Answered step by step

Verified Expert Solution

Question

1 Approved Answer

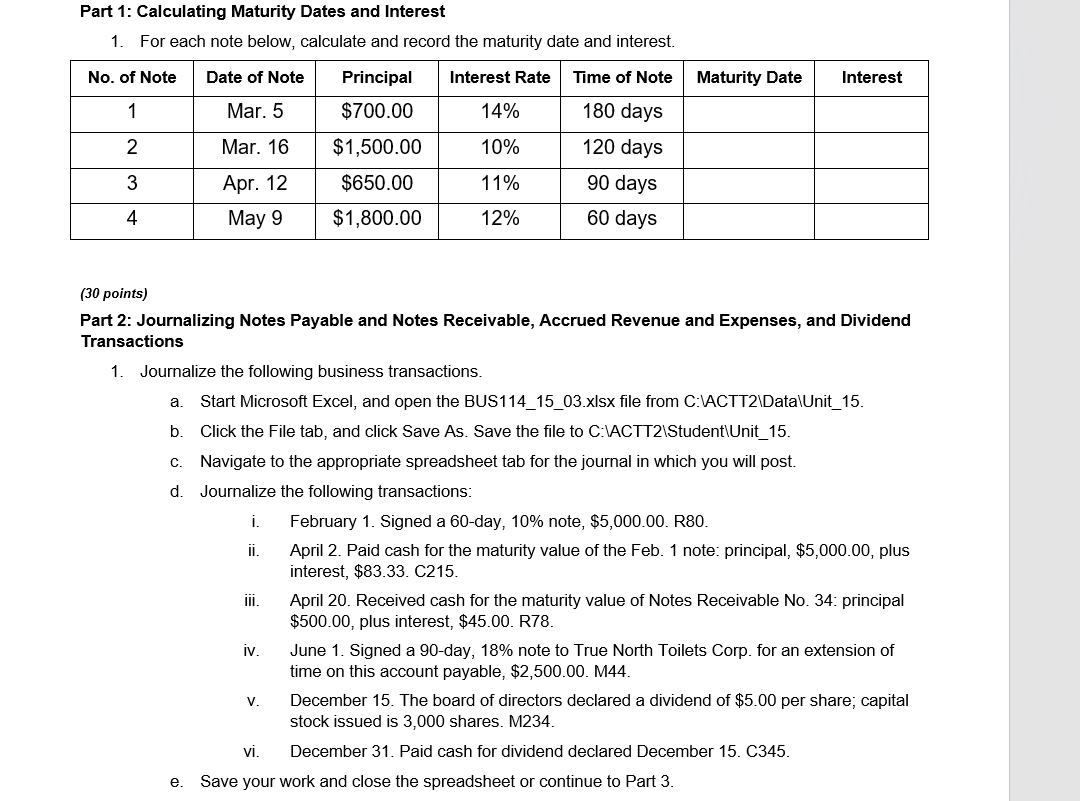

Part 1: Calculating Maturity Dates and Interest 1. For each note below, calculate and record the maturity date and interest. No. of Note Date

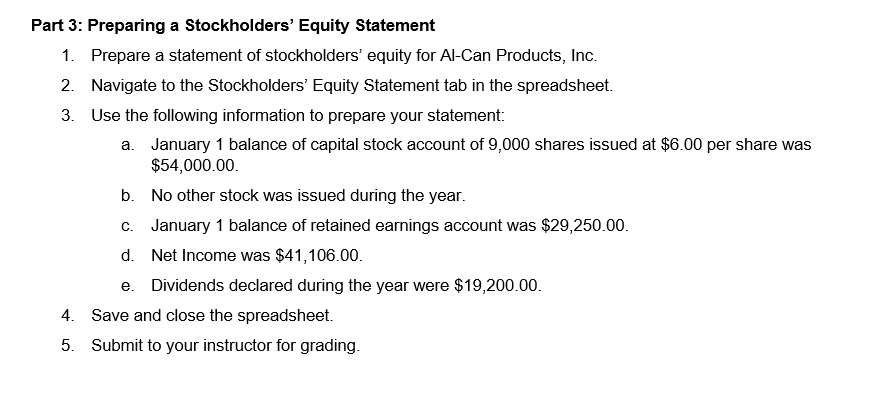

Part 1: Calculating Maturity Dates and Interest 1. For each note below, calculate and record the maturity date and interest. No. of Note Date of Note 1 Mar. 5 Principal $700.00 Interest Rate Time of Note Maturity Date Interest 14% 180 days 2 Mar. 16 $1,500.00 10% 120 days 3 Apr. 12 $650.00 11% 90 days 4 May 9 $1,800.00 12% 60 days (30 points) Part 2: Journalizing Notes Payable and Notes Receivable, Accrued Revenue and Expenses, and Dividend Transactions 1. Journalize the following business transactions. a. Start Microsoft Excel, and open the BUS114_15_03.xlsx file from C:\ACTT2\Data\Unit_15. b. Click the File tab, and click Save As. Save the file to C:\ACTT2\Student\Unit_15. c. Navigate to the appropriate spreadsheet tab for the journal in which you will post. d. Journalize the following transactions: e. i. February 1. Signed a 60-day, 10% note, $5,000.00. R80. ii. iv. V. vi. April 2. Paid cash for the maturity value of the Feb. 1 note: principal, $5,000.00, plus interest, $83.33. C215. April 20. Received cash for the maturity value of Notes Receivable No. 34: principal $500.00, plus interest, $45.00. R78. June 1. Signed a 90-day, 18% note to True North Toilets Corp. for an extension of time on this account payable, $2,500.00. M44. December 15. The board of directors declared a dividend of $5.00 per share; capital stock issued is 3,000 shares. M234. December 31. Paid cash for dividend declared December 15. C345. Save your work and close the spreadsheet or continue to Part 3. Part 3: Preparing a Stockholders' Equity Statement 1. Prepare a statement of stockholders' equity for Al-Can Products, Inc. 2. Navigate to the Stockholders' Equity Statement tab in the spreadsheet. 3. Use the following information to prepare your statement: a. January 1 balance of capital stock account of 9,000 shares issued at $6.00 per share was $54,000.00. b. No other stock was issued during the year. c. January 1 balance of retained earnings account was $29,250.00. d. Net Income was $41,106.00. e. Dividends declared during the year were $19,200.00. 4. Save and close the spreadsheet. 5. Submit to your instructor for grading.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started