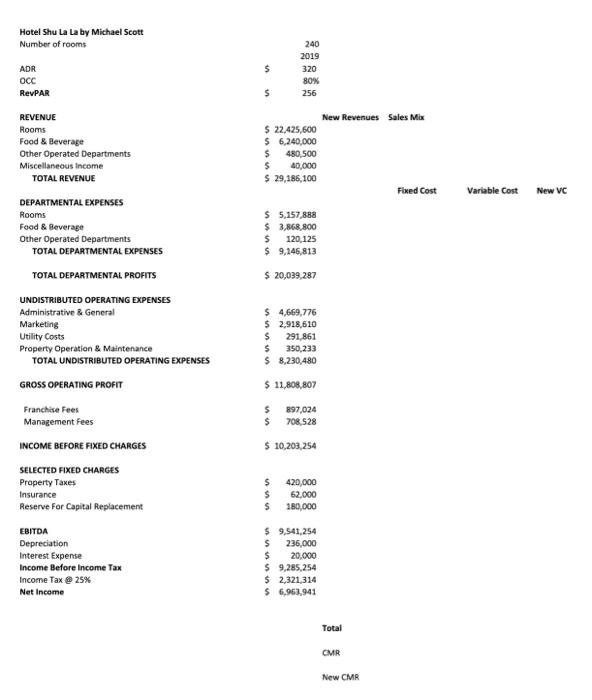

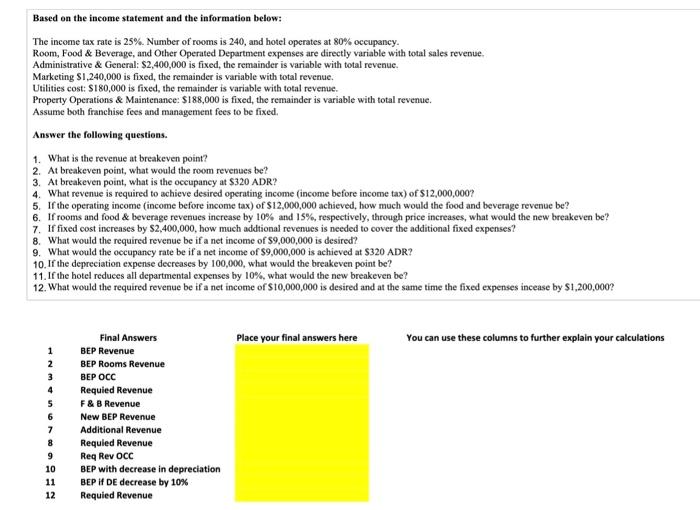

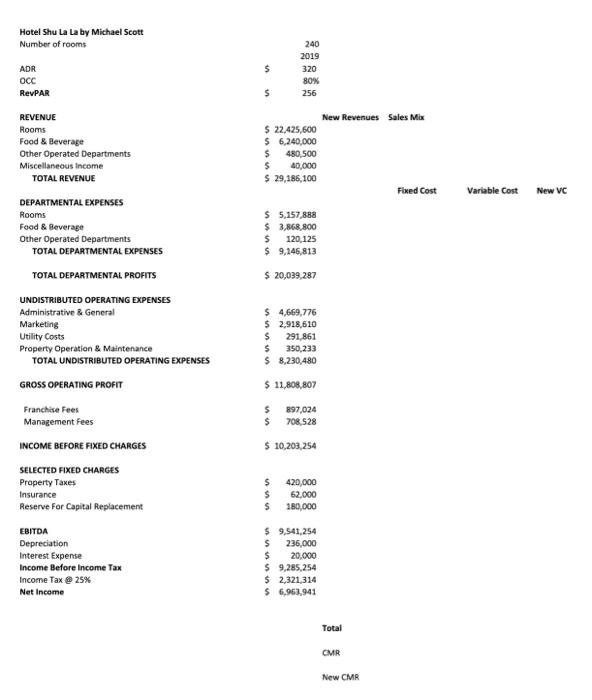

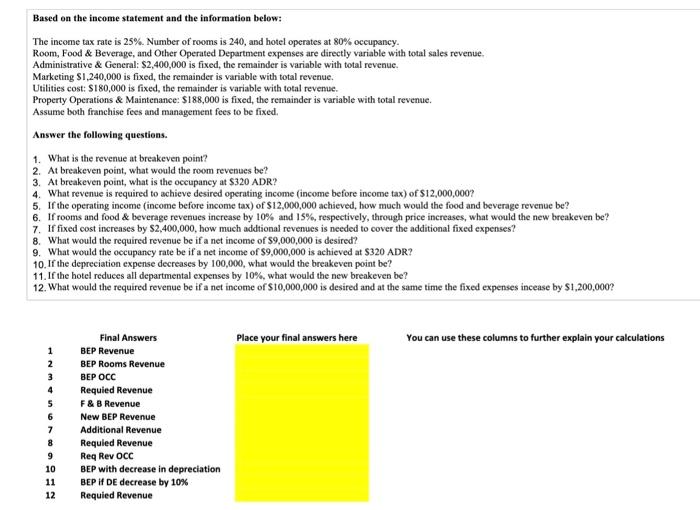

part 1 can you complete the income statement and the missing columns to the right

part 2 after completing the income statement can you answer questions 1-12

Hotel Shu La La by Michael Scott \begin{tabular}{lrr} Number of rooms & & 240 \\ & & 2019 \\ ADR & 5 & 320 \\ OCC & & 800 \\ RevPAR & $ & 256 \end{tabular} REVENUE Rooms Food \& Beverage Other Operated Departments Miscellaneous Income TOTAL REVENUE DEPARTMENTAL EXPENSES Rooms Food \& Beverage Other Operated Departments TOTAL DEPARTMENTAL EXPENSES TOTAL DEPARTMENTAL PROFITS UNDISTRIBUTED OPERATING EXPENSES Administrative \& General Marketing Utility Costs Property Operation \& Maintenance TOTAL UNDISTRIBUTED OPERATING EXPENSES GROSS OPERATING PROFIT Franchise Fees Management fees INCOME BEFORE FIXED CHARGES SELECTED FIXED CHARGES Property Taxes Insurance Reserve For Capital Replacement EBITDA Depreciation Interest Expense Income Before Income Tax Income Tax 625% Net Income New Revenues Sales Mix \begin{tabular}{lr} $ & 22,425,600 \\ $ & 6,240,000 \\ $ & 480,500 \\ $ & 40,000 \\ $ & 29,186,100 \end{tabular} Flued Cost S 5,157,888 $3,868,800 \$ 120,125 \$ 9,146,813 $20,039,287 \$ 4,669,776 $2,918,610 \$ 291,861 5350,233 $8,230,480 $11,808,807 5 897,024 \$ 708,528 510,203,254 $$$420,00062,000180,000 s 9,541,254 \$ 236,000 $20,000 \$ 9,285,254 52,321,314 \$ 6,963,941 Total CMR New CMR Based on the income statement and the information below: The income tax rate is 25%. Number of rooms is 240 , and hotel operates at 80% occupancy. Room, Food \& Beverage, and Other Operated Department expenses are directly variable with total sales revenue. Administrative \& General: $2,400,000 is fixed, the remainder is variable with total revenue. Marketing $1,240,000 is fixed, the remainder is variable with total revenue. Utilities cost: $180,000 is fixed, the remainder is variable with total revenue. Property Operations \& Maintenance: $188,000 is fixed, the remainder is variable with total revenue. Assume both franchise fees and management fees to be fixed. Answer the following questions. 1. What is the revenue at breakeven point? 2. At breakeven point, what would the room revenues be? 3. At breakeven point, what is the occupancy at \$320 ADR? 4. What revenue is required to achieve desired operating income (income before income tax) of $12,000,000 ? 5. If the operating income (income before income tax) of $12,000,000 achieved, how much would the food and beverage revenue be? 6. If rooms and food \& beverage revenues increase by 10% and 15%, respectively, through price increases, what would the new breakeven be? 7. If fixed cost increases by $2,400,000, how much addtional revenues is needed to cover the additional fixed expenses? 8. What would the required revenue be if a net income of $9,000,000 is desired? 9. What would the occupancy rate be if a net income of $9,000,000 is achieved at $320ADR ? 10. If the depreciation expense decreases by 100,000 , what would the breakeven point be? 11. If the hotel reduces all departmental expenses by 10%, what would the new breakeven be? 12. What would the required revenue be if a net income of $10,000,000 is desired and at the same time the fixed expenses incease by $1,200,000 ? You can use these columns to further explain your calculations Hotel Shu La La by Michael Scott \begin{tabular}{lrr} Number of rooms & & 240 \\ & & 2019 \\ ADR & 5 & 320 \\ OCC & & 800 \\ RevPAR & $ & 256 \end{tabular} REVENUE Rooms Food \& Beverage Other Operated Departments Miscellaneous Income TOTAL REVENUE DEPARTMENTAL EXPENSES Rooms Food \& Beverage Other Operated Departments TOTAL DEPARTMENTAL EXPENSES TOTAL DEPARTMENTAL PROFITS UNDISTRIBUTED OPERATING EXPENSES Administrative \& General Marketing Utility Costs Property Operation \& Maintenance TOTAL UNDISTRIBUTED OPERATING EXPENSES GROSS OPERATING PROFIT Franchise Fees Management fees INCOME BEFORE FIXED CHARGES SELECTED FIXED CHARGES Property Taxes Insurance Reserve For Capital Replacement EBITDA Depreciation Interest Expense Income Before Income Tax Income Tax 625% Net Income New Revenues Sales Mix \begin{tabular}{lr} $ & 22,425,600 \\ $ & 6,240,000 \\ $ & 480,500 \\ $ & 40,000 \\ $ & 29,186,100 \end{tabular} Flued Cost S 5,157,888 $3,868,800 \$ 120,125 \$ 9,146,813 $20,039,287 \$ 4,669,776 $2,918,610 \$ 291,861 5350,233 $8,230,480 $11,808,807 5 897,024 \$ 708,528 510,203,254 $$$420,00062,000180,000 s 9,541,254 \$ 236,000 $20,000 \$ 9,285,254 52,321,314 \$ 6,963,941 Total CMR New CMR Based on the income statement and the information below: The income tax rate is 25%. Number of rooms is 240 , and hotel operates at 80% occupancy. Room, Food \& Beverage, and Other Operated Department expenses are directly variable with total sales revenue. Administrative \& General: $2,400,000 is fixed, the remainder is variable with total revenue. Marketing $1,240,000 is fixed, the remainder is variable with total revenue. Utilities cost: $180,000 is fixed, the remainder is variable with total revenue. Property Operations \& Maintenance: $188,000 is fixed, the remainder is variable with total revenue. Assume both franchise fees and management fees to be fixed. Answer the following questions. 1. What is the revenue at breakeven point? 2. At breakeven point, what would the room revenues be? 3. At breakeven point, what is the occupancy at \$320 ADR? 4. What revenue is required to achieve desired operating income (income before income tax) of $12,000,000 ? 5. If the operating income (income before income tax) of $12,000,000 achieved, how much would the food and beverage revenue be? 6. If rooms and food \& beverage revenues increase by 10% and 15%, respectively, through price increases, what would the new breakeven be? 7. If fixed cost increases by $2,400,000, how much addtional revenues is needed to cover the additional fixed expenses? 8. What would the required revenue be if a net income of $9,000,000 is desired? 9. What would the occupancy rate be if a net income of $9,000,000 is achieved at $320ADR ? 10. If the depreciation expense decreases by 100,000 , what would the breakeven point be? 11. If the hotel reduces all departmental expenses by 10%, what would the new breakeven be? 12. What would the required revenue be if a net income of $10,000,000 is desired and at the same time the fixed expenses incease by $1,200,000 ? You can use these columns to further explain your calculations