Answered step by step

Verified Expert Solution

Question

1 Approved Answer

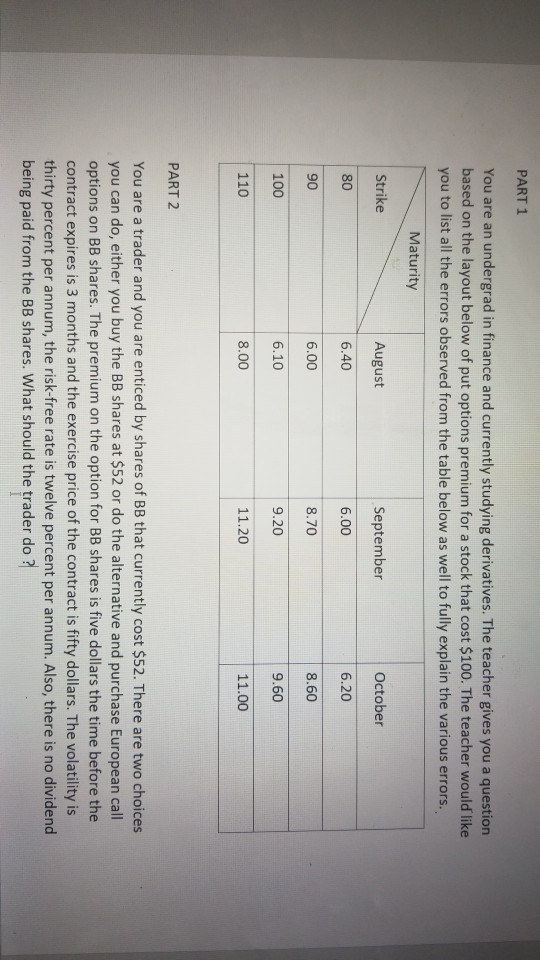

PART 1 You are an undergrad in finance and currently studying derivatives. The teacher gives you a question based on the layout below of put

PART 1 You are an undergrad in finance and currently studying derivatives. The teacher gives you a question based on the layout below of put options premium for a stock that cost $100. The teacher would like you to list all the errors observed from the table below as well to fully explain the various errors. Maturity Strike August September October 80 6.40 6.00 6.20 90 6.00 8.70 8.60 100 6.10 9.20 9.60 110 8.00 11.20 11.00 PART 2 You are a trader and you are enticed by shares of BB that currently cost $52. There are two choices you can do, either you buy the BB shares at $52 or do the alternative and purchase European call options on BB shares. The premium on the option for BB shares is five dollars the time before the contract expires is 3 months and the exercise price of the contract is fifty dollars. The volatility is thirty percent per annum, the risk-free rate is twelve percent per annum. Also, there is no dividend being paid from the BB shares. What should the trader do

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started