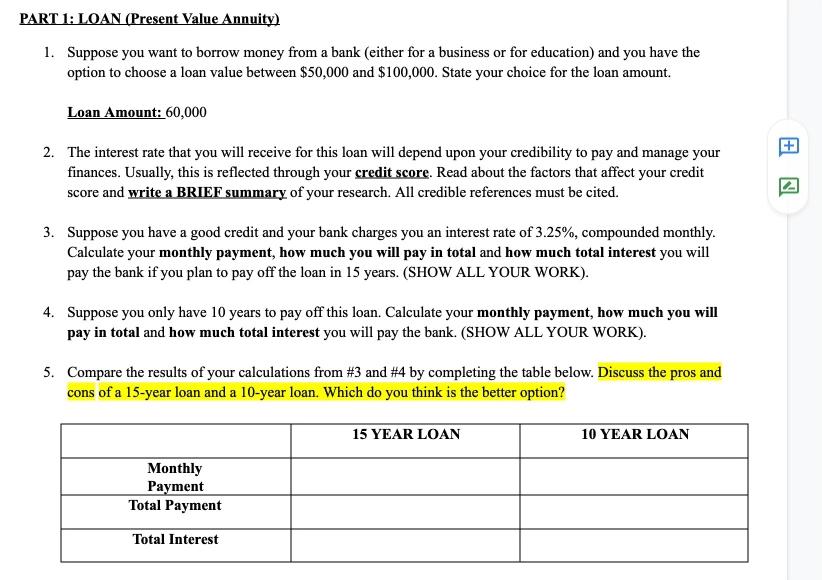

PART 1: LOAN (Present Value Annuity) 1. Suppose you want to borrow money from a bank (either for a business or for education) and you have the option to choose a loan value between $50,000 and $100,000. State your choice for the loan amount. Loan Amount: 60,000 2. The interest rate that you will receive for this loan will depend upon your credibility to pay and manage your finances. Usually, this is reflected through your credit score. Read about the factors that affect your credit score and write a BRIEF summary of your research. All credible references must be cited. 2 3. Suppose you have a good credit and your bank charges you an interest rate of 3.25%, compounded monthly. Calculate your monthly payment, how much you will pay in total and how much total interest you will pay the bank if you plan to pay off the loan in 15 years. (SHOW ALL YOUR WORK). 4. Suppose you only have 10 years to pay off this loan. Calculate your monthly payment, how much you will pay in total and how much total interest you will pay the bank. (SHOW ALL YOUR WORK). 5. Compare the results of your calculations from #3 and #4 by completing the table below. Discuss the pros and cons of a 15-year loan and a 10-year loan. Which do you think is the better option? 15 YEAR LOAN 10 YEAR LOAN Monthly Payment Total Payment Total Interest PART 1: LOAN (Present Value Annuity) 1. Suppose you want to borrow money from a bank (either for a business or for education) and you have the option to choose a loan value between $50,000 and $100,000. State your choice for the loan amount. Loan Amount: 60,000 2. The interest rate that you will receive for this loan will depend upon your credibility to pay and manage your finances. Usually, this is reflected through your credit score. Read about the factors that affect your credit score and write a BRIEF summary of your research. All credible references must be cited. 2 3. Suppose you have a good credit and your bank charges you an interest rate of 3.25%, compounded monthly. Calculate your monthly payment, how much you will pay in total and how much total interest you will pay the bank if you plan to pay off the loan in 15 years. (SHOW ALL YOUR WORK). 4. Suppose you only have 10 years to pay off this loan. Calculate your monthly payment, how much you will pay in total and how much total interest you will pay the bank. (SHOW ALL YOUR WORK). 5. Compare the results of your calculations from #3 and #4 by completing the table below. Discuss the pros and cons of a 15-year loan and a 10-year loan. Which do you think is the better option? 15 YEAR LOAN 10 YEAR LOAN Monthly Payment Total Payment Total Interest