Answered step by step

Verified Expert Solution

Question

1 Approved Answer

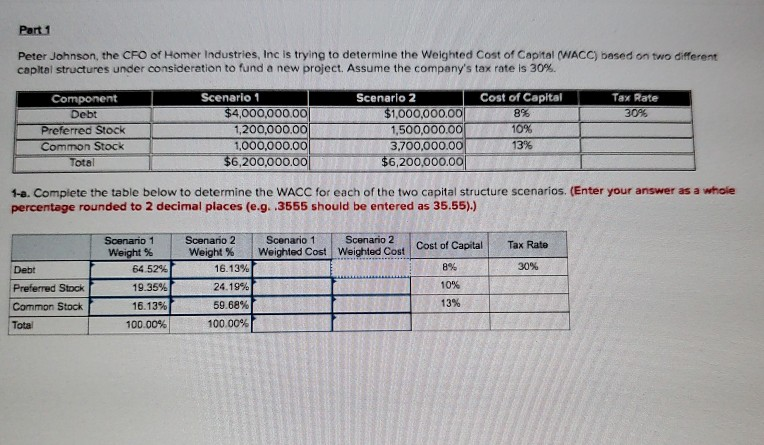

Part 1 Peter Johnson, the CFO of Homer Industries, Inc is trying to determine the Weighted Cost of Capital (WACC) based on two different capital

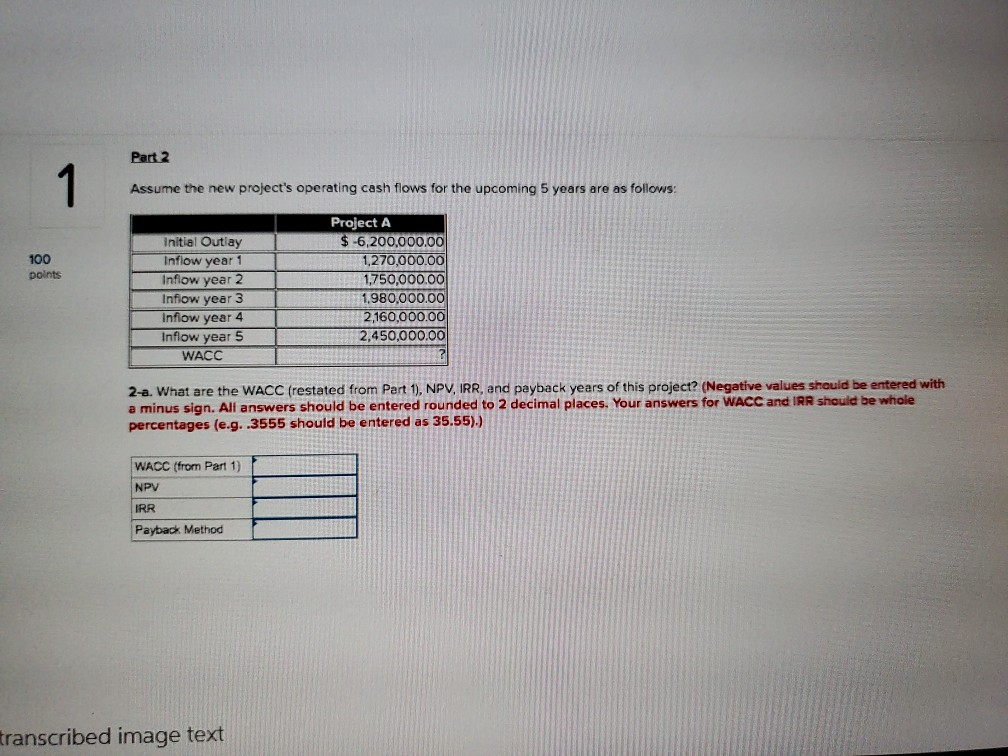

Part 1 Peter Johnson, the CFO of Homer Industries, Inc is trying to determine the Weighted Cost of Capital (WACC) based on two different capital structures under consideration to fund a new project. Assume the company's tax rate is 30%. Tax Rate 3095 Component Debt Preferred Stock Common Stock Total Scenario 1 $4,000,000.00 1,200,000.00 1,000,000.00 $6,200,000.00 Scenario 2 $1,000,000.00 1,500,000.00 3,700,000.00 $6,200,000.00 Cost of Capital 8% 10% 13% 1-a. Complete the table below to determine the WACC for each of the two capital structure scenarios. (Enter your answer as a whole percentage rounded to 2 decimal places (e.g..3555 should be entered as 35.55).) Scenario 1 Scenario 2 Weighted Cost Weighted Cost os Cost of Capital Tax Rate Scenario 2 Weight % 16.13% 24.19% 30% Scenario 1 Weight % 64.529 19.35% 16.13% 100.00% Debt Preferred Stock Common Stock Total 8% 10% 59 68% 13% 100.00% Part 2 Assume the new project's operating cash flows for the upcoming 5 years are as follows: 100 points Initial Outlay Inflow year 1 Inflow year 2 Inflow year 3 Inflow year 4 Inflow year 5 WACC Project A $ -6,200,000.00 1,270,000.00 1,750,000.00 1.980,000.00 2,160,000.00 2,450,000.00 2-a. What are the WACC (restated from Part 1), NPV, IRR, and payback years of this project? (Negative values should be entered with a minus sign. All answers should be entered rounded to 2 decimal places. Your answers for WACC and IRR should be whole percentages (e.g..3555 should be entered as 35.55).) WACC (from Part 1) NPV IRR Payback Method cranscribed image text

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started