Answered step by step

Verified Expert Solution

Question

1 Approved Answer

part 1: part2: part3: I apologize for putting the question into parts, but it cannot be copied ...Please answer quickly! Case four: (25 marks) The

part 1:

part2:

part3:

I apologize for putting the question into parts, but it cannot be copied ...Please answer quickly!

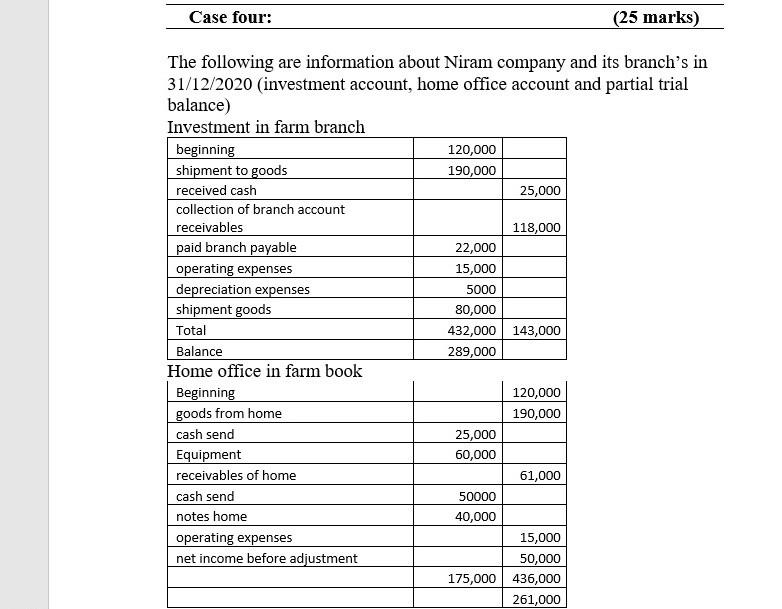

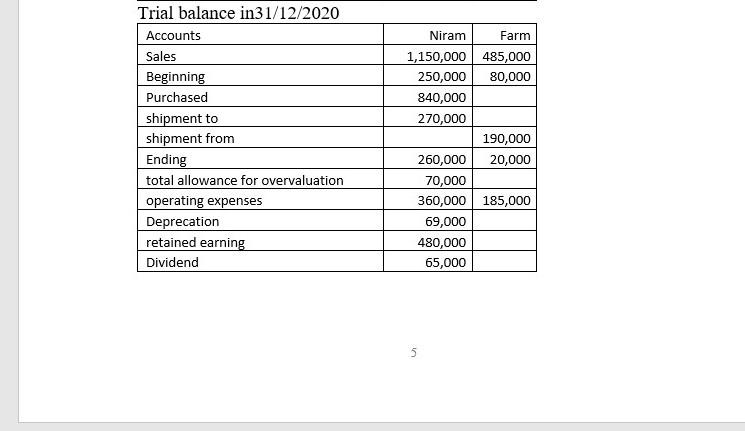

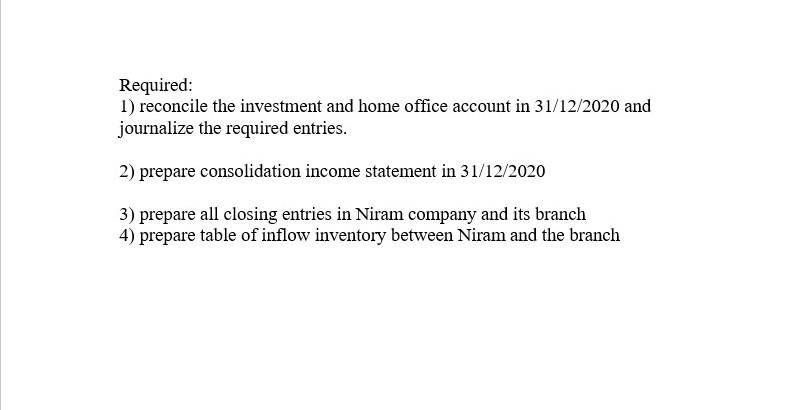

Case four: (25 marks) The following are information about Niram company and its branch's in 31/12/2020 (investment account, home office account and partial trial balance) Investment in farm branch beginning 120,000 shipment to goods 190,000 25,000 received cash collection of branch account 118,000 22,000 receivables paid branch payable operating expenses depreciation expenses shipment goods 15,000 5000 80,000 Total 432,000 143,000 289,000 120,000 190,000 Balance Home office in farm book Beginning goods from home cash send Equipment receivables of home cash send notes home operating expenses net income before adjustment 25,000 60,000 61,000 50000 40,000 15,000 50,000 175,000 436,000 261,000 Trial balance in31/12/2020 Accounts Niram Farm Sales 1,150,000 485,000 250,000 80,000 840,000 270,000 Beginning Purchased shipment to shipment from Ending total allowance for overvaluation operating expenses Deprecation retained earning Dividend 190,000 260,000 20,000 70,000 360,000 185,000 69,000 480,000 65,000 5 Required: 1) reconcile the investment and home office account in 31/12/2020 and journalize the required entries. 2) prepare consolidation income statement in 31/12/2020 3) prepare all closing entries in Niram company and its branch 4) prepare table of inflow inventory between Niram and the branch Case four: (25 marks) The following are information about Niram company and its branch's in 31/12/2020 (investment account, home office account and partial trial balance) Investment in farm branch beginning 120,000 shipment to goods 190,000 25,000 received cash collection of branch account 118,000 22,000 receivables paid branch payable operating expenses depreciation expenses shipment goods 15,000 5000 80,000 Total 432,000 143,000 289,000 120,000 190,000 Balance Home office in farm book Beginning goods from home cash send Equipment receivables of home cash send notes home operating expenses net income before adjustment 25,000 60,000 61,000 50000 40,000 15,000 50,000 175,000 436,000 261,000 Trial balance in31/12/2020 Accounts Niram Farm Sales 1,150,000 485,000 250,000 80,000 840,000 270,000 Beginning Purchased shipment to shipment from Ending total allowance for overvaluation operating expenses Deprecation retained earning Dividend 190,000 260,000 20,000 70,000 360,000 185,000 69,000 480,000 65,000 5 Required: 1) reconcile the investment and home office account in 31/12/2020 and journalize the required entries. 2) prepare consolidation income statement in 31/12/2020 3) prepare all closing entries in Niram company and its branch 4) prepare table of inflow inventory between Niram and the branchStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started