Answered step by step

Verified Expert Solution

Question

1 Approved Answer

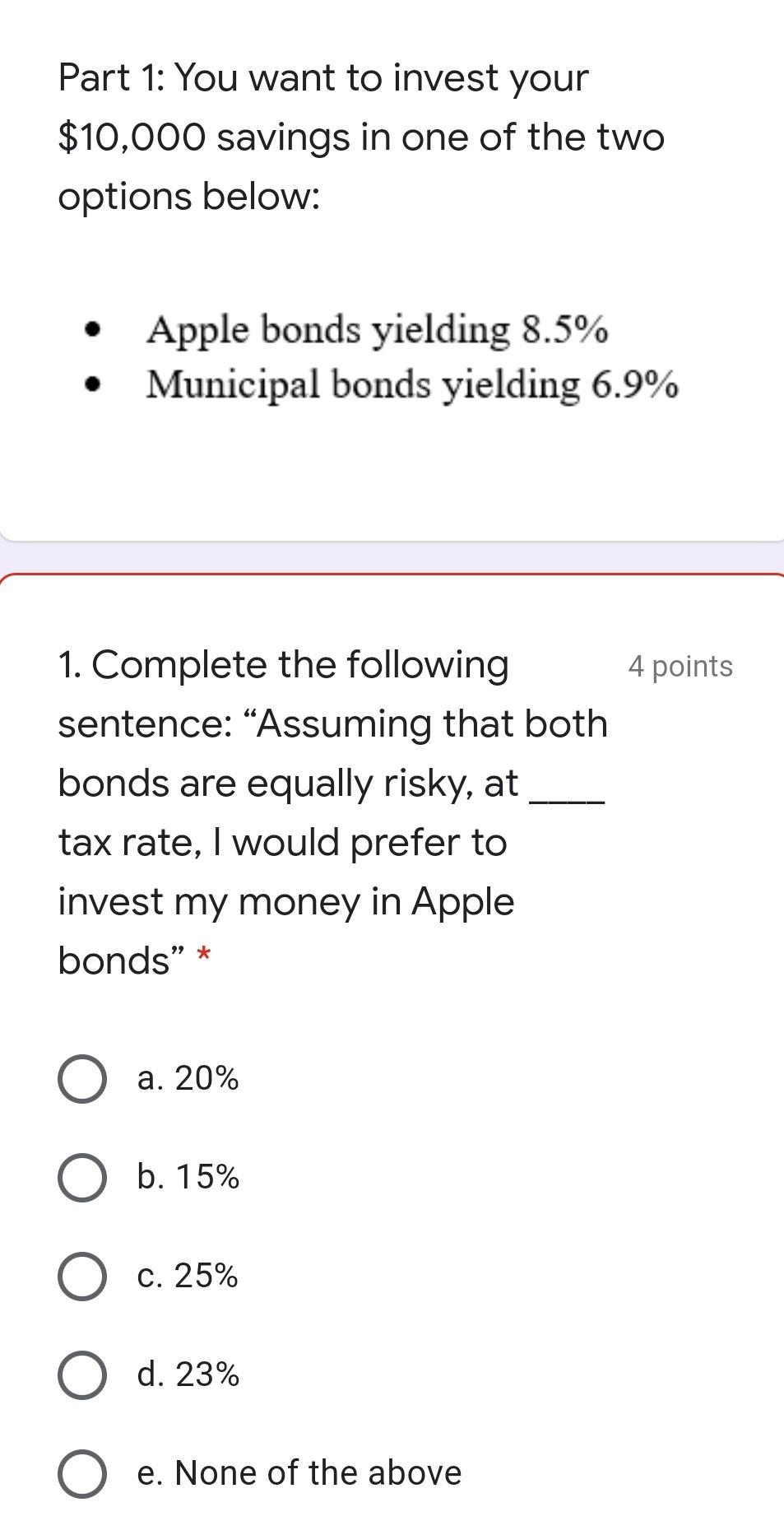

Part 1: You want to invest your $10,000 savings in one of the two options below: Apple bonds yielding 8.5% Municipal bonds yielding 6.9% 4

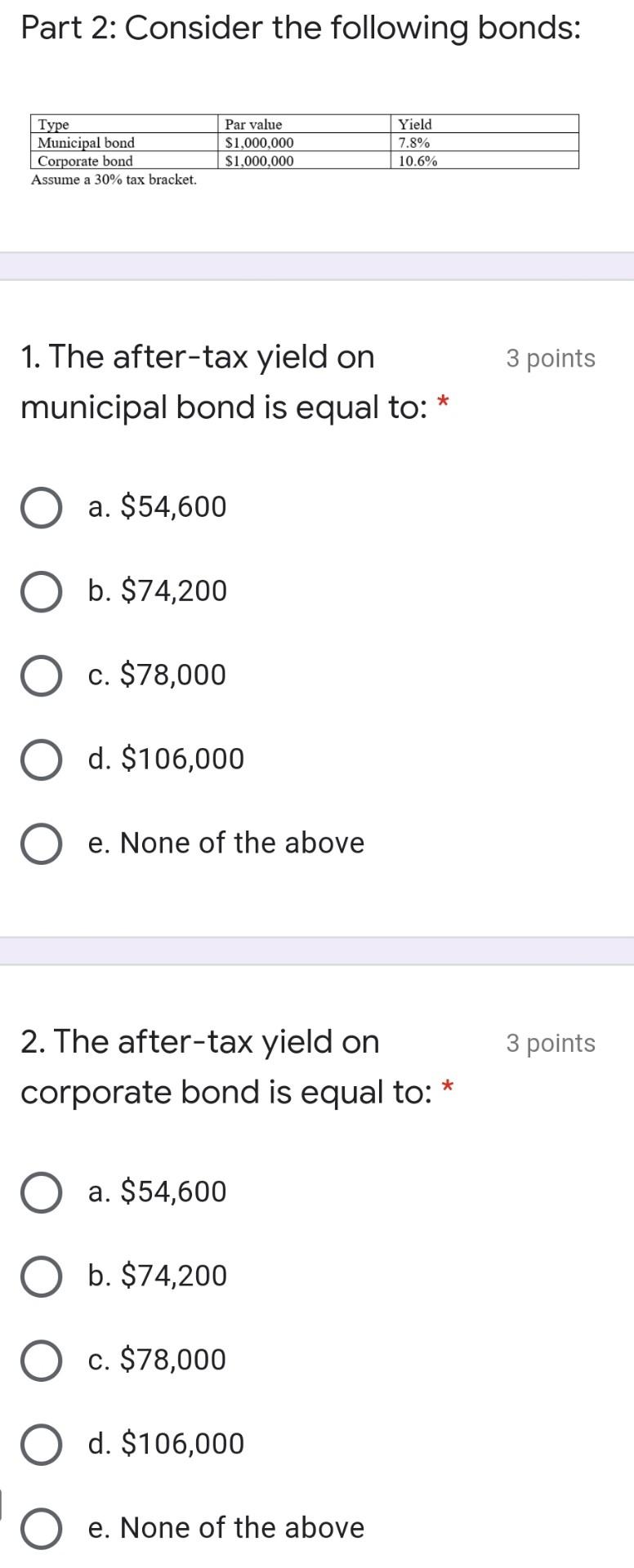

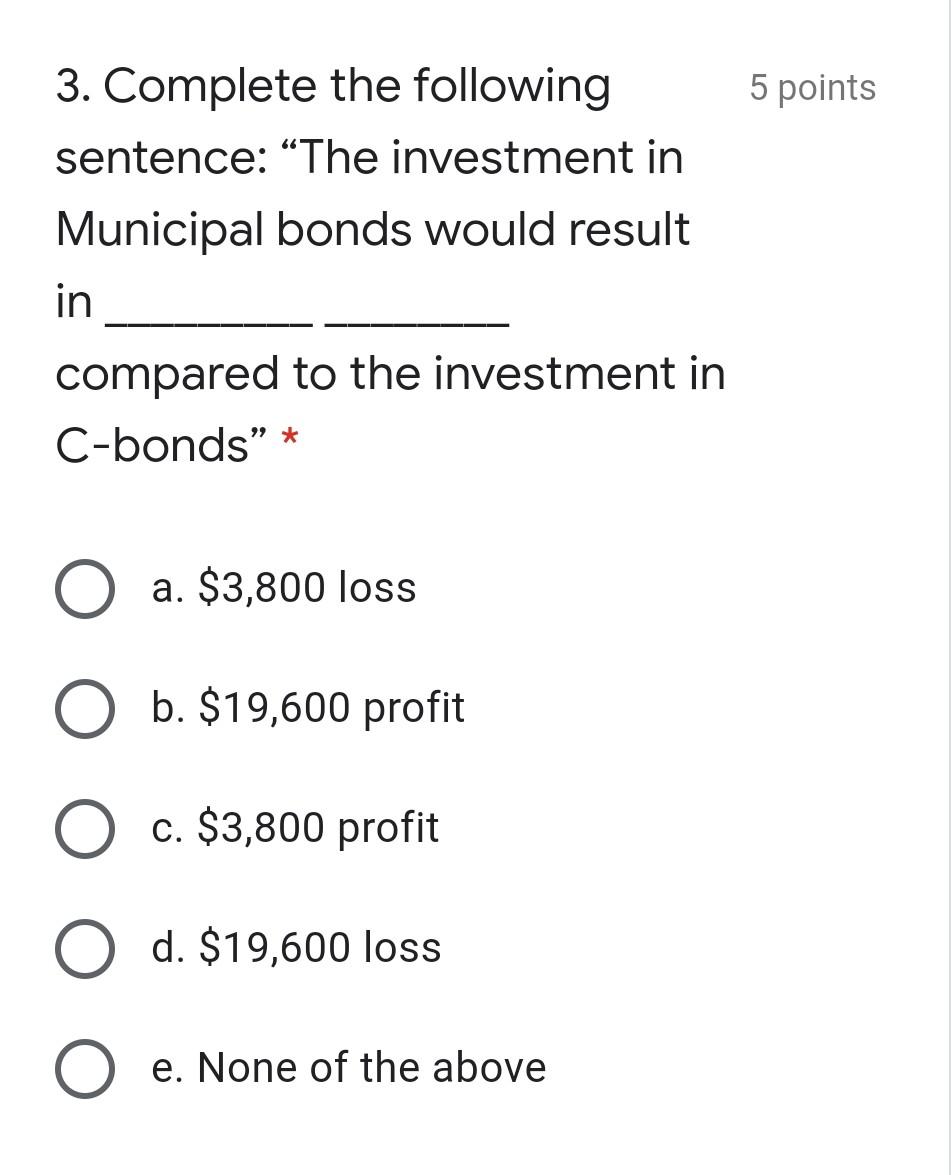

Part 1: You want to invest your $10,000 savings in one of the two options below: Apple bonds yielding 8.5% Municipal bonds yielding 6.9% 4 points 1. Complete the following sentence: Assuming that both bonds are equally risky, at tax rate, I would prefer to invest my money in Apple bonds * a. 20% O b. 15% O c. 25% d. 23% O e. None of the above Part 2: Consider the following bonds: Type Municipal bond Corporate bond Assume a 30% tax bracket. Par value $1,000,000 $1,000,000 Yield 7.8% 10.6% 3 points 1. The after-tax yield on municipal bond is equal to: * a. $54,600 b. $74,200 c. $78,000 d. $ 106,000 e. None of the above 3 points 2. The after-tax yield on corporate bond is equal to: * a. $54,600 b. $74,200 c. $78,000 d. $106,000 e. None of the above 5 points 3. Complete the following sentence: The investment in Municipal bonds would result in compared to the investment in C-bonds" * a. $3,800 loss b. $19,600 profit c. $3,800 profit O d. $19,600 loss e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started