Question

Part 1 of 2 - Graph to follow You have decided to diversify a portfolio with 70% invested in large-cap equities, 25 % in bonds

Part 1 of 2 - Graph to follow

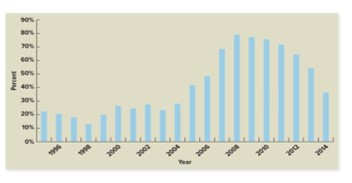

You have decided to diversify a portfolio with 70% invested in large-cap equities, 25 % in bonds and 5% in a money market fund. The information you have been given is that Vanguard 500Index Fund is essentially identical to your index funds. For the 20 investment periods shown in the graph (1986-2014), in only 7 of these periods did more than 50 % of the mutual fund managers beat the Vanguard 500 Index Fund. Using the graph- Is the graph consistent with market efficiency and what investment would you make with the equity portion of your account?

Please explain your steps and rational, I am really trying to understand this

Part 2 0f 2 Graph to answer the question - please remember to explain your answer. Please refer to Part1 of 2 for the question

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started