Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part 1: Forecasting and Seasonal Production Schedule Part 2: Monthly Cash Payments Schedule Part 3: Monthly Cash Receipts Schedule Part 4: Monthly Cash Flow Part

Part 1: Forecasting and Seasonal Production Schedule

Part 2: Monthly Cash Payments Schedule

Part 3: Monthly Cash Receipts Schedule

Part 4: Monthly Cash Flow

Part 5: Cash Budget

Part 6: Pro Forma Income Statement

Part 7: Cost of Goods Sold Schedule

Part 8: Pro Forma Balance Sheet (March)

Part 9: Explanation of Changes in the Balance Sheet

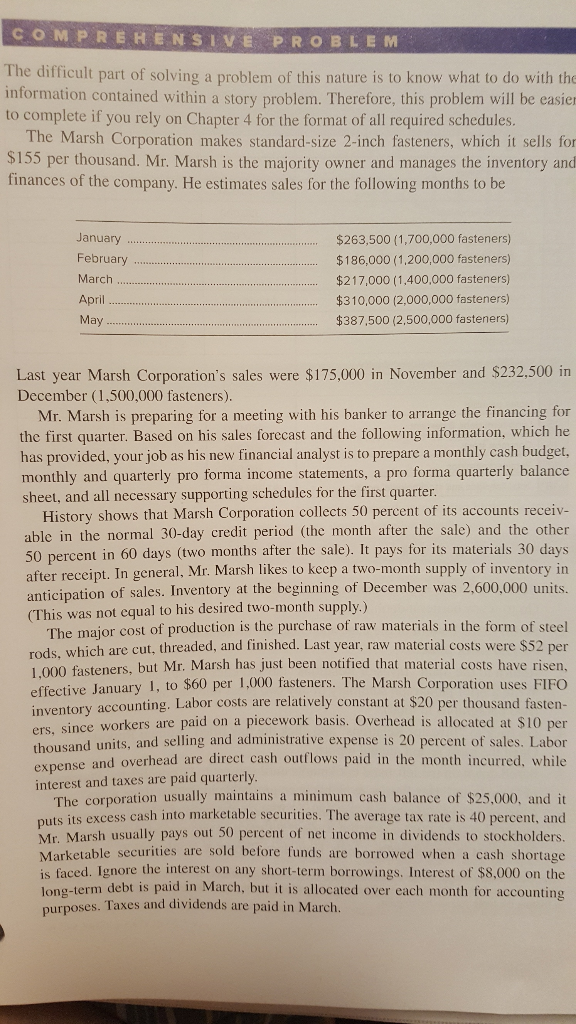

COMPREHENSIVE PROBLEM The difficult part of solving a problem of this nature is to know what to do with the information contained within a story problem. Therefore, this problem will be easier to complete if you rely on Chapter 4 for the format of all required schedules. The Marsh Corporation makes standard-size 2-inch fasteners, which it sells for $155 per thousand. Mr. Marsh is the majority owner and manages the inventory and finances of the company. He estimates sales for the following months to be January February March April May $263,500 (1,700,000 fasteners) $186,000 (1,200,000 fasteners) $217,000 (1.400,000 fasteners) $310,000 (2,000,000 fasteners) $387,500 (2,500,000 fasteners) Last year Marsh Corporation's sales were $175,000 in November and $232,500 in December (1,500,000 fasteners). Mr. Marsh is preparing for a meeting with his banker to arrange the financing for the first quarter. Based on his sales forecast and the following information, which he has provided, your job as his new financial analyst is to prepare a monthly cash budget, monthly and quarterly pro forma income statements, a pro forma quarterly balance sheet, and all necessary supporting schedules for the first quarter. History shows that Marsh Corporation collects 50 percent of its accounts receiv- able in the normal 30-day credit period (the month after the sale) and the other 50 percent in 60 days (two months after the sale). It pays for its materials 30 days after receipt. In general, Mr. Marsh likes to keep a two-month supply of inventory in anticipation of sales. Inventory at the beginning of December was 2,600,000 units. (This was not equal to his desired two-month supply.) The major cost of production is the purchase of raw materials in the form of steel rods, which are cut, threaded, and finished. Last year, raw material costs were $52 per 1,000 fasteners, but Mr. Marsh has just been notified that material costs have risen, effective January 1, to $60 per 1,000 fasteners. The Marsh Corporation uses FIFO inventory accounting, Labor costs are relatively constant at $20 per thousand fasten- ers, since workers are paid on a piecework basis. Overhead is allocated at $10 per thousand units, and selling and administrative expense is 20 percent of sales. Labor expense and overhead are direct cash outflows paid in the month incurred, while interest and taxes are paid quarterly. The corporation usually maintains a minimum cash balance of $25,000, and it puts its excess cash into marketable securities. The average tax rate is 40 percent, and Mr. Marsh usually pays out 50 percent of net income in dividends to stockholders. Marketable securities are sold before funds are borrowed when a cash shortage is faced. Ignore the interest on any short-term borrowings. Interest of $8,000 on the long-term debt is paid in March, but it is allocated over each month for accounting purposes. Taxes and dividends are paid in March. COMPREHENSIVE PROBLEM The difficult part of solving a problem of this nature is to know what to do with the information contained within a story problem. Therefore, this problem will be easier to complete if you rely on Chapter 4 for the format of all required schedules. The Marsh Corporation makes standard-size 2-inch fasteners, which it sells for $155 per thousand. Mr. Marsh is the majority owner and manages the inventory and finances of the company. He estimates sales for the following months to be January February March April May $263,500 (1,700,000 fasteners) $186,000 (1,200,000 fasteners) $217,000 (1.400,000 fasteners) $310,000 (2,000,000 fasteners) $387,500 (2,500,000 fasteners) Last year Marsh Corporation's sales were $175,000 in November and $232,500 in December (1,500,000 fasteners). Mr. Marsh is preparing for a meeting with his banker to arrange the financing for the first quarter. Based on his sales forecast and the following information, which he has provided, your job as his new financial analyst is to prepare a monthly cash budget, monthly and quarterly pro forma income statements, a pro forma quarterly balance sheet, and all necessary supporting schedules for the first quarter. History shows that Marsh Corporation collects 50 percent of its accounts receiv- able in the normal 30-day credit period (the month after the sale) and the other 50 percent in 60 days (two months after the sale). It pays for its materials 30 days after receipt. In general, Mr. Marsh likes to keep a two-month supply of inventory in anticipation of sales. Inventory at the beginning of December was 2,600,000 units. (This was not equal to his desired two-month supply.) The major cost of production is the purchase of raw materials in the form of steel rods, which are cut, threaded, and finished. Last year, raw material costs were $52 per 1,000 fasteners, but Mr. Marsh has just been notified that material costs have risen, effective January 1, to $60 per 1,000 fasteners. The Marsh Corporation uses FIFO inventory accounting, Labor costs are relatively constant at $20 per thousand fasten- ers, since workers are paid on a piecework basis. Overhead is allocated at $10 per thousand units, and selling and administrative expense is 20 percent of sales. Labor expense and overhead are direct cash outflows paid in the month incurred, while interest and taxes are paid quarterly. The corporation usually maintains a minimum cash balance of $25,000, and it puts its excess cash into marketable securities. The average tax rate is 40 percent, and Mr. Marsh usually pays out 50 percent of net income in dividends to stockholders. Marketable securities are sold before funds are borrowed when a cash shortage is faced. Ignore the interest on any short-term borrowings. Interest of $8,000 on the long-term debt is paid in March, but it is allocated over each month for accounting purposes. Taxes and dividends are paid in March

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started