Question

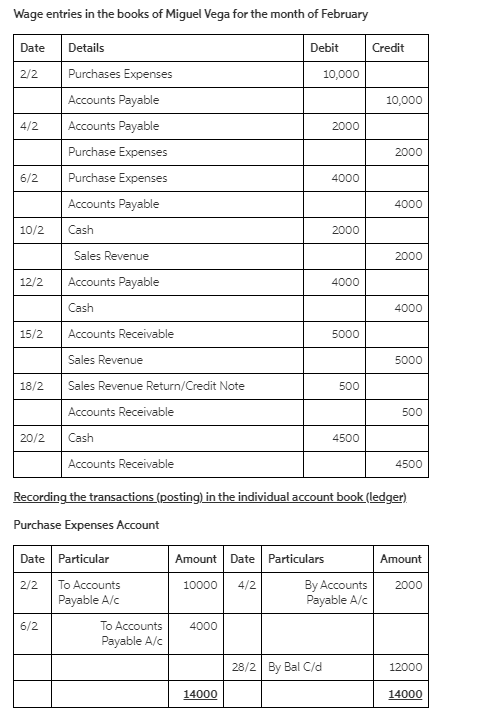

Part 1. Read the following case, make the wage entries and the process of recording the transactions (posting) in the individual account book (ledger). Miguel

Part 1. Read the following case, make the wage entries and the process of recording the transactions (posting) in the individual account book (ledger).

Miguel Vega has a music equipment sales business called Music Sound. During the month of February the following transactions occurred:

Date

(February) Transaction

2 $ 10,000 worth of speakers purchased to sell at the business outside of the discount period.

4 Of the speakers purchased on Day 2, 4 were returned at a cost of $ 500 each to the seller because they were damaged.

6 20 amplifiers were purchased for sale on credit with a value of $ 4,000 with a payment term of 2/10 n / 30.

10 A sale was made to a customer of 5 amplifiers for $ 2,000.

12 Payment of the purchase of the 6th was made in full.

15 Music Sound made a $ 5,000 credit sale to a customer with a term of 3/10 n / 30. The cost of the merchandise was $2,500.

18 The customer who purchased merchandise on the 15th returned $ 500 worth of merchandise because it was defective.

20 he customer who made the purchase on the 15th paid in full with the corresponding discount.

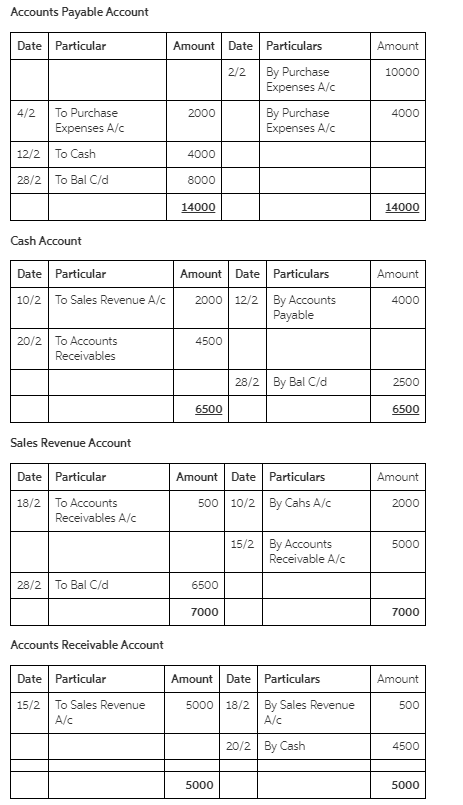

Part 2. Using the information in part 1, make the closing entries in the general ledger and ledgers for each account.

Please answer part 2 alone I have attached the part 1 answer too

Part-1 answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started