Question

Part 1 : Budget estimations The Stark Industries company has an industrial activity. It manufactures in its workshops two types of finished products (classic armor

Part 1 : Budget estimations

The Stark Industries company has an industrial activity. It manufactures in its workshops two types of finished products (classic armor and space armor) from two raw materials (steel and vibranium).

In September N, Director Tony Stark hires you as a management controller and asks you to build the budget for year N + 1. It provides you with the following forecast information.

- Sales

The sales goals (in quantities) for years Y, Y+1 and Y+2 are the following:

|

| Y | Y+1 | Y+2 |

| Classic Armor | 70 | 80 | 90 |

| Space Armor | 15 | 20 | 25 |

Unit sales prices, identical to those of year Y, are estimated at :

| Y+1 | |

| Classic Armor | 240,000 |

| Space Armor | 400,000 |

Based on previous years, it can be assumed that at the end of year Y+1, 30% of turnover will not be collected given the payment period granted to customers. There are no stocks of finished products.

- Production

- Direct Production Costs

The production department estimated that, for Y + 1, the quantities of raw materials needed for the production of armor would be:

|

| Y+1 | |

|

| Classic Armor | Space Armor |

| Steel | 600 kg | 500 kg |

| Vibranium | 8 kg | 19 kg |

Forecasts for the unit purchase cost of raw materials are as follows:

|

| Y+1 |

| Steel | 15 per kilo |

| Vibranium | 19,000 per kilo |

For the Y + 1 budget, for the steel we buy from supplier Thor, it is estimated that 20% of the amount of raw material purchases over the year will not yet be paid to suppliers at the end of December, due to the payment period granted by this supplier. For vibranium, it is estimated that 10% of the raw material purchases to the supplier Loki will not yet be paid to the supplier due to payment terms obtained.

In addition, Stark Industries holds stocks of steel and vibranium (the unit price of these two raw materials has not changed between Y and Y + 1). We want to have in stock the quantity of steel and vibranium necessary to produce 10% of the sales forecast for the following year.

Production labor is considered a direct variable production cost. Indeed, Stark Industries uses highly qualified professionals (members of SHIELD). Based on the operating schedule, reviewed by production manager, Virginia Potts, the unit manufacturing times for each of the two products are as follows:

|

| Y+1 | |

|

| Classic Armor | Space Armor |

| Direct Labour per armor produced | 115 hours | 160 hours |

According to the director, the average hourly cost of production labor should be in Y + 1 of 64 euros (social charges included). Salaries are paid within the month, so there are no payment delays on these salaries.

- Manufacturing overhead costs

The cost of machines used in production is considered an indirect charge as they are used for the production of both finished products. In addition, this cost is considered fixed and corresponds to the depreciation allowance for production equipment. The depreciation of this equipment, which was acquired and put into operation on January 1 of year Y for a value of 5,000,000 euros, will be done on a straight-line basis over 10 years, with no residual value at the end of the amortization period. The annual salary cost of the production manager, Virginia Potts, is also considered as an indirect fixed cost of production and has been estimated at 62,000 for year Y + 1. These indirect fixed costs are distributed in proportion to the overall labor time spent on each product. Disbursable charges are settled within the month.

- Non-manufacturing overhead costs

A buyer, Daredevil, was hired by the group. This frees the manager from this task (which he estimated to take 10% of his time) to further develop his strategic thinking, forging partnerships and business contacts. A portion of the buyer's salary is re-invoiced each month by the group and paid monthly by the company. It is estimated for the whole of Y + 1 at 6,000.

Variable transport costs are distributed according to the number of products delivered and sold (unit of work). The variable transport costs per product delivered should be 500 in Y + 1.

Other costs are fixed, mainly ships (Transport Material) used to deliver armor. These fixed assets will be acquired during year N + 1 for a value of 1,000,000 euros. The purchase will be made and paid for on April 1st, Y + 1. They will be amortized over 6 years (no residual value is taken into account).

Your predecessor had already prepared an estimate of the balance sheet at year Y, December 31 (in Euros).

Part 2. Variance analyses

A year later, the Strak Industries Company recorded the following accomplishments for year Y + 1:

| Classic Armor | Space Armor | |

| Actual quantity produced (units) | 75 | 23 |

| Actual unit cost Steel (/kg) | 17 | 17 |

| Actual Unit Cost Vibranium (/kg) | 18,000 | 18,000 |

| Actual cost per hour of direct production labour | 60 | 60 |

| Actual total quantities consumed | Classic Armor | Space Armor |

| Total Steel raw material | 50,000 kg | 10,200 kg |

| Total Vibranium raw material | 600 kg | 385 kg |

| Total direct production labour | 9500 h | 3200 h |

In addition, the sales data actually recorded for Y + 1 are as follows:

|

| Actual unit sales price | Actual quantities sold (units) |

| Classic Armor | 220,000 | 75 |

| Space Armor | 390,000 | 23 |

Finally, the market size that had been anticipated was 500 units. In reality, it was for Y + 1 of 600 units.

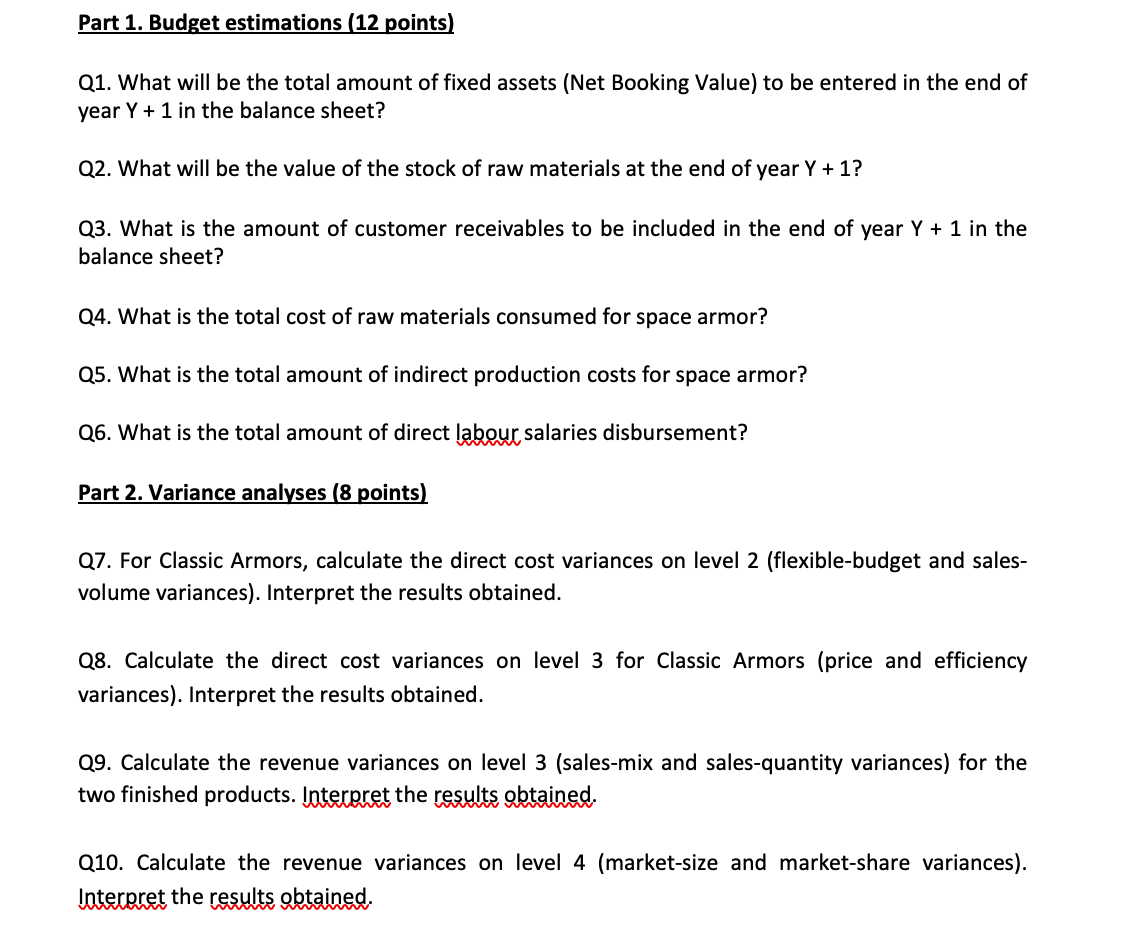

Part 1. Budget estimations (12 points) Q1. What will be the total amount of fixed assets (Net Booking Value) to be entered in the end of year Y + 1 in the balance sheet? Q2. What will be the value of the stock of raw materials at the end of year Y + 1? Q3. What is the amount of customer receivables to be included in the end of year Y + 1 in the balance sheet? Q4. What is the total cost of raw materials consumed for space armor? Q5. What is the total amount of indirect production costs for space armor? Q6. What is the total amount of direct labour salaries disbursement? Part 2. Variance analyses (8 points) Q7. For Classic Armors, calculate the direct cost variances on level 2 (flexible-budget and sales- volume variances). Interpret the results obtained. Q8. Calculate the direct cost variances on level 3 for Classic Armors (price and efficiency variances). Interpret the results obtained. Q9. Calculate the revenue variances on level 3 (sales-mix and sales-quantity variances) for the two finished products. Interpret the results obtained. Q10. Calculate the revenue variances on level 4 (market-size and market-share variances). Interpret the results obtained. Part 1. Budget estimations (12 points) Q1. What will be the total amount of fixed assets (Net Booking Value) to be entered in the end of year Y + 1 in the balance sheet? Q2. What will be the value of the stock of raw materials at the end of year Y + 1? Q3. What is the amount of customer receivables to be included in the end of year Y + 1 in the balance sheet? Q4. What is the total cost of raw materials consumed for space armor? Q5. What is the total amount of indirect production costs for space armor? Q6. What is the total amount of direct labour salaries disbursement? Part 2. Variance analyses (8 points) Q7. For Classic Armors, calculate the direct cost variances on level 2 (flexible-budget and sales- volume variances). Interpret the results obtained. Q8. Calculate the direct cost variances on level 3 for Classic Armors (price and efficiency variances). Interpret the results obtained. Q9. Calculate the revenue variances on level 3 (sales-mix and sales-quantity variances) for the two finished products. Interpret the results obtained. Q10. Calculate the revenue variances on level 4 (market-size and market-share variances). Interpret the results obtainedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started