Answered step by step

Verified Expert Solution

Question

1 Approved Answer

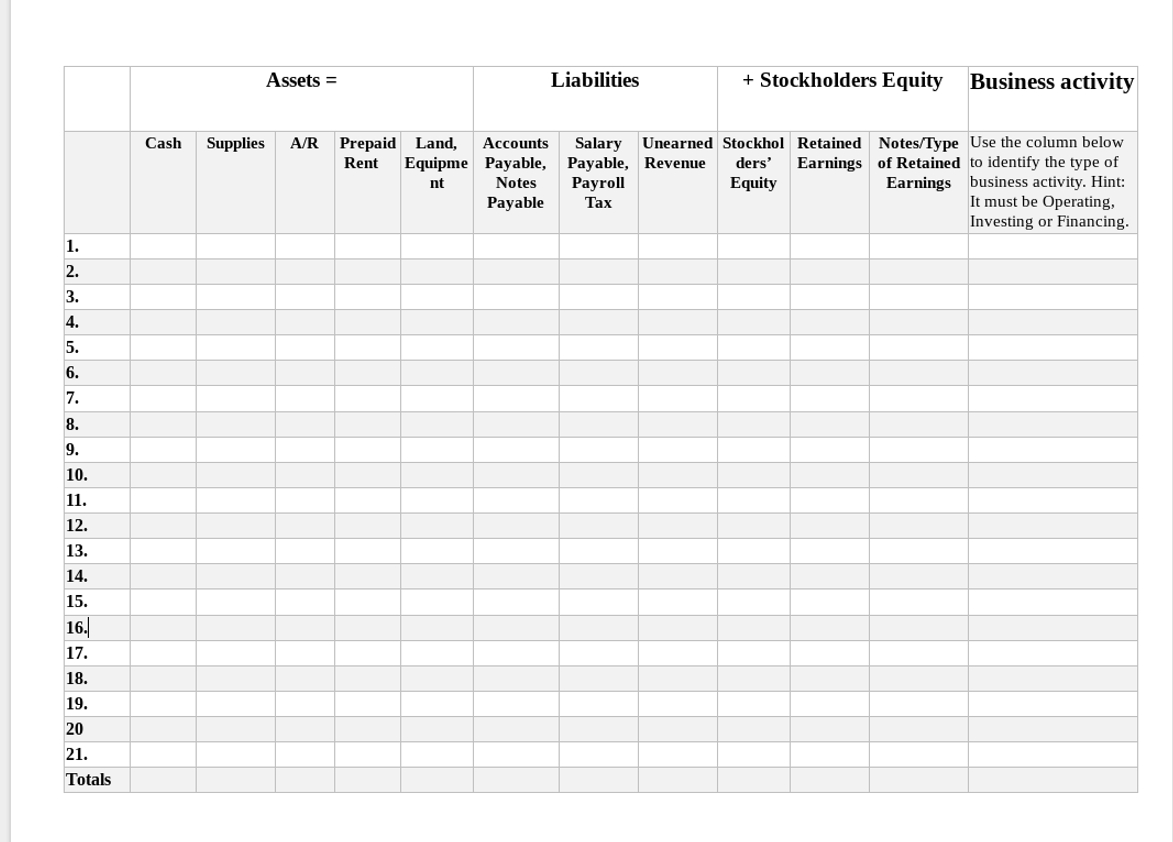

Part 1 : Use the attached Tabular Analysis Chart to record transactions and complete the following Business Transactions: 1 . August 3 rd , Bruce's

Part : Use the attached Tabular Analysis Chart to record transactions and complete the following Business Transactions:

August rd Bruce's Original Ts borrowed $ from the bank. The loan is due in years. The cash was received on Aug rd

August th Bruce's Original Ts paid $ for a new manufacturing press.

August th Bruce's Original Ts prepaid rent for months in the amount of $

August th Bruce's Original Ts purchased $ in supplies from Lola's graphic shirt design supply on account.

August th Bruce's Original Ts paid for a billboard on the highway, $ per month.

August th Bruces Original Ts designed custom logos for Georges shirts incorporated. Bruce earned $ in cash.

August th Bruces Original Ts received $ as payment for consulting services performed by Stans hats and Ts

August th Bruce's Original Ts sold $ in graphic Ts to another store on account.

August th Bruce's Original Ts received a $ payment in advance from Coastal Ts for consulting work to be completed in September.

August th Bruce's Original Ts paid in full for the supplies purchased on account in #

August th Bruce negotiated a contract with Lexis surf shop. A deposit was made for materials of $ The work will begin in September.

August th Bruce's Original Ts Collected partial payment of $ for payment of merchandise sold on account to another store in transaction #

August th Bruce's Original Ts sold $ in shirts to a new customer in exchange for cash

Augustth Bruce's Original Ts paid its employees $ dollars for their biweekly payroll. Please note, that the work has already been completed by the employees.

August th Bruce's Original Ts estimated its monthly bill for $ to United Utility. The actual bill will be sent on Sept.

August st Bruce's Original Ts counted supplies and its end of month count shows $ in supplies on hand.

August st Bruce's Original Ts adjusted prepaid rent of $ for the month of August.

August st Bruce's Original Ts will pay wages of $ to its employees in September for work completed in August.

August st Bruce's Original Ts sold $ in vacant land @ book value in exchange for cash. Note, do not need to record gain or loss.

August st Bruces Original Ts will pay payroll taxes of $ to the Federal Government in Sept for work completed in August.

August st Bruces Original Ts sold shares of common stock @ $ per share in exchange for cash.

Please use tabular chart attached

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started