Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part 1 Examples of ordinary income, income from personal exertion A lawyer of many years had been involved with a family company and after

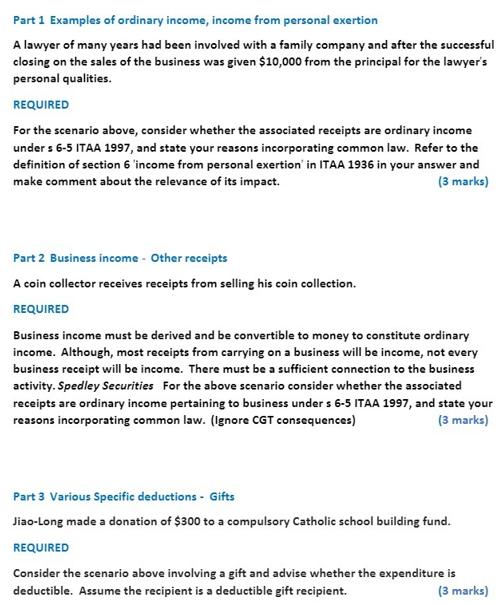

Part 1 Examples of ordinary income, income from personal exertion A lawyer of many years had been involved with a family company and after the successful closing on the sales of the business was given $10,000 from the principal for the lawyer's personal qualities. REQUIRED For the scenario above, consider whether the associated receipts are ordinary income under s 6-5 ITAA 1997, and state your reasons incorporating common law. Refer to the definition of section 6 income from personal exertion in ITAA 1936 in your answer and make comment about the relevance of its impact. (3 marks) Part 2 Business income - Other receipts A coin collector receives receipts from selling his coin collection. REQUIRED Business income must be derived and be convertible to money to constitute ordinary income. Although, most receipts from carrying on a business will be income, not every business receipt will be income. There must be a sufficient connection to the business activity. Spedley Securities For the above scenario consider whether the associated receipts are ordinary income pertaining to business under s 6-5 ITAA 1997, and state your reasons incorporating common law. (Ignore CGT consequences) (3 marks) Part 3 Various Specific deductions - Gifts Jiao-Long made a donation of $300 to a compulsory Catholic school building fund. REQUIRED Consider the scenario above involving a gift and advise whether the expenditure is deductible. Assume the recipient is a deductible gift recipient. (3 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Part 1 Examples of Ordinary Income Income from Personal Exertion For the scenario involving the lawyer receiving 10000 from the principal of the family company after the successful sale of the busines...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started