Answered step by step

Verified Expert Solution

Question

1 Approved Answer

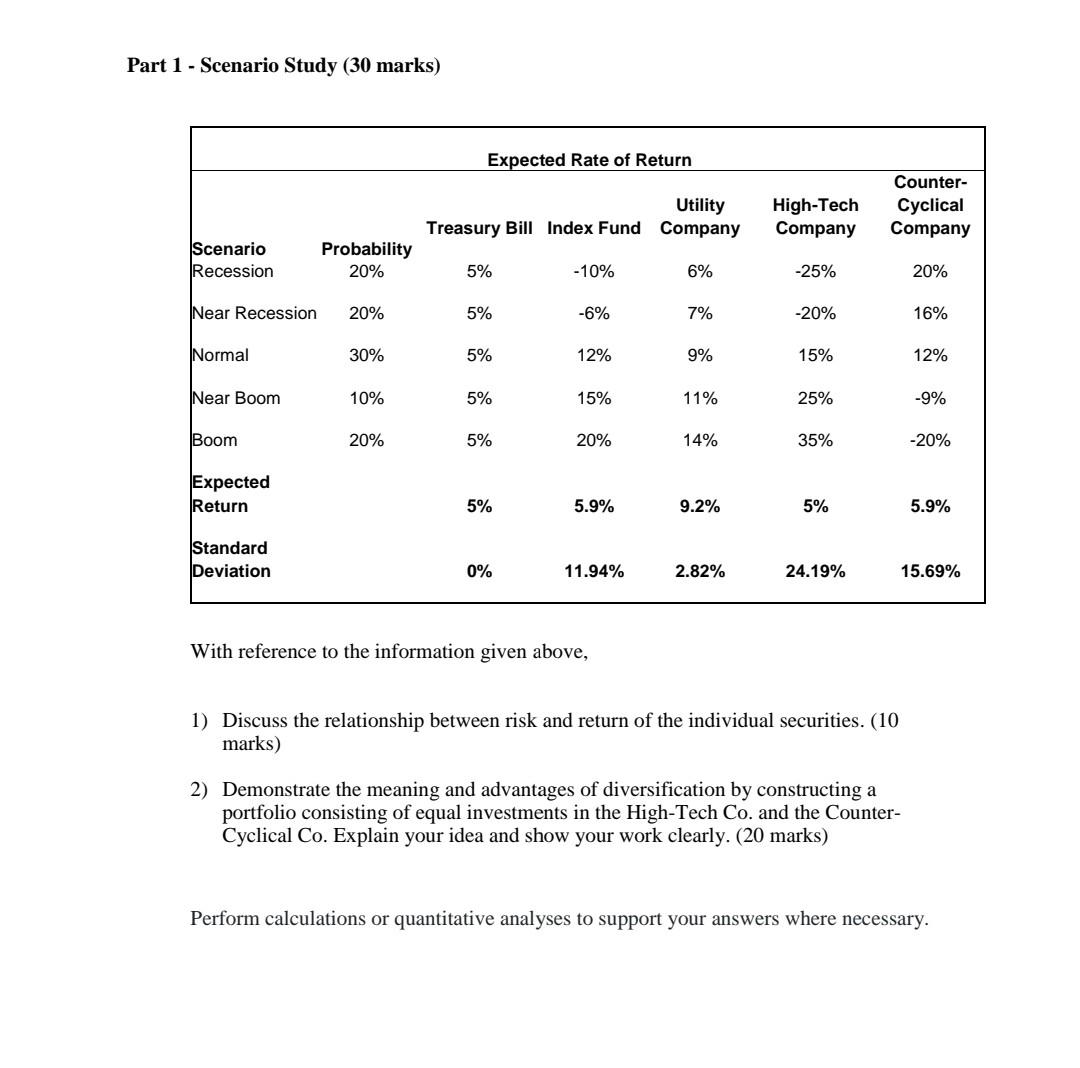

Part 1 - Scenario Study (30 marks) Expected Rate of Return Utility Treasury Bill Index Fund Company High-Tech Company Counter- Cyclical Company Scenario Recession Probability

Part 1 - Scenario Study (30 marks) Expected Rate of Return Utility Treasury Bill Index Fund Company High-Tech Company Counter- Cyclical Company Scenario Recession Probability 20% 5% -10% 6% -25% 20% Near Recession 20% 5% -6% 7% -20% 16% Normal 30% 5% 12% 9% 15% 12% Near Boom 10% 5% 15% 11% 25% -9% Boom 20% 5% 20% 14% 35% -20% Expected Return 5% 5.9% 9.2% 5% 5.9% Standard Deviation 0% 11.94% 2.82% 24.19% 15.69% With reference to the information given above, 1) Discuss the relationship between risk and return of the individual securities. (10 marks) 2) Demonstrate the meaning and advantages of diversification by constructing a portfolio consisting of equal investments in the High-Tech Co. and the Counter- Cyclical Co. Explain your idea and show your work clearly. (20 marks) Perform calculations or quantitative analyses to support your answers where necessary

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started