Answered step by step

Verified Expert Solution

Question

1 Approved Answer

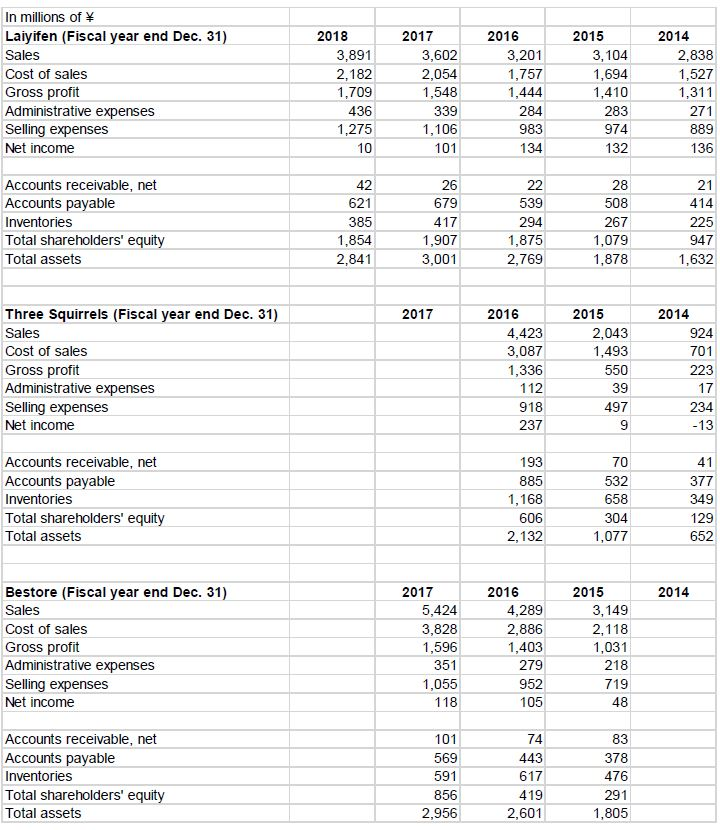

Part 1 Use the five years of financial information for LYFEN and three years for LYFEN's two primary competitors, Three Squirrels and Bestore. Use the

Part 1

Use the five years of financial information for LYFEN and three years for LYFEN's two primary competitors, Three Squirrels and Bestore.

- Use the appropriate finance tools that you feel are relevant to do a complete financial analysis of LYFEN and its two competitors using the information provided. Make reasonable assumptions to determine missing balance sheet information that you desire. Consider any relevant qualitative factors in your analysis and comparison. Provide a thorough interpretation of the results. (35%)

- In your opinion, is LYFEN financially ready to engage in their desired growth objectives for the next five years? Provide support for your answer. (10%)

- What specific recommendations would you suggest Yu make to the company's chairman, Yonglei Shi about future growth goals? (5%)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started