Part 1

What is Accounting?

Part 2

Please see the attached photos.

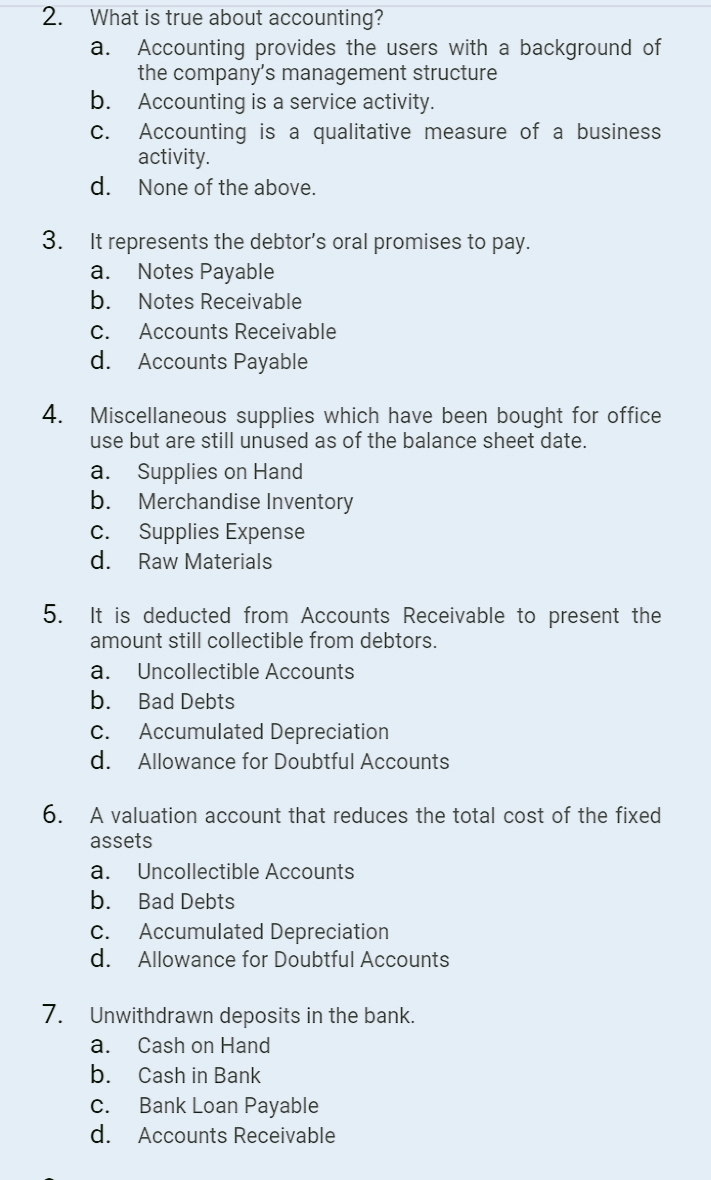

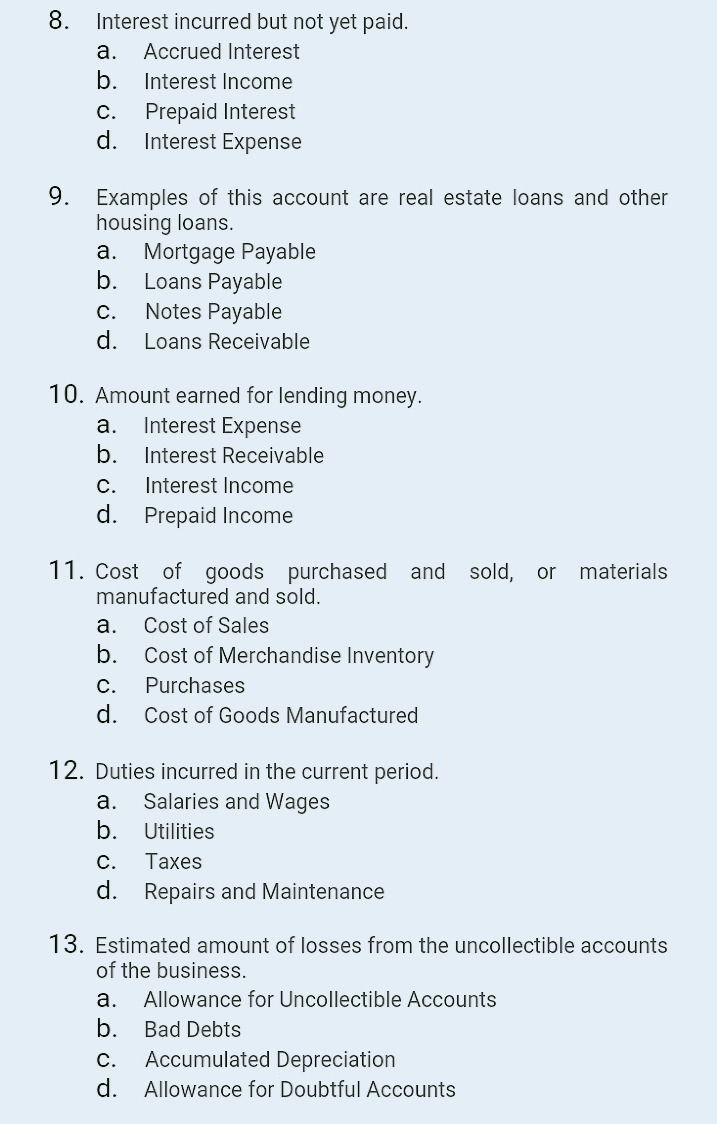

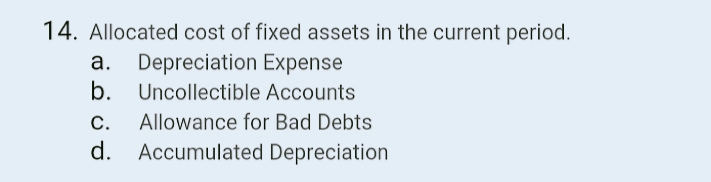

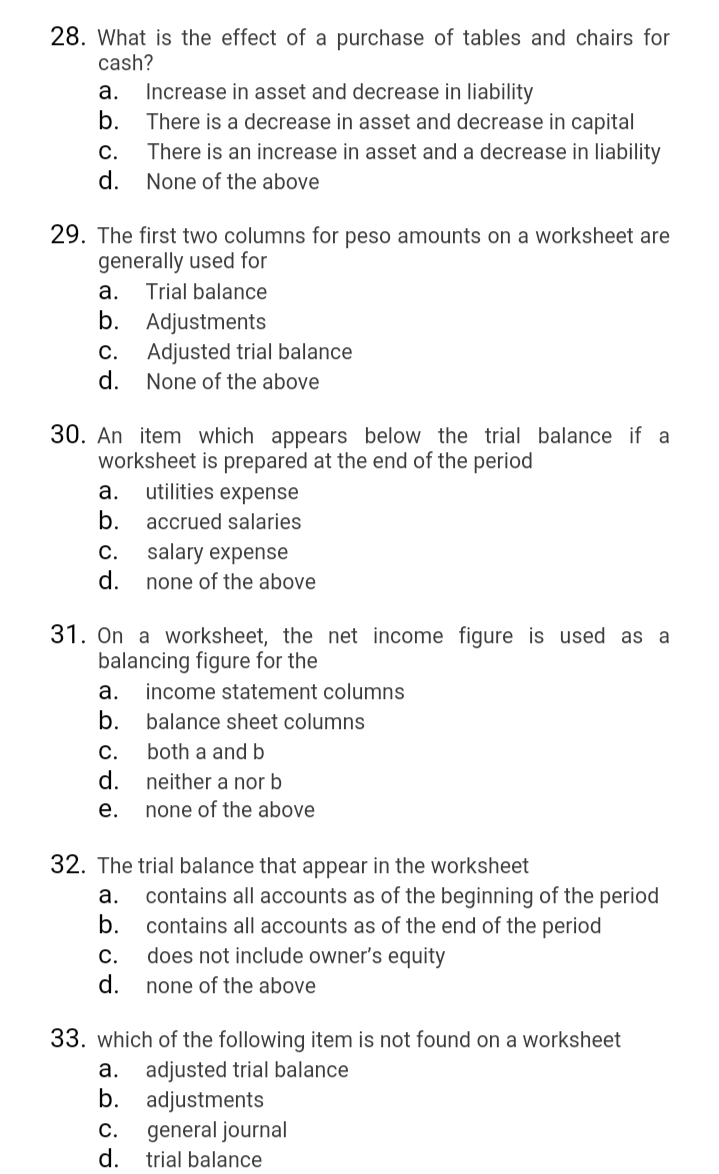

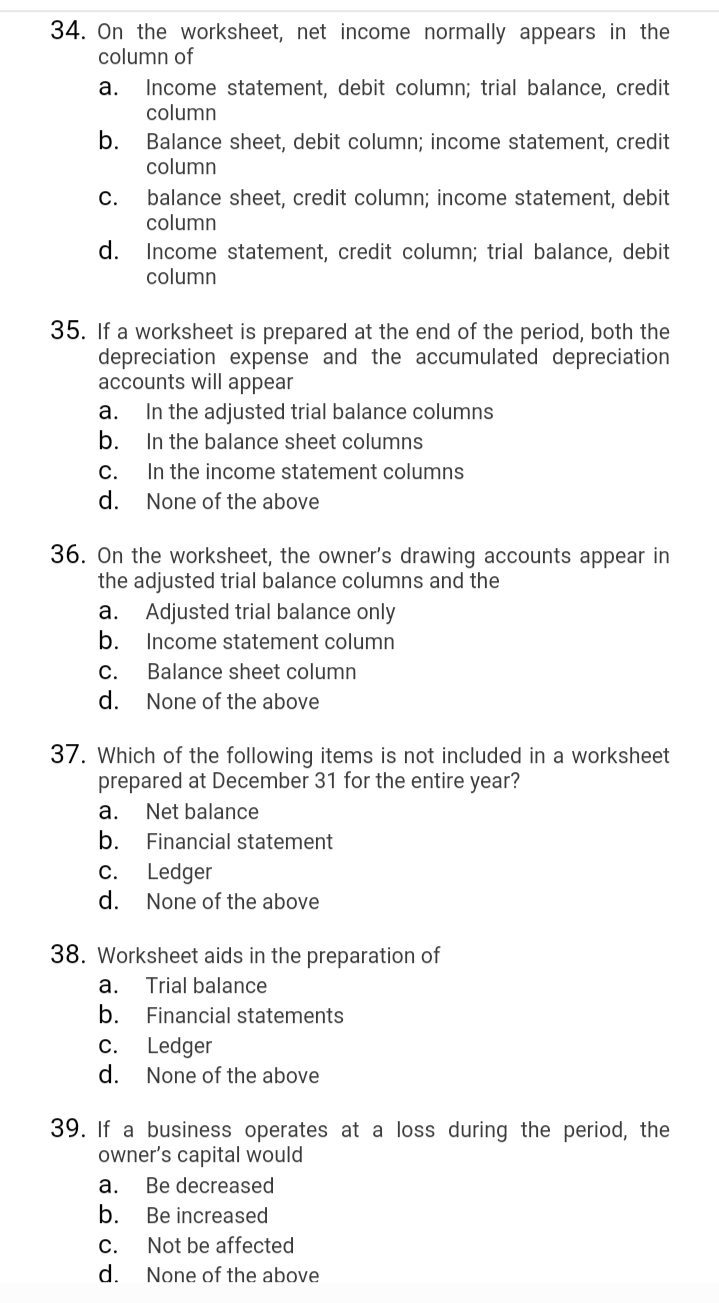

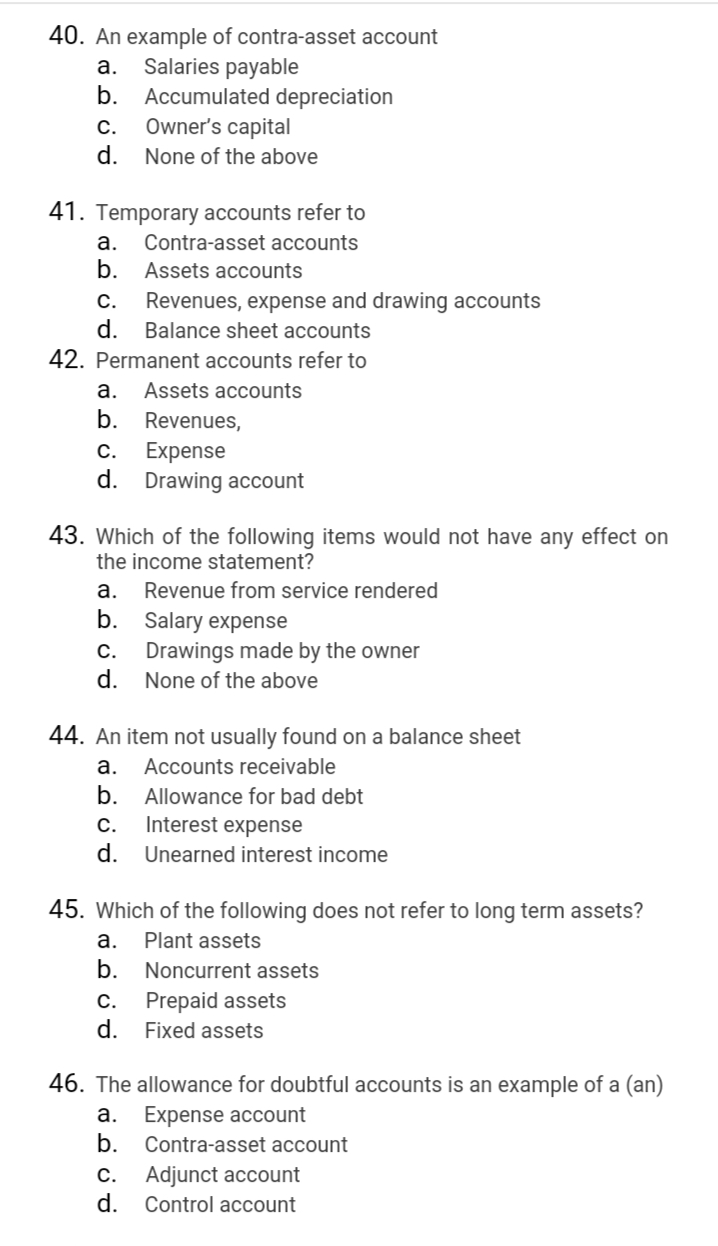

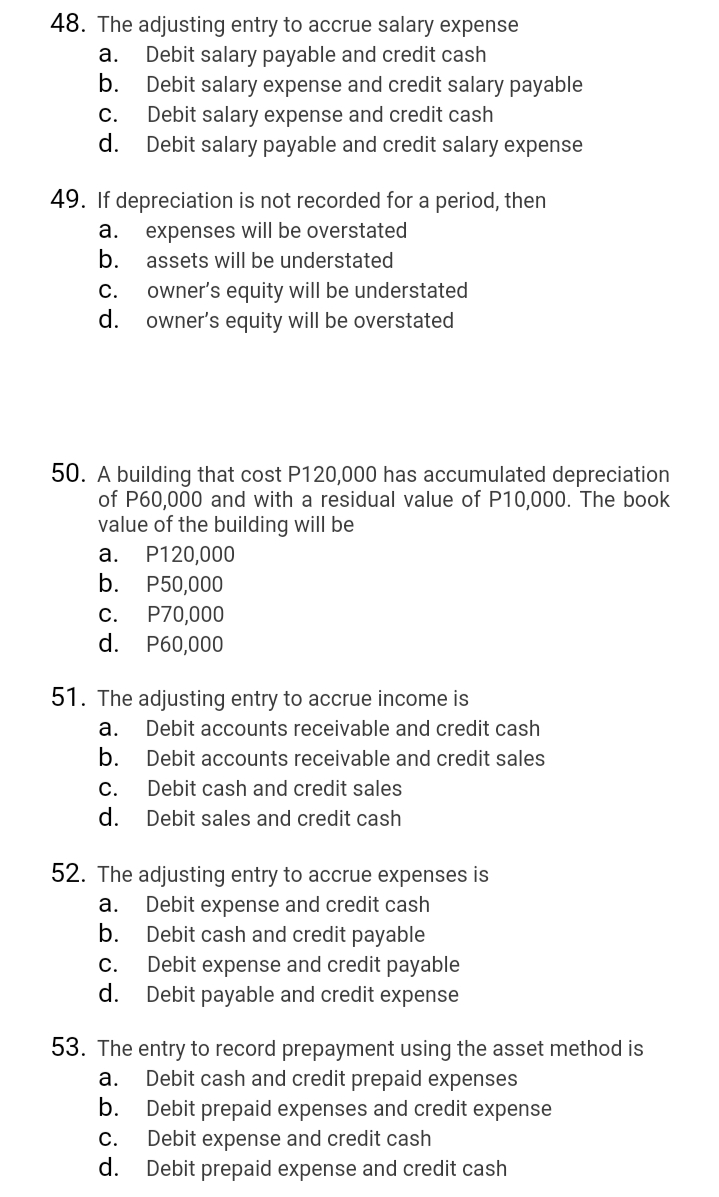

What is true about accounting? a. Accounting provides the users with a background of the company's management structure b. Accounting is a service activity. c. Accounting is a qualitative measure of a business activity. d. None of the above. It represents the debtor's oral promises to pay. a. Notes Payable b. Notes Receivable c. Accounts Receivable d. Accounts Payable Miscellaneous supplies which have been bought for office use but are still unused as of the balance sheet date. a. Supplies on Hand b. Merchandise Inventory c. Supplies Expense d Raw Materials It is deducted from Accounts Receivable to present the amount still collectible from debtors. a. Uncollectible Accounts b. Bad Debts c. Accumulated Depreciation d. Allowance for Doubtful Accounts A valuation account that reduces the total cost of the fixed assets a. UncollectibleAccounts b. Bad Debts c. Accumulated Depreciation d. Allowance for Doubtful Accounts Unwithdrawn deposits in the bank. a. Cash on Hand b. Cash in Bank c. Bank Loan Payable (1. Accounts Receivable 8. Interest incurred but not yet paid. a. Accrued Interest b. Interest Income C. Prepaid Interest d. Interest Expense 9. Examples of this account are real estate loans and other housing loans. a. Mortgage Payable b. Loans Payable C. Notes Payable d. Loans Receivable 10. Amount earned for lending money. a. Interest Expense b. Interest Receivable C. Interest Income d. Prepaid Income 11. Cost of goods purchased and sold, or materials manufactured and sold. a. Cost of Sales b. Cost of Merchandise Inventory C. Purchases (1. Cost of Goods Manufactured 12. Duties incurred in the current period. a. Salaries and Wages b. Utilities C. Taxes d. Repairs and Maintenance 13. Estimated amount of losses from the uncollectible accounts of the business. a. Allowance for Uncollectible Accounts b. Bad Debts C. Accumulated Depreciation d. Allowance for Doubtful Accounts 14. Allocated cost of fixed assets in the current period. a. Depreciation Expense b. Unoollectible Accounts c. Allowance for Bad Debts d. Accumulated Depreciation 2B. 29. 30. 31. 32. 33. What is the effect of a purchase of tables and chairs for cash? an. Increase in asset and decrease in liability b. There is a decrease in asset and decrease in capital 0. There is an increase in asset and a decrease in liability d. None of the above The first two columns for peso amounts on a worksheet are generally used for a. Trial balance b. Adjustments 0. Adjusted trial balance (I. None of the above An item which appears below the trial balance if a worksheet is prepared at the end of the period a. utilities expense b. accrued salaries C. salary expense (I. none of the above On a worksheet, the net income figure is used as a balancing figure for the income statement columns balance sheet columns both a and b neither a nor b none of the above so??? The trial balance that appear in the worksheet 3. contains all accounts as of the beginning of the period b. contains all accounts as of the end of the period 0. does not include owner's equity d. none of the above which of the following item is not found on a worksheet an. adjusted trial balance b. adjustments 0. general journal (I. trial balance 34. On the worksheet, net income normally appears in the 35. 36. 37. 38. 39. column of a. Income statement, debit column; trial balance, credit column b. Balance sheet, debit column; income statement, credit column c. balance sheet, credit column; income statement, debit column d. Income statement, credit column; trial balance, debit column If a worksheet is prepared at the end of the period, both the depreciation expense and the accumulated depreciation accounts will appear a. In the adjusted trial balance columns b. In the balance sheet columns 0. In the income statement columns d. None of the above On the worksheet, the owner's drawing accounts appear in the adjusted trial balance columns and the a. Adjusted trial balance only b. Income statement column c. Balance sheet column (3!. None of the above Which of the following items is not included in a worksheet prepared at December 31 for the entire year? a. Net balance b. Financial statement c. Ledger (3! None of the above Worksheet aids in the preparation of a. Trial balance b. Financial statements c. Ledger (2]. None of the above If a business operates at a loss during the period, the owner's capital would a. Be decreased Be increased b. 0. Not be affected d None of the above 40. An example of contra-asset account a. Salaries payable b. Accumulated depreciation c. Owner's capital d. None of the above 41. Temporary accounts refer to a. Contra-asset accounts b. Assets accounts c. Revenues, expense and drawing accounts d. Balance sheet accounts 42. Permanent accounts refer to a. Assets accounts b. Revenues, c. Expense d. Drawing account 43. Which of the following items would not have any effect on the income statement? a. Revenue from service rendered b. Salary expense c. Drawings made by the owner d. None of the above 44. An item not usually found on a balance sheet 3. Accounts receivable b. Allowance for bad debt c. Interest expense d. Unearned interest income 45. Which of the following does not refer to long term assets? a. Plant assets b. Noncurrent assets c. Prepaid assets d. Fixed assets 46. The allowance for doubtful accounts is an example of a (an) a. Expense account b. Contra-asset account c. Adjunct account d. Control account 48. The adjusting entry to accrue salary expense a. Debit salary payable and credit cash b. Debit salary expense and credit salary payable C. Debit salary expense and credit cash d. Debit salary payable and credit salary expense 49. If depreciation is not recorded for a period,then a. expenses will be overstated b. assets will be understated c. owner's equity will be understated d. owner's equity will be overstated 50. A building that cost P120000 has accumulated depreciation of P60,000 and with a residual value of P10,000. The book value of the building will be a. P120000 b. P50,000 C. P70,000 d. P610000 51 . The adjusting entry to accrue income is a. Debit accounts receivable and credit cash b. Debit accounts receivable and credit sales C. Debit cash and credit sales d. Debit sales and credit cash 52. The adjusting entry to accrue expenses is a. Debit expense and credit cash b. Debit cash and credit payable 0. Debit expense and credit payable d. Debit payable and credit expense 53. The entry to record prepayment using the asset method is a. Debit cash and credit prepaid expenses b. Debit prepaid expenses and credit expense C. Debit expense and credit cash d. Debit prepaid expense and credit cash