Question

Part 1: Calculate the value of Tottenham in January 2008 (i.e. with the old stadium and without buying a new striker) by following these steps.

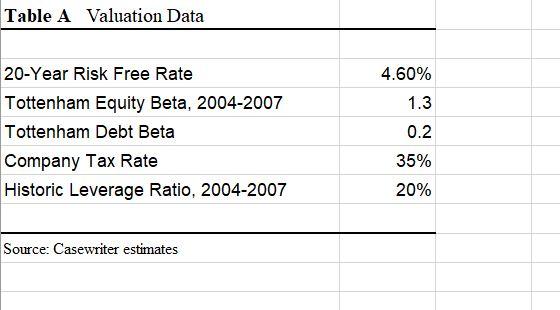

Part 1: Calculate the value of Tottenham in January 2008 (i.e. with the old stadium and without buying a new striker) by following these steps. Please use a 10% discount rate throughout.

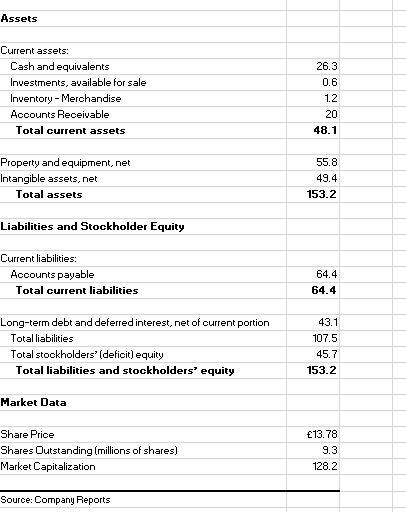

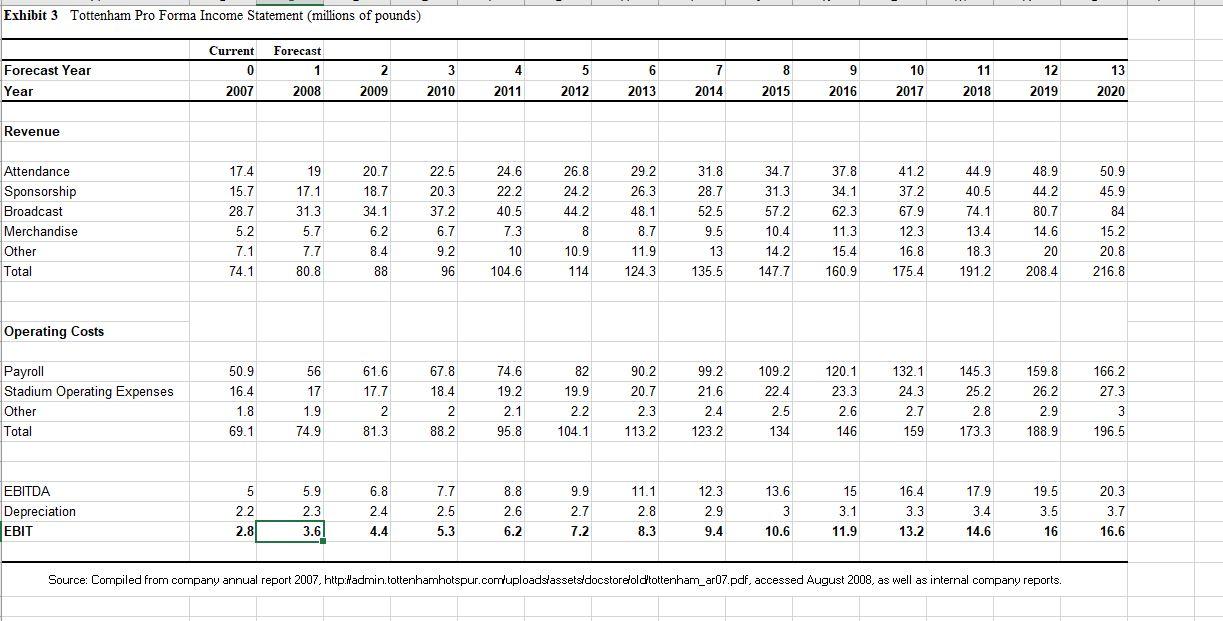

1. Calculate the free cash flows for Tottenham for each year in case exhibit 5 according to the free cash flow recipe:

FCF= EBIT*(1-t) + Depreciation - Capital Expenditures - Increase in Net Working Capital

You will need to forecast net working capital (=AR+Inv-AP) for each year to calculate the increase in net working capital. Generally, one would expect each of these items to grow in proportion to sales. To forecast net working capital, take a look at existing NWC and then forecast out its growth.

Assume all FCFs within the year arrive at the end of the year. Discount each year's FCF back to January 2008.

2. Calculate the continuing terminal value of Tottenham using the PV of a perpetuity formula. Tottenham will generate free cash flows in perpetuity. Take the forecast cash flow from 2020. What growth rate do you expect from 2020 to 2021 and from 2021 onwards? Form a terminal value (TV) based on 2021 cash flows. Don't forget to discount the TV back to January 2008 (remembering, that by using the perpetuity formula, you have already discounted by 1 year, back to 2020).

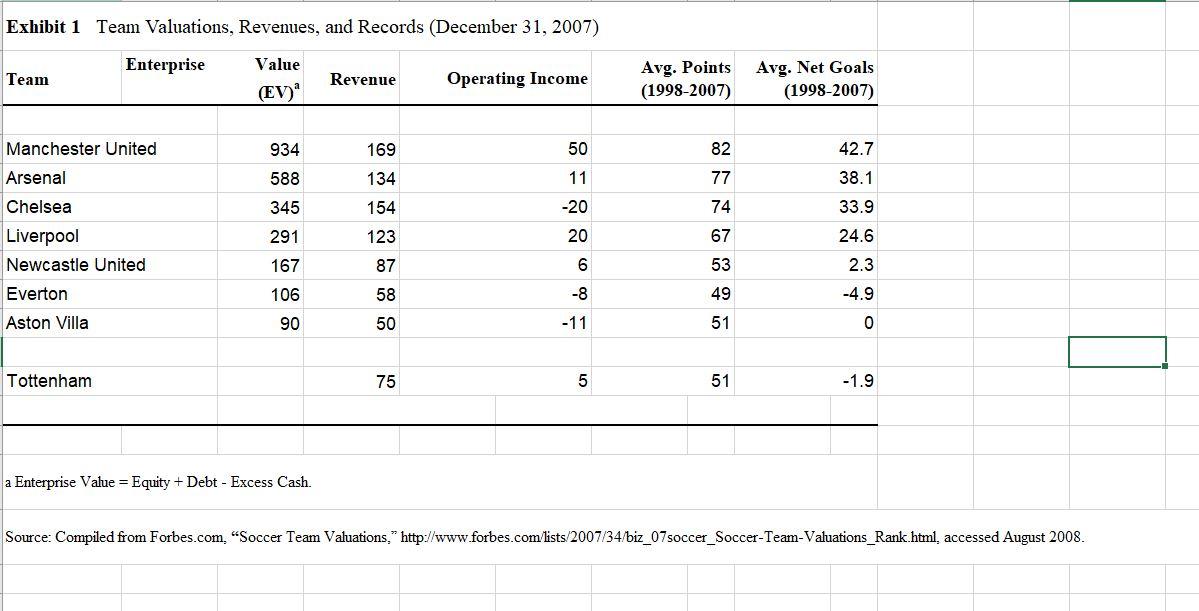

3. Add up all the discounted FCFs to arrive at an estimate for enterprise value for Tottenham. From your estimate of enterprise value, arrive at an estimate for the value of Tottenham's equity. Do you think that Tottenham is fairly valued, undervalued, or over-valued by the market, at GBP 13.80 per share?

4. Now redo your analysis of steps 1-3 but adjusting all the numbers (for revenues, costs, capx, depn, nwc, etc) to figure out the value of Tottenham if it builds a new stadium. Would you recommend to the board to go ahead with the plans for the new stadium or not, based on your analysis of the figures they have provided.

--------------------------------------------

Optional Part 2: Analysis of the decision to build a new stadium and to buy a new striker together. This part is just for fun for interested/advanced students who have time only, we will not cover this in class. I include it only because this decision is mentioned in the case and some students might wonder how to tackle it.

5. Use the same DCF approach above and information in the text of the case regarding the impact of the following changes to perform a valuation of Tottenham. For parts (b) and (c), note that regression analysis of the last 10 years' of Premier League data suggest that for every 1% increase in a team's point total, the team could expect a 1.5% increase in revenues.

(a) with a new stadium

(b) with a new striker

(c) with a new stadium and a new striker

Explain how it can be that your answers to (a) and (b) are negative, but your answer to (c) is positive. What decision would you recommend to the board?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started