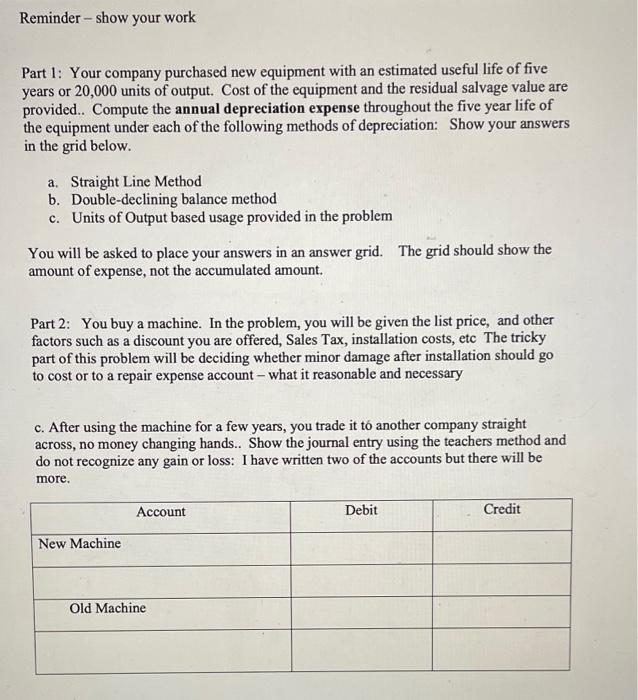

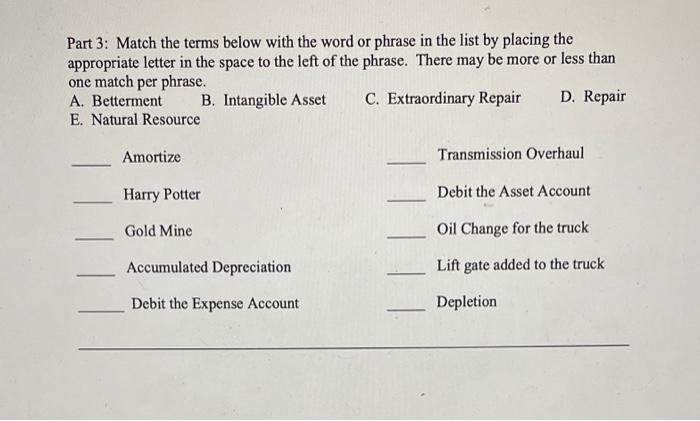

Part 1: Your company purchased new equipment with an estimated useful life of five years or 20,000 units of output. Cost of the equipment and the residual salvage value are provided.. Compute the annual depreciation expense throughout the five year life of the equipment under each of the following methods of depreciation: Show your answers in the grid below. a. Straight Line Method b. Double-declining balance method c. Units of Output based usage provided in the problem You will be asked to place your answers in an answer grid. The grid should show the amount of expense, not the accumulated amount. Part 2: You buy a machine. In the problem, you will be given the list price, and other factors such as a discount you are offered, Sales Tax, installation costs, etc The tricky part of this problem will be deciding whether minor damage after installation should go to cost or to a repair expense account - what it reasonable and necessary c. After using the machine for a few years, you trade it t another company straight across, no money changing hands.. Show the journal entry using the teachers method and do not recognize any gain or loss: I have written two of the accounts but there will be more. Part 3: Match the terms below with the word or phrase in the list by placing the appropriate letter in the space to the left of the phrase. There may be more or less than Nna match nor nhraes Part 1: Your company purchased new equipment with an estimated useful life of five years or 20,000 units of output. Cost of the equipment and the residual salvage value are provided.. Compute the annual depreciation expense throughout the five year life of the equipment under each of the following methods of depreciation: Show your answers in the grid below. a. Straight Line Method b. Double-declining balance method c. Units of Output based usage provided in the problem You will be asked to place your answers in an answer grid. The grid should show the amount of expense, not the accumulated amount. Part 2: You buy a machine. In the problem, you will be given the list price, and other factors such as a discount you are offered, Sales Tax, installation costs, etc The tricky part of this problem will be deciding whether minor damage after installation should go to cost or to a repair expense account - what it reasonable and necessary c. After using the machine for a few years, you trade it t another company straight across, no money changing hands.. Show the journal entry using the teachers method and do not recognize any gain or loss: I have written two of the accounts but there will be more. Part 3: Match the terms below with the word or phrase in the list by placing the appropriate letter in the space to the left of the phrase. There may be more or less than Nna match nor nhraes