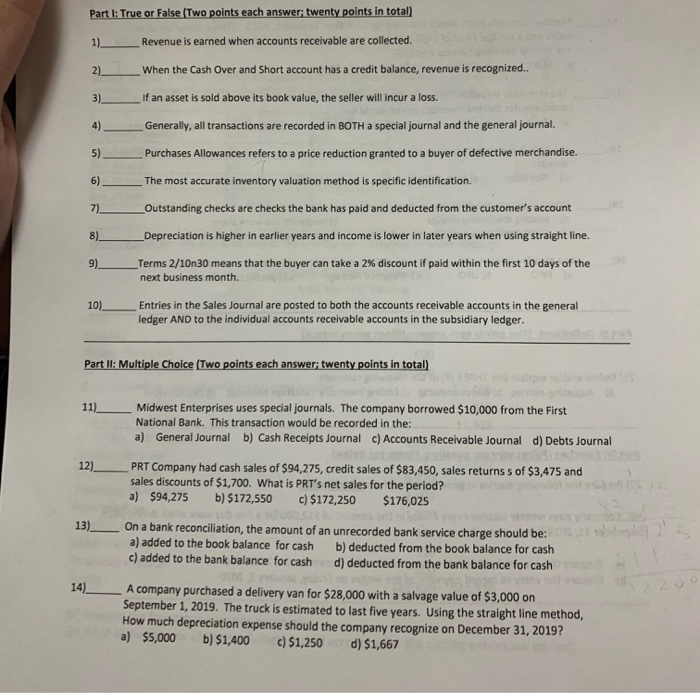

Part 1: True or False (Two points each answer; twenty points in total) Revenue is earned when accounts receivable are collected. When the Cash Over and Short account has a credit balance, revenue is recognized.. If an asset is sold above its book value, the seller will incur a loss. Generally, all transactions are recorded in BOTH a special journal and the general journal. Purchases Allowances refers to a price reduction granted to a buyer of defective merchandise. The most accurate inventory valuation method is specific identification. Outstanding checks are checks the bank has paid and deducted from the customer's account Depreciation is higher in earlier years and income is lower in later years when using straight line. Terms 2/10n30 means that the buyer can take a 2% discount if paid within the first 10 days of the next business month. Entries in the Sales Journal are posted to both the accounts receivable accounts in the general ledger AND to the individual accounts receivable accounts in the subsidiary ledger. Part II: Multiple Choice (Two points each answer; twenty points in total) 11) Midwest Enterprises uses special journals. The company borrowed $10,000 from the First National Bank. This transaction would be recorded in the: a) General Journal b) Cash Receipts Journal c) Accounts Receivable Journal d) Debts Journal 12) PRT Company had cash sales of $94,275, credit sales of $83,450, sales returns s of $3,475 and sales discounts of $1,700. What is PRT's net sales for the period? a) $94,275 b) $172,550 c) $172,250 $176,025 On a bank reconciliation, the amount of an unrecorded bank service charge should be: ecorded bank service charge should be: a) added to the book balance for cash b) deducted from the book balance for cash c) added to the bank balance for cash d) deducted from the bank balance for cash bank balance for cash 14) A company purchased a delivery van for $28,000 with a salvage value of $3,000 on September 1, 2019. The truck is estimated to last five years. Using the straight line method, How much depreciation expense should the company recognize on December 31, 2019? a) $5,000 b) $1,400 c)$1,250 d) $1,667