Answered step by step

Verified Expert Solution

Question

1 Approved Answer

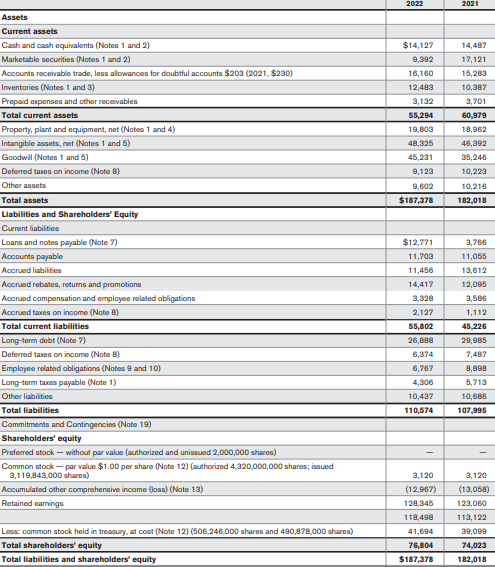

Part 1 (Use the annual report of your selected company) Please let us know if you company has any long-term debt on its balance sheet.

Part 1 (Use the annual report of your selected company)

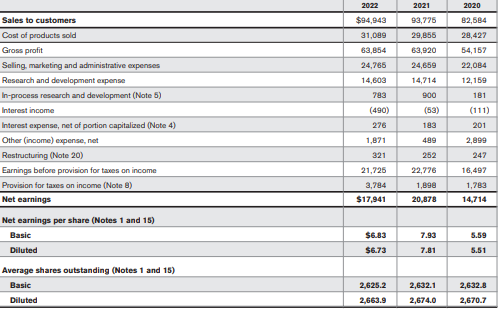

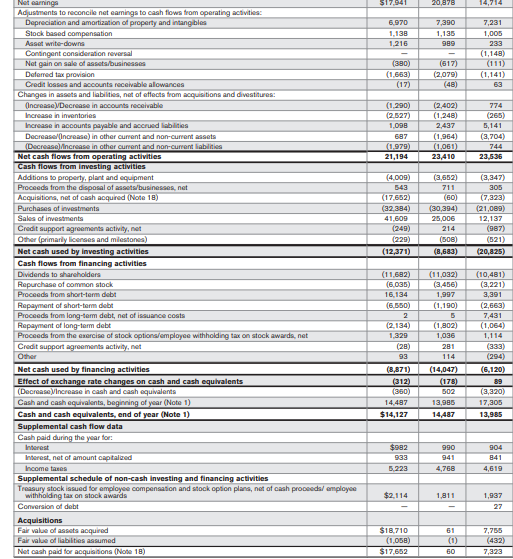

Please let us know if you company has any long-term debt on its balance sheet. Please give us some information about that long-term debt. You will have to look in the notes to the financial statements for this information. Also please calculate the times interest earned ratio for this corporation and let us know what this ratio indicates about its financial condition.

\begin{tabular}{|c|c|c|c|} \hline & 2022 & 2021 & 2020 \\ \hline Sales to customers & $94,943 & 93,775 & 82,584 \\ \hline Cost of peoducts sold & 31,089 & 29,855 & 28,427 \\ \hline Gross profit & 63,854 & 63,920 & 54,167 \\ \hline Seling, marketing and administrative expenses & 24,765 & 24,659 & 22,084 \\ \hline Research and development eipense & 14,603 & 14,714 & 12,169 \\ \hline In-process research and development (Note 5) & 783 & 9oo & 181 \\ \hline Interest income & (490) & (53) & (111) \\ \hline Interest expense, net of portion capitalized (Note 4) & 276 & 183 & 201 \\ \hline Other (inoome) expense, net & 1,871 & 489 & 2,899 \\ \hline Restructuring (Note 20) & 321 & 252 & 247 \\ \hline Earnings befoer provision for tawes on income & 21,726 & 22,776 & 16,497 \\ \hline Provision for tawes on income (Note 8) & 3,784 & 1,898 & 1,783 \\ \hline Net earnings & $17,941 & 20,878 & 14,714 \\ \hline \multicolumn{4}{|l|}{ Net earnings per share (Notes 1 and 15) } \\ \hline Basic & $6.83 & 7.93 & 5.59 \\ \hline Diluted & $6.73 & 7.81 & 5.51 \\ \hline \multicolumn{4}{|l|}{ Average shares outstanding (Notes 1 and 15) } \\ \hline Basic & 2,625.2 & 2,632.1 & 2,632.8 \\ \hline Diluted & 2,663.9 & 2,674.0 & 2,670.7 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Not earninge & & & \\ \hline \multicolumn{4}{|l|}{ Adjustments to reconcile net eamings to cash flows from coerating activities: } \\ \hline Depreciation and amortization of property and intang bles & 6.970 & 7,390 & 7,231 \\ \hline Stock baged compensation & 1,138 & 1,136 & 1,005 \\ \hline Asant wite-downa & 1,216 & 989 & 233 \\ \hline Contingent consideration reversal & - & - & (1,149) \\ \hline Net gain on sale of assots/businesses & (390) & (617) & (111) \\ \hline Deferred tax provision & (1,653) & (2,079) & (1,141) \\ \hline Credit bases and accounts recelvible alowances & (17) & (48) & 63 \\ \hline \multicolumn{4}{|l|}{ Changes in assets and labilises, net of effects from accuisitions and divestifures: } \\ \hline (Increase)VDecrease in acoounts recestrable & (1,290) & (2,402) & 774 \\ \hline horease in imventories & (2,527) & (1,248) & (265) \\ \hline horease in accounts payable and acorusd lablities & 1,098 & 2,437 & 5,141 \\ \hline Decreasel(Increase) in other current and non-curfent assets & 697 & (1,964) & (3,704) \\ \hline (Decreage)/Increase in other cument and non-cument liablitise & (1.979) & (1.061) & 744 \\ \hline Net cash flows from operating activities & 21,194 & 23,410 & 23,536 \\ \hline \multicolumn{4}{|l|}{ Cash flows from investing activities } \\ \hline Addions to property, plant and equipment & (4,009) & (3,652) & (3,347) \\ \hline Procesda from the disposal of assots/businesses, net & B43 & 711 & 305 \\ \hline Accuisitiona, net of cash acqured (Note 18) & (17,652) & (60) & (7,323) \\ \hline Purchases of investments & (32,394) & (30,394) & (21,089) \\ \hline Sales of imestments & 41,609 & 25,006 & 12,137 \\ \hline Credit aupport agreements activiny, net & (249) & 214 & (987) \\ \hline Other (primarly licenees and milestones) & (229) & (508) & (521) \\ \hline Net cash used by investing activities & (12,371) & (8,683) & (20,825) \\ \hline \multicolumn{4}{|l|}{ Cash flows from financing activities } \\ \hline Dividends to shareholders & (11,692) & (11,032) & (10,481) \\ \hline Repurchase of common stock & (6,035) & (3,456) & (3,221) \\ \hline Procesda from short-term debt & 16,134 & 1,997 & 3,391 \\ \hline Repayment of ahort-tem debt & (6,B50) & (1,190) & (2,663) \\ \hline Procesda from long-term debt, net of issuance coats & 2 & 5 & 7,431 \\ \hline Repayment of long-term debt & (2,134) & (1,802) & (1,064) \\ \hline Proceseda from the exercise of stock optiona/employee withholding tax on stock awards, net & 1,329 & 1,036 & 1,114 \\ \hline Credit aupport agreements activiby, net & (2B) & 2B1 & (333) \\ \hline Othar & 93 & 114 & (294) \\ \hline Net cash used by financing activities & (8,871) & (14,047) & (6,120) \\ \hline Effect of exchange rate changes on cash and cash equihralents & (312) & (178) & 89 \\ \hline (Docrease) VIncrease in cash and cash equivalents & (360) & BO2 & (3,320) \\ \hline Cash and cash equiralents, beginning of year (Note 1) & 14,497 & 13,985 & 17,305 \\ \hline Cash and cash equivalents, end of year (Note 1) & $14,127 & 14,487 & 13,985 \\ \hline \multicolumn{4}{|l|}{ Supplemental cash flow data } \\ \hline \multicolumn{4}{|l|}{ Cash paid during the year for: } \\ \hline Interest & $992 & 990 & 904 \\ \hline Interest, net of amount captalead & 933 & 941 & 841 \\ \hline Income taxes & 5,223 & 4,768 & 4,619 \\ \hline \multicolumn{4}{|l|}{ Supplemental schedule of non-cash investing and financing activities } \\ \hline \begin{tabular}{l} Tressury stock issued for employse compensation and stock option plans, net of casch proosoda/ employese \\ withholding tax on stock awards \end{tabular} & $2,114 & 1,811 & 1,937 \\ \hline Conversion of debt & - & - & 27 \\ \hline \multicolumn{4}{|l|}{ Acquisitions } \\ \hline Fair value of agsets acquired & $18,710 & 61 & 7,785 \\ \hline Far value of liablities assumed & (1,05B) & (1) & (432) \\ \hline Not asch paid for acquiafions (Nobe 18) & $17,652 & 60 & 7,323 \\ \hline \end{tabular}

\begin{tabular}{|c|c|c|c|} \hline & 2022 & 2021 & 2020 \\ \hline Sales to customers & $94,943 & 93,775 & 82,584 \\ \hline Cost of peoducts sold & 31,089 & 29,855 & 28,427 \\ \hline Gross profit & 63,854 & 63,920 & 54,167 \\ \hline Seling, marketing and administrative expenses & 24,765 & 24,659 & 22,084 \\ \hline Research and development eipense & 14,603 & 14,714 & 12,169 \\ \hline In-process research and development (Note 5) & 783 & 9oo & 181 \\ \hline Interest income & (490) & (53) & (111) \\ \hline Interest expense, net of portion capitalized (Note 4) & 276 & 183 & 201 \\ \hline Other (inoome) expense, net & 1,871 & 489 & 2,899 \\ \hline Restructuring (Note 20) & 321 & 252 & 247 \\ \hline Earnings befoer provision for tawes on income & 21,726 & 22,776 & 16,497 \\ \hline Provision for tawes on income (Note 8) & 3,784 & 1,898 & 1,783 \\ \hline Net earnings & $17,941 & 20,878 & 14,714 \\ \hline \multicolumn{4}{|l|}{ Net earnings per share (Notes 1 and 15) } \\ \hline Basic & $6.83 & 7.93 & 5.59 \\ \hline Diluted & $6.73 & 7.81 & 5.51 \\ \hline \multicolumn{4}{|l|}{ Average shares outstanding (Notes 1 and 15) } \\ \hline Basic & 2,625.2 & 2,632.1 & 2,632.8 \\ \hline Diluted & 2,663.9 & 2,674.0 & 2,670.7 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Not earninge & & & \\ \hline \multicolumn{4}{|l|}{ Adjustments to reconcile net eamings to cash flows from coerating activities: } \\ \hline Depreciation and amortization of property and intang bles & 6.970 & 7,390 & 7,231 \\ \hline Stock baged compensation & 1,138 & 1,136 & 1,005 \\ \hline Asant wite-downa & 1,216 & 989 & 233 \\ \hline Contingent consideration reversal & - & - & (1,149) \\ \hline Net gain on sale of assots/businesses & (390) & (617) & (111) \\ \hline Deferred tax provision & (1,653) & (2,079) & (1,141) \\ \hline Credit bases and accounts recelvible alowances & (17) & (48) & 63 \\ \hline \multicolumn{4}{|l|}{ Changes in assets and labilises, net of effects from accuisitions and divestifures: } \\ \hline (Increase)VDecrease in acoounts recestrable & (1,290) & (2,402) & 774 \\ \hline horease in imventories & (2,527) & (1,248) & (265) \\ \hline horease in accounts payable and acorusd lablities & 1,098 & 2,437 & 5,141 \\ \hline Decreasel(Increase) in other current and non-curfent assets & 697 & (1,964) & (3,704) \\ \hline (Decreage)/Increase in other cument and non-cument liablitise & (1.979) & (1.061) & 744 \\ \hline Net cash flows from operating activities & 21,194 & 23,410 & 23,536 \\ \hline \multicolumn{4}{|l|}{ Cash flows from investing activities } \\ \hline Addions to property, plant and equipment & (4,009) & (3,652) & (3,347) \\ \hline Procesda from the disposal of assots/businesses, net & B43 & 711 & 305 \\ \hline Accuisitiona, net of cash acqured (Note 18) & (17,652) & (60) & (7,323) \\ \hline Purchases of investments & (32,394) & (30,394) & (21,089) \\ \hline Sales of imestments & 41,609 & 25,006 & 12,137 \\ \hline Credit aupport agreements activiny, net & (249) & 214 & (987) \\ \hline Other (primarly licenees and milestones) & (229) & (508) & (521) \\ \hline Net cash used by investing activities & (12,371) & (8,683) & (20,825) \\ \hline \multicolumn{4}{|l|}{ Cash flows from financing activities } \\ \hline Dividends to shareholders & (11,692) & (11,032) & (10,481) \\ \hline Repurchase of common stock & (6,035) & (3,456) & (3,221) \\ \hline Procesda from short-term debt & 16,134 & 1,997 & 3,391 \\ \hline Repayment of ahort-tem debt & (6,B50) & (1,190) & (2,663) \\ \hline Procesda from long-term debt, net of issuance coats & 2 & 5 & 7,431 \\ \hline Repayment of long-term debt & (2,134) & (1,802) & (1,064) \\ \hline Proceseda from the exercise of stock optiona/employee withholding tax on stock awards, net & 1,329 & 1,036 & 1,114 \\ \hline Credit aupport agreements activiby, net & (2B) & 2B1 & (333) \\ \hline Othar & 93 & 114 & (294) \\ \hline Net cash used by financing activities & (8,871) & (14,047) & (6,120) \\ \hline Effect of exchange rate changes on cash and cash equihralents & (312) & (178) & 89 \\ \hline (Docrease) VIncrease in cash and cash equivalents & (360) & BO2 & (3,320) \\ \hline Cash and cash equiralents, beginning of year (Note 1) & 14,497 & 13,985 & 17,305 \\ \hline Cash and cash equivalents, end of year (Note 1) & $14,127 & 14,487 & 13,985 \\ \hline \multicolumn{4}{|l|}{ Supplemental cash flow data } \\ \hline \multicolumn{4}{|l|}{ Cash paid during the year for: } \\ \hline Interest & $992 & 990 & 904 \\ \hline Interest, net of amount captalead & 933 & 941 & 841 \\ \hline Income taxes & 5,223 & 4,768 & 4,619 \\ \hline \multicolumn{4}{|l|}{ Supplemental schedule of non-cash investing and financing activities } \\ \hline \begin{tabular}{l} Tressury stock issued for employse compensation and stock option plans, net of casch proosoda/ employese \\ withholding tax on stock awards \end{tabular} & $2,114 & 1,811 & 1,937 \\ \hline Conversion of debt & - & - & 27 \\ \hline \multicolumn{4}{|l|}{ Acquisitions } \\ \hline Fair value of agsets acquired & $18,710 & 61 & 7,785 \\ \hline Far value of liablities assumed & (1,05B) & (1) & (432) \\ \hline Not asch paid for acquiafions (Nobe 18) & $17,652 & 60 & 7,323 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started