Part #1

Part #2

Part #3

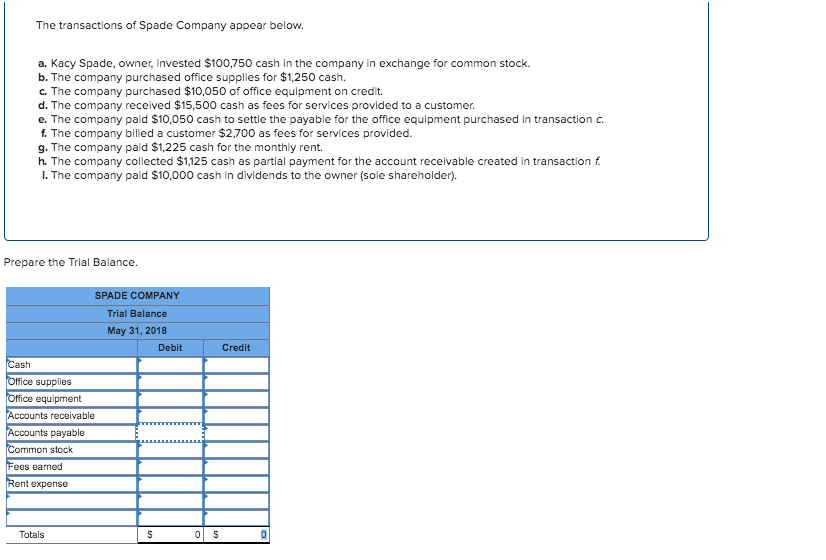

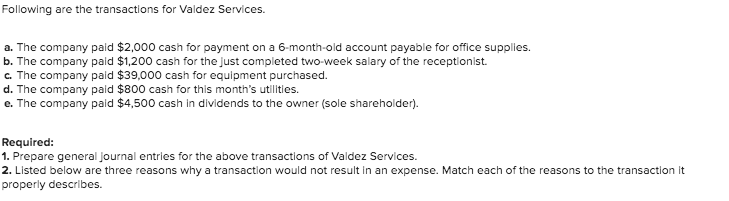

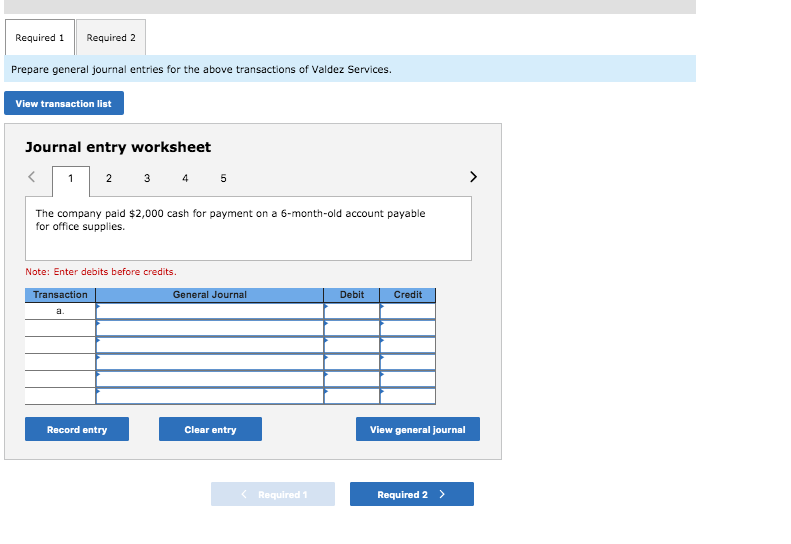

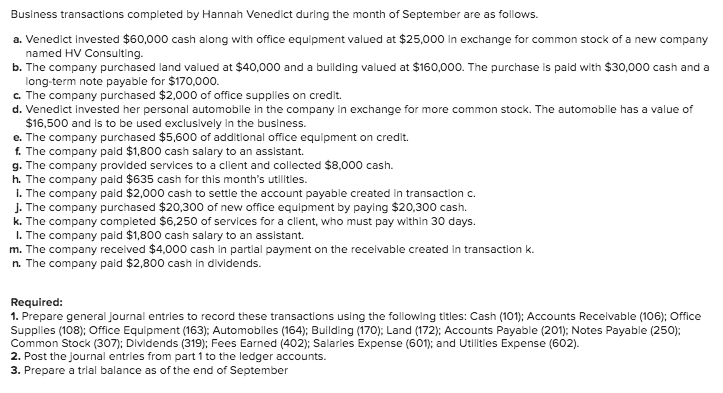

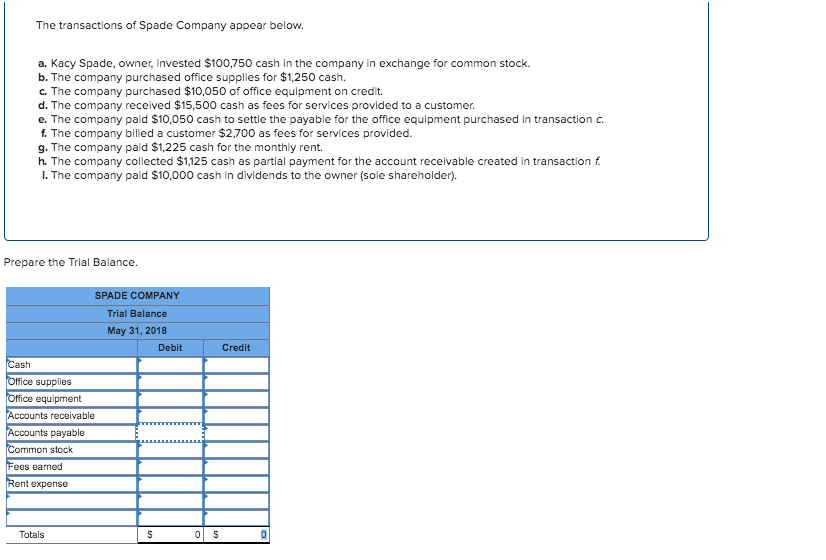

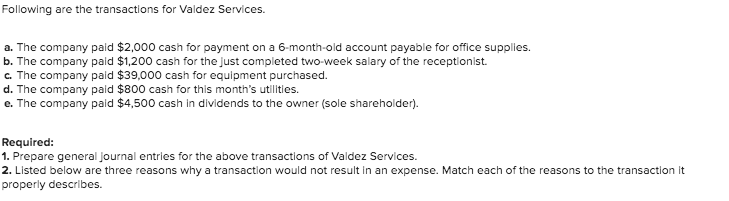

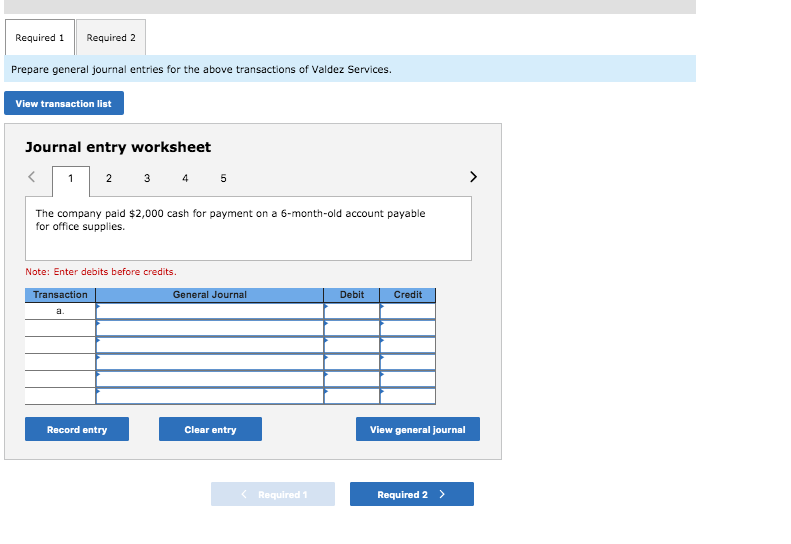

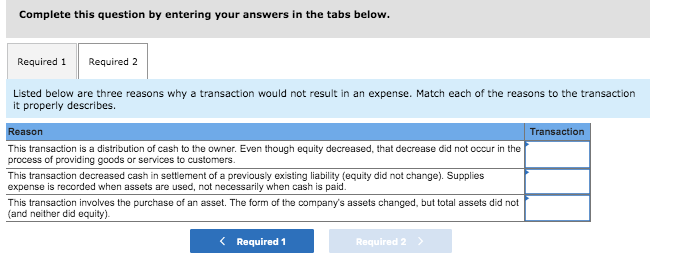

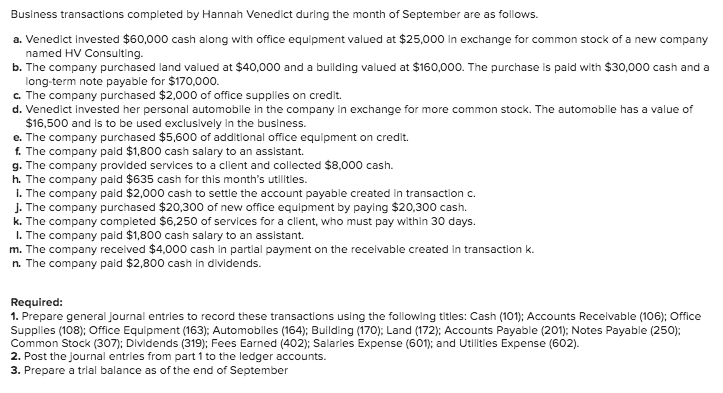

The transactions of Spade Company appear below. a. Kacy Spade, owner, invested $100,750 cash in the company in exchange for common stock b. The company purchased office supplies for $1,250 cash c. The company purchased $10,050 of office equipment on credit. d. The company recelved $15,500 cash as fees for services provided to a customer. e. The company paid $10,050 cash to settle the payable for the office equipment purchased in transaction c f. The company billed a customer $2,700 as fees for services provided. g. The company paid $1,225 cash for the monthly rent. h. The company collected $1,125 cash as partial payment for the account receivable created in transaction f I. The company paid $10,000 cash in dividends to the owner (sole shareholder) Prepare the Trial Balance. SPADE COMPANY Trial Balance May 31, 2018 Debit Credit Cash Office supplies Office equipment Accounts receivable Accounts payable Common stock Fees earned Rent expense S Totals S C C Following are the transactions for Valdez Services. a. The company paid $2,000 cash for payment on a 6-month-old account payable for office supplies. b. The company paid $1,200 cash for the just completed two-week salary of the receptionist c. The company paid $39,000 cash for equipment purchased. d. The company paid $800 cash for this month's utilities e. The company paid $4,500 cash in dividends to the owner (sole shareholder) Required: 1. Prepare general journal entries for the above transactions of Valdez Services 2. Listed below are three reasons why a transaction would not result in an expense. Match each of the reasons to the transaction it properly describes. Required 1 Required 2 Prepare general journal entries for the above transactions of Valdez Services. View transaction list Journal entry worksheet > 1 2 3 4 5 The company paid $2,000 cash for payment on a 6-month-old account payable for office supplies Note: Enter debits before credits. Debit Transaction General Journal Credit a Record entry Clear entry View general journal Required 1 Required 2> Complete this question by entering your answers in the tabs below Required 1 Required 2 Listed below are three reasons why a transaction would not result in an expense. Match each of the reasons to the transaction it properly describes. Reason Transaction This transaction is a distribution of cash to the owner. Even though equity decreased, that decrease did not occur in the process of providing goods or services to customers. This transaction decreased cash in settlement of a previously existing liability (equity did not change). Supplies expense is recorded when assets are used, not necessarily when cash is paid. This transaction involves the purchase of an asset. The form of the company's assets changed, but total assets did not (and neither did equity). Required 1 Required 2 > Business transactions completed by Hannah Venedict during the month of September are as follows. a. Venedict invested $60,000 cash along with office equipment valued at $25,000 in exchange for common stock of a new company named HV Consulting b. The company purchased land valued at $40,000 and a buildingg valued at $160,000. The purchase is paid with long-term note payable for $170,000. c. The company purchased $2,000 of office supplies on credit. d. Venedict invested her personal automobile in the company in exchange for more $16,500 and is to be used exclusively in the business. e. The company purchased $5,600 of additional office equipment on credit. f. The company paid $1,800 cash salary to an assistant g. The company provided services to a client and collected $8,000 cash. h. The company paid $635 cash for this month's utilities . The company paid $2,000 cash to settle the account payable created in transaction c. J. The company purchased $20,300 of new office equipment by paying $20,300 cash k. The company completed $6,250 of services for a client, who must pay within 30 days. . The company paid $1,800 cash salary to an assistant. m. The company recelved $4,000 cash in partlal payment on the recelvable created in transaction k n. The company paid $2,800 cash in dividends $30,000 cash and a common stock. The automobile has a value of C Required: 1. Prepare general journal entries to record these transactions using the following titles: Cash (101); Accounts Receivable (106); Office Supplies (108); Office Equipment (163); Automobiles (164); Building (170); Land (172); Accounts Payable (201); Notes Payable (250); Common Stock (307); Dividends (319); Fees Earned (402); Salaries Expense (601); and Utilities Expense (602). 2. Post the journal entries from part 1 to the ledger accounts. 3. Prepare a trial balance as of the end of September