Question

Part 1 Risk analysisSolar Designs is considering an investment in an expanded product line. Two possible types of expansion are under review. After investigating the

Part 1

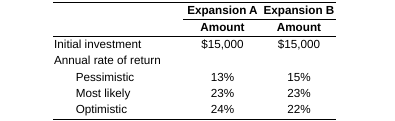

Risk analysisSolar Designs is considering an investment in an expanded product line. Two possible types of expansion are under review. After investigating the possible outcomes, the company made the estimates shown in the following table:

. The pessimistic and optimistic outcomes occur with a probablity of 25%, and the most likely outcome occurs with a probability of 50%.

a.Determine the range of the rates of return for each of the two projects.

b.Which project is less risky?

c.If you were making the investment decision, which one would you choose? What does this imply about your feelings toward risk?

d.Assume that expansion B's most likely outcome is 24% per year and that all other facts remain the same. Does this change your answer to part c?

Expansion A Expansion B Amount Amount $15,000 $15,000 Initial investment Annual rate of return Pessimistic Most likely Optimistic 13% 23% 24% 15% 23% 22%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started