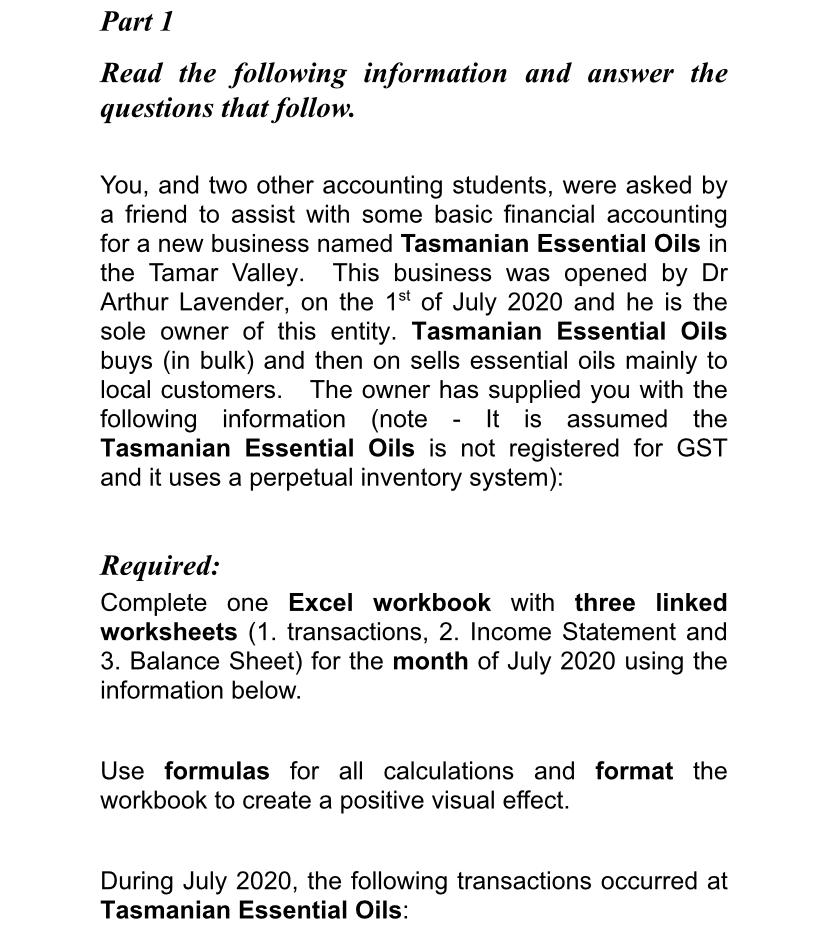

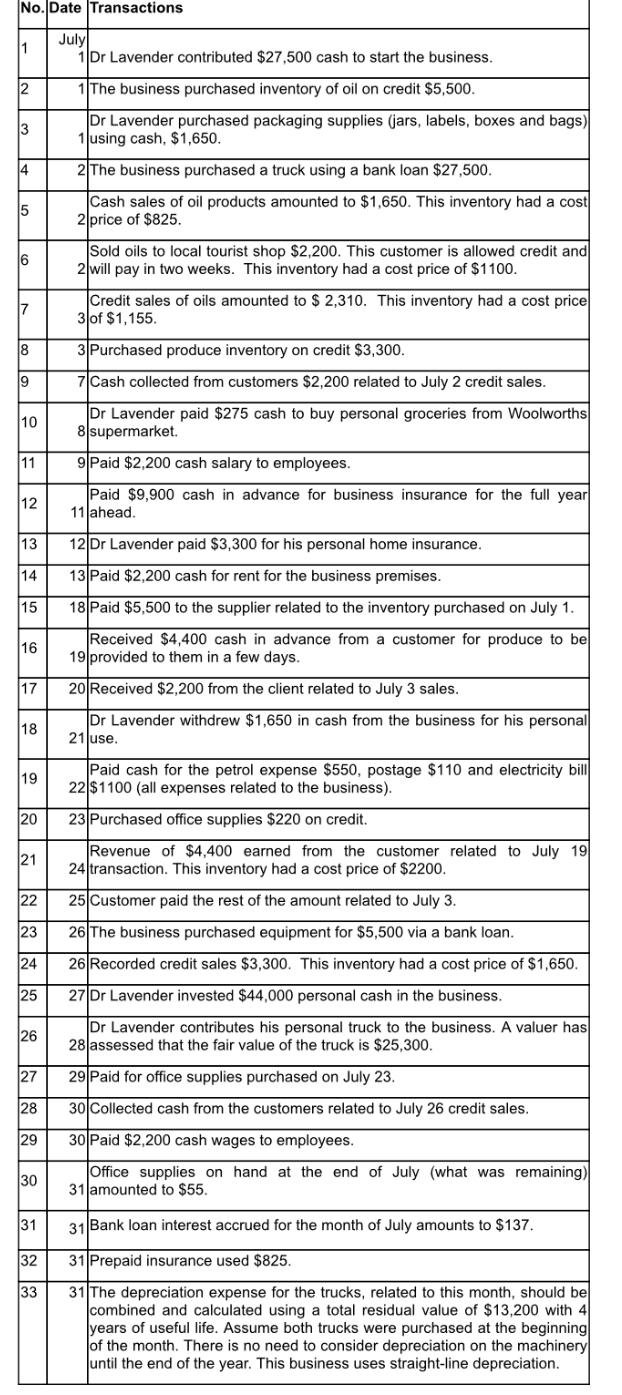

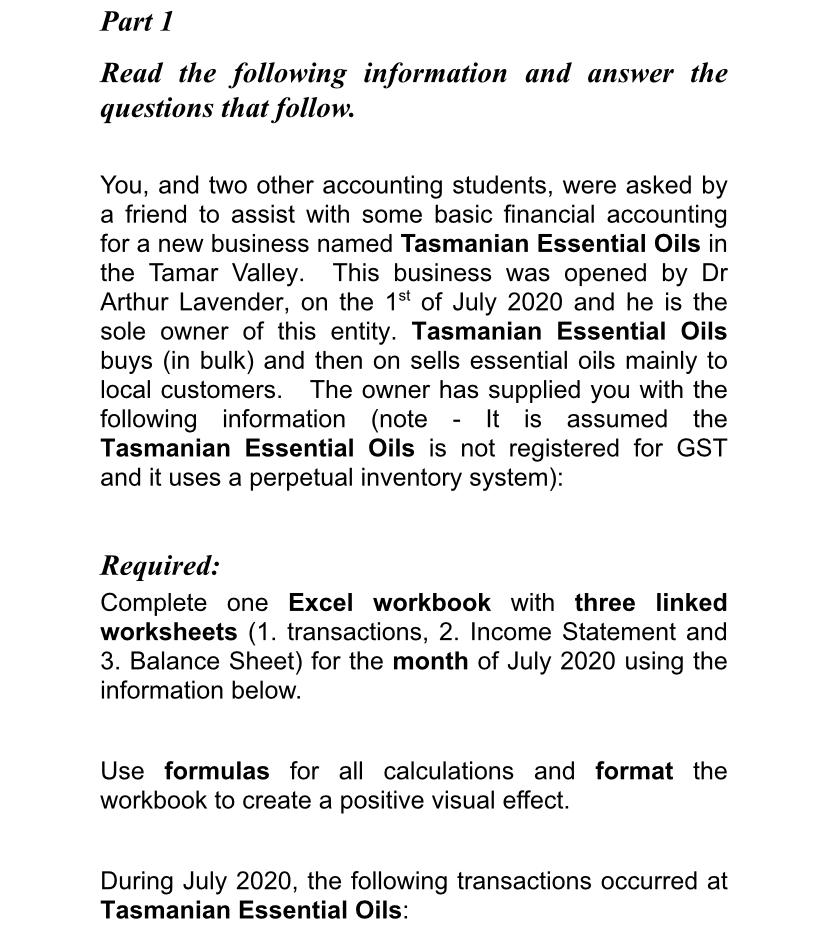

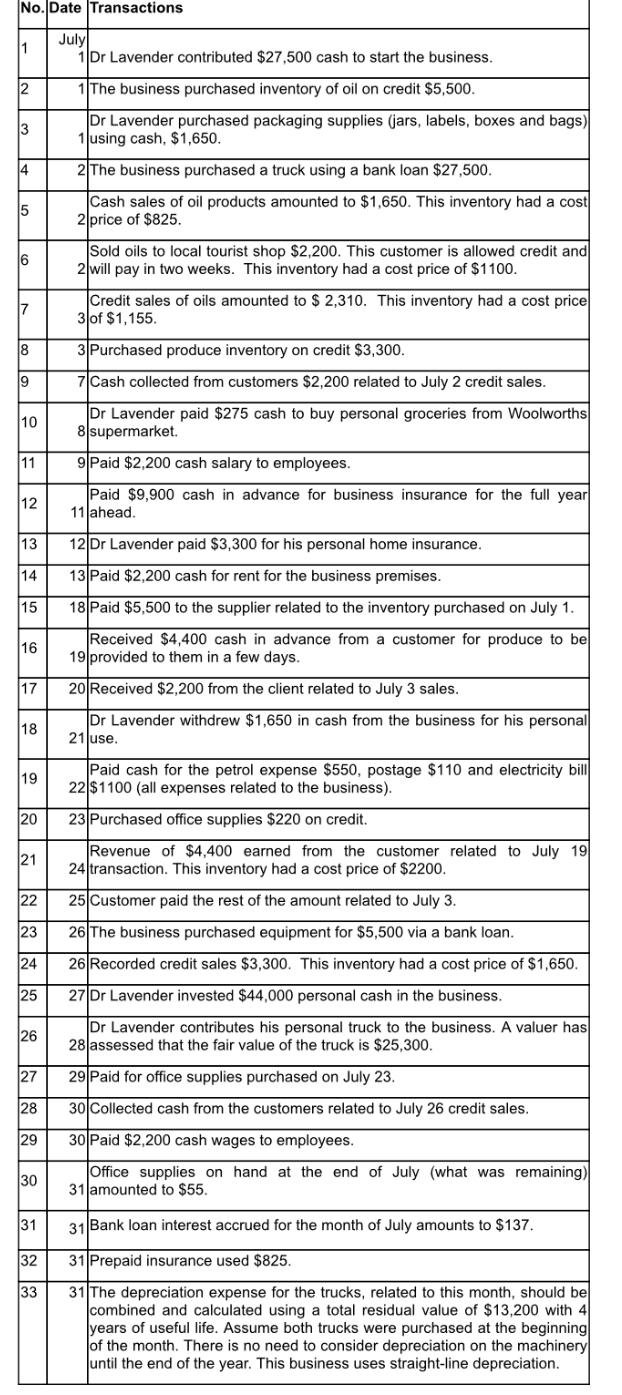

Part 1 Read the following information and answer the questions that follow. You, and two other accounting students, were asked by a friend to assist with some basic financial accounting for a new business named Tasmanian Essential Oils in the Tamar Valley. This business was opened by Dr Arthur Lavender, on the 1st of July 2020 and he is the sole owner of this entity. Tasmanian Essential Oils buys (in bulk) and then on sells essential oils mainly to local customers. The owner has supplied you with the following information (note - It is assumed the Tasmanian Essential Oils is not registered for GST and it uses a perpetual inventory system): Required: Complete one Excel workbook with three linked worksheets (1. transactions, 2. Income Statement and 3. Balance Sheet) for the month of July 2020 using the information below. Use formulas for all calculations and format the workbook to create a positive visual effect. During July 2020, the following transactions occurred at Tasmanian Essential Oils: No. Date Transactions 11 July 1 Dr Lavender contributed $27,500 cash to start the business 2 1 The business purchased inventory of oil on credit $5,500. Dr Lavender purchased packaging supplies (jars, labels, boxes and bags) 1 using cash, $1,650. 13 14 2 The business purchased a truck using a bank loan $27,500. 15 Cash sales of oil products amounted to $1,650. This inventory had a cost 2 price of $825. 16 Sold oils to local tourist shop $2,200. This customer is allowed credit and 2 will pay in two weeks. This inventory had a cost price of $1100. Credit sales of oils amounted to $ 2,310. This inventory had a cost price 3 of $1,155. 17 18 3 Purchased produce inventory on credit $3,300. 7 Cash collected from customers $2,200 related to July 2 credit sales. 19 10 Dr Lavender paid $275 cash to buy personal groceries from Woolworths 8 supermarket 11 9 Paid $2,200 cash salary to employees. Paid $9,900 cash in advance for business insurance for the full year 11 Jahead. 12 13 12 Dr Lavender paid $3,300 for his personal home insurance. 14 13 Paid $2,200 cash for rent for the business premises. 15 18 Paid $5,500 to the supplier related to the inventory purchased on July 1. Received $4,400 cash in advance from a customer for produce to be 19 provided to them in a few days. 16 17 20 Received $2,200 from the client related to July 3 sales. 18 Dr Lavender withdrew $1,650 in cash from the business for his personal 21 use. 19 20 Paid cash for the petrol expense $550, postage $110 and electricity bill 22 $1100 (all expenses related to the business). 23 Purchased office supplies $220 on credit. Revenue of $4,400 earned from the customer related to July 19 24 transaction. This inventory had a cost price of $2200. 25 Customer paid the rest of the amount related to July 3. 21 22 23 26 The business purchased equipment for $5,500 via a bank loan. 24 26 Recorded credit sales $3,300. This inventory had a cost price of $1,650. 25 27 Dr Lavender invested $44,000 personal cash in the business. 26 Dr Lavender contributes his personal truck to the business. A valuer has 28 assessed that the fair value of the truck is $25,300. 127 29 Paid for office supplies purchased on July 23. 28 30 Collected cash from the customers related to July 26 credit sales. 29 30 Paid $2,200 cash wages to employees. 30 Office supplies on hand at the end of July (what was remaining) 31 amounted to $55. 31 31 Bank loan interest accrued for the month of July amounts to $137. 32 33 31 Prepaid insurance used $825. 31 The depreciation expense for the trucks, related to this month, should be combined and calculated using a total residual value of $13,200 with 4 years of useful life. Assume both trucks were purchased at the beginning of the month. There is no need to consider depreciation on the machinery until the end of the year. This business uses straight-line depreciation