Question

Part 1: Investment Appraisal (A) An investor has two alternative schemes to improve his property portfolio. Scheme A involves a complete modernisation now of buildings

Part 1: Investment Appraisal

(A) An investor has two alternative schemes to improve his property portfolio. Scheme A involves a complete modernisation now of buildings which will cost 5,500,000 now. Annual operation and maintenance charges will amount to 125,000 per year. Scheme B would involve investing 1,800,000 now and the remainder of the work carried out in 5 years time at a cost of 3,700,000. In this alternative case annual operating and maintenance charges will be 150,000 per year for the first 5 years and 125,000 per year thereafter. Calculate the net present value (NPV) and the annual equivalent (AE). Advise the client which scheme should be selected. Assume an annual interest rate of 5% and an asset life of 30 years for both schemes. [10%]

(B) Critically evaluate the suitability of Cost Benefit Analysis as a decision making tool for public sector infrastructure projects. Illustrate your answer with examples [20%]

Part 2: Case Study - Business Performance

(A) Review the accounts of Carillion PLC (2007 to 2016). Using four financial ratios of your choice discuss the performance of the company over this period.[50%]

(B) Business failure in the construction industry is not uncommon. It is important therefore that construction professionals and business owners are aware of factors that contribute to business failure. Briefly discuss the factors that may have significantly contribute to failure of Carillion PLC.[20%]

[Max 750 words]

Thank you guys. It would be grateful.

Please refer to the annual report. http://www.annualreports.co.uk/HostedData/AnnualReports/PDF/LSE_CLLN_2016.pdf

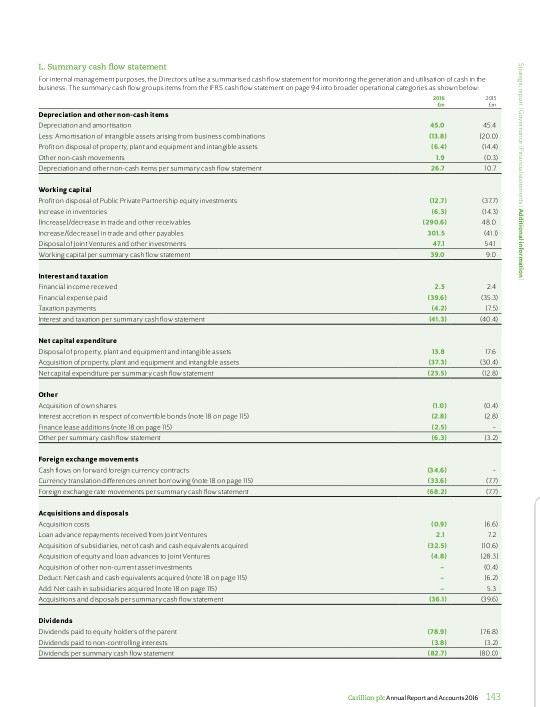

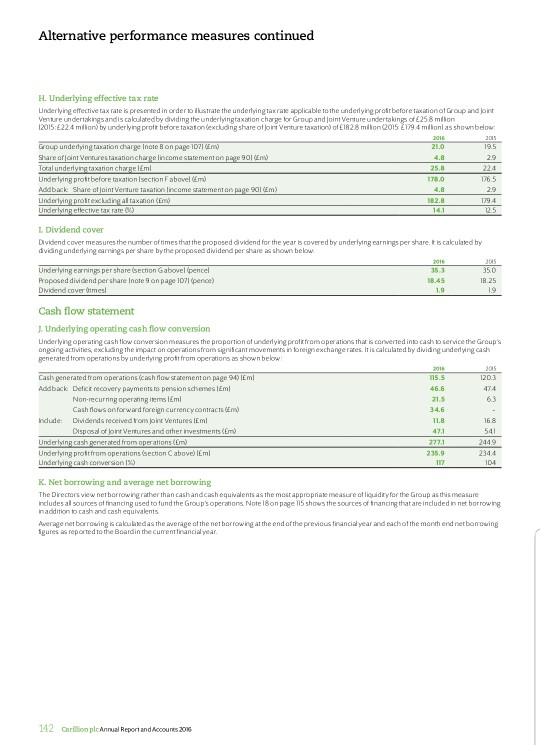

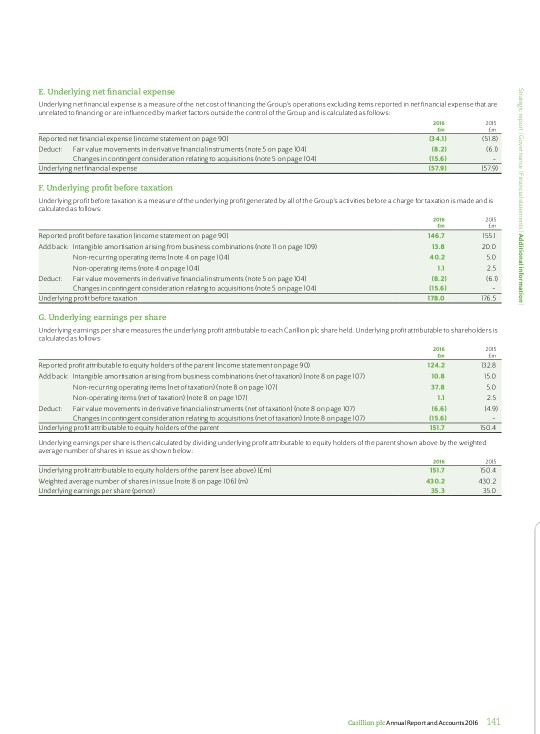

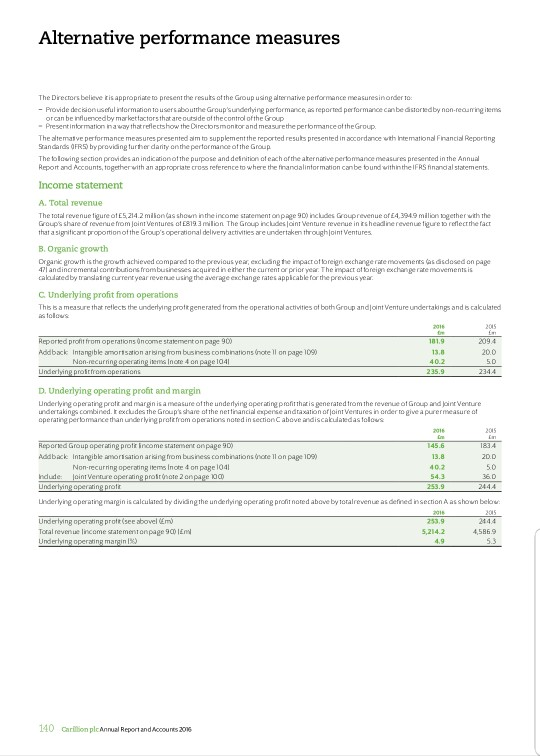

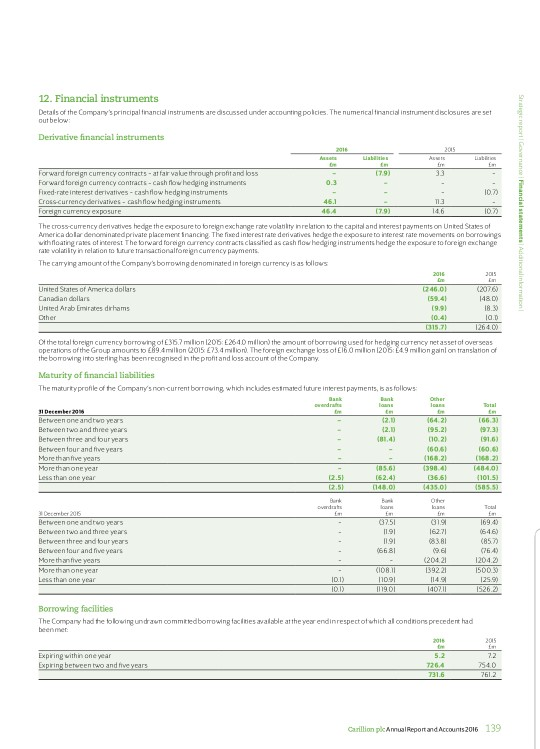

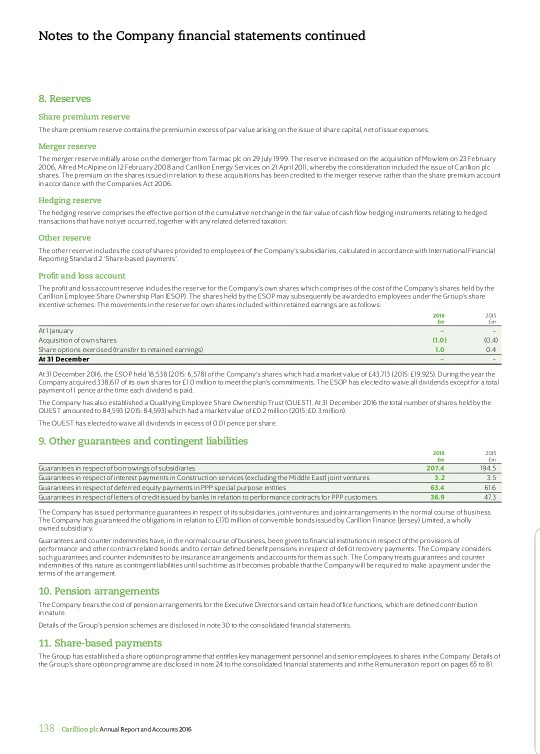

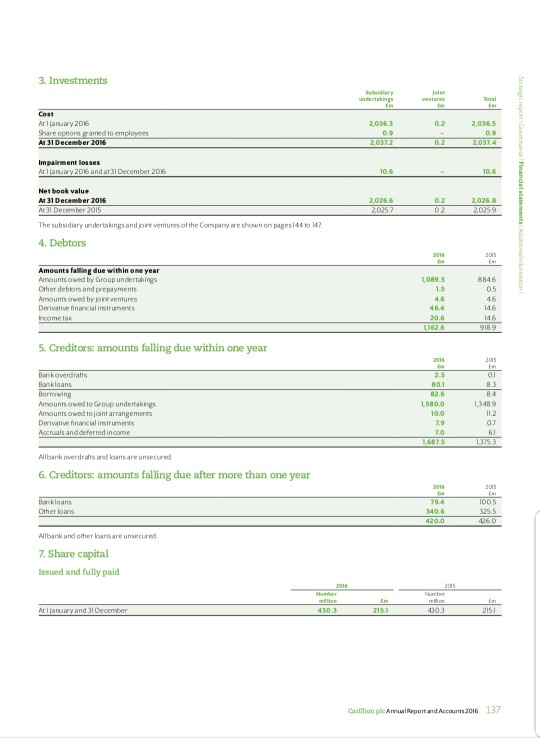

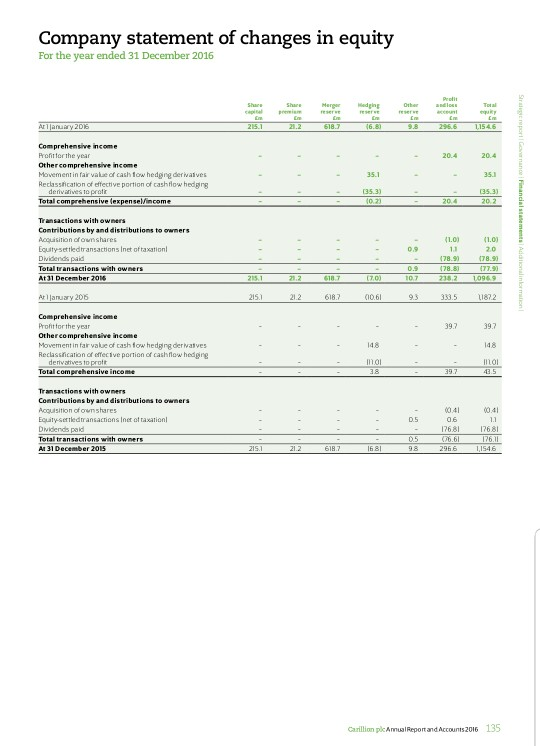

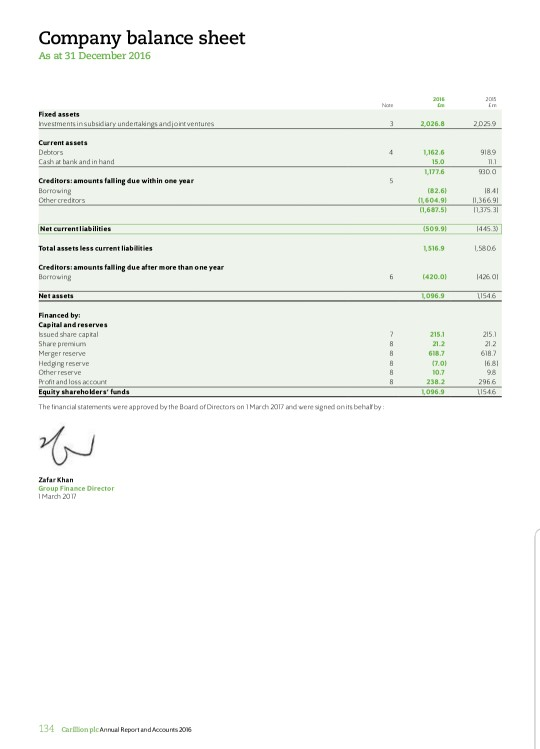

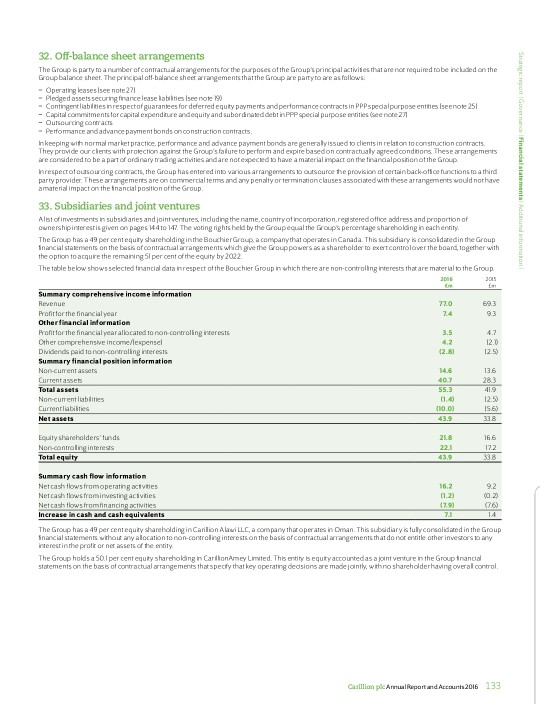

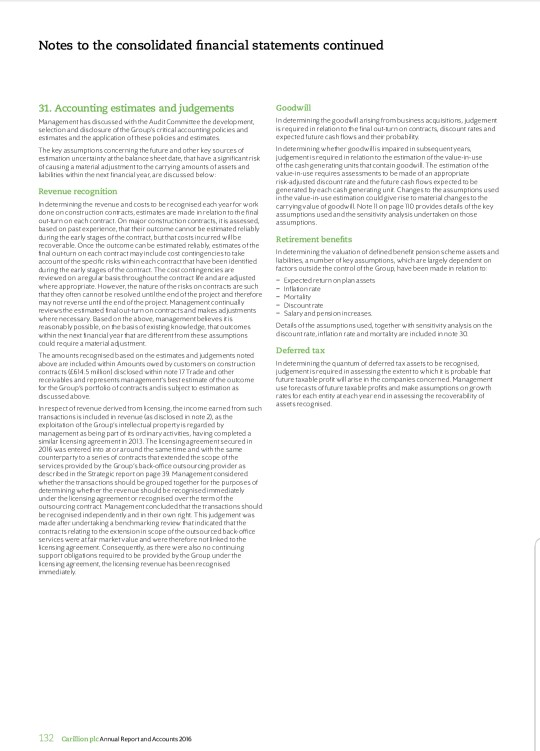

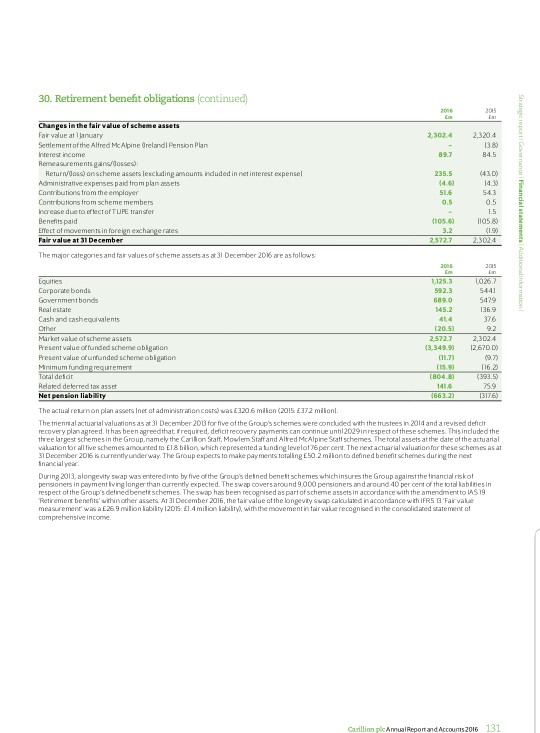

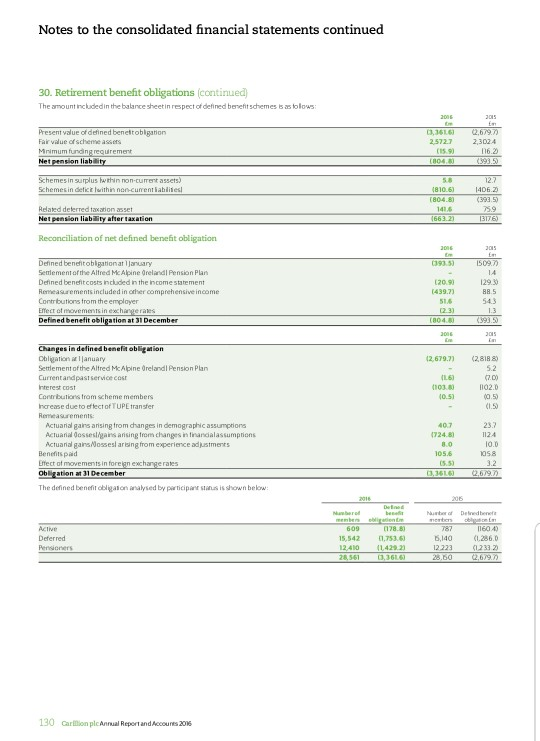

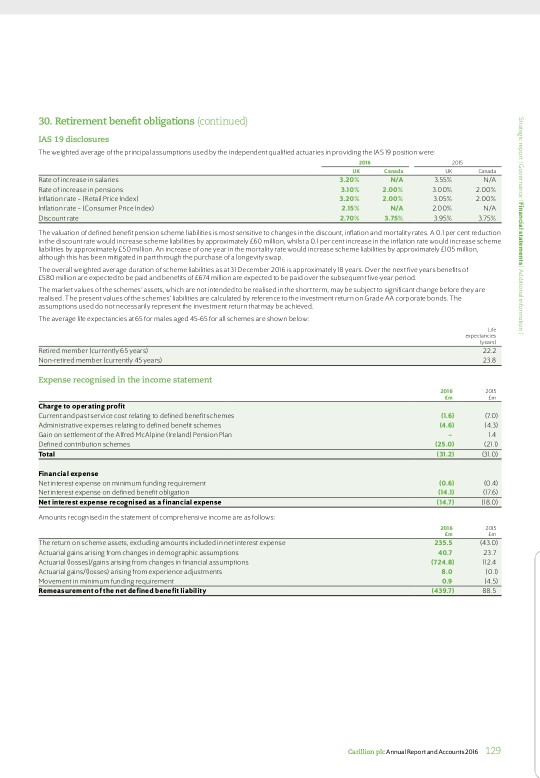

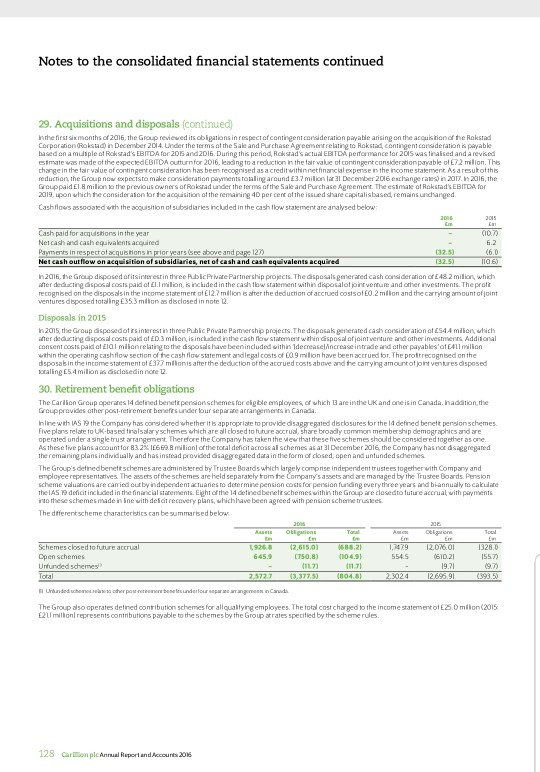

L Summary cash flow statement For internal management purposes, the Directors utlse a summarsed cashflow statement for monitoring the peneration and utlsaton of cash in the business. The summarycash flow groups items from the FRS cashflowstaremet on page 94 inmo broader operarional caegories as shounbelou: 2015 2016 fim Depreciation and othernon-cash tems Depreciationand amortsation Less Amortisation of intangble assets arising from business combinations Profiton disposal ot property, plantand equipment and intangible assets 454 45.0 (13.8) 120.00 (6.4 (144 Cther non-cash movements 19 (D.30 Depreciationand othernon-cash tems per summarycash flow statement 26.7 10.7 Working capital 02.7) (377 Profiton disposal of Public Private Partnership equity invesments ngrease in inventories (6.3) (14.3) Increasel/decrease in trade and other recevables (290.6) 480 IncreseNdecreasel in trade and other payables (41.0 301.5 Disposalot jointVentures and other invesments 471 54 Working capital per summary cash flow starement 39.0 90 Interestand taxation Financial incomereceived 2.5 24 (39.61 (4.2) Financial expense paid Taxation payments (35,30 17.5 nterest and taxation per summary cashflow statementh (41.3) (40.4) Net capital expenditure Disposalot propety, plant and equipmentand intangible asses Acquisition of property, plant and equipment and intangble assets Netcapital expenditure per summarycash flowstatement 13.8 I76 (37.3) (304 (23.5) (12.80 Other Acouisition of ownshares 0.01 0.4x 12.8) Interest accretion in respect of comvertible bonds inote 18 on page 115 12 8% Finance lease additions note 18 on page 15 (2.5) Drher per summary ca 6.31 13.20 ement Foreign exchange movements Cash fows on forward foregn currency contracts 04.6) (33.6 Curnency translarionditerences onnet bomrowing noe 18 on page 115) (7) Foreign exchangerae movements persummarycash flow starement (68.2) Acquisitions and disposals (09) 166x Acquisition costs Loan advance repayments received trom joinr Ventures 2. 22 Acquisition of subsidiaries, net of cash and cashequivalents acquired 132.5) l10.6x (4.8 Acquisition of equty and loan advances to joint Ventures 128.31 Acquisition of other non-currentassetimvestments Deduct Netcash and cash equivalenrs acquired nore 18 on page 115x 004) 16.2 Add Ner cash in subsidiaries acquired Inore 18 on page TS) 5.3 (36.1 Acquisitions and deposab persummarycash flow statement 396 Dividends 178.91 (3.8) Dividends paid to equity holderss of the parenr 1768 Dividends paid to non-controlling inrerests Dvidends per summary cash tlow statements 13.2 (82.7 180.00 143 Carillian ple AnualRaport and Accounts 2016 Additional inlormation Alternative performance measures continued H. Underlying effective tax rate Underlying effective rax rate is presented in order o iustrate the underlying taxrae applicable to the underlying protrbefore taxarion of Group and joinr Venture undertakingsandis caloulahedby dviding the underlyingtaxation charge for Groupand joint Venture undertakings of E25.8 milon 12015:E224 milor) by underlying prott before taxaton (exckuding share of jont Venture taxation) of E1828 milon (2015 E179.4 milonl as shownbelow 2015 2016 Group underlying taxation dharge Inote B on page 1071 (Em Share ofjaint Ventures raxationcharge lincome sarement on page 901 Em Total underlying taxation charge lm 21,0 19.5 4.8 29 25.0 22.4 Underlying prottbefore taxation Isection F abovel (Em 178.0 176.5 Addback Share ot joint Venture taxation lincome sratement on page 901(Em) 48 29 179 4 Underlying proftesclading all taxanion (Em) 182.8 Underlying etlectve tax rat 05 14.1 125 1 Dividend cover Dividend cover measures the number of times that the proposed dividend for the year is covered by underlying earnings per share. t s cakculated by dviding undertying carnings per share bythe proposed dividend per share as shown below 2016 205 Underlying earnings per share (section Gabovel (pencel 35.3 350 Proposed dividend per share Inote 9 on page 1071 (pence) Dvidend cover hmesl 18.45 18.25 19 1.9 Cash flow statement J Underlying operating cash flow conversion Underlying operating cash tlow conversionmeasures the proportion at underlying protrfromoperations thar is converted into cash o service the Group's ongoing activities exclading the impacr on operaionsfrom signitcant movements in toreignexchange rates. It is calculated by dividing underlying cash generated from operations by underlying prott from operations as shown below 2018 2015 15.5 Cash generared from operations (cash flow starement on page 94) IEml 120.3 Addback Deticit recovery payments to pension schemes lEml Non-recurning operating items 1Eml Cash flows anforward foreign currencycontracts (Em 46.6 474 21.5 6.3 34.6 ndude Dividends received trom joint Ventures lEm 11.8 16.8 Cisposal of loint Ventures and other westments (Cm) 541 471 Underlying cash generated from opeerations (Em) Underlying prottfrom operations (section C above) IEml Underlying cash conwersion 1%x 277.1 244.9 2344 235.9 104 K. Net borrowing and average net borrowing The Direcrors view net borrowing raher than cash andcashequivalents as the mostappropriae measure ot liquidiry for the Group as this measure includes al sources of financing used to fund the Group's operations. Note 18on page 15 shows the sources of tnancing that are included in net borrowing inaddition to cash and cash equlvalents. Average net borrouing is calaulaedas the average of the net borrowing at the end of the previous financial year and eachot the month end netbomrouing igures as reported to the Boardin the current financial year. Carion plcAnrual Report and Accounts 2o 142 E. Underlying net financial expense Underlyingnetfinancial expense is a measure of the net cost offinancing the Groups operations excluding tems reported in netfinancial expense that are unrelated to finanding or are intlaencedby marker factors outside the control of the Group and is calculaed as follows pese uie acuarom 21 2015 Repored ner financial expense lincome starement on page 90 Deduct (3411 (518) .2) Farvalue movements in derivative financialinstruments (note 5 on page 04 Changes incontingent consideration relating to acquisitions (none S onpage 104 (6.0 (15.61 1579) Underlying netfinandal expenses (579) F.Underlying profit before taxation Underlying profit before taxation is a measure of the underlying profit generaned by all ot the Group's acivities betore a charge tor taxaion is made and is calalaredas tolous 305 2016 I55 Repored profit before taxation lincome starement on page 901 146.7 Addback Intangible amorisation arising from business combinations nore l on page 1090 13.8 20.D Non-recurring operating items Inote 4 on page 104 40.2 500 Non-operating items (note 4 on page 104 Fairvalue movements in denvarive tinancialinsruments (note 5 on page 104 Changes incontingent consideration relatrg to acquisitions (note 5 onpage 104 1.1 2.5 Deduct (21 (6.D (15.6) Underhving prottbefore taxation 178.0 176.5 G. Underlying earnings per share Underlying eamings per share meassures the underlying profit attributable to each Canlion pk share held. Underlying profit attributable to shareholders is calulatedas folows 2016 2015 E Reported profit attrbutable to equity holders of the parent Iincome statementonpage 900 124.21 1328 Addback Intangible amortsation arsing from business combinations netoftaxation) Inote 8 on page 107 150 10.8 Non-recurring operating items Inet oftaxation)(note 8 on page 107 Non-operating iems (net of taxarion) Inote B on page 107 Farvalue movements in derivarive tinancialinsruments (ner ot raxationl onore 8 onpage 10 Changes incontingent consideration relating to acquisitions (netof taxation) Inote 8 onpage l07 37.8 500 2.5 Deduct 6.61 14.90 (15.6) Underlying profratrbutable to equity holders ofthe parent 151.7 504 Lnderlying eamings per share is thencalculared by dividing underlying prott amrburable to equty holders ot the parenrshoun above by the weighred average number af shares in isue as shown below 2016 2015 Underlying prott attributable to equaty holders of the parent Isee above) IEm Weghted averagenumber of shares inissue Inote 8 on page 1061 (m) Underlying earnings per share (pence) 151.7 604 430.2 430.2 35.3 350 Casillian ple ArnualRaport and Accounts 2016 141 Additional information Alternative performance measures The Directors believe itis appropriare to present the resuts ot the Group using alternative performance measuresinorder to: -Provide decisionuseful intormanion to users abouthe Group's underlying performance, as reported performance can be distored by non-reauming iems orcan be influencedby markettactorsthat are outside of thecontrol ofthe Group Presentinformation inaway thatreflectshow the Cirectorsmontor and measurethe perlormance of the Group The altematve performance measures presented am to supplementthe reported resuls presented in accordance with Intemational Financial Reporting Srandards FRS) by providing turther danty onthe pertormance ot the Group The tolouing section provides an indicarionot the purpose and deinition ot each of the ahernaive pertomance measures presented in the Annual Report and Accounts, togetherwith an appropriate cross reference to where the finandalintormation can be found within the I FRS finandal statements. Income statement A. Total revenue The total revenue tigure ot ES,214.2 millon (as shoun inthe income starement onpage 90) includes Grouprevenue of E4,3949 milion ogether with the Groups share of revenue from joint Ventures ot ES19.3 milion The Group includes loint Venture revenue in rs head ine revenue figure 1o reflecrthe fact that a significant proportionof the Group's operational delvery activities are undertaken throughjoint Ventures B. Organic growth Drganic growth is the growth achieved compared to the previous year, exclading the impactof foreign exchangerae movements (as disdosed on page 47 andincremental contrburions from businesses acquiredin ether the curent or prior year The impact at toreign exchange rate movements is callaredby transaing currentyear revenae using the average exchange rates appicable for the previous year C Underlying profit from operations This s a measure that retlects the underlying proftgenerated from the operational activities of both Group andjoint Venture undertakings and is cakculated stolous 2018 2015 Reported profit from operations Oncome statement on page 900 Addback Intangible amortsation arising from business combinations note 1l on page 109) 181.9 209.4 200 13.8 Non-recurring operaring iems Inore 4 on page 104 40.2 50 Underlying prottfrom operations 235.9 2344 D. Underlying operating profit and margin Underlying operating prott and margin is a measure of the underlying operaring profittharis generated trom the revenue of Group and joinr Vennure undertakings combined. t exclades the Group's share otthe nettinancial expense andraxation ofloint Ventures in order to give a purermeasure of operating pertomance than underlying protefrom operations noted in secrionC above andiscakudaed as folous 2016 2015 Repored Group aperaing protr income statement onpage 90 Addback Intangible amorisation arising from business combinations nore 1l on page 109) 145.6 183 4 13.8 20.0 Non-recurning operating items Inote 4 on page 104 laintVennre operaring profronote 2 onpage 100 50 40.2 ndude 54. 3 36.0 253.9 2444 Underlying operating prote Lnderlying operating margin is calculated by dividing the undelying operaing profit nored above by toralrevenue as defined insecrion A asshown below: 305 2018 253.9 Underlying operating profe(see abovel Emb Toral revenue lincome sratementonpage 900 lEm Underlying operating margin %) 2444 5.214.2 4,586.9 5.3 4.9 Carllion plcAnnual Report and Accounes 2o- 140 12. Financial instruments Detals of the Company's principal financial instruments are discussed under accounting polcies. The numerical financial instrument disclosures are set out below Derivative financial instrumnents 2015 2016 As fr Aasts ablities Liabton n Forward forelgn currency contracts- at fair value through profit and loss Forward toreign currency contracts-cash flow hedging instmuments Fxed-rate interest derivatives-cashflow hedginginstruments Cross-currencyderivatives- cashflow hedging instruments. Foregn currency exposure (7.9) 0.3 I070 46.1 464 (7.9) 14.6 1070 The cross-currency derivatives hedge the exposure to foreignexchange rate volatity inrelation to the capital and interest payments on Unted States of America dolar denominaredprivate placement inancing The fised inerest rae derivarives hedge the exposure to interesr rate movements on bornrowings vithloatingraes of interest The torward foreign aurrency contracts classitied as cash flow hedging instruments hedge the exposure to foreign exchange rae volaiity in relation to tunure transactionalforeigncurency payments The carrying amount of the Company's borrowing denominated in foreign currency is as tollows 2016 2015 (2076) United States of America dollars (246.0) (5941 Canadian dellars 14800 United Arab Emirates dirhams (9.9) 18.30 Other (0.4) ja.D 315.7) 1264.00 Of the total foregn currency borrowng of E367 milion 1205: 2640 mllion) the amount ofborrowing used for hedging currency netasset of overseas operations of the Group amounts to E89.4millon (2015 734 mlon The fre the borowingR into srelng has beenrecognbed in the prght and loss accoure of ange loss ofEl6.0mlon 1205 49mlon gainl on translation of the Company Maturity of financial liabilities The maturty profile of the Company's non-current borrowing which inckudes estmated turure interest payments, is as follows Tatal Nandrata losas Inasa 1December 20s Between one andtwo years Betweentwo and three years Between three and tour years Between four and five years More than five years tn (2.10 (64.2) 95.2) (66.3) 12.D (97.3) (01.4) no.2) (91.6) (60.6) (168.2) (60.6) (68.23 (398.4) (36.6 More thanone year (85.6) (484.0) Less than one vear (62,4) (101.5) 148.0) (2.51 1435.01 (585.5) Banik 0ter pyndratu lowe Ioane Toul Decamber 2015 frm Between one andtwo years Between two and three years Between three and four vears Between four and five years (3751 31.9 169.4) .9 162.71 064.6) 838 9 (857) 06681 96l (764) (204.21 3922 More thanfive years 1204.2 More thanone year (I08.11 1500.30 Less than one year 11091 14.9 25.9 1407.1 I19.01 1526.2 Borrowing facilities The Compary had the tolowing undraun commttedborrowing facities avalable atthe year endinrespectotuhich all condtions precedent had beenmer 2016 305 Expiring within one year Expring between two and frve years 5.2 72 7540 726.4 731.6 761.2 139 Carillion plcAmnual Report and Accounts 2016 Financial atatements Notes to the Company financial statements continued 8. Reserves Share premium reserve The share premium reserve conrains the premiumin excess of parvalue aris ing on the issue ot share capital net ofissue expenses Merger reserve The merger reserve intially arose onthe demergerfrom Tarmac plc on 29 July 1999 The reserve increased on the acquisition of Mowlem on 23 Febraary 2006, Ared McAlpine on 12 February 2008 and Canillon Energy Services on 21 April 2011, whereby the consideration included the issue of CariBon plc shares. The premium on the shares issuedinrelation to these acquistions has beencredted to the merger reserve rather than the share premkum account inaccordance with the Companies Acr 2006 Hedging reserve The hedging reserve comprises the effective portion ot the cumuaive netchange in the fair value of cash tlow hedging instruments relaring o hedged transactions thathave notyet occurred,together with any related deferred taxation Other reserve The otherreserve includes the costof shares provided to employees of the Company's subsidaries, cakulaned in accordance with Inernaniona l Financial Repoming Standard 2 Share-based payments Profit and loss account The profit and lossaccount reserve Indudes the reserve for the Company's oun shares whichcomprises of the cost of the Company's shares held by the Canlion Employee Share Cunership Plan ESOP). The shares held bythe ESOP may subsequently be awardedto employees under the Group's share incentive schemes. The movements inthe reserve for own shaes included withinretained earnings are as follows. 3015 2016 At1anuary Acquisition of ownshares Share options exerdisedransfer o rerained eamingsk 1.0h 004) 10 04 At 31 December Ar31 December 2016, the ESOP held 18538 1206: 6.5781 of the Company's shares which had a market vakue of 43,713 1206: E19.925. During the year the Company acquired 338 617 of ts own shars for E10 milion to meet the nians commitments. The ESOP has electedto wahe all dvidends exoeptfor a total payment ofI pence atthe time each diidend is paid The Company has also established a Ouaitying Employee Share Ownership Trusr (OUESTI. Ar31 December 2016 the otal number of shares held by thes CUEST amounted to 84593 1205 B4,5931 uich had a markervalue of ED2 millon (2015:D.3milion. The OUEST has electedto wave all dividends in excess of 001 pence per share. 9. Other guarantees and contingent liabilities Guarantees in respectof borrowings of subsidiaries 2074 194 5 Garanees in respect ofinteresr payments in Construction services (excluding the Middle Eastl joint vennures Guaranees in respectof defered equity payments in PPP special purpose ennities Guarantees in respect ofletters of credit issued by banks in relation to performance contracts for PPP customers 3 7 3.5 63.4 616 473 36.9 The Compary has ssued perlormance guarantees in respect of its subsidkaries.jointventures and joint arrangements in the normal course of business. The Compary has guaranteed the obligations in relation to E170 milion oft convetible bonds issuedby Carllion Finance lersey) Limted, awholly ouned subsidiary Guarantees and couner indemnities have, in the normalcourse of business been given to financial insniturions in respect of the provisions ot performance and othercontracHrelaed bonds andto certain detined benetit pensions inrespect ot deiat recovery payments. The Company considers suchguarantees and counter indemnites to be iresurance arrangements andaccounts for them assuch. The Company treats guarantees and counter Indemnties of ths nature as contingentlabities until suchtime as it becomes probable that the Company wil be required to make apayment under the terms of the arrangement 10. Pension arrangements The Company bears dhe cost of pensionarrangements tor the Executive Direcrorsand certain headofice functions, which are detinedcontrbution innature Detals of the Group's pension schemes are disclosed in note 30 to the consalidaed tirancial statements 11. Share-based payments The Group has established a share option programme that enttles key management personnel and senioremplayees to shares inthe Company. Detals of the Group's share optionprogramme are disclosed in note 24 to the consolidated firancial statements and inthe Remuneraton report on pages 65 to 81. 138 Carilion plc Annual Report and Accounes 20- 3, Investments Sebsidiary undertakings Jein ventures Tatal En Cost Ar 1January 201 Share options granted to employees At 31 December 2016 2.036.3 0.2 2.036.5 0.9 2,037.2 0.9 0.2 2,037.4 Impairment losses Ar1january 2016 and at 31 December 206 10.6 10 6 Net book value 2,026.6 At 31 December 2016 0.2 2.026.8 Ar 31 December 2015 2025.7 0 2 2025 9 The subsidiary undertakingsand joint ventures of the Company are shown on pages144 to 147 4. Debtors 201. 2015 Amounts falling due within one year Amounts owed by Group undertakings Other debtors and prepayments Amounts owed by joint ventures Derivative financial instruments L089.5 8846 1.5 05 4.6 46 146 46.4 Income tax 20.6 146 L162.6 918 9 5. Creditors: amounts falling due within one year 2010 2015 Bankaverdralts 2.5 Bankloans 80.1 83 Berrowing 82.6 8.4 Amounts oved to Group undertakings Amounts owed to joint arrangements Dertvative financial instrummts 1580.0 1,3489 10.0 11.2 7.9 07 Accruals anddefer red income 7C 6J 1,687.5 1375.3 Allbank overdrats and loans are unsecured 6. Creditors: amounts falling due after more than one year 201 2015 Bankloans Other loans 79.4 1005 340,6 325.5 420.0 426 0 Allbank and other loansare unsecuaed 7. Share capital Issued and fully paid ar5 2018 Nunber Nurber mllion TBom ArJanuary and 31 December 215 1 2151 430.3 4303 137 Carillian plc AnnuaiRepot and Accounts 2016 Financial statements Notes to the Company financial statements 1. Significant accounting policies The following accounting polides have been appled consistently in dealing fan hichare considered material in relation to the Compamy's Share-based payments Members ot the Group's senior management eam are enitled to participate in the Leadership Equity Award Plan ILEAPI and UK employees are able to particlipate in the Sharesave scheme. statements Under the terms of the Group's bonus arrangements, Executive Cirectors and certain senior employees receive a proportion oftheir bonus in shares which are delerredfor a period of upto three years. The tair value ofthe LEAP Sharesave and deferred bonus arangements ar the date of grant are estimated using the Black-Scholes pricing model Basis of preparation These financialstatements were prepared in accordance with Financial Reporting Standard 101 Reduced Cisclosure Framework CFRS 101L The amendments to FRS10 12013/14 Cycle) sued injuly 2014 and effectives immediately have beenapplied. The far value determin ed at grant date is expensed on a straight-Ine bass t VSingperiod.basedon anestimate of the number of sharestharwillevennually vest andtaking into accountservice and r the In preparing these financial statements, the Company applies the recognition, measrement nd dsclosureregakements of International Firancial Reporting Standards as adopted by the BUCAdopted IF RSs, but makes amendments where necessaryinorder to complywith Companies- non-market conditions The Group also operates a Share Incentive Plan (SIP under which qualtying Canllon Energy Services partnersmay recetve free shares. The fair value ofthe free shares are recognsed asan expense in the income statement over the vesting period of the shares Act 2006 The finandialstarements are presented inpounds sering They are- preparedon the historical cost basis,eceptforfinancial instmaments tha are measured atrevaluedamounts or far values atthe end of each reporting period, as explained in the accounting polcies below Financial guarantee contracts Where the Company enters intofinancial guarantee contracts to guarantee the indebtedness of subsidiary companles, the Company corsiders these- to be insurance arrangements and treats the guarantee contract as a contingentliablity uml suchtime as it becomes probable tharhe Company wil berequired to make a paymentunder the guaratee Taxation Deterred tax is provided using the balance sheer iability method, providing for temporary dimferencesberweenthe carrying amounts ot assets and lahine for trancial reportng purposes and the amounts used for taxation purpose ement edisbased on the epeiliabl ation or senad bance sheetda ng faxrates enactrdor substantively enacted aTthe es The Retirement benefit obligations tof the carrying amor d55ers a For defined contribution pensionschemes operated by the Group amounts payable by the Company are charged to the income statement as theyfal due Adeterred tax asset is recognised only to the extent tharit is probable thar future taxable profits will be available against which the asset can be utlised. Deferred tax assets are reduced to the extent that it is no lorger probable tharthe related tax beneitwill be realised. 2. Profit for the year and dividends Aspermited by the Companies Act 2006, the Company has elected netto presentits oun proft andlossaccountfor the year. Carilon plc reported a prottfor the financialyearended 31 December2016 of 20.4mllon 205: 397millonl Fixed asset investments In the Company's inancial sraements, invesments in subsidary undertakings and joint ventures are stated at cost less provisionfor any imparment Fees payable o KPMGLLP and irs associates for non-audrservices to the Company are norrequired to be disclosed in the individual accounts of Carlionplcbecause the Company's cons to disdose suchfees on a consolidated basis dared accounts are required Own shares Considerationpaid for shares in the Company held bythe Employee Share- OwnershipPlan(ESOPI Trust are deducredfromthe protr and loss account reserve Wheresuchshares subsequentlyvest in the employees under the terms of the Company's share optionschemes or are sold.any consideration receved s included in the profit andloss accountreserve. A final dvidend, dedared in the previous year, of 12.55 pence 12015 12.6pencel per share was paldduring the yeat amounting to E540 milion 205 52.3 millon Aninterim dividendot58 pence 12015: 57 pence) per share was paid during the year, amounting to 24.9 milon (2015 6245 milonl. A final dvidend of12.65 pence (2015 1255 pence) per share, amounting to 544 mllon (2015 E540 mlonl,was approved by the Board on I March 2017 and, subject1o approval by shareholders atthe Anual General Meering, wil be paid on 9 June 2017to sharehokders on the register one 12May 2017 Foreign currencies Transactions denominatedin foregn currencles are translated into- stering andrecorded using the exchangerate prevailng at the date of the transacton Monetary assets and labilities denominated in foreigne aurrency are translated into stering using exchange rates as at the balance sheet dae Financial instruments The Company's prindpalfinancial assets and liabitnies are cash at bank and in hand and borrowings. Cash at bank and in hand is carried in the balance sheetat amotisedcost Borowings are recognisedinitialyatfair value less anibutable trans acrion costs and subsequently a amomised cost. In addnon, the Company enters into forward contracts in order o hedge against smal and intrequent ransactional foreign ourrency exposures. In cases where these c is appled where nve irstrumentsare significant. hedge accounsng during the year are recognsedinthe proft and loss account, Fair values are based on quoted marker prices ar the balance sheet dae. The Company has taken the exemption within FRS 10I Financial Insruments Disclosure and does notpresent all of the requireddisdosures as they are includedinthe consolidated financial statements of which the Company s the parent ere hedge accountrg b not appled, movementsin lue 136 Cullion ple AnnualReport and Accounts 2016 Company statement of changes in equity For the year ended 31 December 2016 Protit shece Share Hedging Other Total ane Nergn gren equ Eom Ar1anuary 2016 215.1 21.2 618.7 16 8L 11546 9.8 296.6 Comprehensive income Profittorthe year Othercomprehensive income Movement in fair value of cash tow hedging derivasves 20.4 20.4 35.1 35.J Reclassfication of effective portion of cashflow hedgng derivatives to protin Total comprehensive (expenselincome (35.3) (35.3) (0.2) 20.4 20.2 Transactions with owners Contributions by and distributions to owners Acquisition of ownshares (1,0) (1.0 2.0 11 Equitysettledtransactions Inet of taxation 0.9 Dividends paid (78.9) (78.9) Tetal transactions with owners 0.9 (78.8) (77.90 At31 December 2016 215 1 21.2 (7.00 10.7 238.2 1096 9 6187 10.6 Arl January 206 215. 21.2 618.7 93 333.5 1872 Comprehensive income Profit for the year 39.7 397 Othercomprehensive income Movement in far value of cash fow hedging der vatves Reclassiication of effecive portion of cashflow hedging dernvatves to proft 148 14 8 39 7 43 5 38 Total comprehensive income Transactions with owners Contributions by and distributions to owners Acquisition of ownshares Equity-serrledransactions Inet of taxationl Dvidends paid Total transactions with owners At 31 December 2015 004 004 n5 0.6 11 17681 6.61 1768 76.11 05 16.8 215.1 21.2 618.7 98 296.6 1,1546 Carillion plc AnnualReport and Accounts2016135 c report Go nande Financial statements Company balance sheet As at 31 December 2016 21 205 Em Note Fixed assets Investments insubsidiary undenakings andjonrventures 2,026.8 2025.9 Current asseta Debtors L162.6 9189 Cash bank and in hand 15.0 L177.6 930.0 Creditors: amounts fall ing due within one year Borrowing Cther creditors IB4 I1,366.9 1335.31 (82.61 (1604.9 1,687.5) Net currentliabilities (509.9 1445.3 Total assets less current liabilities 1,5806 1516.9 Creditors: amounts fall ing due after more than one year Borrawing 1426O (420,01 Net assets L096.9 11546 Financed bys Capital and reserves ssued share captal 215.1 215.1 Share premium 21.2 21.2 618.7 618.7 Merger reserve (7.0 16.81 Hedging reserve Other reserve Proft and loss account 98 10.7 238.2 2966 L096.9 Equity shareholders' funds 1U546 The financial sratements were approved by the Board of Directors on 1 March 2017 and were signed onits behalby: Zafar Khan Group Finance Director IMarch 2012 Carion plc Anrual Report and Accounts 2016- 134 32. Off-balance sheet arrangements The Group is party oanumber of contracnual amangements for the purposes otthe Group's principal activites that are nor required to be incladed on the Groupbalance sheer. The principal oft-balance sheet arrangements thatthe Group are partyto are as follows Operating leases Isee note 27 Pledged assets securing finance lease labitis Isee note 19 -Contingentliabines inrespectof guarantees for deferred equty payments and performance contracts in PPPspedalpurpose entties Iseenote 251 - Capital commitments torcapital expendinure andequity and subordnaed debt in PPP special purpose entities (seenote 27 - Outsourcing coracts Performance andadvance payment bonds on construction contracts Inkeeping with normal market practice, performance and advance payment bonds are generalyissued to clients in relaton to construction contracts They provide ourclents with protection against the Group's falure to perform and expire basedon contractualy agreedcondsions These arrangements are considered to be a part of ordnary trading activities and are notexpeced to have a manerial impact on the finandalpostionotthe Group Inrespecrotoursourdng contracts, the Group has entered ino various arrangements to oursource the provision ot certainback-otice functions ro athind party provider. These arrangements are on commercial terms and any penalty orterminationclauses associated with these arrangements would nothave amaterial impact on the tnancial postion of the Group 33. Subsidiaries and joint ventures Alst of imvestments in subsidaries and jointventures, including the name.countryof incorporation.regsteredoffice address and proportion of ounershipinterestis given on pages 4410 147. The vating nghts held by the Groupequal the Group's percentage shareholding in eachennity. The Group has a 49 per centequity shareholdinginthe BouchierGroup, a companythar operares inCanada. This subsidiary is consoidaredin the Group inancial staements on the basis of contracnal arrangements whidh give the Grouppowers as a shareholder to exertcontrolover he board togerher with the option to acquire the remaining 5l per cent of the equity ty 2022 The table below showsselected financial data inrespect of the Bouchler Group in which there are non-controlling interests that are mater lal to the Group. 2009 ans Summary comprehensive income information Revenue 77.0 693 Profittorthe financial year 74 93 Otherfinancial information Profitforthe financialyearallocated to non-controling inrerests Other comprehensve incomelexpensel Dividends paid to non-controlling interests Summary financial position information 3.5 4.7 4.2 12.0 12.5) (2.8 Non-current assers Currentassets Total assets Non-current lablites 14.6 13.6 40.7 55.3 28.3 41.9 1.4 12.5 Currentliabilties (10.0) I5.6) Net assets 43.9 33 8 Equity 218 16.6 Non-controling interess Total equity 22.1 177 43.90 338 Summary cash flow information Netcash tlowsfromoperating actvities Netcash flows frominvesting acivties Netcash flows fromfinancing activites Increase in cash and cash equivalents 16.2 9.2 .2 00.20 79 (76) 14 71 The Group has a 49 per centequty shareholding in Canlion A lawi LLC, a company tharoperates in Oman. This subsidiary is fully consolidared in the Group inancial staements withour any alocation to non-controling interests on the basis of contracnal arrangements that do nor ennitle other invesrors n any interestinthe prott or ner assets of the entity. The Group holds a 50l per cent equty shareholding in CarllonAmey Limited. This entity s equtyaccountedas a joint venture in the Group tnancial statements on the bass of contractual arrangements thatspecfy that key operating dedsions are made jointy, withno shareholderhaving overal control. 133 Casillian plc ArmualRepot and Accounts 2016 Notes to the consolidated financial statements continued 31. Accounting estimates and judgements Goodwill Indetemining the goodullansing frombusiness acquisitions, judgement isrequired in relaionto the final out-non conracts, discount rates and expected future cash tlows and their probabity Indetemining whether goodwilis impaired in subsequentyears judgementisrequired in relationto the estimation of the value-in-use of the cashgenerating units that contain g0oduil. The estimation of the value-in-use requires assessments to be made of an appropriate risk-adjusted discount rate and the funure cash flows expected to be generated byeachcash generating unt Changes to the assumptions used inthe value-in-use estimanion couldgive rise to material changesto the carryingvalue of goodwill Note ll on page 10 provides detals of the key assumptions usedandthe sensitivity analysis undertaken on those assumptions Management has dsassed with the Audit Commimee the development, selectionand disdosure of the Group's criical accounting policies and esimates and the applicaion ofthese poides and esimates The key assumptions concerning the furure and other key sources of estmation uncertainty ar the balanoe sheet date, that have a signiticantrisk ot causing a marenial adjustmentto the carrying amounts of assets and abilties wihin the next financial year, are discussed below Revenue recognition Indetermining the reverue and costs to be recognisedeach yearfor work done onconstruction contracts,estimates are made inrelation to the final out-non each contract. On maor construction contracts, it is assessed hased on pasrexperience, thar their outcome canor be estimated reliably during the early stages of the contract, butthat costs incurred willbe recoverable. Once the outcome canbe estimated relably, estimates of the inal outturn on each contract mayinclude cost contingenciesto take account of the speaic risks withineachcontractthat have been identitied duning the early srages of the contract. The cosr contngencies are vieved on aregia basisthroughourthe contract We andare adusted eappropriane Hovever, the nanure ottherisks oncontracts are sch Retirement benefits Indetemining the vakation of detinedbenett pensionscheme assets and labilties anumber of key assumptions, which are largely dependent on factors outside the control of the Group, have been made in relation to Expectedreturnon plan assets -Inflatonrae ced untilthe endotthe project and that they oftern cam d of fhS project. Managementcom ry refore ualy reviewsthe esimaled fnalout-turnon cotracts and makes adjunments where necessary. Basedon the above, management beleves itis reasonably possible, on the basisofexisting knowledge, thar oukomes wthin the next tnancial year that are dtterent from these assumptions -Mortality - Discountrare - Salary and pemionincreases. may not reverse Detals of the assumptions used, together with sensitivity analysis on thes discount rane,intlation rae and mortality are incaded innote 30 could require a material adustment Deferred tax The amounts recognised based on the estimates and udgements noted above are inckaded within Amounts oued by customers on construction contracts E614.5 milionl disclosed within note 17 Trade and other receivables and represents management's bestestimae of the outcome or the Group's portfolo of contracts andis subject o estimaion as dscussedabove Indetemining thequantum of deferred tax assets to be recognised. judgementisrequired in assessing the extentto which t is probable that future taxable prott will arise in the companies concerned. Management use forecasts of fuure taxable profts and make assumptions on growth raes lor each entity at each year end in assessing the recoverablity of assers recognised Inrespectof revenue derved from lcensing.theincome earned from such Transactions is included in revenue as disclosed in note 2 as the exploitaton of the Group's intellectual propertyis regarded by management as being part of ts ordinaryactivities, having completed a similar lcensing agreement in 2013. The Icensing agreementsecured in 2016 was entered into atoraround the same time and with the same counterparty to a series of contracts that extended the scope of the services provided by the Group's back-office outsourcing provider as described in the Straegik reporton page 39 Management considered whether the transactions should be grouped together for the purposes of detemining wheher the revenue should be recognisedimmediately under the licensing agreement or recognised over the termof the outsourcing contract Management concladedthat the transactions should be recognised independently and in their own right. This jadgement was. made afer undertaking a benchmarking reviru tatindicared that ther contracts relating to the extensionin scope of the outsurced back office services were atfar marketvalue and were therefore not inked to the Icensing agreement Consequently, as there were aso no continuing support obligatons required to be provided by the Group under the Icensing agreement, the licensing revenue has beenrecognised immediate ly arlion ple Annual Report and Accounts 2016- 132 30. Retirement benefit obligations (continued) 2006 2015 Changes in the fair value of scheme assets Far value at 1anuary 2,302.4 2.320.4 Settlement of the Alfred McAlpine Orelandl Pension Plan 138 Interesr income 89.7 84.5 Remeasurements gans/gosses Return/oss) onscheme assets lexclding amounts induded in net interest expensel Administrative expenses paid from plan assets- Contbutions from the employer 235.5 (4300 (4.6) 14.3 51.6 S4.3 Contributions from scheme members Inarease due to ef lect of TUPE trander Benefits paid Efect of movements in foreign exe 0.5 0.5 15 (105.67 05.80 (19) 3.2 erates Fair value at 31 December 2572.7 2.3024 The major categories and fair values of scheme assets as at 31 December 2016 are as follows 2006 305 L026.7 544 Equities L125.3 Corporare bonds Governmentbonds Real estates 592.3 5479 689.0 145.2 136.9 Cash and cashequivalents 376 414 Crher (20.5) 92 Marker value ot scheme assers. 2,572.7 (3,349.90 2,3024 12,670.00 Present value of funded scheme obigaion Present value ofunfunded scheme obigaion 0m.7) 97 16.2 (393.5) (15.9) Mnimum funding requurements Taral detat (804.8 Related delerred tax assets Net pension liablity 141.6 75.9 13176) (663.2) The actual rermon plan assers Iner of adminismaioncosts) was E320.6 milon (2015 E372 milon The triennal actuarial valuations as at 31 December 2013 for fhve ofthe Group's schemes were conckuded with the trustees in 2014 and a revised deficit recovery planagreed. It has been agreedthat, frequired, deficit recovery payments can continue until2029inrespect of these schemes. Thisincluded the three largest schemesin the Group.namely the Carilon Staff, Mowlem Staff and Altred McAlpine Statt schemes The total assets atthe date of the actuarial vakation tor all five schemes amounted to E18 bilion which representeda tanding levelof 76per cent. The next actuarial valuarionforthese schemes as at 31 December 206 is curnendyunderway. The Group expects to make payments 1otaling E50.2 miionto defined benefit schemes during the next inancial year During 2013, alorgevity swap was enteredinto by five of the Group's deined benett schemes which insures the Group againstthe tinancial riskot pena m r cent of the total labinesin respect af the Group s defnedhnatrbema T prcted. The swap coversaround 9.000 pensioners ana k the amemdmmtto 6S19 The n has been recognised as partofscheme a55eta dccordance with the Retirement benefireatorbec Decmbe 3l6. he tar value of the longevity suip calulaed inacordance wl lFRS Fairvake measuremenr was a E26.9 millon labiity 1205: E1.4 milion lability withthe movement in tair value recognised in the consolidared srate menr of comprehensive income. assets A Carillion plcAmualRrootand Accounts 2016 131 Financial statements Notes to the consolidated financial statements continued 30. Retirement benefit obligations (continued The amount includedin the balance sheetin respect of defined benefit sdchemes is as folows: 200 Present value of defined benettoblgation Fair value of scheme assers 3,3616) 2679.7 2.572.7 2,3024 16.2 (393 5) Mnimum fundngrequrement Net pension liablity (I5.9) (804.8) Schemesin surplus hwthin non-current assetsk 12.7 58 Schemesin detict luithin non-cument iablitesl (810.6) 14D6.2 (804.8) (393.5) 141 Related delerred taxation asset 75 9 Net pension liabity after taxation (663.2) 13176x Reconciliation of net defined benefit obligation 2006 3015 Em Defined benefitoblgationat 1January 393.5) 1509.7 Setlementofthe Altred Mc Alpine Qrelandl Pension Plan Defined benefitcosts included in the income statement Remeasurements included in orher comprehensive income Contrbutions from the emplayer Effect ot movements in exchangeraes i Defined benefit obligation at 31 December J4 (20.9) 129 W [439.7) B8.5 54.3 514 2.3 1.3 (393.5) (804.8) 2006 2015 Changes in defined benefit obligation (2,679.7 Obligation a anuary Setlement of the Altred McAlpine Orelandl Pension Plan (28188 5.2 Currentandpast service cosr Interest cost Contrbutions from scheme members (16) 03.80 B02.0 00.5) (0.5) Increase due to ef fect of TUPE transfer (1.5) Remeasurements Actuarnal gains arising from changes in demographic assumptions Actuarial Oosseslgains ansing from changes in finandialassumptions Actuarial gainsMossesl arising from experience adjustments Benefits paid Effect of movements in foreign exchange rates Obligation at 31 December 23.7 40.7 (724.8) 8.0 112.4 10.0 105.6 105.8 (5.5) 3.2 3,3616) (2.679.7 The defined benefit obligaton analysed by participant stanus is shown below 206 2018 Deloed bene Nanberef Delnedbenefa obl e l160 4) memben obligaent merbers ACtive 609 178.8) 787 Deferred ,753.6 5,140 1,286.0 15,542 12,410 Pensioners 1429.2 12.223 28.50 1233 2 26/9.0 28,561 3,3616 Carlion plc Annual Report and Accoures 20 130 30. Retirement benefit obligations (continued) LAS 19 disclosures The weghted average of the principalassumptions usedby the independent qualtied actuarles inproviding the AS 19 positionwere 2016 206 Canuda Daats Rare of increase in salanes Rare ot increase in pensigns Intlanionrate-IRetal Price Index 3.20% 355% N/A NJA 3.10% 2.00% 300% 2.D0% 3.20% 2.00% 3.05% 2.D0% 2.15 % Intlationrate-IConsumer Price Indexk N/A 200% N/A Discountrate 3.96 % 375% 2.70% 3.75% The vakation of defined benefit pension sdheme liabities is most sensitive to changesin the discount, inlanionand mortal ity rates AQ.1per cent reduction inthe discount rate would increase scheme labiltnes by approximately E60 milon, whista 0lper cent increasein the intlation rate would increase scheme labilties by approximately E50millon. An increase of one year in the mortalty rate would increase scheme labilties by approximately E105 millon, although this has been mitigated in parth rough the purchase of a longevity swap The overall weighted average duration of scheme labilties as at 31 December 2016 is approximately 18 years. Over the nextfive years beneits of ES80 milion are expecedto be paid and benetirs of E634 milion are expected to be paidover the subsequenttive year period The marker values of the schemes asses, which are not inendedto be reaised in the shortterm, may be subjecT to signifcant dhange betore they are realsed.The present values of the schemes' labilties are calculated by relerence to the imvestment returnon Grade AA corporate bonds. The assumptions useddo notnecessarly represent the investment return that may be achleved The average ite expectancies ar 65 for males aged 45-65 for al schemes are shown below: Lfe epec 733 Retired member lcurrendly65 years) Non-retired member Icurrently 45 yearsk 22.2 238 Expense recognised in the income statement 2009 2015 Charge to operating profit Current andpastservice cosr relating to detined benefit schemes (16) 00 Administrative experses relating to defined benet schemes Gain on semlementof the Afred McAlpine (relandl Pension Plan Defined contributlon schemes (4.6) 14.30 14 25.0 (21.0 Total (31.2) 31.00 Fnancial expense Netinterest expense on minimum funding requirement Netinterest expense on defined benefit obligation Net interest expense recognised as afinancial expense (0.6) (14.10 00.4 (76) 8 00 (14.7) Amounts recognsedin the statement of comprehensve income are as follows 2006 2015 235.5 (43 00 The renurn on scheme assets, eduding amounts incladedinnerinneresr expense- Actuarial gans arising trom changes in demographic assumptions. Actuarial dosses/gains artsing from changes in financial assumptions Actuarial gans/0osses) ansing trom experience adustments 40.7 23.7 (724.80 1124 8.0 1a.D Movement in minimum fundng requirements 4.5 0.9 Remeasurement of the net de fined benefit liability (439.7) 88.5 129 Casillian plc ArnualRaport and Accounts 2016 Notes to the consolidated financial statements continued 29. Acquisitions and disposals (continued Inthe first sixmonths of 2016, the Group reviewed its obigations in respectof continge nt consideration payable arising on the acouis iion of the Rokstad CorporaionRokstac in December 2014. Under the terms ot the Sale and Purchase Agreementrelating to Rokstad, contingent consideration is payable hased on a muliple of Roksrad's EBITDA for 205 and 2016. During this pernod Roksrad's actual EBITDA performance for 2015 was tinalised and a revised estmate was made of the expected EBITOA outturnfor 2016, leadng to a reduction in the far value of contingentconsideration payable of E72 mlion. This change in the fairvalue of contingentconsideration has been recognised as a creditwithinnet financlal experse in the income statement As a resutotths reducrion the Group now expectsto make consideranion payments rotaling around E3.7 milion la 31 December 2016 exchange rates) in 2017. In 2016, the Grouppaid El.8 milion to the previous owners of Roksrad under the terms of the Sale and Purchase Agreement. The esimae of Rokstad's EBITCA for 2019, upon which the consideraton tor the acquisition ot the remaining 4D per cent at the issued share capitalisbased, remains undhanged. Cashflows assocdated with the acquisition of subsidiarles inckuded in the cash flow statementare analysed below 2000 Cash paid for acquistions in the year Netcash and cash equivalents acquired Payments in respectofacqustions in prior years (see above and page 12 Net cash outflow on acquisition of subsidiaries, net of cash and cash equivalents acquired 00.7 6.2 32.53 32 51 (6.0 10.6x In2016, the Group disposed of itsinerestin three Rubic Privane Parinership projects. The disposals generared cash consideranion of E48.2 milion, whidh ater deducting dsposal costs paid ot El.I milion, is incuded in the cash tbw staement within disposalot joinr vemure and orher investments. The protr recognsed on the disposals in the income statement of E12.7 milion s after the deduction of accrued costsof E0.2mllon and the carrying amount of joint ventures dieposed total ing 35.3 milon as disclosed in note 12. Disposals in 2015 h2015, the Group disposedot ts inerest in three Public Private Pamnership projects. The dis posals generaned cash consideration ot E54.4 milon, which ater deducting disposal costs paid at ED.3 milon, is inchaded inthe cash fnlow staement within disposal ofjoint venture and otherinvesments Additonal consent costs paid ot Elal milionre lating to the disposals have been included with in 1 decreasel increase intrade and other payables' of E411 million wthin the operating cashflow section of the cash flowstatement andlegal costs of E09 milion have been accr ued for. The prottrecognised on the dsposabin the income statement of E377 mllonis afterthe deduction ofthe acarued costs above and the camrying amount of joint ventures disposed oraling E54 milion as dsclosedin note 12. 30. Retirement benefit obligations The Carlion Group operares 14 detined benetit pensionschemes for eigble employees, of which 1B are in the UK and one is in Canada. Inaddtion, the Groupprovides other post-retiremet benefts under tour separare arrangements in Canada Inlinewth AS 19 the Company has considered whether it is appropriate to provide disaggregated dsclosures for the 14 defined benett pensionschemes. Fve plans relate to UK-based firalsalary schemes which are all closed to future accrual, share broadly common membership demographics and are operated under asingle trust arrangement. Therefore the Company has taken the wew that these five schemes should be considered together as one. As these tive plans accounttor 83.2% IE6698milionl of the toral deficit across al schemes as at 31 December 2016, the Company has nor dsaggreganed the remaining plansindividually and has instead provided disaggregated dara in the form of closed, open and untunded schemes The Group's detined benettschemes are administered ty Trustee Boards which largely comprise independent trustees togetherwith Company and Truten od in on mplayeerepresentanves The as s are held separaely tom he Company's assets and are maaged by the P the LAS 19 deficitin ied our by independent actuanes nemne pension costsfor pension fnding everythree years ad biannually o candane into these schhemes made in ine with desotrecovery plans, whichba elschemes within the Group are closedno future accrual with payments heme viuations The dfferent scheme characterstics can be summartsed below 200 Deige Oigaions Toral Toal Assets AL 19268 645.9 (2,615.0) 12.076.01 0610 21 19.7 12.695.91 Schemes closed to future accrual 88.2) (104.91 1,479 1328.0 I557 5545 Cpen schemes Unfunded schemes Total (750.8) 17 3,377.5) 7 97 (804.8) 2.3024 (393.5) 2,572.7 Unhunded uchenc a odher pa reteenene benaunderfour saparze arangemens in Canuda The Group also operates detined contribution schemes for allqualtying employees. The total cost charged to the income statement of E25.0 mllon(2015 2Umillonl represents contributions payable to the schemes by the Group atrates specitied by the scheme rules. 128 Carion plc Anrual Raport and Accounts 2016- L Summary cash flow statement For internal management purposes, the Directors utlse a summarsed cashflow statement for monitoring the peneration and utlsaton of cash in the business. The summarycash flow groups items from the FRS cashflowstaremet on page 94 inmo broader operarional caegories as shounbelou: 2015 2016 fim Depreciation and othernon-cash tems Depreciationand amortsation Less Amortisation of intangble assets arising from business combinations Profiton disposal ot property, plantand equipment and intangible assets 454 45.0 (13.8) 120.00 (6.4 (144 Cther non-cash movements 19 (D.30 Depreciationand othernon-cash tems per summarycash flow statement 26.7 10.7 Working capital 02.7) (377 Profiton disposal of Public Private Partnership equity invesments ngrease in inventories (6.3) (14.3) Increasel/decrease in trade and other recevables (290.6) 480 IncreseNdecreasel in trade and other payables (41.0 301.5 Disposalot jointVentures and other invesments 471 54 Working capital per summary cash flow starement 39.0 90 Interestand taxation Financial incomereceived 2.5 24 (39.61 (4.2) Financial expense paid Taxation payments (35,30 17.5 nterest and taxation per summary cashflow statementh (41.3) (40.4) Net capital expenditure Disposalot propety, plant and equipmentand intangible asses Acquisition of property, plant and equipment and intangble assets Netcapital expenditure per summarycash flowstatement 13.8 I76 (37.3) (304 (23.5) (12.80 Other Acouisition of ownshares 0.01 0.4x 12.8) Interest accretion in respect of comvertible bonds inote 18 on page 115 12 8% Finance lease additions note 18 on page 15 (2.5) Drher per summary ca 6.31 13.20 ement Foreign exchange movements Cash fows on forward foregn currency contracts 04.6) (33.6 Curnency translarionditerences onnet bomrowing noe 18 on page 115) (7) Foreign exchangerae movements persummarycash flow starement (68.2) Acquisitions and disposals (09) 166x Acquisition costs Loan advance repayments received trom joinr Ventures 2. 22 Acquisition of subsidiaries, net of cash and cashequivalents acquired 132.5) l10.6x (4.8 Acquisition of equty and loan advances to joint Ventures 128.31 Acquisition of other non-currentassetimvestments Deduct Netcash and cash equivalenrs acquired nore 18 on page 115x 004) 16.2 Add Ner cash in subsidiaries acquired Inore 18 on page TS) 5.3 (36.1 Acquisitions and deposab persummarycash flow statement 396 Dividends 178.91 (3.8) Dividends paid to equity holderss of the parenr 1768 Dividends paid to non-controlling inrerests Dvidends per summary cash tlow statements 13.2 (82.7 180.00 143 Carillian ple AnualRaport and Accounts 2016 Additional inlormation Alternative performance measures continued H. Underlying effective tax rate Underlying effective rax rate is presented in order o iustrate the underlying taxrae applicable to the underlying protrbefore taxarion of Group and joinr Venture undertakingsandis caloulahedby dviding the underlyingtaxation charge for Groupand joint Venture undertakings of E25.8 milon 12015:E224 milor) by underlying prott before taxaton (exckuding share of jont Venture taxation) of E1828 milon (2015 E179.4 milonl as shownbelow 2015 2016 Group underlying taxation dharge Inote B on page 1071 (Em Share ofjaint Ventures raxationcharge lincome sarement on page 901 Em Total underlying taxation charge lm 21,0 19.5 4.8 29 25.0 22.4 Underlying prottbefore taxation Isection F abovel (Em 178.0 176.5 Addback Share ot joint Venture taxation lincome sratement on page 901(Em) 48 29 179 4 Underlying proftesclading all taxanion (Em) 182.8 Underlying etlectve tax rat 05 14.1 125 1 Dividend cover Dividend cover measures the number of times that the proposed dividend for the year is covered by underlying earnings per share. t s cakculated by dviding undertying carnings per share bythe proposed dividend per share as shown below 2016 205 Underlying earnings per share (section Gabovel (pencel 35.3 350 Proposed dividend per share Inote 9 on page 1071 (pence) Dvidend cover hmesl 18.45 18.25 19 1.9 Cash flow statement J Underlying operating cash flow conversion Underlying operating cash tlow conversionmeasures the proportion at underlying protrfromoperations thar is converted into cash o service the Group's ongoing activities exclading the impacr on operaionsfrom signitcant movements in toreignexchange rates. It is calculated by dividing underlying cash generated from operations by underlying prott from operations as shown below 2018 2015 15.5 Cash generared from operations (cash flow starement on page 94) IEml 120.3 Addback Deticit recovery payments to pension schemes lEml Non-recurning operating items 1Eml Cash flows anforward foreign currencycontracts (Em 46.6 474 21.5 6.3 34.6 ndude Dividends received trom joint Ventures lEm 11.8 16.8 Cisposal of loint Ventures and other westments (Cm) 541 471 Underlying cash generated from opeerations (Em) Underlying prottfrom operations (section C above) IEml Underlying cash conwersion 1%x 277.1 244.9 2344 235.9 104 K. Net borrowing and average net borrowing The Direcrors view net borrowing raher than cash andcashequivalents as the mostappropriae measure ot liquidiry for the Group as this measure includes al sources of financing used to fund the Group's operations. Note 18on page 15 shows the sources of tnancing that are included in net borrowing inaddition to cash and cash equlvalents. Average net borrouing is calaulaedas the average of the net borrowing at the end of the previous financial year and eachot the month end netbomrouing igures as reported to the Boardin the current financial year. Carion plcAnrual Report and Accounts 2o 142 E. Underlying net financial expense Underlyingnetfinancial expense is a measure of the net cost offinancing the Groups operations excluding tems reported in netfinancial expense that are unrelated to finanding or are intlaencedby marker factors outside the control of the Group and is calculaed as follows pese uie acuarom 21 2015 Repored ner financial expense lincome starement on page 90 Deduct (3411 (518) .2) Farvalue movements in derivative financialinstruments (note 5 on page 04 Changes incontingent consideration relating to acquisitions (none S onpage 104 (6.0 (15.61 1579) Underlying netfinandal expenses (579) F.Underlying profit before taxation Underlying profit before taxation is a measure of the underlying profit generaned by all ot the Group's acivities betore a charge tor taxaion is made and is calalaredas tolous 305 2016 I55 Repored profit before taxation lincome starement on page 901 146.7 Addback Intangible amorisation arising from business combinations nore l on page 1090 13.8 20.D Non-recurring operating items Inote 4 on page 104 40.2 500 Non-operating items (note 4 on page 104 Fairvalue movements in denvarive tinancialinsruments (note 5 on page 104 Changes incontingent consideration relatrg to acquisitions (note 5 onpage 104 1.1 2.5 Deduct (21 (6.D (15.6) Underhving prottbefore taxation 178.0 176.5 G. Underlying earnings per share Underlying eamings per share meassures the underlying profit attributable to each Canlion pk share held. Underlying profit attributable to shareholders is calulatedas folows 2016 2015 E Reported profit attrbutable to equity holders of the parent Iincome statementonpage 900 124.21 1328 Addback Intangible amortsation arsing from business combinations netoftaxation) Inote 8 on page 107 150 10.8 Non-recurring operating items Inet oftaxation)(note 8 on page 107 Non-operating iems (net of taxarion) Inote B on page 107 Farvalue movements in derivarive tinancialinsruments (ner ot raxationl onore 8 onpage 10 Changes incontingent consideratiStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started