Answered step by step

Verified Expert Solution

Question

1 Approved Answer

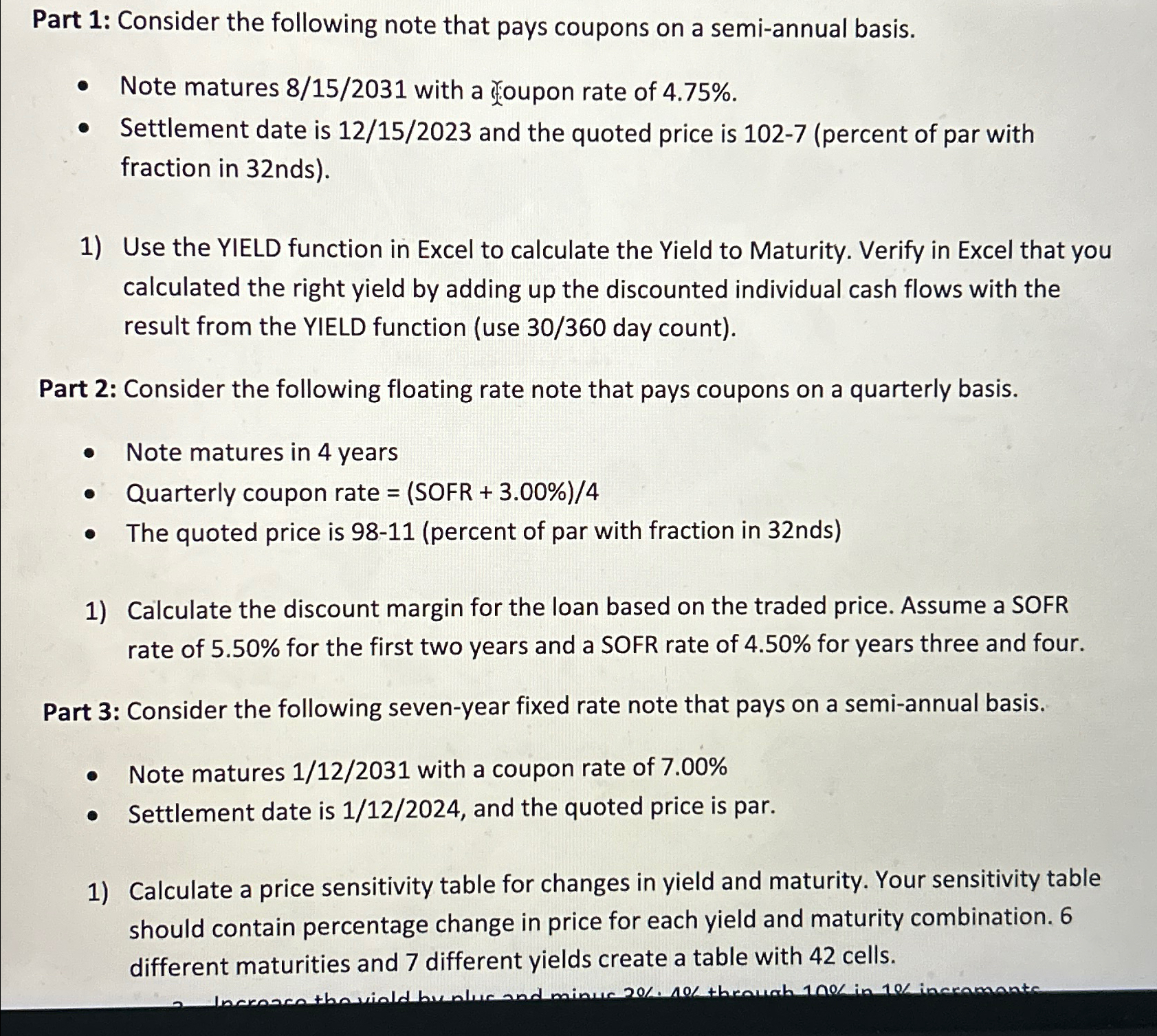

Part 1 : Consider the following note that pays coupons on a semi - annual basis. Note matures 8 1 5 ? 2 0 3

Part : Consider the following note that pays coupons on a semiannual basis.

Note matures with a foupon rate of

Settlement date is and the quoted price is percent of par with fraction in

Use the YIELD function in Excel to calculate the Yield to Maturity. Verify in Excel that you calculated the right yield by adding up the discounted individual cash flows with the result from the YIELD function use day count

Part : Consider the following floating rate note that pays coupons on a quarterly basis.

Note matures in years

Quarterly coupon rate

The quoted price is percent of par with fraction in

Calculate the discount margin for the loan based on the traded price. Assume a SOFR rate of for the first two years and a SOFR rate of for years three and four.

Part : Consider the following sevenyear fixed rate note that pays on a semiannual basis.

Note matures with a coupon rate of

Settlement date is and the quoted price is par.

Calculate a price sensitivity table for changes in yield and maturity. Your sensitivity table should contain percentage change in price for each yield and maturity combination. different maturities and different yields create a table with cells.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started