Answered step by step

Verified Expert Solution

Question

1 Approved Answer

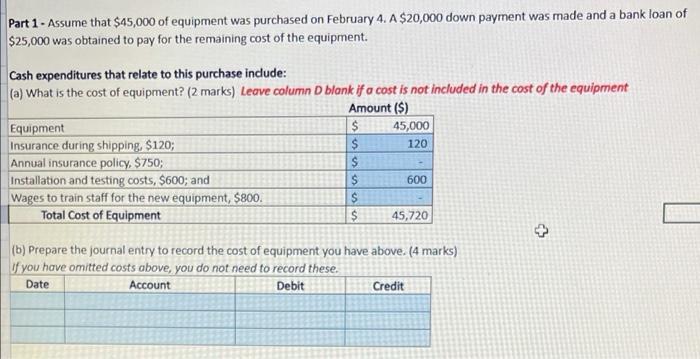

Part 1- Assume that $45,000 of equipment was purchased on February 4. A $20,000 down payment was made and a bank loan of $25,000

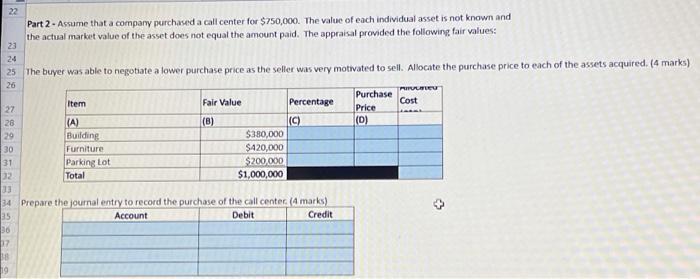

Part 1- Assume that $45,000 of equipment was purchased on February 4. A $20,000 down payment was made and a bank loan of $25,000 was obtained to pay for the remaining cost of the equipment. Cash expenditures that relate to this purchase include: (a) What is the cost of equipment? (2 marks) Leave column D blank if a cost is not included in the cost of the equipment Amount ($) Equipment $ 45,000 Insurance during shipping, $120; $ 120 Annual insurance policy, $750; $ Installation and testing costs, $600; and $ 600 Wages to train staff for the new equipment, $800. Total Cost of Equipment 45,720 (b) Prepare the journal entry to record the cost of equipment you have above. (4 marks) If you have omitted costs above, you do not need to record these. Date Account Debit Credit 555 $ 33 22 Part 2- Assume that a company purchased a call center for $750,000. The value of each individual asset is not known and the actual market value of the asset does not equal the amount paid. The appraisal provided the following fair values: 23 24 25 The buyer was able to negotiate a lower purchase price as the seller was very motivated to sell. Allocate the purchase price to each of the assets acquired. (4 marks) 26 PROLITE Cost Item Fair Value 27 Percentage (C) Purchase Price (0) 26 (A) (B) 29 Building 30 Furniture $380,000 $420,000 $200,000 31 Parking Lot 32 Total $1,000,000 33 34 Prepare the journal entry to record the purchase of the call center (4 marks) 35 Account Debit Credit 36 07 38 19

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Part 1 a Amount Equipment 45000 Insurance during shipping ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started