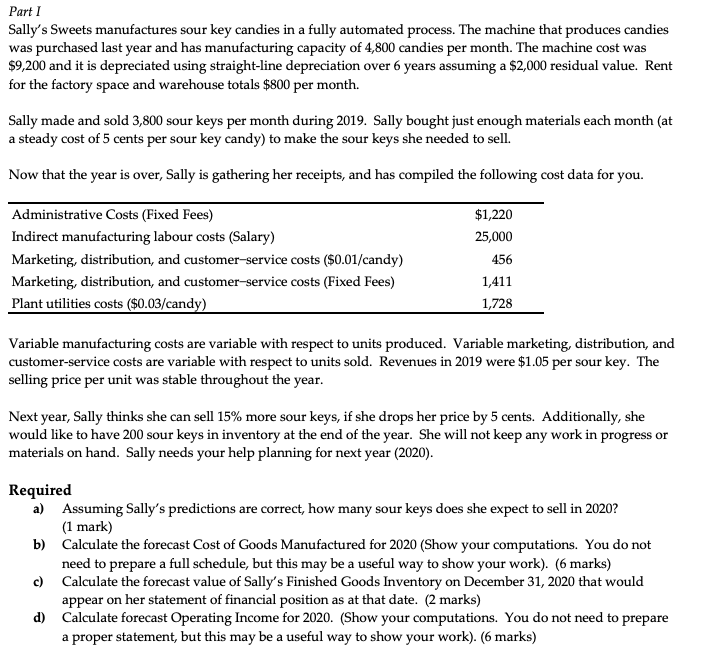

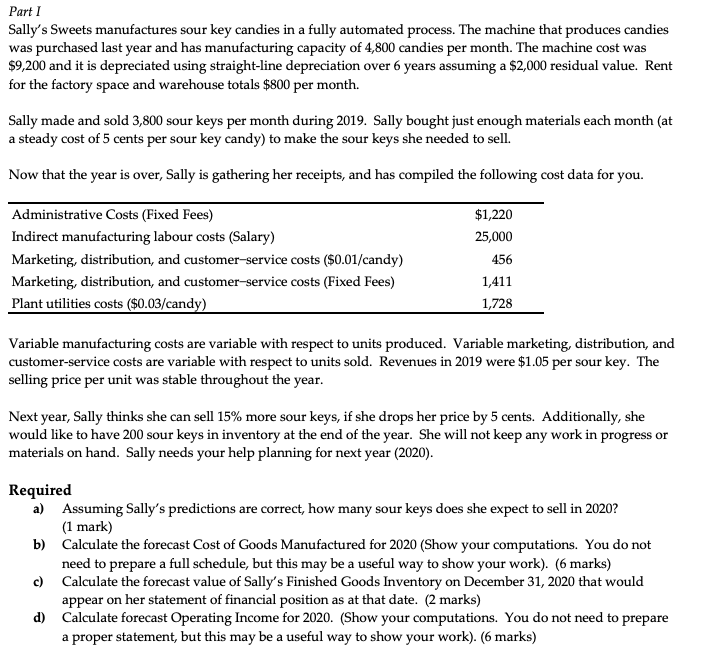

Part 1 Sally's Sweets manufactures sour key candies in a fully automated process. The machine that produces candies was purchased last year and has manufacturing capacity of 4,800 candies per month. The machine cost was $9,200 and it is depreciated using straight-line depreciation over 6 years assuming a $2,000 residual value. Rent for the factory space and warehouse totals $800 per month. Sally made and sold 3,800 sour keys per month during 2019. Sally bought just enough materials each month (at a steady cost of 5 cents per sour key candy) to make the sour keys she needed to sell. Now that the year is over, Sally is gathering her receipts, and has compiled the following cost data for you. Administrative Costs (Fixed Fees) Indirect manufacturing labour costs (Salary) Marketing, distribution, and customer-service costs ($0.01/candy) Marketing, distribution, and customer-service costs (Fixed Fees) Plant utilities costs ($0.03/candy) $1,220 25,000 456 1,411 1,728 Variable manufacturing costs are variable with respect to units produced. Variable marketing, distribution, and customer-service costs are variable with respect to units sold. Revenues in 2019 were $1.05 per sour key. The selling price per unit was stable throughout the year. Next year, Sally thinks she can sell 15% more sour keys, if she drops her price by 5 cents. Additionally, she would like to have 200 sour keys in inventory at the end of the year. She will not keep any work in progress or materials on hand. Sally needs your help planning for next year (2020). Required a) Assuming Sally's predictions are correct, how many sour keys does she expect to sell in 2020? (1 mark) b) Calculate the forecast Cost of Goods Manufactured for 2020 (Show your computations. You do not need to prepare a full schedule, but this may be a useful way to show your work). (6 marks) c) Calculate the forecast value of Sally's Finished Goods Inventory on December 31, 2020 that would appear on her statement of financial position as at that date. (2 marks) d) Calculate forecast Operating Income for 2020. (Show your computations. You do not need to prepare a proper statement, but this may be a useful way to show your work). (6 marks) Part 1 Sally's Sweets manufactures sour key candies in a fully automated process. The machine that produces candies was purchased last year and has manufacturing capacity of 4,800 candies per month. The machine cost was $9,200 and it is depreciated using straight-line depreciation over 6 years assuming a $2,000 residual value. Rent for the factory space and warehouse totals $800 per month. Sally made and sold 3,800 sour keys per month during 2019. Sally bought just enough materials each month (at a steady cost of 5 cents per sour key candy) to make the sour keys she needed to sell. Now that the year is over, Sally is gathering her receipts, and has compiled the following cost data for you. Administrative Costs (Fixed Fees) Indirect manufacturing labour costs (Salary) Marketing, distribution, and customer-service costs ($0.01/candy) Marketing, distribution, and customer-service costs (Fixed Fees) Plant utilities costs ($0.03/candy) $1,220 25,000 456 1,411 1,728 Variable manufacturing costs are variable with respect to units produced. Variable marketing, distribution, and customer-service costs are variable with respect to units sold. Revenues in 2019 were $1.05 per sour key. The selling price per unit was stable throughout the year. Next year, Sally thinks she can sell 15% more sour keys, if she drops her price by 5 cents. Additionally, she would like to have 200 sour keys in inventory at the end of the year. She will not keep any work in progress or materials on hand. Sally needs your help planning for next year (2020). Required a) Assuming Sally's predictions are correct, how many sour keys does she expect to sell in 2020? (1 mark) b) Calculate the forecast Cost of Goods Manufactured for 2020 (Show your computations. You do not need to prepare a full schedule, but this may be a useful way to show your work). (6 marks) c) Calculate the forecast value of Sally's Finished Goods Inventory on December 31, 2020 that would appear on her statement of financial position as at that date. (2 marks) d) Calculate forecast Operating Income for 2020. (Show your computations. You do not need to prepare a proper statement, but this may be a useful way to show your work). (6 marks)