Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part 1 ? Caff Nero, a famous British coffee, plans to launch a new premium coffee line on the market in 2024. To achieve this

Part 1 ?

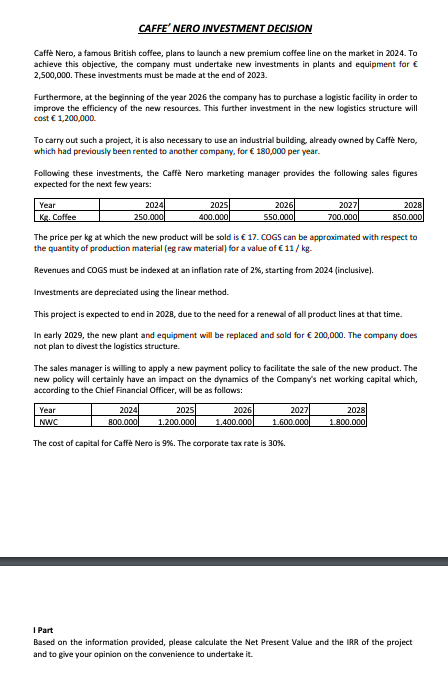

Caff Nero, a famous British coffee, plans to launch a new premium coffee line on the market in 2024. To achieve this abjective, the company must undertake new investments in plants and equipment for f 2,500,000. These investments must be made at the end of 2023 . Furthermore, at the beginning of the year 2026 the company has to purchase a logistic facility in order to improve the efficiency of the new resources. This further investment in the new logistics structure will cost 1,200,000 To carry out such a project, it is also necessary to use an industrial building, already owned by Caff Nero, which had previously been rented to another company, for 180,000 per year. Following these investments, the Caffe Nero marketing manager provides the following sales figures expected for the next few years: The price per kg at which the new product will be sold is E. 17 . COGS can be approwimated with respect to the quantity of production material (eg raw material) for a value of 11/kg. Revenues and COGS must be indexed at an inflation rate of 2%, starting from 2024 (inclusive). Investments are depreciated using the linear method. This project is expected to end in 2028, due to the need for a renewal of all product lines at that time. In early 2029, the new plant and equipment will be replaced and sold for 200,000. The comparry does not plan to divest the logistics structure. The sales manager is willing to apply a new payment policy to facilitate the sale of the new product. The new policy will certainly have an impact on the dynamiss of the Company's net working capital which, according to the Chief Financial Officer, will be as follows: The cost of capital for Caffe Nero is 9%. The corporate tax rate is 30%. I Part Based on the information provided, please calculate the Net Present Value and the IRR of the project and to give your opinion on the convenience to undertake itStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started