Answered step by step

Verified Expert Solution

Question

1 Approved Answer

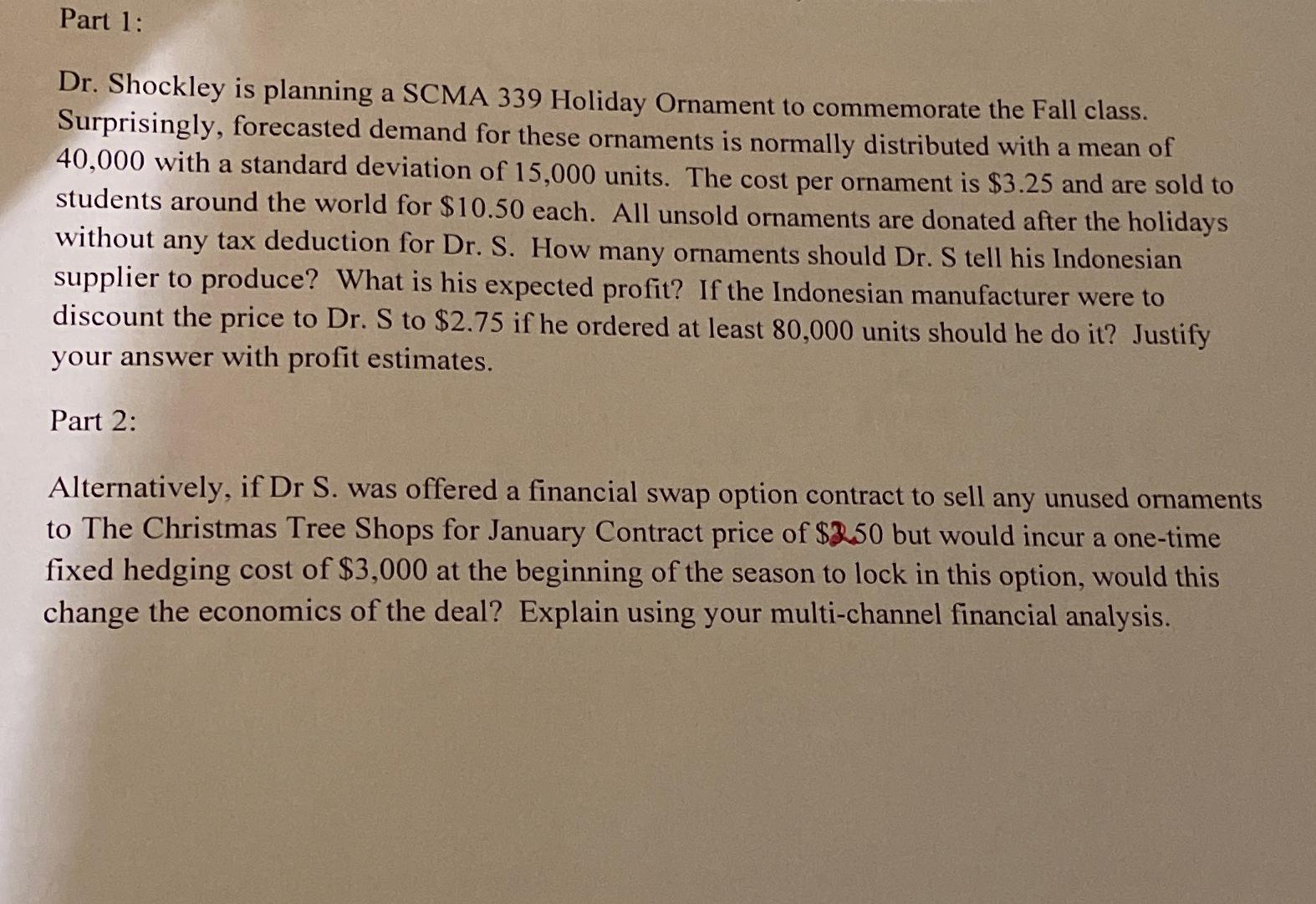

Part 1 : Dr . Shockley is planning a SCMA 3 3 9 Holiday Ornament to commemorate the Fall class. Surprisingly, forecasted demand for these

Part :

Dr Shockley is planning a SCMA Holiday Ornament to commemorate the Fall class. Surprisingly, forecasted demand for these ornaments is normally distributed with a mean of with a standard deviation of units. The cost per ornament is $ and are sold to students around the world for $ each. All unsold ornaments are donated after the holidays without any tax deduction for Dr S How many ornaments should Dr S tell his Indonesian supplier to produce? What is his expected profit? If the Indonesian manufacturer were to discount the price to Dr S to $ if he ordered at least units should he do it Justify your answer with profit estimates.

Part :

Alternatively, if Dr S was offered a financial swap option contract to sell any unused ornaments to The Christmas Tree Shops for January Contract price of $ but would incur a onetime fixed hedging cost of $ at the beginning of the season to lock in this option, would this change the economics of the deal? Explain using your multichannel financial analysis.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started