Answered step by step

Verified Expert Solution

Question

1 Approved Answer

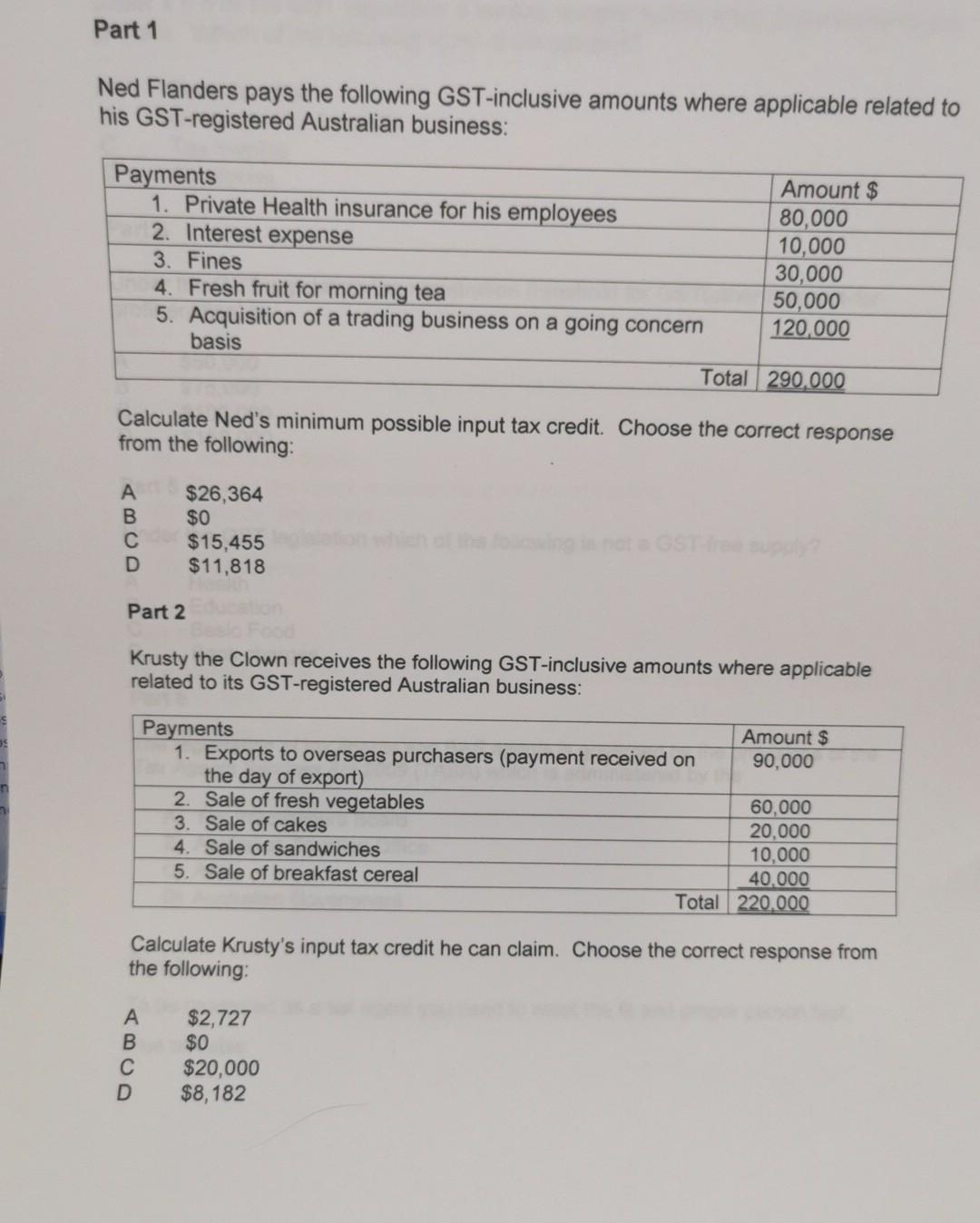

Part 1 Ned Flanders pays the following GST-inclusive amounts where applicable related to his GST-registered Australian business: Payments Amount $ 1. Private Health insurance for

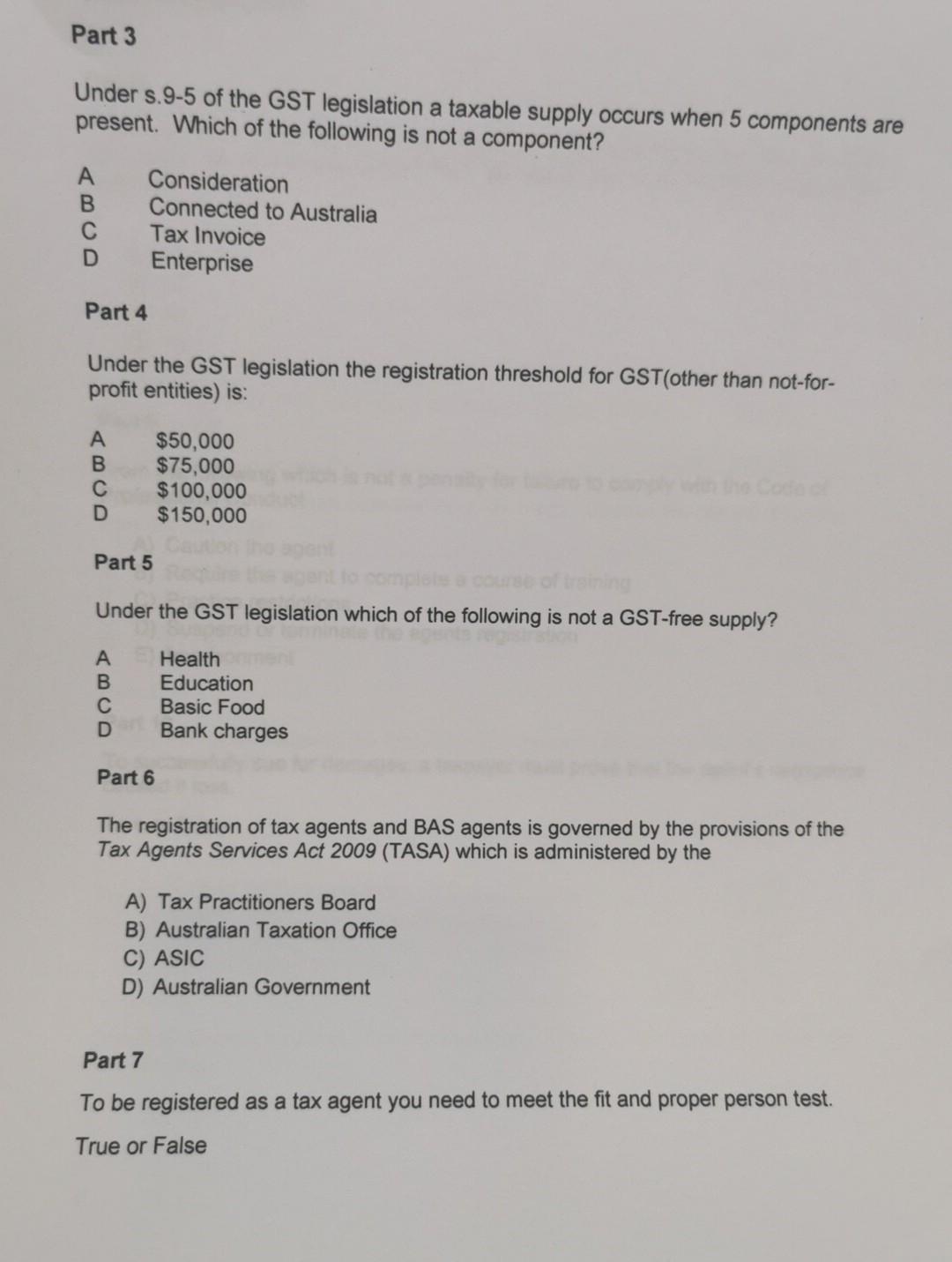

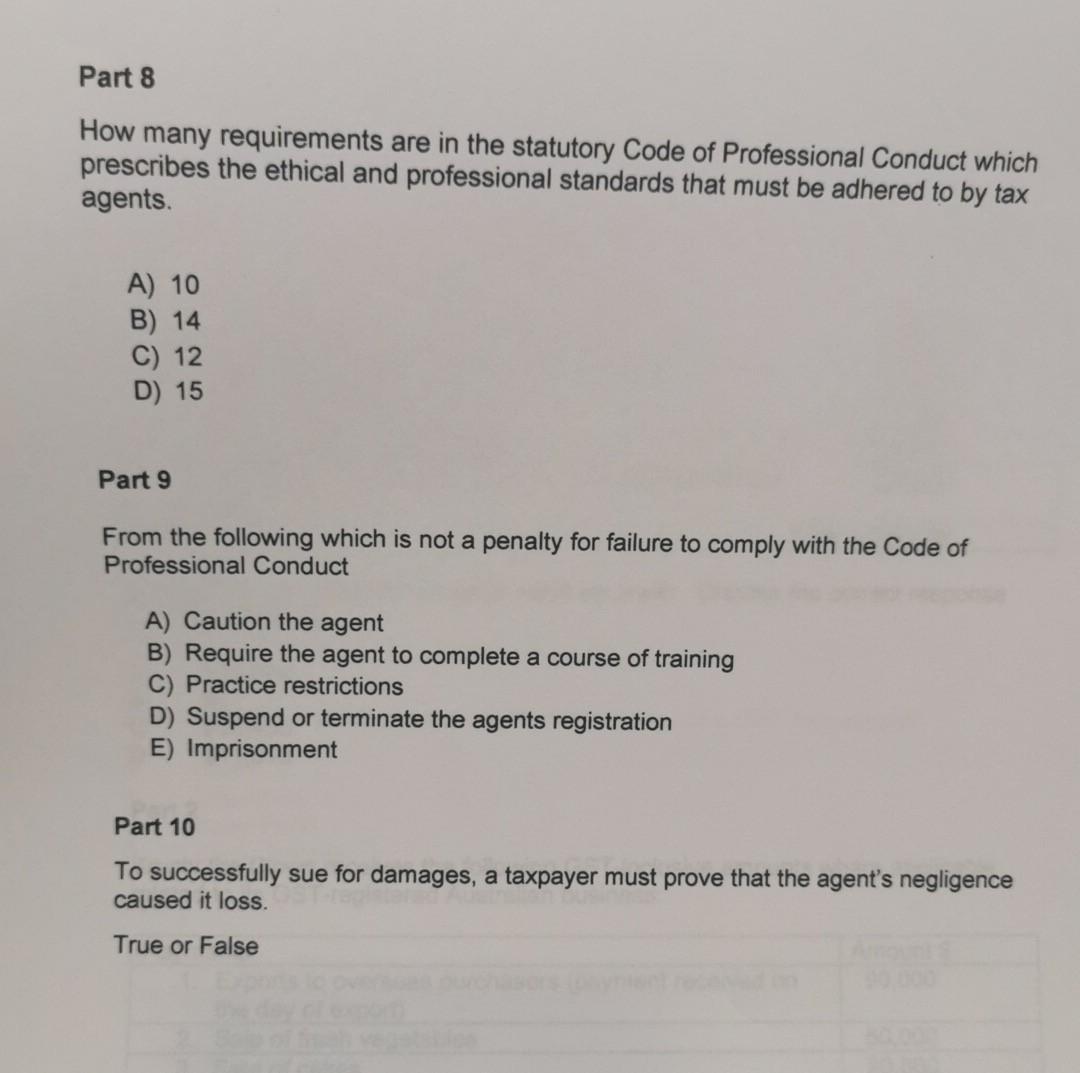

Part 1 Ned Flanders pays the following GST-inclusive amounts where applicable related to his GST-registered Australian business: Payments Amount $ 1. Private Health insurance for his employees 80,000 2. Interest expense 10,000 3. Fines 30,000 4. Fresh fruit for morning tea 50,000 5. Acquisition of a trading business on a going concern 120,000 basis Total 290.000 Calculate Ned's minimum possible input tax credit. Choose the correct response from the following: A D $26,364 $0 $15,455 $11,818 Part 2 Krusty the Clown receives the following GST-inclusive amounts where applicable related to its GST-registered Australian business: Payments Amount $ 1. Exports to overseas purchasers (payment received on 90,000 the day of export) 2. Sale of fresh vegetables 60,000 3. Sale of cakes 20.000 4. Sale of sandwiches 10,000 5. Sale of breakfast cereal 40.000 Total 220.000 Calculate Krusty's input tax credit he can claim. Choose the correct response from the following: B D $2,727 $0 $20,000 $8,182 Part 3 Under s. 9-5 of the GST legislation a taxable supply occurs when 5 components are present. Which of the following is not a component? A B D Consideration Connected to Australia Tax Invoice Enterprise Part 4 Under the GST legislation the registration threshold for GST(other than not-for- profit entities) is: A B D $50,000 $75,000 $100,000 $150,000 Part 5 Under the GST legislation which of the following is not a GST-free supply? A B D Health Education Basic Food Bank charges Part 6 The registration of tax agents and BAS agents is governed by the provisions of the Tax Agents Services Act 2009 (TASA) which is administered by the A) Tax Practitioners Board B) Australian Taxation Office C) ASIC D) Australian Government Part 7 To be registered as a tax agent you need to meet the fit and proper person test. True or False Part 8 How many requirements are in the statutory Code of Professional Conduct which prescribes the ethical and professional standards that must be adhered to by tax agents. A) 10 B) 14 C) 12 D) 15 Part 9 From the following which is not a penalty for failure to comply with the Code of Professional Conduct A) Caution the agent B) Require the agent to complete a course of training C) Practice restrictions D) Suspend or terminate the agents registration E) Imprisonment Part 10 To successfully sue for damages, a taxpayer must prove that the agent's negligence caused it loss True or False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started