreciation, and cash flows occur evenly throughout each year. Annual Amounts Project A Project B Sales $250,000 $200,000 Expenses Direct materials $ 35,000 $ 25,000 Direct materials 50,000 30,000 Overhead including depreci 90,000 90,000 Selling, general, and admin 18,000 18,000 Total expenses 193,000 163,000 Pretax income 57,000 37,000 Income taxes (30%) 17,100 11,100 Income ......... $ 39,900 $ 25,900 Required 1 Compute each project's annual net cash flows. (Round net cash flows to the ne 2a. Compute each project's payback period. (Round the payback period to two de 2b. If the company bases investment decisions solely on payback period, which pi 3a. Compute each project's accounting rate of return. (Round the percentage returi 3b. If the company bases investment decisions solely on accounting rate of return, 4a. Compute each project's net present value using 8% as the discount rate. For pa 4b. If the company bases investment decisions solely on net present value, which 5 Identify the project you would recommend to management; explain your choic Part 2: Comparative Analysis (15 points) Information on assumed capital investments in the current year for Google and Apple fol $ billions Google Apple Initial invi $(2.42) $(2.12) Required i 15% 10% Useful Lit 7 years Annual C ? ? 10 years 15% 7 years Part 2: Comparative Analysis (15 points) Information on assumed capital investments in the current year for Google and Apple fol $ billions Google Apple Initial inve $(2.42) $(2.12) Required i 10% Useful Lit 10 years Annual C ? ? Required 1 Using the information provided, calculate the amount of annual cash flows tha 2 Locate and access Google's and Apple's financial statements for the fiscal yeai Refer to Google's 2017 financial statements and identify the actual amount tha Refer to Apple's 2017 financial statements and identify the actual amount that a. Which company invested more in capital assets in 2017. Hint: The SEC maintains the EDGAR (Electronic Data Gathering, Analysis, and Retriev You may access the annual reports directly from the company's website as well (usually Part 1. Applying payback period, accounting rate of return, and net present value ( Brown Co. can invest in one of two alternative projects. Project A requires a $240,000 initial investment for new machinery with a four-year life and no salvage value. Project B requires a $240,000 initial investment for new machinery with a three-year life and no salvage value. The two projects yield the following predicted annual results. The company uses straight-line depreciation, and cash flows occur evenly throughout each year. Annual Amounts Project A Project B Sales $250,000 $200,000 Expenses Direct materials $ 35,000 $ 25,000 Direct materials 50,000 30,000 Overhead including depreci 90,000 90,000 Selling, general, and admin 18,000 18,000 Total expenses 193,000 163,000 Pretax income 57,000 37,000 Income taxes (30%) 17,100 11,100 Income ......... $ 39,900 $ 25,900 Required 1 Compute each project's annual net cash flows. (Round net cash flows to the ne 2a. Compute each project's payback period. (Round the payback period to two de 2b. If the company bases investment decisions solely on payback period, which pi 3a. Compute each project's accounting rate of return. (Round the percentage returi 3b. If the company bases investment decisions solely on accounting rate of return, 4a. Compute each project's net present value using 8% as the discount rate. For pa 4b. If the company bases investment decisions solely on net present value, which 5 Identify the project you would recommend to management; explain your choic Part 2: Comparative Analysis (15 points) Information on assumed capital investments in the current year for Google and Apple fol $ billions Google Apple Initial invi $(2.42) $(2.12) Required i 15% 10% Useful Lit 7 years Annual C ? ? 10 years 15% 7 years Part 2: Comparative Analysis (15 points) Information on assumed capital investments in the current year for Google and Apple fol $ billions Google Apple Initial inve $(2.42) $(2.12) Required i 10% Useful Lit 10 years Annual C ? ? Required 1 Using the information provided, calculate the amount of annual cash flows tha 2 Locate and access Google's and Apple's financial statements for the fiscal yeai Refer to Google's 2017 financial statements and identify the actual amount tha Refer to Apple's 2017 financial statements and identify the actual amount that a. Which company invested more in capital assets in 2017. Hint: The SEC maintains the EDGAR (Electronic Data Gathering, Analysis, and Retriev You may access the annual reports directly from the company's website as well (usually