Question

Part 1: Make two simple assumption changes: Base year revenue is $2.0 billion in 2006 (as compared to $2.5 billion in the Book and Lecture).

Part 1: Make two simple assumption changes:

Base year revenue is $2.0 billion in 2006 (as compared to $2.5 billion in the Book and Lecture).

The maturity growth rate is 7%, rather than 6%.

Please recreate the Free Cash Flow, Terminal Value, and Total Enterprise Value tables and fill in numbers based on these assumption changes.

You should use Excel for the calculations. Then copy and paste that to Word. Please Paste Special and select Microsoft Excel Worksheet Object.

Part 2: Discuss some of the benefits and disadvantages of using the Discounted Cash Flow valuation method.

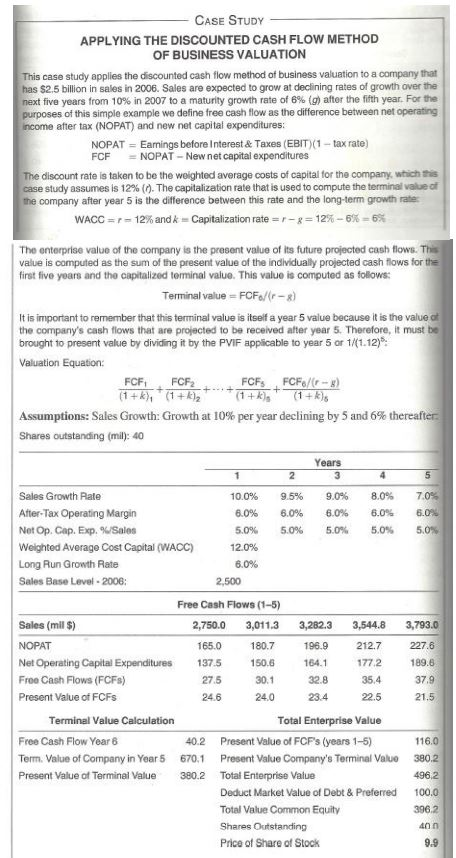

CASE STUDY APPLYING THE DISCOUNTED CASH FLOW METHOD OF BUSINESS VALUATION This case study applies the discounted cash flow method of business valuation to a company that has $2.5 billion in sales in 2006. Sales are expected to grow at declining rates of growth over the next five years from 10% in 2007 to a maturity growth rate of 6% (g) after the fifth year. For the rposes of this simple example we define free cash flow as the difference between net operating ncome after tax (NOPAT) and new net capital expenditures: NOPAT Eamings before Interest &Taxes (EBIT (1 axrate) FCF =NOPAT-New net capital expenditures The discount rate is taken to be the weighted average costs of capital for the company, which this ase study assumes is 12% (r). The capitalization rate that is used to compute the terminal value of the company after year 5 is the difference between this rate and the long-term growth rate: WACC = 12% and k = Capitalization rate-r-g = 12%-6% 6% The enterprise value of the company is the present value of its future projected cash flows. Th value is computed as the sum of the present value of the individually projected cash flows for the first five years and the capitalized terminal value. This value is computed as follows: Terminal value FCFe/(-R) It is important to remember that this terminal value is itself a year 5 value because it is the value o the company's cash flows that are projected to be received after year 5. Therefore, it must be brought to present value by dividing it by the PVIF applicable to year 5 or 1.12) Valuation Equation: FCF FCF2 Assumptions: Sales Growth: Growth at 10% per year declining by 5 and 5% thereafter Shares outstanding (mil);: 40 Years Sales Growth Rate After-Tax Operating Margin NetOp. Cap. Exp. %sales Weighted Average Cost Capital (WACC) Long Run Growth Rate Sales Base Level-2006: 10.0% 6.0% 5.0% 12.0% 6.0% 9.5% 6.0% 5.0% 9.0% 6.0% 5.0% 8.0% 6.0% 5.0% 7.0% 6.0% 50s 2,500 Free Cash Flows (1-5) Sales (mil s) NOPAT Net Operating Capital Expenditures Froe Cash Flows (FCFs) Present Value of FCFs 2,750.0 3,011.3 3,282.3 3,544.8 3,793.0 165.0 1807 196.9 212.7 227.6 189.6 37.9 137.5 1506 64. 177 275 30 328 35.4 24.6 24.0 23.4 22.5 Terminal Value Calculation Total Enterprise Value Free Cash Flow Year 6 40.2 Present Value of FCF's (years 1-5) 116.0 Term. Value of Company in Year 5 670.1 Present Value Company's Terminal Value 380.2 496,2 Deduct Market Value of Debt& Preferred 100.0 396.2 40 0 9.9 Present Value of Terminal Value 30 Total Enterprise Value Total Value Common Equity Shares Outstanding Price of Share of StockStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started