Question

Part 1 Use Excel to create a workbook to perform a cost benefit analysis of the project. The workbook should use fixed and variable cell

Part 1

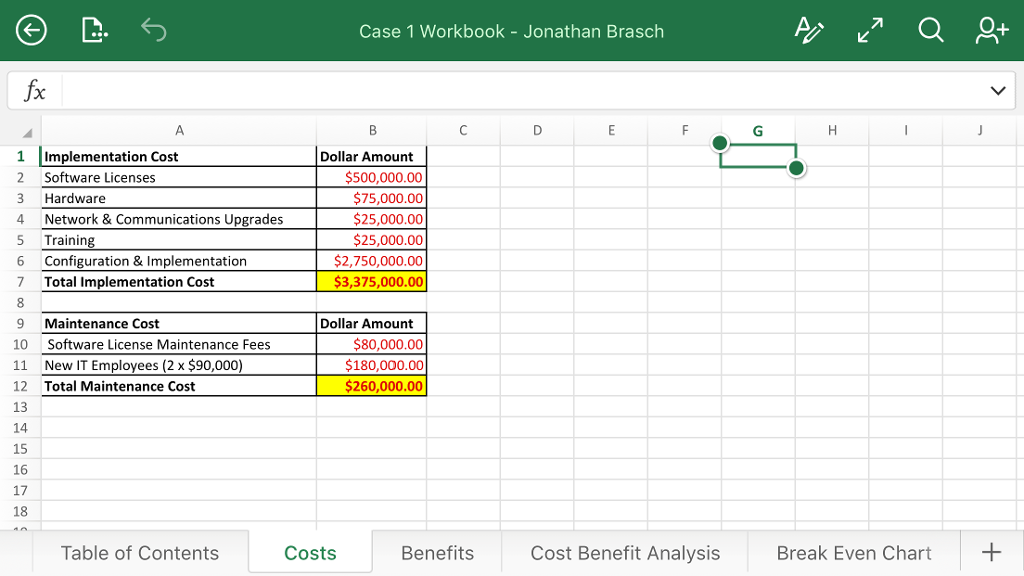

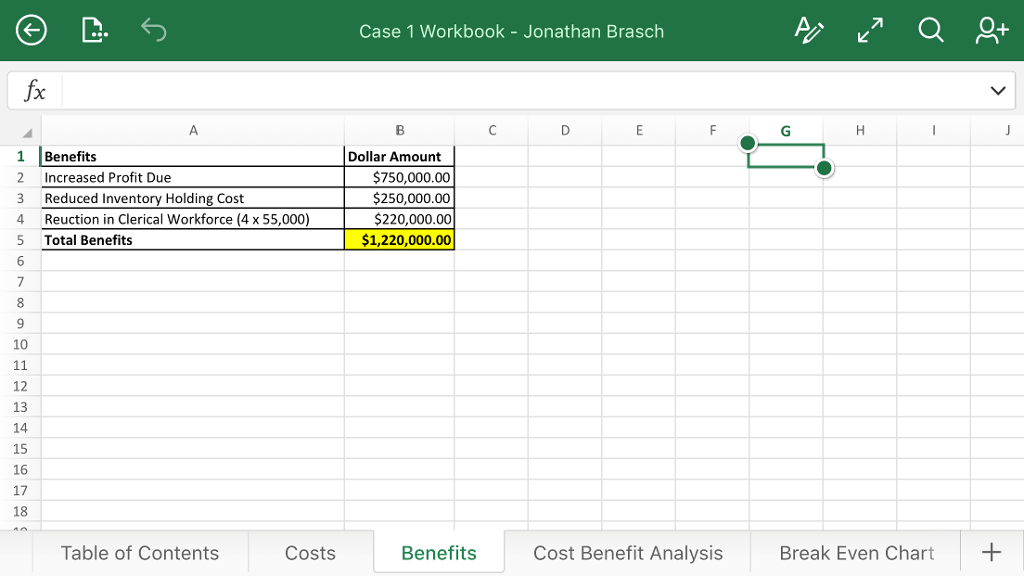

Use Excel to create a workbook to perform a cost benefit analysis of the project. The workbook should use fixed and variable cell references where applicable to support rapid assessment of the business case under different assumptions for interest rates, benefits and costs. The workbook should contain the following worksheets.

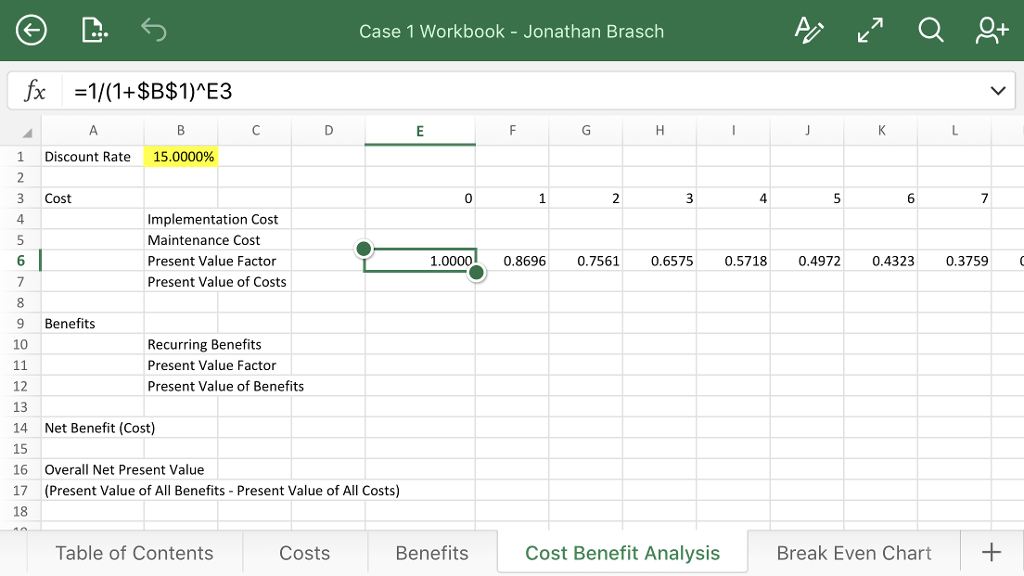

Cost Benefit Analysis - Should contain the discount rate, costs, benefits, present value factor, and the present value of costs and benefits for each year of the project. It should also include the Overall Net Present Value (NPV) for the proposed project, which is the net present value of all benefits minus the net present value of all costs.

Part 2

Please answer the following questions using the workbook you created in Part 1.

1. Assume a discount rate of 15%. What is the overall net present value for the project? When will the project break-even?

2. Assume a discount rate of 30%. What is the overall net present value for the project? When will the project break-even?

3. Assume the recurring value of benefits due to increased sales was overly optimistic and net income due to increased sales is only $375,000 instead of $750,000. In addition, assume the benefits due to a reduction in inventory holding costs are only $50,000 instead of $250,000. Assuming a discount rate of 15%, what is the overall net present value for the project? When will the project break-even?

4. Assume the recurring value of benefits due to increased sales was overly optimistic and net income due to increased sales is only $375,000 instead of $750,000. In addition, assume the benefits due to a reduction in inventory holding costs are only $50,000 instead of $250,000. At what discount rate is the project economically feasible? (Please note that the discount rate you calculate must include four decimal places of accuracy e.g. 12.3456%).

Please show what formulas are used and where to input them in order to get the correct values. Thank you!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started