Part 1: Calculate the companys Weighted Average Cost of Capital (30 marks) a) Calculate the before-tax cost of bank loans, mortgage loans, and corporate bonds

Part 1: Calculate the company’s Weighted Average Cost of Capital (30 marks)

a) Calculate the before-tax cost of bank loans, mortgage loans, and corporate bonds (6 marks).

b) Calculate the (market) value of bank loans, mortgage loans, and corporate bonds (6 marks).

c) Calculate the cost of ordinary shares and preference shares (6 marks).

d) Calculate the market prices of ordinary shares and preference shares (4 marks).

e) Calculate the total market values of ordinary shares and preference shares (4 marks).

f) Calculate the company’s WACC (4 marks).

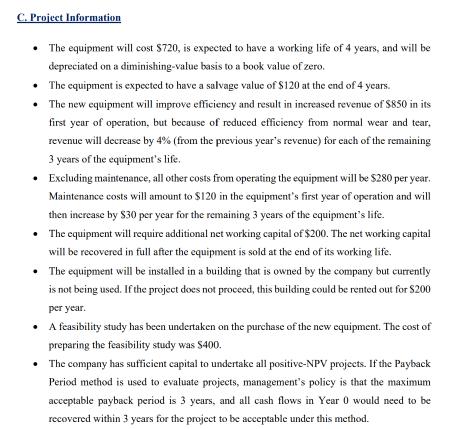

Part 3: Calculate the project’s NPV, Payback Period, and Profitability Index (20 marks)

a) Calculate NPV, Payback Period, and Profitability Index (10 marks)

b) Should the project be accepted? Explain your answer (10 marks).

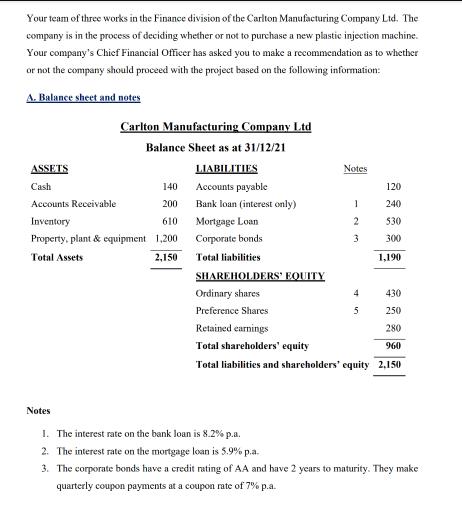

Your team of three works in the Finance division of the Carlton Manufacturing Company Ltd. The company is in the process of deciding whether or not to purchase a new plastic injection machine. Your company's Chief Financial Officer has asked you to make a recommendation as to whether or not the company should proceed with the project based on the following information: A. Balance sheet and notes ASSETS Cash Carlton Manufacturing Company Ltd Balance Sheet as at 31/12/21 LIABILITIES 140 Accounts Receivable 200 Inventory 610 Property, plant & equipment 1,200 Total Assets 2,150 Notes Accounts payable Bank loan (interest only) Mortgage Loan Corporate bonds. Total liabilities SHAREHOLDERS' EQUITY Ordinary shares Preference Shares Notes 1 2 3 4 5 120 240 530 300 1,190 430 250 Retained earnings 280 Total shareholders' equity 960 Total liabilities and shareholders' equity 2,150 1. The interest rate on the bank loan is 8.2% p.a. 2. The interest rate on the mortgage loan is 5.9% p.a. 3. The corporate bonds have a credit rating of AA and have 2 years to maturity. They make quarterly coupon payments at a coupon rate of 7% p.a.

Step by Step Solution

3.58 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a Calculate the beforetax cost of bank loans mortgage loans and corporate bonds Beforetax cost of bank loans 82 pa given Beforetax cost of mortgage loans 59 pa given Beforetax cost of corporate bonds ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started