Answered step by step

Verified Expert Solution

Question

1 Approved Answer

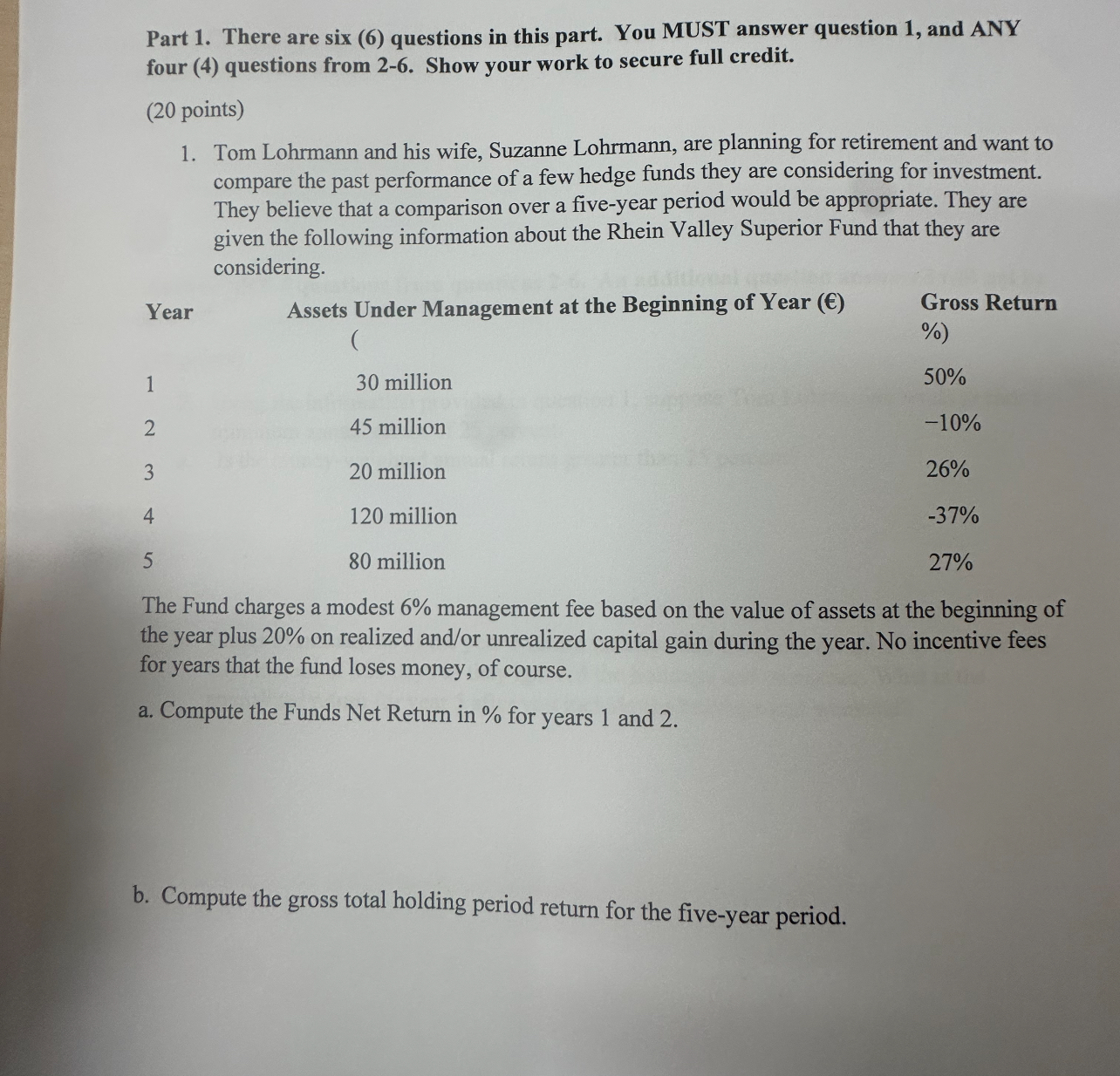

Part 1 . There are six ( 6 ) questions in this part. You MUST answer question 1 , and ANY four ( 4 )

Part There are six questions in this part. You MUST answer question and ANY

four questions from Show your work to secure full credit.

points

Tom Lohrmann and his wife, Suzanne Lohrmann, are planning for retirement and want to

compare the past performance of a few hedge funds they are considering for investment.

They believe that a comparison over a fiveyear period would be appropriate. They are

given the following information about the Rhein Valley Superior Fund that they are

considering.

The Fund charges a modest management fee based on the value of assets at the beginning of

the year plus on realized andor unrealized capital gain during the year. No incentive fees

for years that the fund loses money, of course.

a Compute the Funds Net Return in for years and

b Compute the gross total holding period return for the fiveyear period.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started