Answered step by step

Verified Expert Solution

Question

1 Approved Answer

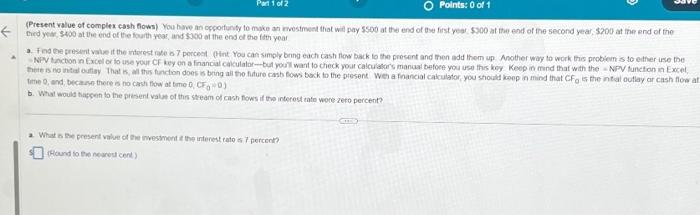

Part 1 of 2 A (Present value of complex cash flows) You have an opportunity to make an investment that will pay $500 at the

Part 1 of 2 A (Present value of complex cash flows) You have an opportunity to make an investment that will pay $500 at the end of the first year, $300 at the end of the second year, $200 at the end of the third year, $400 at the end of the fourth year, and $300 at the end of the fifth year. Points: 0 of 1 a. Find the present value if the interest rate is 7 percent. (Hint: You can simply bring each cash flow back to the present and then add them up. Another way to work this problem is to either use the = NPV function in Excel or to use your CF key on a financial calculator-but you'll want to check your calculator's manual before you use this key Keep in mind that with the = NPV function in Excel, there is no initial outlay. That is, all this function does is bring all the future cash flows back to the present. With a financial calculator, you should keep in mind that CF is the initial outlay or cash flow at time 0, and, because there is no cash flow at time 0, CF = 0) b. What would happen to the present value of this stream of cash flows if the interest rate were zero percent? a. What is the present value of the investment if the interest rate is 7 percent? (Round to the nearest cent.) CB

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started