part 1.

part 2.

help please!

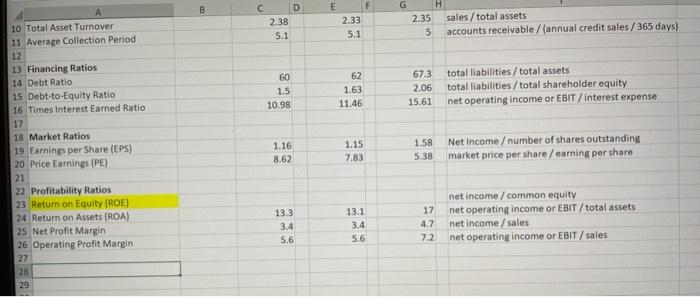

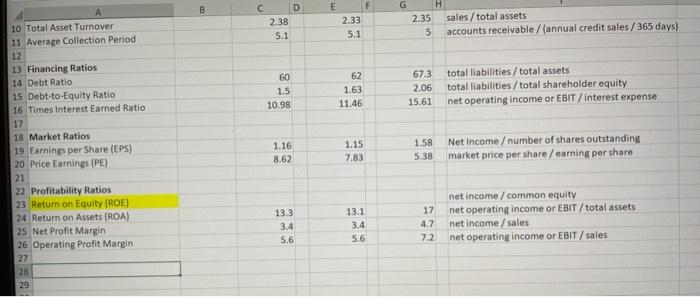

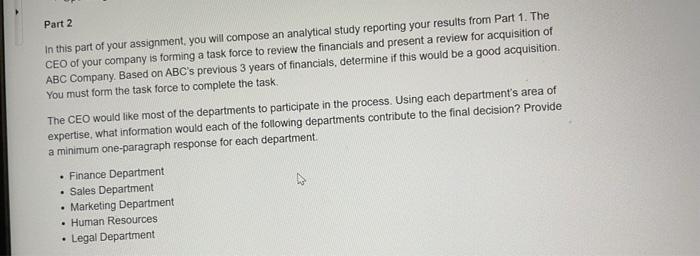

B D E F G 2.38 5.1 2.33 5.1 H 2.35 sales/total assets 5 accounts receivable/(annual credit sales/365 days) 60 1.5 10.98 62 1.63 11.46 67.3 2.06 15.61 total liabilities/total assets total liabilities / total shareholder equity net operating income or EBIT / interest expense 10 Total Asset Turnover 11 Average Collection Period 12 13 Financing Ratios 14 Debt Ratio 15 Debt-to-Equity Ratio 16 Times Interest Earned Ratio 17 18 Market Ratios 19 Earnings per Share (EPS) 20 Price Earnings (PE) 21 22 Profitability Ratios 23 Return on Equity (ROE) 24 Return on Assets (ROA) 25 Net Profit Margin 26 Operating Profit Margin 27 28 29 1.16 8.62 1.15 7.83 1.58 5.38 Net Income / number of shares outstanding market price per share / earning per share 17 13.3 3.4 5.6 13.1 3.4 5.6 net income/common equity net operating income or EBIT / total assets net income / sales net operating income or EBIT/ sales 4.7 7.2 Part 2 In this part of your assignment, you will compose an analytical study reporting your results from Part 1. The CEO of your company is forming a task force to review the financials and present a review for acquisition of ABC Company. Based on ABC's previous 3 years of financials, determine if this would be a good acquisition You must form the task force to complete the task. The CEO would like most of the departments to participate in the process. Using each department's area of expertise, what information would each of the following departments contribute to the final decision? Provide a minimum one-paragraph response for each department. Finance Department Sales Department Marketing Department Human Resources Legal Department 23 B D E F G 2.38 5.1 2.33 5.1 H 2.35 sales/total assets 5 accounts receivable/(annual credit sales/365 days) 60 1.5 10.98 62 1.63 11.46 67.3 2.06 15.61 total liabilities/total assets total liabilities / total shareholder equity net operating income or EBIT / interest expense 10 Total Asset Turnover 11 Average Collection Period 12 13 Financing Ratios 14 Debt Ratio 15 Debt-to-Equity Ratio 16 Times Interest Earned Ratio 17 18 Market Ratios 19 Earnings per Share (EPS) 20 Price Earnings (PE) 21 22 Profitability Ratios 23 Return on Equity (ROE) 24 Return on Assets (ROA) 25 Net Profit Margin 26 Operating Profit Margin 27 28 29 1.16 8.62 1.15 7.83 1.58 5.38 Net Income / number of shares outstanding market price per share / earning per share 17 13.3 3.4 5.6 13.1 3.4 5.6 net income/common equity net operating income or EBIT / total assets net income / sales net operating income or EBIT/ sales 4.7 7.2 Part 2 In this part of your assignment, you will compose an analytical study reporting your results from Part 1. The CEO of your company is forming a task force to review the financials and present a review for acquisition of ABC Company. Based on ABC's previous 3 years of financials, determine if this would be a good acquisition You must form the task force to complete the task. The CEO would like most of the departments to participate in the process. Using each department's area of expertise, what information would each of the following departments contribute to the final decision? Provide a minimum one-paragraph response for each department. Finance Department Sales Department Marketing Department Human Resources Legal Department 23