Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part 1 of 6 Points: 0 of 1 Question list Question 1 Question 2 Question 3 Question 4 Question 5 Question 6 Requirements a .

Part of

Points: of

Question list

Question

Question

Question

Question

Question

Question

Requirements

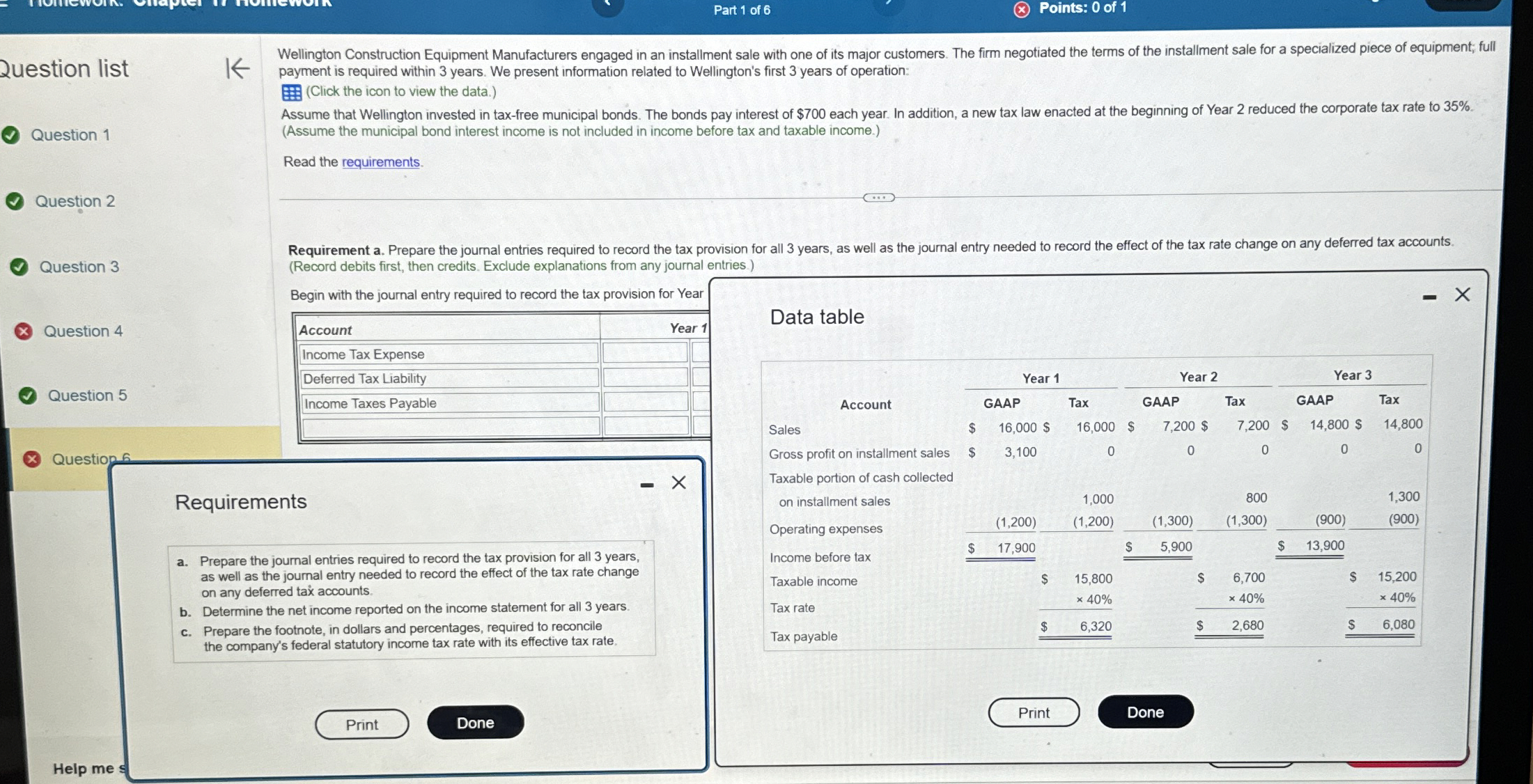

a Prepare the journal entries required to record the tax provision for all years, as well as the journal entry needed to record the effect of the tax rate change on any deferred tax accounts.

b Determine the net income reported on the income statement for all years.

c Prepare the footnote, in dollars and percentages, required to reconcile the company's federal statutory income tax rate with its effective tax rate.

Wellington Construction Equipment Manufacturers engaged in an installment sale with one of its major customers. The firm negotiated the terms of the installment sale for a specialized piece of equill payment is required within years. We present information related to Wellington's first years of operation:

Click the icon to view the data.Assume the municipal bond interest income is not included in income before tax and taxable income.

Read the requirements.

Requirement a Prepare the journal entries required to record the tax provision for all years, as well as the journal entry needed to record the effect of the tax rate change on any deferred tax accounts. Record debits first, then credits. Exclude explanations from any journal entries.

Begin with the journal entry required to record the tax provision for Year

tableAccount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started