Answered step by step

Verified Expert Solution

Question

1 Approved Answer

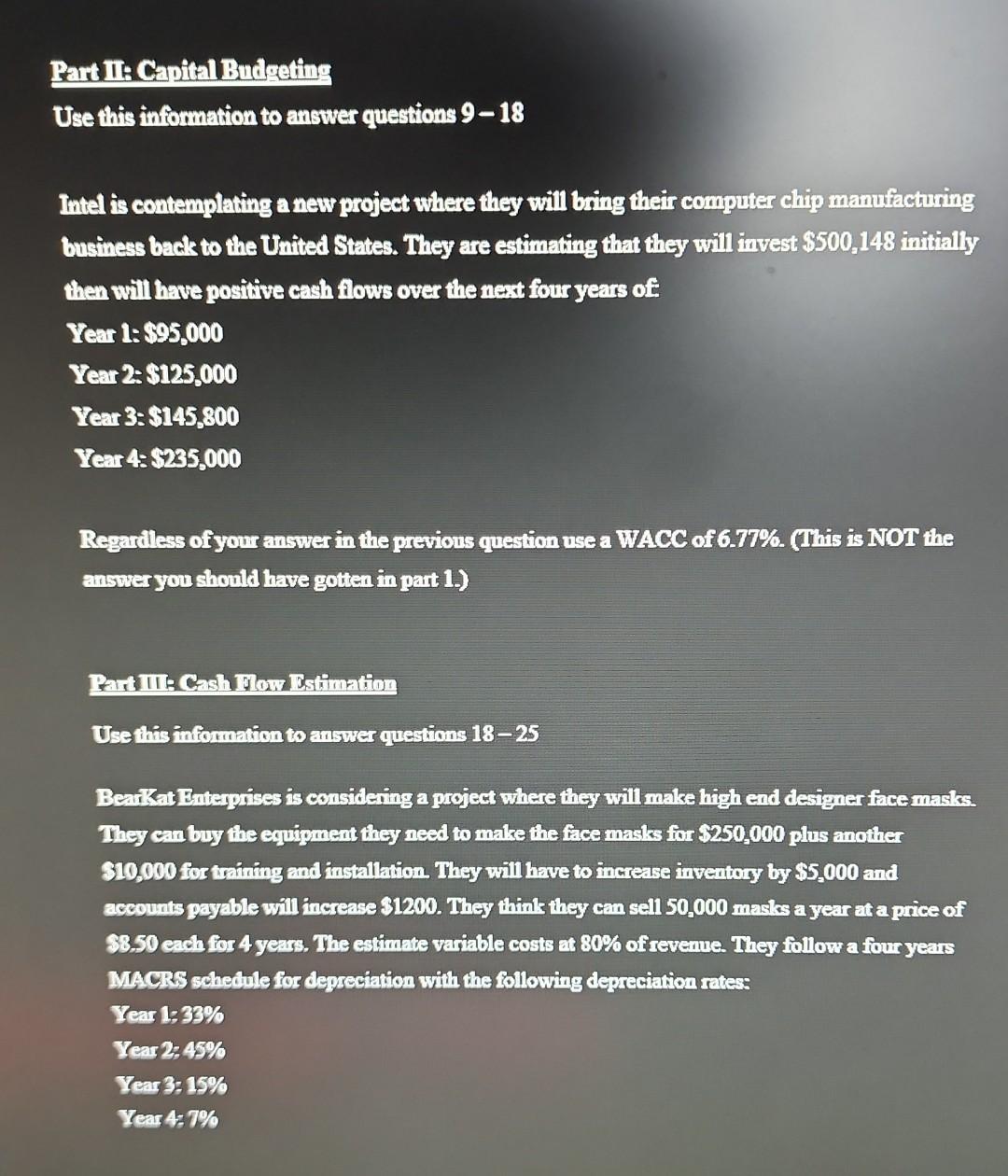

Part 1: Capital Budgeting Use this information to answer questions 9-18 Intel is contemplating a new project where they will bring their computer chip manufacturing

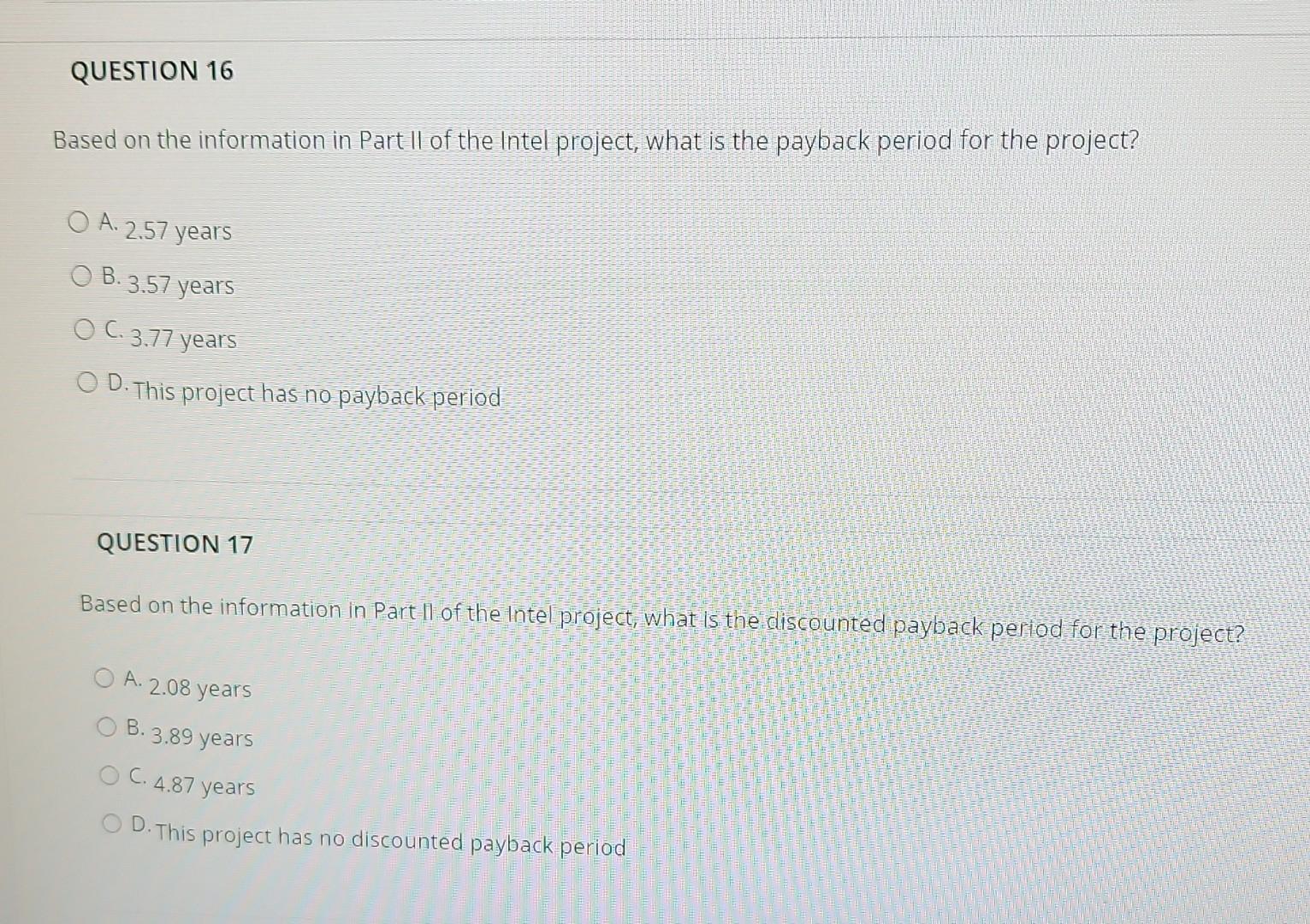

Part 1: Capital Budgeting Use this information to answer questions 9-18 Intel is contemplating a new project where they will bring their computer chip manufacturing business back to the United States. They are estimating that they will invest $500,148 initially then will have positive cash flows over the next four years of Year 1: $95.000 Year 2: $125.000 Year 3: $145,800 Year 4: $235,000 a Regardless of your answer in the previous question use a WACC of 6.77%. (This is NOT the answer you should have gotten in part 1.) Part II: Cash Flow Estimation Use this information to answer questions 18-25 Bearkat Enterprises is considering a project where they will make high end designer face masks. They can buy the equipment they need to make the face masks for $250,000 plus another $10,000 for training and installation. They will have to increase inventory by $5,000 and accounts payable will increase $1200. They think they can sell 50,000 masks a year at a price of $8.50 each for 4 years. The estimate variable costs at 80% of revenue. They follow a four years MACRS schedule for depreciation with the following depreciation rates: Year 1:33% Year 2.45% Year 3: 15% Year 4: 7% QUESTION 16 Based on the information in Part II of the Intel project, what is the payback period for the project? O A. 2.57 years O B. 3.57 years 2 O C.3.77 years O D. This project has no payback period QUESTION 17 Based on the information in Part Il of the Intel project, what is the discounted payback period for the project? O A. 2.08 years OB.3.89 years C. 4.87 years D. This project has no discounted payback period

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started