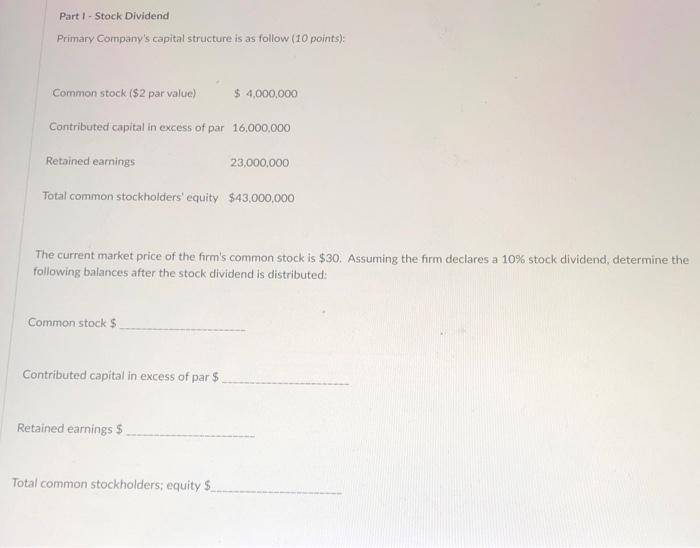

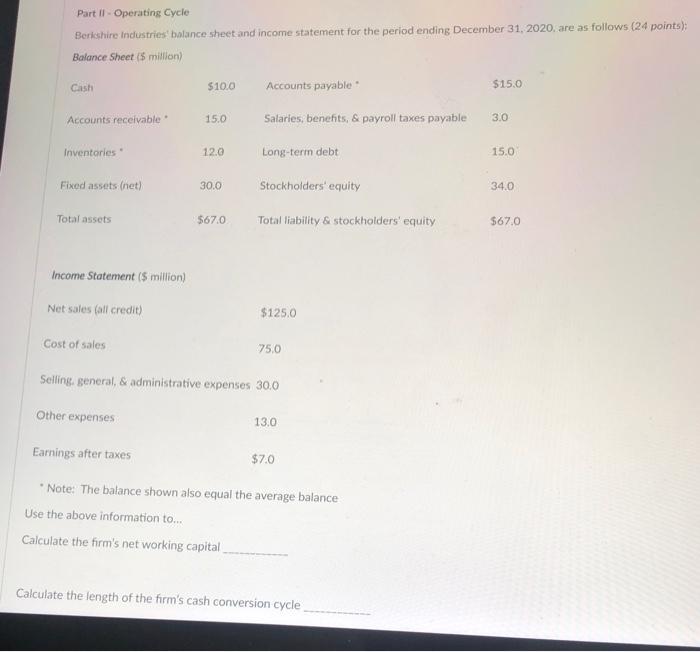

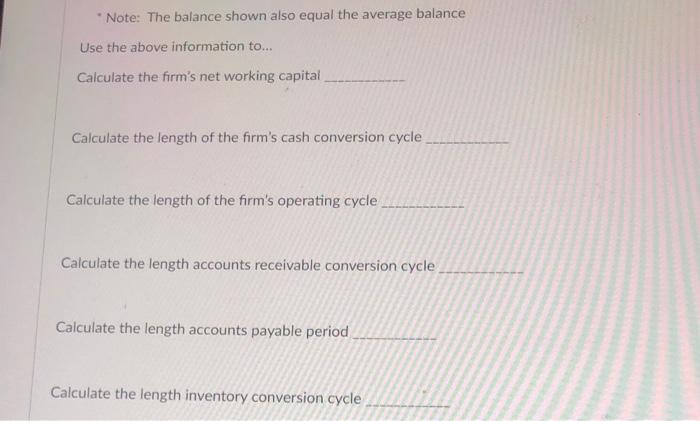

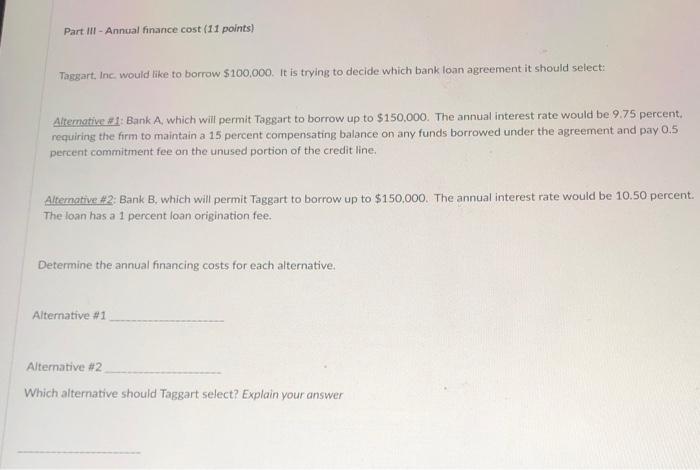

Part 1 - Stock Dividend Primary Company's capital structure is as follow (10 points) Common stock ($2 par value) $ 4,000,000 Contributed capital in excess of par 16,000,000 Retained earnings 23,000,000 Total common stockholders' equity $43,000,000 The current market price of the firm's common stock is $30. Assuming the firm declares a 10% stock dividend, determine the following balances after the stock dividend is distributed: Common stock $ Contributed capital in excess of par $ Retained earnings $ Total common stockholders, equity $ Part I - Operating Cycle Berkshire Industries balance sheet and income statement for the period ending December 31, 2020. are as follows (24 points) Balance Sheet (5 million) Cash $100 Accounts payable $15.0 Accounts receivable 15.0 Salaries, benefits, & payroll taxes payable 3.0 Inventories 12.0 Long-term debt 15.0 Fixed assets (net) 30.0 Stockholders' equity 34.0 Total assets $67.0 Total liability & stockholders' equity $67.0 Income Statement (5 million) Net soles (all credit) $125.0 Cost of sales 750 Selling, general, & administrative expenses 30.0 Other expenses 13.0 Earnings after taxes $7.0 * Note: The balance shown also equal the average balance Use the above information to... Calculate the firm's net working capital Calculate the length of the firm's cash conversion cycle Note: The balance shown also equal the average balance Use the above information to... Calculate the firm's net working capital Calculate the length of the firm's cash conversion cycle Calculate the length of the firm's operating cycle Calculate the length accounts receivable conversion cycle Calculate the length accounts payable period Calculate the length inventory conversion cycle Part III - Annual finance cost (11 points) Taggart, Inc would like to borrow $100,000. It is trying to decide which bank loan agreement it should select: Alternative #1: Bank A, which will permit Taggart to borrow up to $150,000. The annual interest rate would be 9.75 percent, requiring the firm to maintain a 15 percent compensating balance on any funds borrowed under the agreement and pay 0.5 percent commitment fee on the unused portion of the credit line: Alternative #2: Bank B, which will permit Taggart to borrow up to $150,000. The annual interest rate would be 10.50 percent. The loan has a 1 percent loan origination fee. Determine the annual financing costs for each alternative. Alternative #1 Alternative #2 Which alternative should Taggart select? Explain your