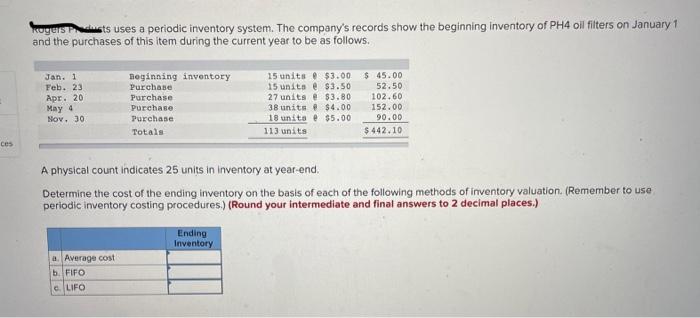

ces kogers Products uses a periodic inventory system. The company's records show the beginning inventory of PH4 oil filters on January 1 and the

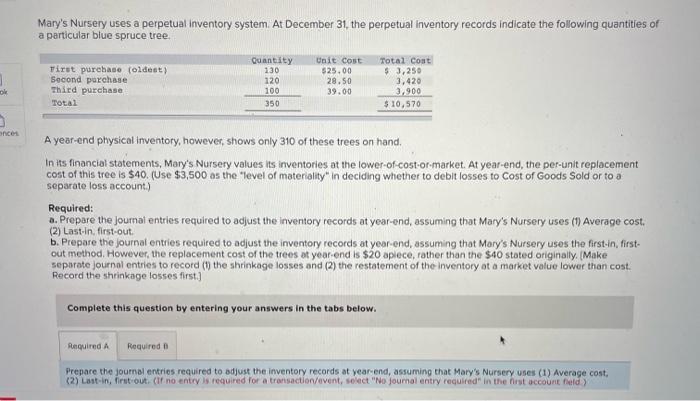

ces kogers Products uses a periodic inventory system. The company's records show the beginning inventory of PH4 oil filters on January 1 and the purchases of this item during the current year to be as follows. Jan. 1 Feb. 23 Apr. 201 May 41 Beginning inventory Purchase Purchase 15 units $3.00 15 units @ $3.50 27 units $ 45.00 52.50 $3.80 102.60 Nov. 30, Purchase Purchase 38 units $4.00 152.00 Totals 18 units @ $5.00 113 units 90.00 $442.10 A physical count indicates 25 units in inventory at year-end. Determine the cost of the ending inventory on the basis of each of the following methods of inventory valuation. (Remember to use periodic inventory costing procedures.) (Round your intermediate and final answers to 2 decimal places.) Ending Inventory a. Average cost b. FIFO c. LIFO ences Mary's Nursery uses a perpetual inventory system. At December 31, the perpetual inventory records indicate the following quantities of a particular blue spruce tree. First purchase (oldest) Second purchase Third purchase Total Quantity 130 Unit Cost $25.00 120 100 350 39.00 28.50 Total Cost $ 3,250 3,420 3,900 $10,570 A year-end physical inventory, however, shows only 310 of these trees on hand. In its financial statements, Mary's Nursery values its inventories at the lower-of-cost-or-market. At year-end, the per-unit replacement cost of this tree is $40. (Use $3,500 as the "level of materiality" in deciding whether to debit losses to Cost of Goods Sold or to a separate loss account.) Required: a. Prepare the journal entries required to adjust the inventory records at year-end, assuming that Mary's Nursery uses (1) Average cost. (2) Last-in, first-out. b. Prepare the journal entries required to adjust the inventory records at year-end, assuming that Mary's Nursery uses the first-in, first- out method. However, the replacement cost of the trees at year-end is $20 apiece, rather than the $40 stated originally. (Make separate journal entries to record (1) the shrinkage losses and (2) the restatement of the inventory at a market value lower than cost. Record the shrinkage losses first.] Complete this question by entering your answers in the tabs below. Required A Required B Prepare the journal entries required to adjust the inventory records at year-end, assuming that Mary's Nursery uses (1) Average cost, (2) Last-in, first-out. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To address both parts of the question I will provide detailed steps for inventory valuation using th...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started