Answered step by step

Verified Expert Solution

Question

1 Approved Answer

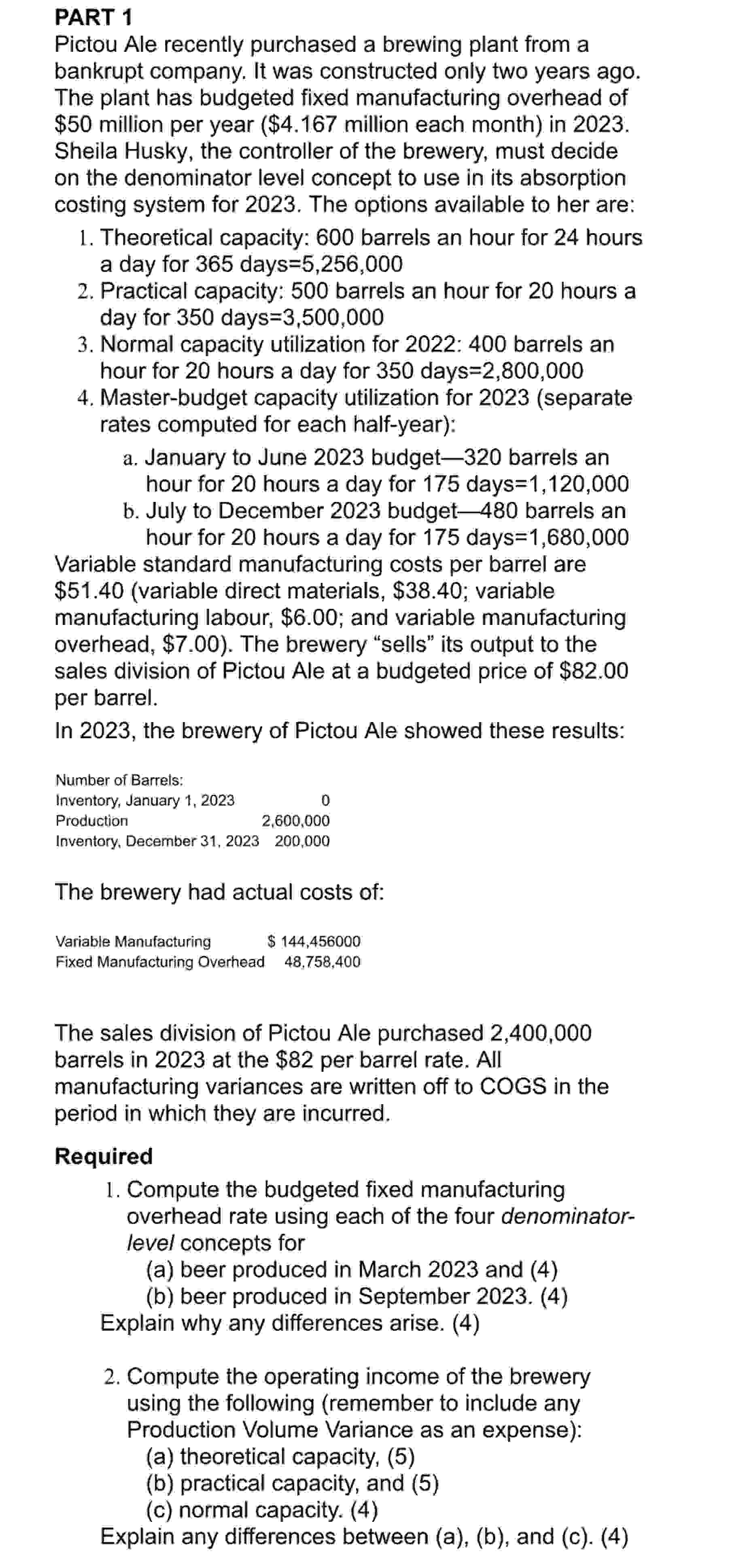

PART 1 Pictou Ale recently purchased a brewing plant from a bankrupt company. It was constructed only two years ago. The plant has budgeted fixed

PART

Pictou Ale recently purchased a brewing plant from a

bankrupt company. It was constructed only two years ago.

The plant has budgeted fixed manufacturing overhead of

$ million per year $ million each month in

Sheila Husky, the controller of the brewery, must decide

on the denominator level concept to use in its absorption

costing system for The options available to her are:

Theoretical capacity: barrels an hour for hours

a day for days

Practical capacity: barrels an hour for hours a

day for days

Normal capacity utilization for : barrels an

hour for hours a day for days

Masterbudget capacity utilization for separate

rates computed for each halfyear:

a January to June budget barrels an

hour for hours a day for days

b July to December budget barrels an

hour for hours a day for days

Variable standard manufacturing costs per barrel are

$variable direct materials, $; variable

manufacturing labour, $; and variable manufacturing

overhead, $ The brewery "sells" its output to the

sales division of Pictou Ale at a budgeted price of $

per barrel.

In the brewery of Pictou Ale showed these results:

Number of Barrels:

Inventory, January

Production

Inventory, December

The brewery had actual costs of:

The sales division of Pictou Ale purchased

barrels in at the $ per barrel rate. All

manufacturing variances are written off to COGS in the

period in which they are incurred.

Required

Compute the budgeted fixed manufacturing

overhead rate using each of the four denominator

level concepts for

a beer produced in March and

b beer produced in September

Explain why any differences arise.

Compute the operating income of the brewery

using the following remember to include any

Production Volume Variance as an expense:

a theoretical capacity,

b practical capacity, and

c normal capacity.

Explain any differences between ab and c

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started