Part 1 of 4 05 points abook Print References Required information Problem 24-2A (Algo) Payback period, accounting rate of return, net present value, and

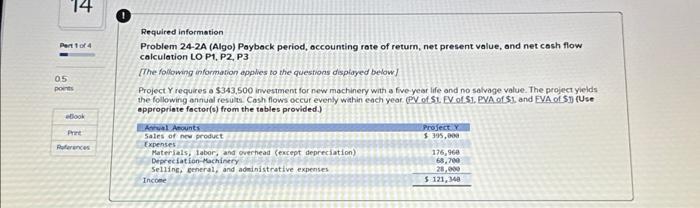

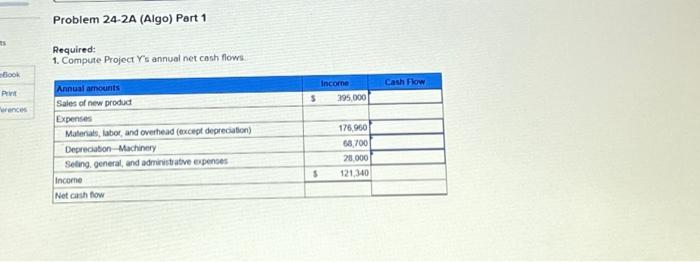

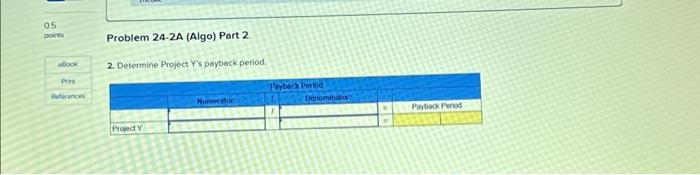

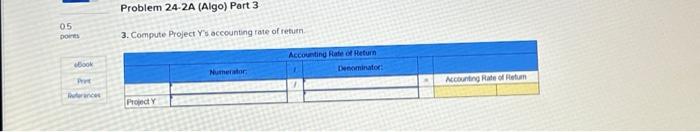

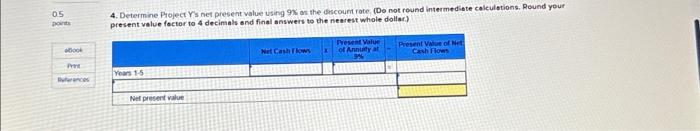

Part 1 of 4 05 points abook Print References Required information Problem 24-2A (Algo) Payback period, accounting rate of return, net present value, and net cash flow calculation LO P1, P2, P3 [The following information applies to the questions displayed below] Project Y requires a $343,500 investment for new machinery with a five-year life and no salvage value. The project yields the following annual results. Cash flows occur evenly within each year. (PV of $1. EV of S1. PVA of $1, and EVA of S1) (Use appropriate factor(s) from the tables provided.) Annual Amounts Sales of new product Expenses Materials, labor, and overhead (except depreciation) Depreciation Machinery Selling, general, and administrative expenses Income Project Y $395,000 176,968 68,700 28,000 $121,348 Book Print Ferences Problem 24-2A (Algo) Part 1 Required: 1. Compute Project Y's annual net cash flows Annual amounts Sales of new produc Expenses Materials, labor, and overhead (except depreciation) Depreciation-Machinery Selling, general, and administrative expenses Income: Net cash flow Income Cash Flow $ 395,000 176,960 68,700 28,000 $ 121,340 05 points Book Print References Problem 24-2A (Algo) Part 2 2. Determine Project Y's payback period. Numerator Project Y Payback Period Denominator Payback Perod 05 points Problem 24-2A (Algo) Part 3. 3. Compute Project Y's accounting rate of return Numerator Referances Project Y Accounting Rate of Return Denominator: Accounting Rate of Retum 05 points book 4. Determine Project Y's net present value using 9% as the discount rate. (Do not round intermediate calculations. Round your present value factor to 4 decimals and final answers to the nearest whole dollar) Pr ferences Years 1-5 Nel present value Net Cash Flows Present Value of Annuity at 9% Present Value of Net Cash Flows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Computation of Project Ys Annual Cash flow is given below Particulars Income Cash Flow Reve...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started